E-signature company DocuSign (DOCU) reported results in line with analysts' expectations in Q1 CY2024, with revenue up 7.3% year on year to $709.6 million. The company expects next quarter's revenue to be around $727 million, in line with analysts' estimates. It made a non-GAAP profit of $0.82 per share, improving from its profit of $0.72 per share in the same quarter last year.

Is now the time to buy DocuSign? Find out by accessing our full research report, it's free.

DocuSign (DOCU) Q1 CY2024 Highlights:

- Revenue: $709.6 million vs analyst estimates of $707.4 million (small beat)

- EPS (non-GAAP): $0.82 vs analyst estimates of $0.79 (3.7% beat)

- Revenue Guidance for Q2 CY2024 is $727 million at the midpoint, roughly in line with what analysts were expecting

- The company reconfirmed its revenue guidance for the full year of $2.93 billion at the midpoint

- Gross Margin (GAAP): 78.9%, in line with the same quarter last year

- Free Cash Flow of $232.1 million, similar to the previous quarter

- Billings: $709.5 million at quarter end, up 5.1% year on year

- Market Capitalization: $10.96 billion

"Docusign is off to a strong start in fiscal 2025. We launched a significant expansion to our company strategy with our announcement of the Docusign Intelligent Agreement Management platform," said Allan Thygesen, CEO of Docusign.

Founded by Seattle-based entrepreneur Tom Gonser, DocuSign (NASDAQ:DOCU) is the pioneer of e-signature and offers software as a service that allows people and organisations to sign legally binding documents electronically.

Document Management

The catch phrase "digital transformation" originally referred to the digitization of documents within enterprises. The growth of digital documents has spurred an explosion of collaboration within and between businesses, which in turn is driving the demand for e-signature and content management platforms.

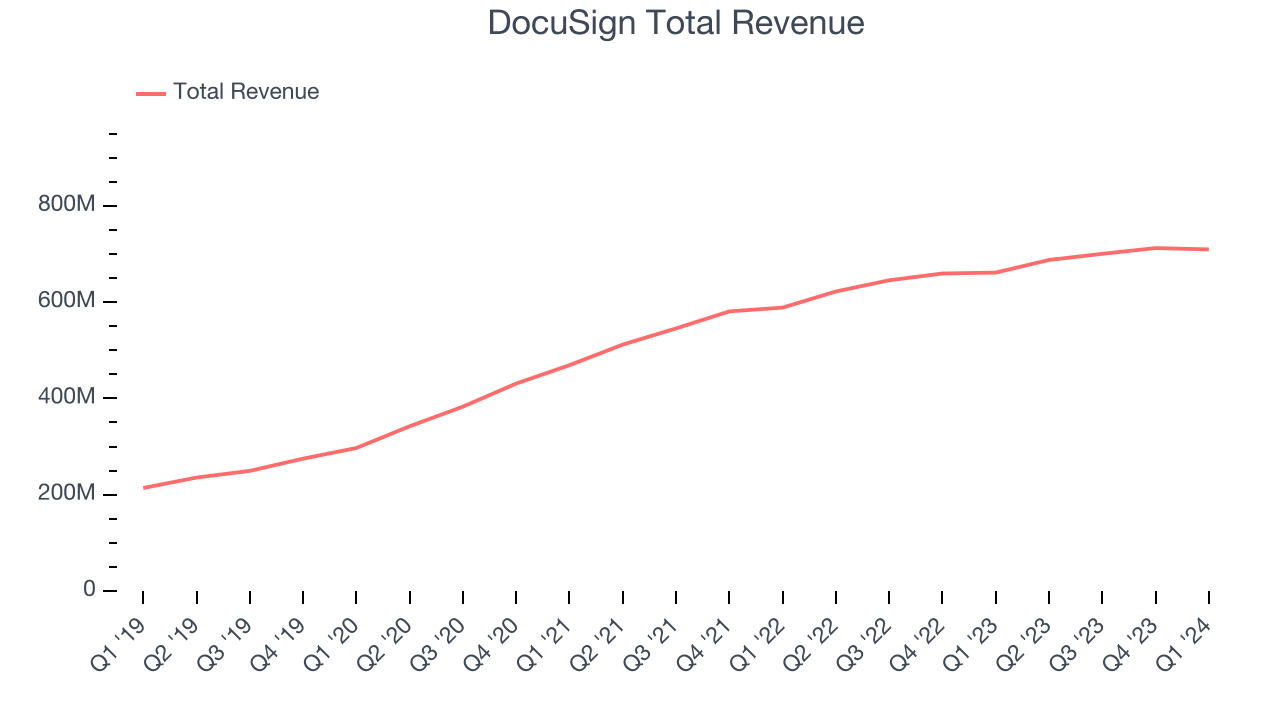

Sales Growth

As you can see below, DocuSign's revenue growth has been strong over the last three years, growing from $469.1 million in Q1 2022 to $709.6 million this quarter.

