The end of the earnings season is always a good time to take a step back and see who shined (and who not so much). Let’s have a look at how the productivity software stocks have fared in Q1, starting with DocuSign (NASDAQ:DOCU).

Rising employee costs and the shift to more remote work has increased the ever-present pressure to improve corporate productivity, which in turn has driven rising demand for productivity software that enables remote work, streamline project management and automate business tasks.

The 17 productivity software stocks we track reported a slower Q1; on average, revenues beat analyst consensus estimates by 1.77%, while on average next quarter revenue guidance was 0.1% above consensus. Tech stocks have been under pressure as inflation makes their long-dated profits less valuable, but productivity software stocks held their ground better than others, with the share prices up 15.4% since the previous earnings results, on average.

DocuSign (NASDAQ:DOCU)

Founded by Seattle-based entrepreneur Tom Gonser, DocuSign (NASDAQ:DOCU) is the pioneer of e-signature and offers software as a service that allows people and organisations to sign legally binding documents electronically.

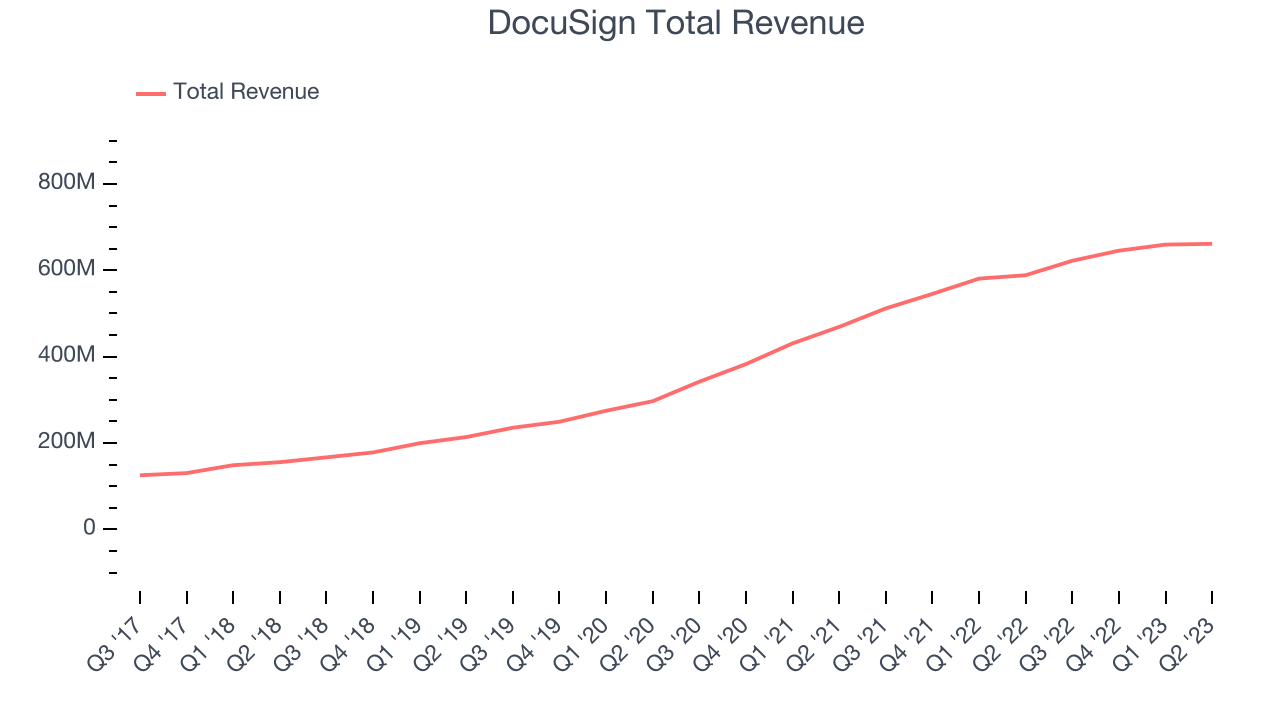

DocuSign reported revenues of $661.4 million, up 12.3% year on year, beating analyst expectations by 3.07%. It was a solid quarter for the company, with revenue guidance for the next quarter and the upcoming year exceeding analysts' expectations.

"DocuSign's first quarter results, coupled with traction on our strategic objectives reflect a solid start to the year," said Allan Thygesen, CEO of DocuSign.

The stock is down 8.13% since the results and currently trades at $53.77.

Is now the time to buy DocuSign? Access our full analysis of the earnings results here, it's free.

Best Q1: Monday.com (NASDAQ:MNDY)

Founded in Israel in 2014, and named after the dreaded first day of the work week, Monday.com (NASDAQ:MNDY) makes software as a service platforms that helps teams plan and track work efficiently.

