Fantasy sports and betting company DraftKings (NASDAQ:DKNG) reported results ahead of analysts' expectations in Q1 CY2024, with revenue up 52.7% year on year to $1.17 billion. The company's full-year revenue guidance of $4.9 billion at the midpoint also came in 1.7% above analysts' estimates. It made a non-GAAP profit of $0.03 per share, improving from its loss of $0.51 per share in the same quarter last year.

DraftKings (DKNG) Q1 CY2024 Highlights:

- Revenue: $1.17 billion vs analyst estimates of $1.12 billion (4.6% beat)

- EPS (non-GAAP): $0.03 vs analyst estimates of -$0.11 ($0.14 beat)

- The company lifted its revenue guidance for the full year from $4.78 billion to $4.9 billion at the midpoint, a 2.6% increase

- Average Revenue per MUP: $114 vs analyst estimates of $105

- Gross Margin (GAAP): 39.6%, up from 32.2% in the same quarter last year

- Free Cash Flow was -$73.42 million, down from $71.05 million in the previous quarter

- Market Capitalization: $19.89 billion

Getting its start in daily fantasy sports, DraftKings (NASDAQ:DKNG) is a digital sports entertainment and gaming company.

DraftKings was founded in 2012 by Jason Robins, Matthew Kalish, and Paul Liberman to capitalize on sports betting legalization in the United States. On its platform, it offers daily fantasy sports contests across various professional sports leagues as well as sports betting and online casino games.

The company's primary revenue stream comes from its online gaming platforms, including the entry fees for daily fantasy sports contests, sports betting wagers, and online casino gaming. DraftKings also utilizes a technology-driven approach to sports betting and gaming, allowing for scalability and customer convenience. For example, consumers can download the DraftKings app on their mobile devices and instantly place bets from their couches on a user-friendly interface.

A unique aspect of DraftKing's business is that the legalization of sports betting is a major factor, and in the United States, gambling legislation is determined on a state-by-state basis. As such, when a new state "opens" (aka sports betting is legalized), companies like DraftKings typically make huge marketing pushes to win new consumers.

Gaming Solutions

Gaming solution companies operate in a dynamic and evolving market, and the digital transformation of the gaming industry presents significant opportunities for innovation and growth, whether it be immersive slot machine terminals or mobile sports betting. However, the gaming solution industry is not without its challenges. Regulatory compliance is a crucial consideration as companies must navigate a complex and often fragmented regulatory landscape across different jurisdictions. Changes in regulations can impact product offerings, operational practices, and market access, requiring companies to maintain flexibility and adaptability in their business strategies. Additionally, the competitive nature of the industry necessitates continuous investment in research and development to stay ahead of competitors and meet evolving consumer demands.

Competitors in the digital sports entertainment and gaming sector include Caesars Entertainment (NASDAQ:CZR), PENN Entertainment (NASDAQ:PENN),and Rush Street Interactive (NYSE: RSI).Sales Growth