DocuSign's quarterly revenue was only up 7.3% year on year, which might disappoint some shareholders. On top of that, the company's revenue actually decreased by $2.75 million in Q1 compared to the $11.97 million increase in Q4 CY2023. While we'd like to see revenue increase each quarter, management is guiding for growth to rebound in the next quarter and a one-off fluctuation is usually not concerning.

Next quarter's guidance suggests that DocuSign is expecting revenue to grow 5.7% year on year to $727 million, slowing down from the 10.5% year-on-year increase it recorded in the same quarter last year. Looking ahead, analysts covering the company were expecting sales to grow 5.7% over the next 12 months before the earnings results announcement.

Here at StockStory, we certainly understand the potential of thematic investing. Diverse winners from Microsoft (MSFT) to Alphabet (GOOG), Coca-Cola (KO) to Monster Beverage (MNST) could all have been identified as promising growth stories with a megatrend driving the growth. So, in that spirit, we’ve identified a relatively under-the-radar profitable growth stock benefitting from the rise of AI, available to you FREE via this link.

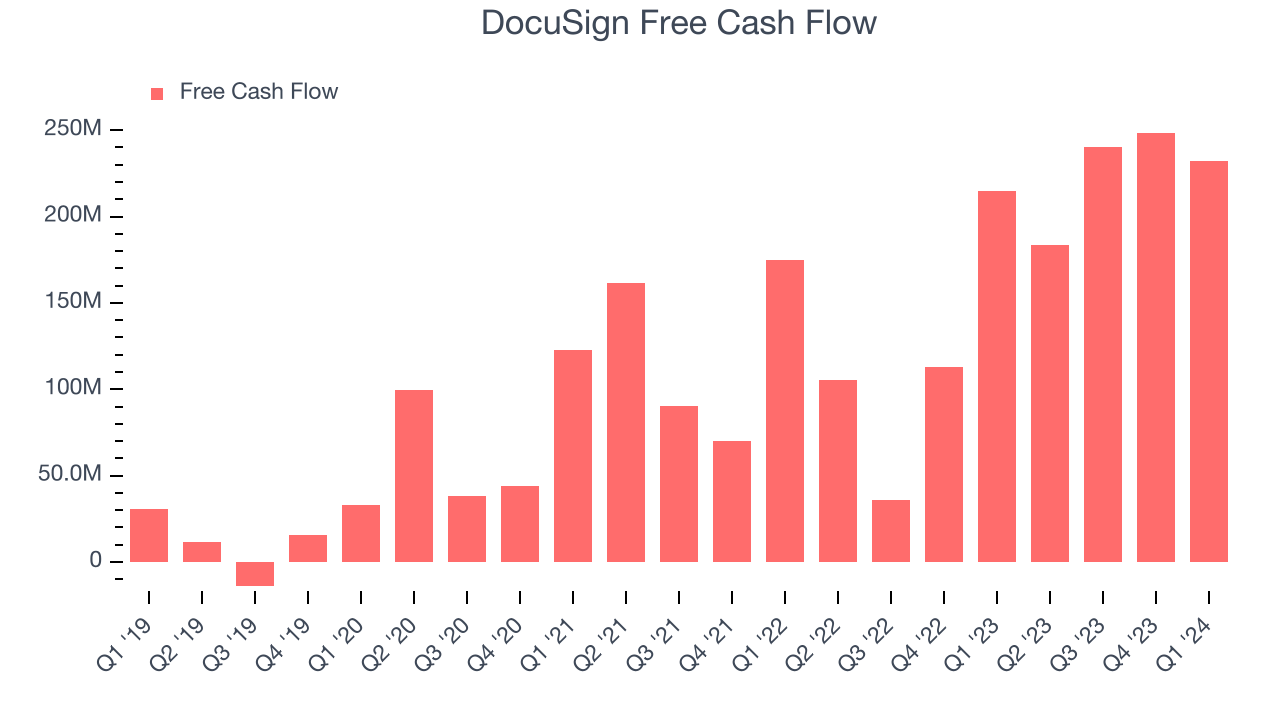

Cash Is King

If you've followed StockStory for a while, you know that we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can't use accounting profits to pay the bills. DocuSign's free cash flow came in at $232.1 million in Q1, up 8.2% year on year.

DocuSign has generated $904.6 million in free cash flow over the last 12 months, an eye-popping 32.2% of revenue. This robust FCF margin stems from its asset-lite business model, scale advantages, and strong competitive positioning, giving it the option to return capital to shareholders or reinvest in its business while maintaining a healthy cash balance.

Key Takeaways from DocuSign's Q1 Results

We enjoyed seeing DocuSign exceed analysts' billings expectations this quarter. On the other hand, its gross margin declined. Guidance for next quarter and the full year were both in line for revenue. Furthermore, full year revenue and operating margin guidance were maintained. Zooming out, we think this was still a decent, albeit mixed, quarter, showing that the company is staying on track. The stock is flat after reporting and currently trades at $55.10 per share.

So should you invest in DocuSign right now? When making that decision, it's important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it's free.