Doughnut chain Krispy Kreme (NASDAQ:DNUT) announced better-than-expected results in Q4 FY2023, with revenue up 11.4% year on year to $450.9 million. It made a non-GAAP profit of $0.09 per share, down from its profit of $0.11 per share in the same quarter last year.

Krispy Kreme (DNUT) Q4 FY2023 Highlights:

- Revenue: $450.9 million vs analyst estimates of $438.9 million (2.7% beat)

- EPS (non-GAAP): $0.09 vs analyst expectations of $0.13 (28.2% miss)

- Free Cash Flow was -$31.31 million compared to -$36.54 million in the previous quarter

- Gross Margin (GAAP): 30.5%, up from 28.1% in the same quarter last year

- Store Locations: 14,147 at quarter end, increasing by 2,310 over the last 12 months

- Market Capitalization: $2.33 billion

Famous for its Original Glazed doughnuts and parent company of Insomnia Cookies, Krispy Kreme (NASDAQ:DNUT) is one of the most beloved and well-known fast-food chains in the world.

The company was founded in 1937 by Vernon Rudolph when he rented a small building in North Carolina to sell doughnuts to local grocery stores.

Since then, Krispy Kreme has evolved into an omni-channel business and acquired Insomnia Cookies, another revered brand, in 2018. Together, these two banners work harmonically to provide fresh sweets to its customers.

Krispy Kreme and Insomnia Cookies have an unwavering commitment to freshness and quality. At Krispy Kreme, each doughnut is made with the finest ingredients, ensuring a “hot-off-the-line, melt-in-your-mouth” experience, and at Insomnia Cookies, bakers work hard to create “CookieMagic”. In addition to its core menu items, Krispy Kreme serves a range of premium beverages, while Insomnia Cookies also offers ice cream, brownies, and cakes.

When entering Krispy Kreme’s stores, customers are greeted by the unmistakable aroma of warm doughnuts wafting through the air. The warm and inviting atmosphere, often adorned with the mesmerizing sight of doughnuts being freshly glazed through a see-through glass window, creates an immersive and joyful environment for customers.

On the other hand, Insomnia Cookies leverages a digital-first concept, using its popular app to facilitate in-store pickup and delivery orders. This channel accounts for over 40% of Insomnia Cookies’ sales.

Traditional Fast Food

Traditional fast-food restaurants are renowned for their speed and convenience, boasting menus filled with familiar and budget-friendly items. Their reputations for on-the-go consumption make them favored destinations for individuals and families needing a quick meal. This class of restaurants, however, is fighting the perception that their meals are unhealthy and made with inferior ingredients, a battle that's especially relevant today given the consumers increasing focus on health and wellness.

Some competitors that sell sweet treats include private company Dunkin’ as well as public companies Dutch Bros (NYSE:BROS), McDonald’s (NYSE:MCD), Starbucks (NYSE:SBUX), and Tim Hortons (owned by Restaurant Brands, NYSE:QSR).Sales Growth

Krispy Kreme is larger than most restaurant chains and benefits from economies of scale, giving it an edge over its smaller competitors.