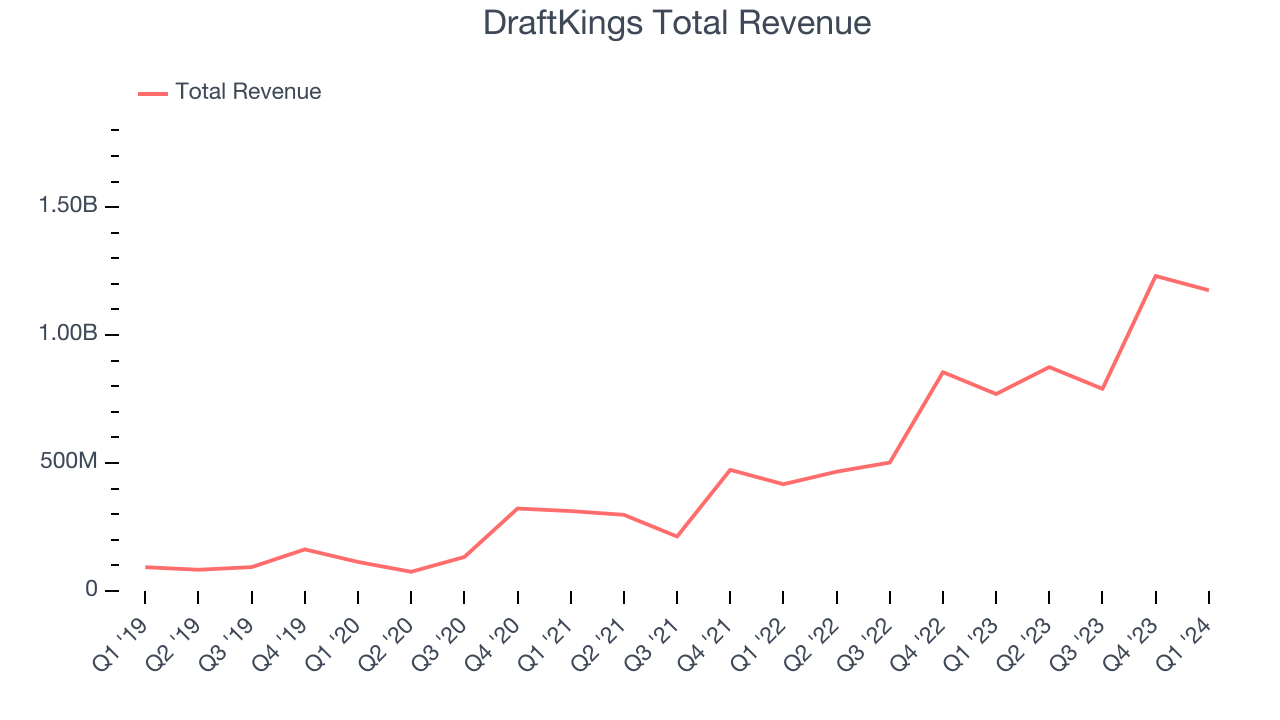

A company's long-term performance can indicate its business quality. Any business can enjoy short-lived success, but best-in-class ones sustain growth over many years. DraftKings's annualized revenue growth rate of 71.8% over the last five years was incredible for a consumer discretionary business.  Within consumer discretionary, product cycles are short and revenue can be hit-driven due to rapidly changing trends. That's why we also follow short-term performance. DraftKings's recent history shows its momentum has slowed as its annualized revenue growth of 70.5% over the last two years is below its five-year trend.

Within consumer discretionary, product cycles are short and revenue can be hit-driven due to rapidly changing trends. That's why we also follow short-term performance. DraftKings's recent history shows its momentum has slowed as its annualized revenue growth of 70.5% over the last two years is below its five-year trend.

This quarter, DraftKings reported magnificent year-on-year revenue growth of 52.7%, and its $1.17 billion of revenue beat Wall Street's estimates by 4.6%. Looking ahead, Wall Street expects sales to grow 23.8% over the next 12 months, a deceleration from this quarter.