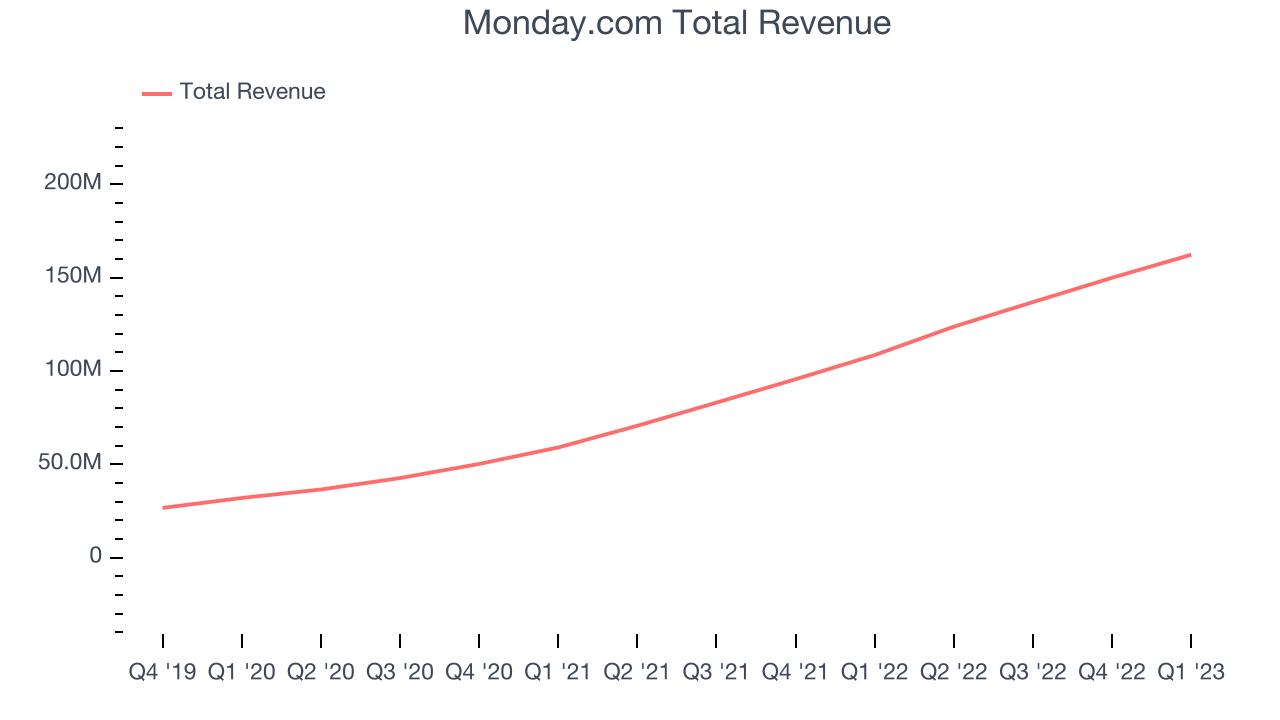

Monday.com reported revenues of $162.3 million, up 49.5% year on year, beating analyst expectations by 4.49%. It was a solid quarter for the company, with a decent beat of analyst estimates and strong sales guidance for the next quarter.

Monday.com delivered the fastest revenue growth and highest full year guidance raise among its peers. The company added 209 enterprise customers paying more than $50,000 annually to a total of 1,683. The stock is up 35% since the results and currently trades at $176.68.

Is now the time to buy Monday.com? Access our full analysis of the earnings results here, it's free.

Slowest Q1: Pegasystems (NASDAQ:PEGA)

Founded by Alan Trefler in 1983, Pegasystems (NASDAQ:PEGA) offers a software-as-a-service platform to automate and optimize workflows in customer service and engagement.

Pegasystems reported revenues of $325.5 million, down 13.5% year on year, missing analyst expectations by 7.14%. It was a weak quarter for the company, with a miss of the top line analyst estimates and a decline in gross margin.

Pegasystems had the weakest performance against analyst estimates and slowest revenue growth in the group. The stock is up 12.2% since the results and currently trades at $49.

Read our full analysis of Pegasystems's results here.

RingCentral (NYSE:RNG)

Founded in 1999 during the dot-com era, RingCentral (NYSE:RNG) provides software as a service that unifies phone, text, fax, video calls and chat in one platform.

RingCentral reported revenues of $533.7 million, up 14.1% year on year, beating analyst expectations by 1.07%. It was a solid quarter for the company, with revenue guidance for the next quarter and the full year roughly inline with Consensus. On a more positive note, EPS guidance for the next quarter exceeded expectations, and the company raised the full-year EPS guidance.

The stock is up 28.8% since the results and currently trades at $34.1.

Read our full, actionable report on RingCentral here, it's free.

Smartsheet (NYSE:SMAR)

Founded in 2005, Smartsheet (NYSE:SMAR) is a software as a service platform that helps companies plan, manage and report on work.

Smartsheet reported revenues of $219.9 million, up 30.6% year on year, beating analyst expectations by 2.67%. It was a slower quarter for the company, with decelerating growth in large customers and underwhelming revenue guidance for the next quarter.

The company added 390 enterprise customers paying more than $5,000 annually to a total of 18,483. The stock is down 15.7% since the results and currently trades at $41.31.

Read our full, actionable report on Smartsheet here, it's free.

The author has no position in any of the stocks mentioned