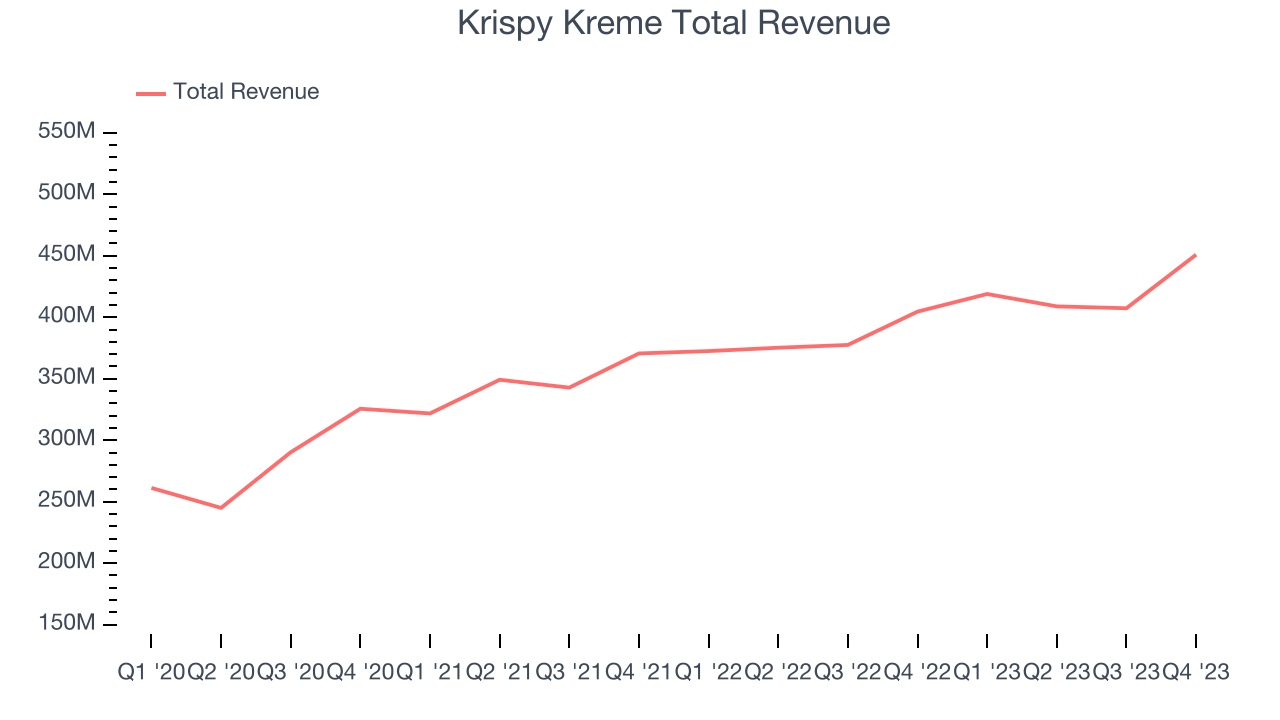

As you can see below, the company's annualized revenue growth rate of 15.1% over the last four years (we compare to 2019 to normalize for COVID-19 impacts) was impressive as it added more dining locations and expanded its reach.

This quarter, Krispy Kreme reported robust year-on-year revenue growth of 11.4%, and its $450.9 million in revenue exceeded Wall Street's estimates by 2.7%. Looking ahead, Wall Street expects sales to grow 6.8% over the next 12 months, a deceleration from this quarter.

Number of Stores

A restaurant chain's total number of dining locations often determines how much revenue it can generate.