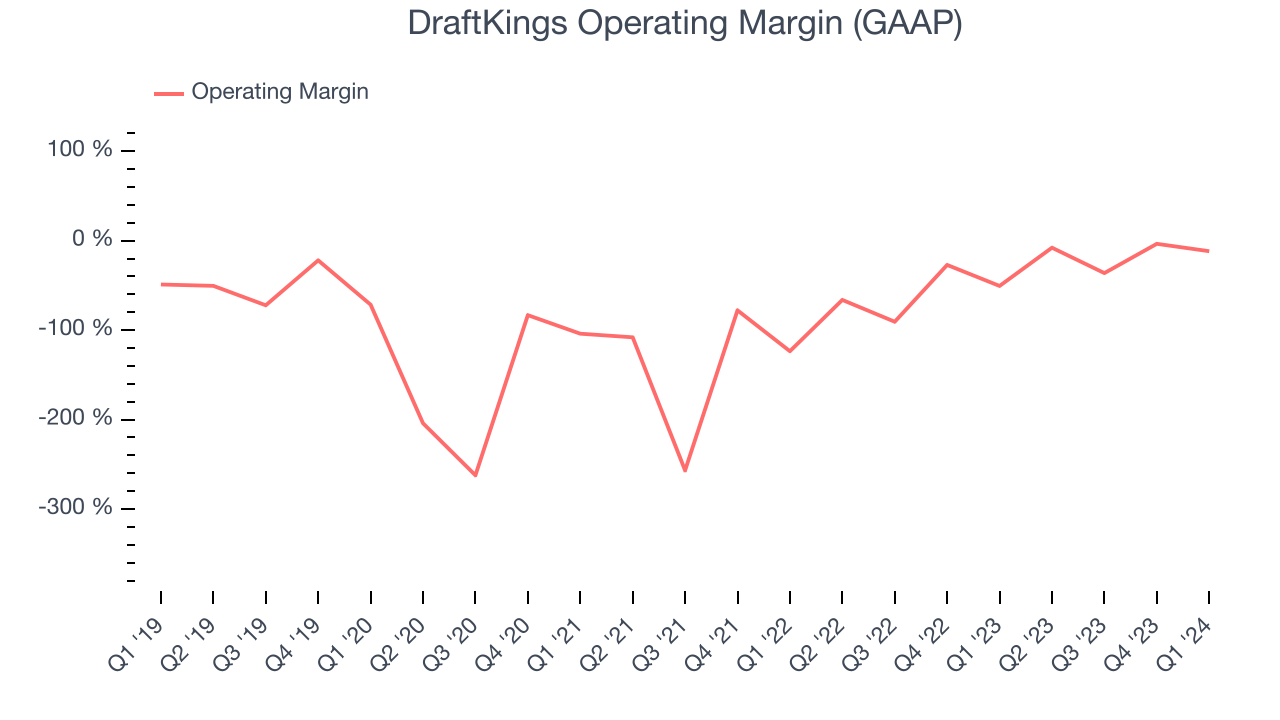

Operating Margin

Operating margin is a key measure of profitability. Think of it as net income–the bottom line–excluding the impact of taxes and interest on debt, which are less connected to business fundamentals.

Given the consumer discretionary industry's volatile demand characteristics, unprofitable companies should be scrutinized. Over the last two years, DraftKings's high expenses have contributed to an average operating margin of negative 28.9%.

In Q1, DraftKings generated an operating profit margin of negative 11.8%, up 38.8 percentage points year on year.

Over the next 12 months, Wall Street expects DraftKings to break even on its operating profits. Analysts are expecting the company’s LTM operating margin of negative 13.2% to rise by 13 percentage points.EPS