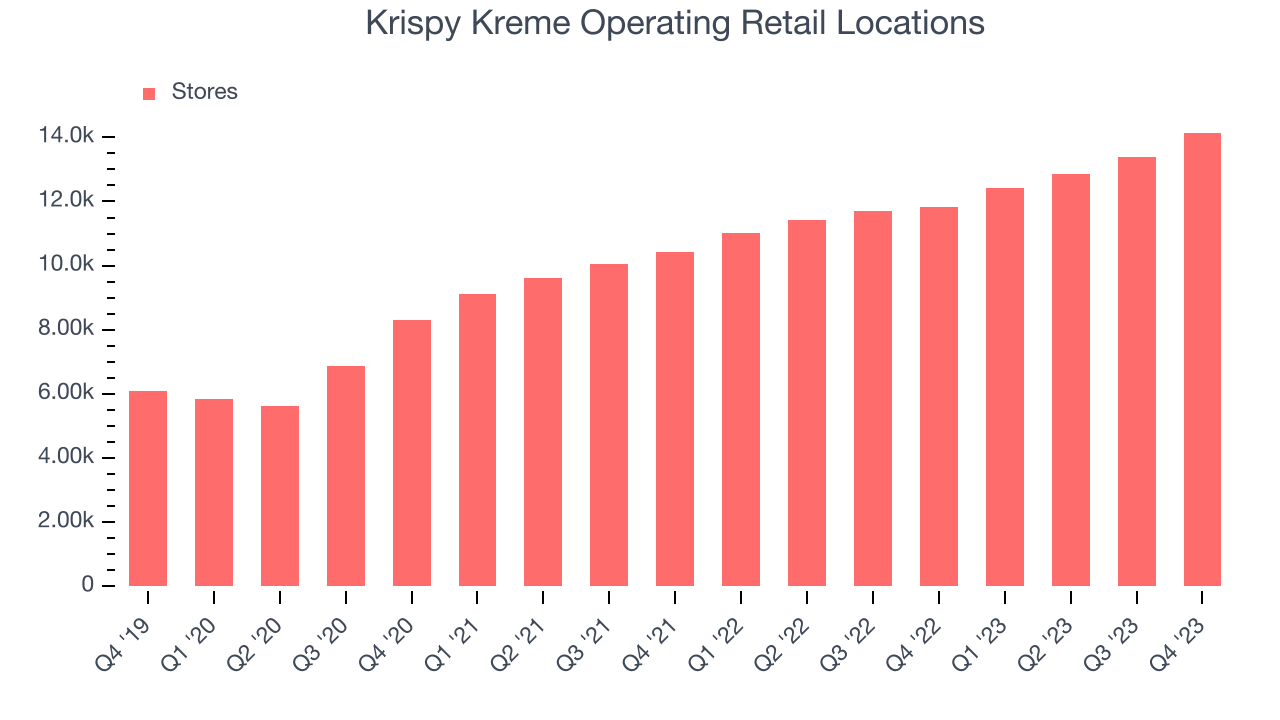

When a chain like Krispy Kreme is opening new restaurants, it usually means it's investing for growth because there's healthy demand for its meals and there are markets where the concept has few or no locations. Krispy Kreme's restaurant count increased by 2,310, or 19.5%, over the last 12 months to 14,147 locations in the most recently reported quarter.

Over the last two years, Krispy Kreme has rapidly opened new restaurants, averaging 16.1% annual increases in new locations. This growth is among the fastest in the restaurant sector. Analyzing a restaurant's location growth is important because expansion means Krispy Kreme has more opportunities to feed customers and generate sales.

Gross Margin & Pricing Power

Gross profit margins are an important measure of a restaurant's pricing power and differentiation, whether it be the dining experience or quality and taste of food.

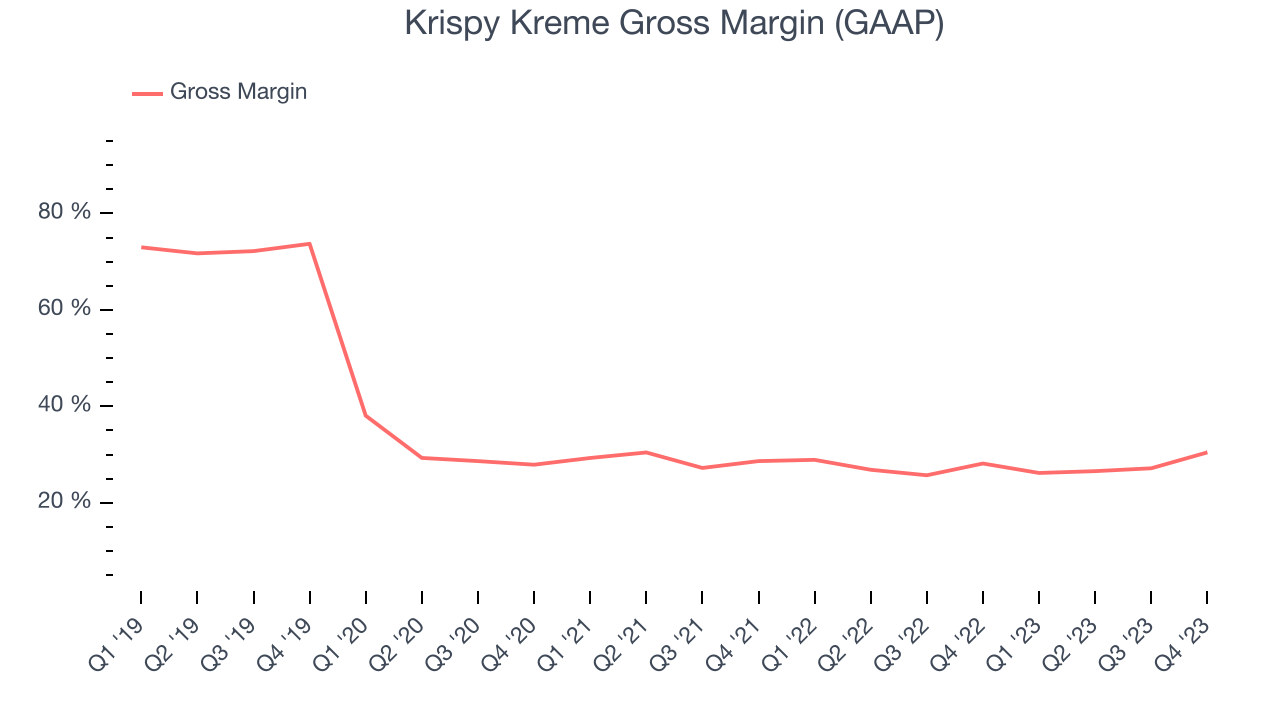

In Q4, Krispy Kreme's gross profit margin was 30.5%. up 2.3 percentage points year on year. This means the company makes $0.27 for every $1 in revenue before accounting for its operating expenses.

Krispy Kreme's unit economics are higher than the typical restaurant company, giving it the flexibility to invest in areas such as marketing and talent to reach more consumers. As you can see above, it's averaged a decent 27.5% gross margin over the last eight quarters. Its margin has also been consistent over the last year, suggesting it has stable input costs (such as ingredients and transportation expenses).

Operating Margin

Operating margin is an important measure of profitability for restaurants as it accounts for all expenses keeping the lights on, including wages, rent, advertising, and other administrative costs.