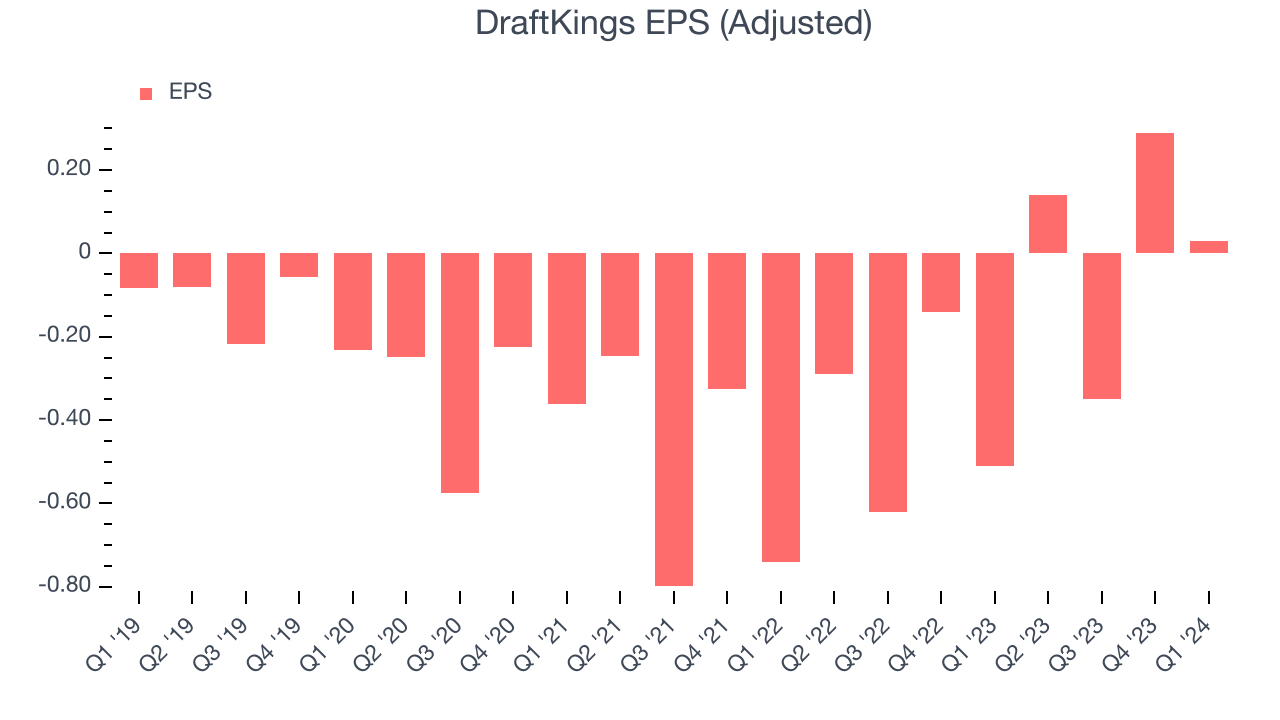

Analyzing long-term revenue trends tells us about a company's historical growth, but the long-term change in its earnings per share (EPS) points to the profitability and efficiency of that growth–for example, a company could inflate its sales through excessive spending on advertising and promotions.

Over the last four years, DraftKings cut its earnings losses and improved its EPS by 21.6% each year.

In Q1, DraftKings reported EPS at $0.03, up from negative $0.51 in the same quarter last year. This print easily cleared analysts' estimates, and shareholders should be content with the results. Over the next 12 months, Wall Street expects DraftKings to grow its earnings. Analysts are projecting its LTM EPS of $0.11 to climb by 479% to $0.64.