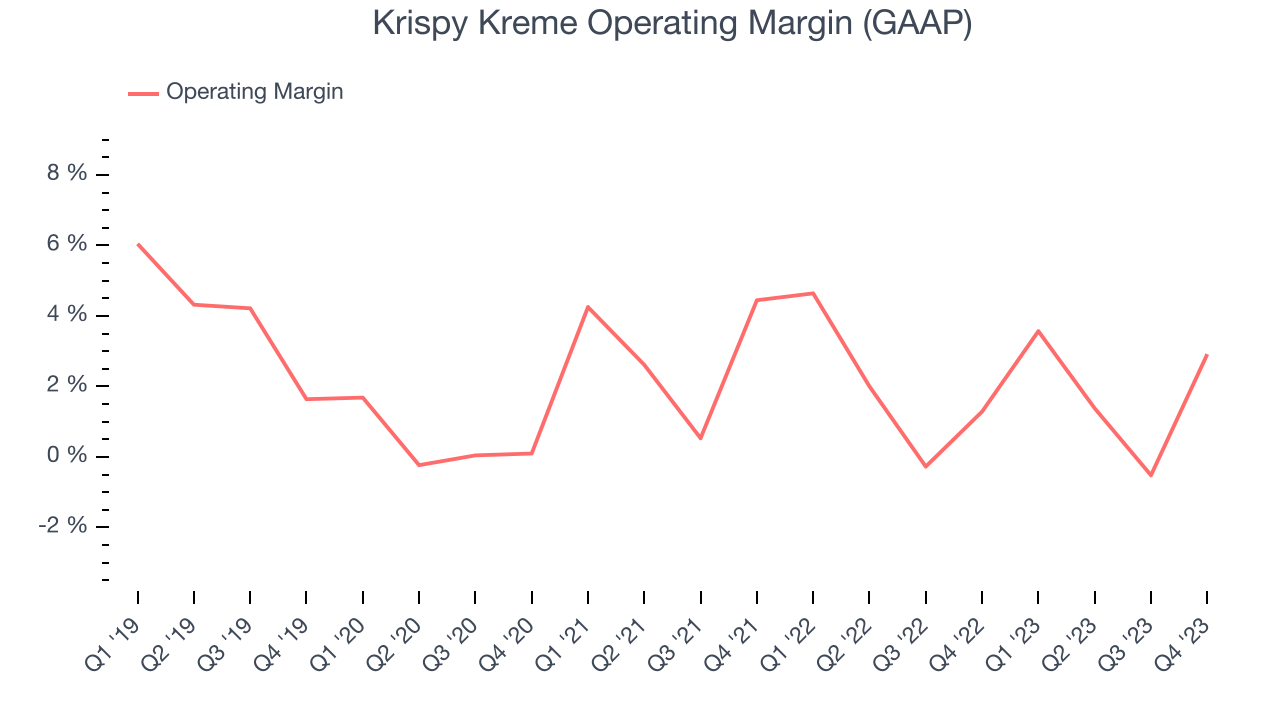

In Q4, Krispy Kreme generated an operating profit margin of 2.9%, up 1.6 percentage points year on year. This increase was encouraging and driven by stronger pricing power or lower ingredient/transportation costs, as indicated by the company's larger rise in gross margin.

Zooming out, Krispy Kreme was profitable over the last eight quarters but held back by its large expense base. Its average operating margin of 1.9% has been among the worst in the restaurant sector. Its margin has also seen few fluctuations, meaning it will take a big change to improve profitability.

Zooming out, Krispy Kreme was profitable over the last eight quarters but held back by its large expense base. Its average operating margin of 1.9% has been among the worst in the restaurant sector. Its margin has also seen few fluctuations, meaning it will take a big change to improve profitability.EPS

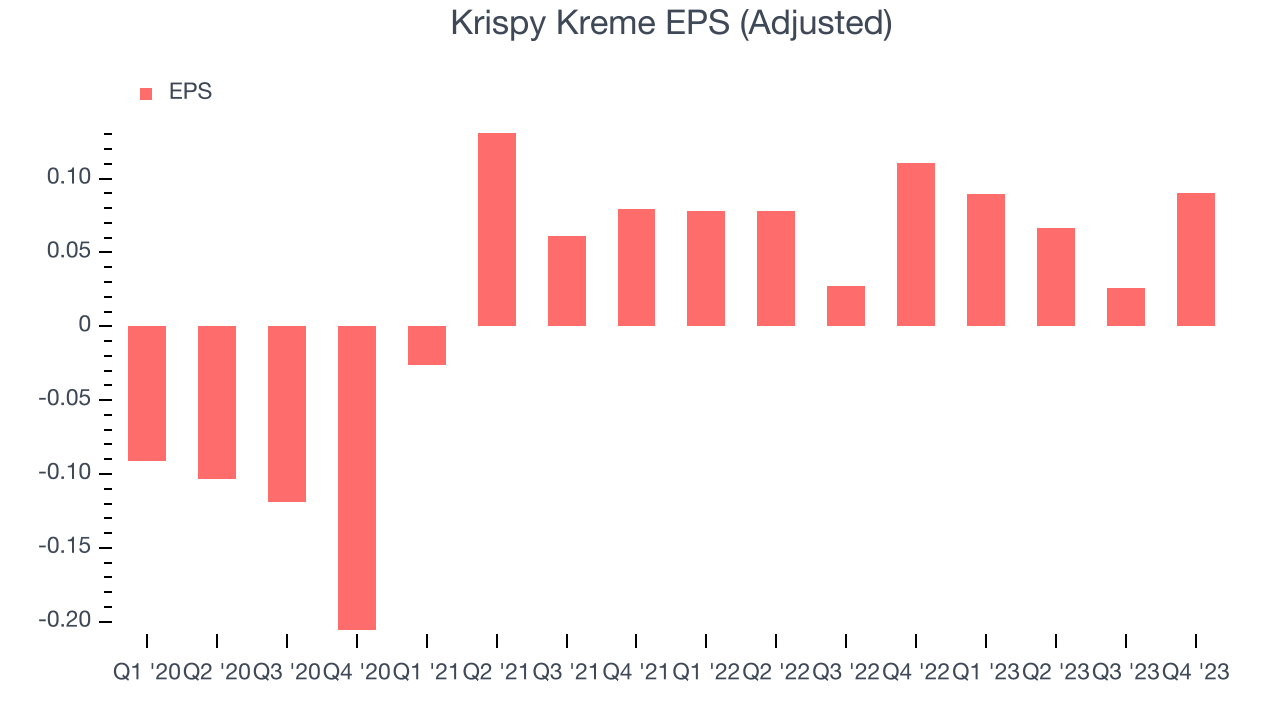

These days, some companies issue new shares like there's no tomorrow. That's why we like to track earnings per share (EPS) because it accounts for shareholder dilution and share buybacks.

In Q4, Krispy Kreme reported EPS at $0.09, down from $0.11 in the same quarter a year ago. This print unfortunately missed Wall Street's estimates, but we care more about long-term EPS growth rather than short-term movements.

Between FY2019 and FY2023, Krispy Kreme's adjusted diluted EPS grew 200%, translating into a remarkable 31.6% compounded annual growth rate. This growth is materially higher than its revenue growth over the same period, showing that Krispy Kreme has excelled in managing its expenses.

Wall Street expects the company to continue growing earnings over the next 12 months, with analysts projecting an average 33% year-on-year increase in EPS.