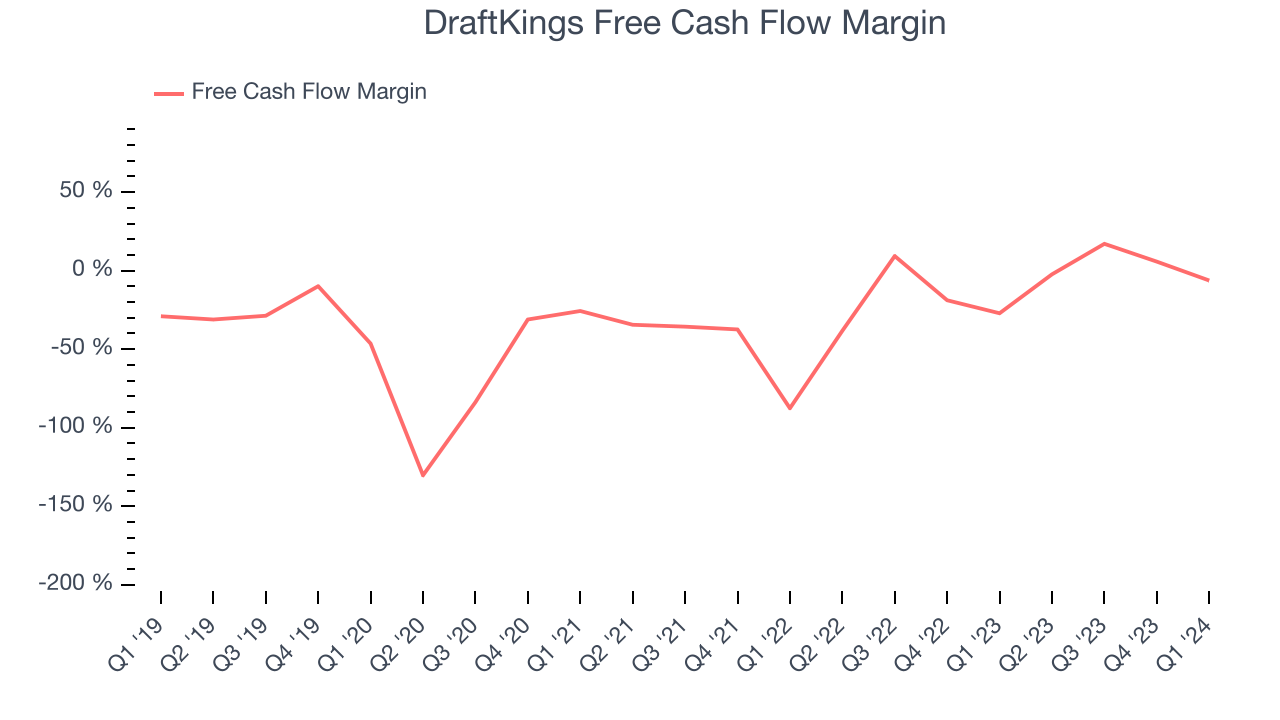

Cash Is King

Although earnings are undoubtedly valuable for assessing company performance, we believe cash is king because you can't use accounting profits to pay the bills.

Over the last two years, DraftKings's demanding reinvestments to stay relevant with consumers have drained company resources. Its free cash flow margin has been among the worst in the consumer discretionary sector, averaging negative 5.8%.

DraftKings burned through $73.42 million of cash in Q1, equivalent to a negative 6.2% margin, increasing its cash burn by 64.8% year on year.

Balance Sheet Risk

As long-term investors, the risk we care most about is the permanent loss of capital. This can happen when a company goes bankrupt or raises money from a disadvantaged position and is separate from short-term stock price volatility, which we are much less bothered by.

DraftKings is a well-capitalized company with $1.19 billion of cash and $90.2 million of debt, meaning it could pay back all its debt tomorrow and still have $1.10 billion of cash on its balance sheet. This net cash position gives DraftKings the freedom to raise more debt, return capital to shareholders, or invest in growth initiatives.

Key Takeaways from DraftKings's Q1 Results

We were impressed by how significantly DraftKings blew past analysts' EPS expectations this quarter. We were also excited its revenue outperformed as its average revenue per monthly unique payer beat Wall Street's estimates ($114 vs estimates of $105).

During the quarter, DraftKings launched its sportsbook in Vermont and North Carolina. Looking ahead, the company raised its full-year revenue and EBITDA guidance to $4.9 billion and $500 million at the midpoint, both of which beat Wall Street's projections.

Zooming out, we think this was a great quarter that shareholders will appreciate. The stock is up 1.8% after reporting and currently trades at $43.8 per share.

Is Now The Time?

DraftKings may have had a good quarter, but investors should also consider its valuation and business qualities when assessing the investment opportunity.

DraftKings isn't a bad business, but it probably wouldn't be one of our picks. Although its revenue growth has been exceptional over the last five years, its cash burn raises the question of whether it can sustainably maintain growth. And while its projected EPS for the next year implies the company's fundamentals will improve, the downside is its operating margins reveal poor profitability compared to other consumer discretionary companies.

DraftKings's price-to-earnings ratio based on the next 12 months is 67.5x. We can find things to like about DraftKings and there's no doubt it's a bit of a market darling, at least for some investors. But it seems there's a lot of optimism already priced in and we wonder if there are better opportunities elsewhere right now.

Wall Street analysts covering the company had a one-year price target of $51.57 per share right before these results (compared to the current share price of $43.80).

To get the best start with StockStory, check out our most recent stock picks, and then sign up for our earnings alerts by adding companies to your watchlist here. We typically have the quarterly earnings results analyzed within seconds of the data being released, and especially for companies reporting pre-market, this often gives investors the chance to react to the results before the market has fully absorbed the information.