Cash Is King

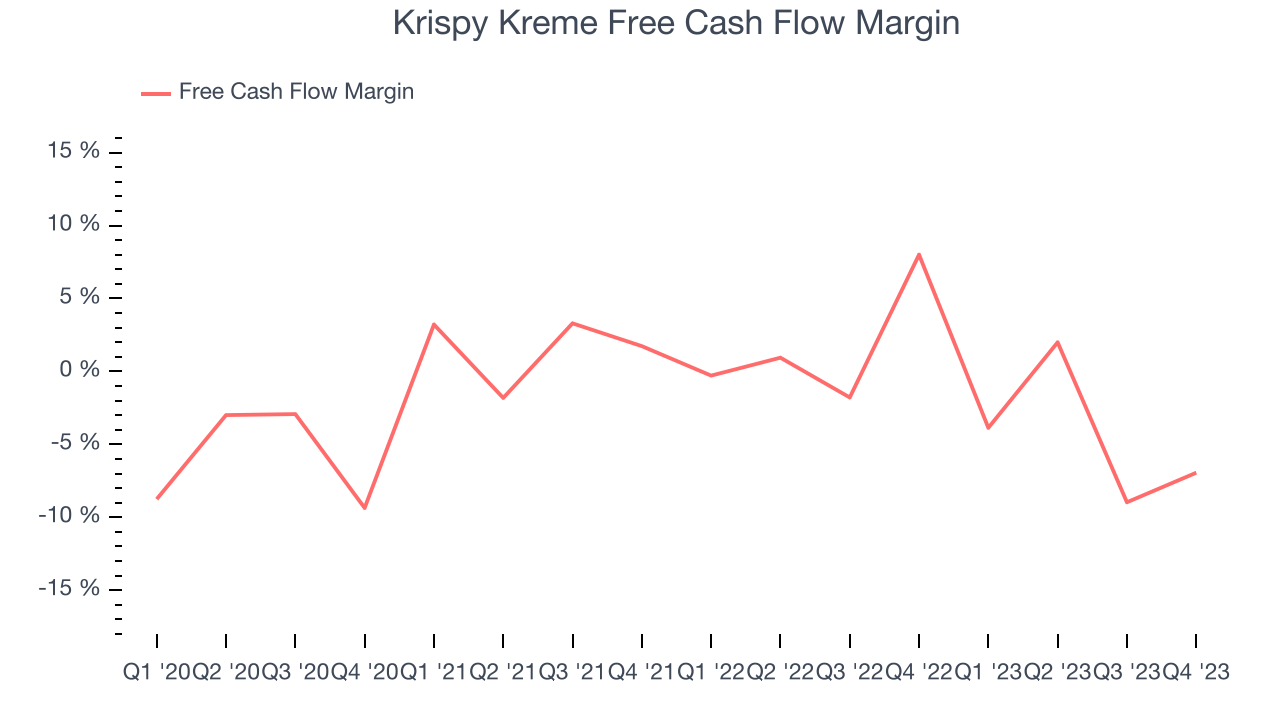

If you've followed StockStory for a while, you know that we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can't use accounting profits to pay the bills.

Krispy Kreme burned through $31.31 million of cash in Q4, representing a negative 6.9% free cash flow margin. The company shifted to cash flow negative from cash flow positive in the same quarter last year, which happened for several reasons including (but not limited to) seasonality or unforeseen, one-time events.

Over the last two years, Krispy Kreme's capital-intensive business model and large investments in new restaurant locations have drained company resources. Its free cash flow margin has been among the worst in the restaurant sector, averaging negative 1.4%. Furthermore, its margin has averaged year-on-year declines of 6.3 percentage points. We'll keep an eye on this as almost any movement in the wrong direction is undesirable given it's already burning cash. The company will need to improve its free cash flow conversion if it wants to survive (and ultimately thrive).

Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing revenue. But was it capital-efficient? A company’s ROIC explains this by showing how much operating profit a company makes compared to how much money the business raised (debt and equity).

Krispy Kreme's five-year average ROIC was 1.9%, somewhat low compared to the best restaurant companies that consistently pump out 15%+. Its returns suggest it historically did a subpar job investing in profitable business initiatives.

The trend in its ROIC, however, is often what surprises the market and drives the stock price. Unfortunately, Krispy Kreme's ROIC over the last two years averaged a 1.2 percentage point decrease each year. In conjunction with its already low returns, these declines suggest the company's profitable business opportunities are few and far between.

Key Takeaways from Krispy Kreme's Q4 Results

We enjoyed seeing Krispy Kreme beat past analysts' revenue expectations this quarter, driven by strong organic growth and more new store openings than anticipated. That stood out as a positive in these results. On the other hand, its gross margin and EPS missed estimates along with its full-year 2024 earnings forecast. Overall, this was a mediocre quarter for Krispy Kreme. The company is down 4.7% on the results and currently trades at $13.2 per share.

Is Now The Time?

Krispy Kreme may have had a tough quarter, but investors should also consider its valuation and business qualities when assessing the investment opportunity.

We cheer for all companies serving consumers, but in the case of Krispy Kreme, we'll be cheering from the sidelines. Although its revenue growth has been impressive over the last four years, its relatively low ROIC suggests it has struggled to grow profits historically. And while its new restaurant openings have increased its brand equity, the downside is its cash burn raises the question of whether it can sustainably maintain growth.

Krispy Kreme's price-to-earnings ratio based on the next 12 months is 38.2x. While we've no doubt one can find things to like about Krispy Kreme, we think there are better opportunities elsewhere in the market. We don't see many reasons to get involved at the moment.

Wall Street analysts covering the company had a one-year price target of $15.82 per share right before these results (compared to the current share price of $13.20).

To get the best start with StockStory, check out our most recent stock picks, and then sign up to our earnings alerts by adding companies to your watchlist here. We typically have the quarterly earnings results analyzed within seconds of the data being released, and especially for companies reporting pre-market, this often gives investors the chance to react to the results before the market has fully absorbed the information.