Quarterly earnings results are a good time to check in on a company’s progress, especially compared to other peers in the same sector. Today we are looking at DocuSign (NASDAQ:DOCU), and the best and worst performers in the productivity software group.

Rising employee costs and the shift to more remote work has increased the ever-present pressure to improve corporate productivity, which in turn has driven rising demand for productivity software that enables remote work, streamline project management and automate business tasks.

The 17 productivity software stocks we track reported a slower Q4; on average, revenues beat analyst consensus estimates by 3.25%, while on average next quarter revenue guidance was 0.93% under consensus. Tech stocks have been hit the hardest as investors start to value profits over growth, but productivity software stocks held their ground better than others, with share prices down 2.81% since the previous earnings results, on average.

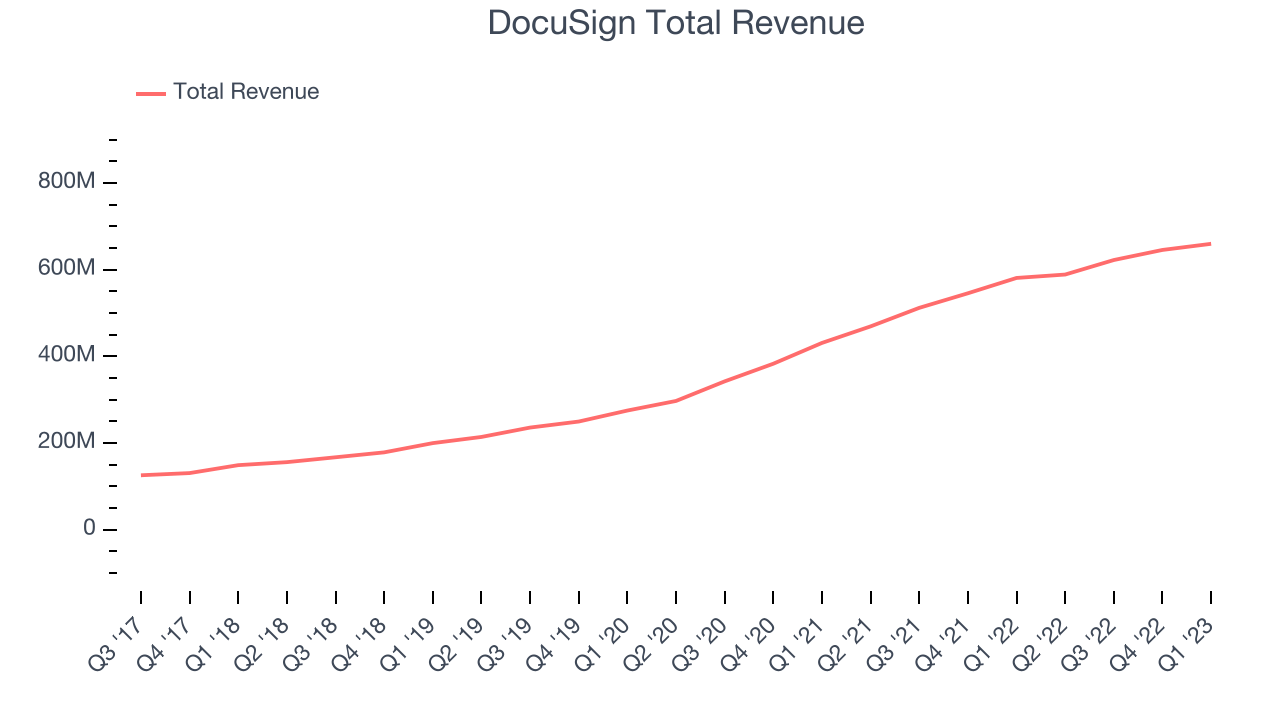

DocuSign (NASDAQ:DOCU)

Founded by Seattle-based entrepreneur Tom Gonser, DocuSign (NASDAQ:DOCU) is the pioneer of e-signature and offers software as a service that allows people and organisations to sign legally binding documents electronically.

DocuSign reported revenues of $659.6 million, up 13.6% year on year, beating analyst expectations by 3.14%. It was a weaker quarter for the company, with underwhelming guidance for the next year and slow revenue growth.

"We finished the year strong, delivering across our key financial metrics and making tangible progress on our strategic priorities. We are reshaping DocuSign to invest in our innovation roadmap and self-service capabilities," said Allan Thygesen, CEO of DocuSign.

The stock is down 11.2% since the results and currently trades at $57.2.

Read our full report on DocuSign here, it's free.

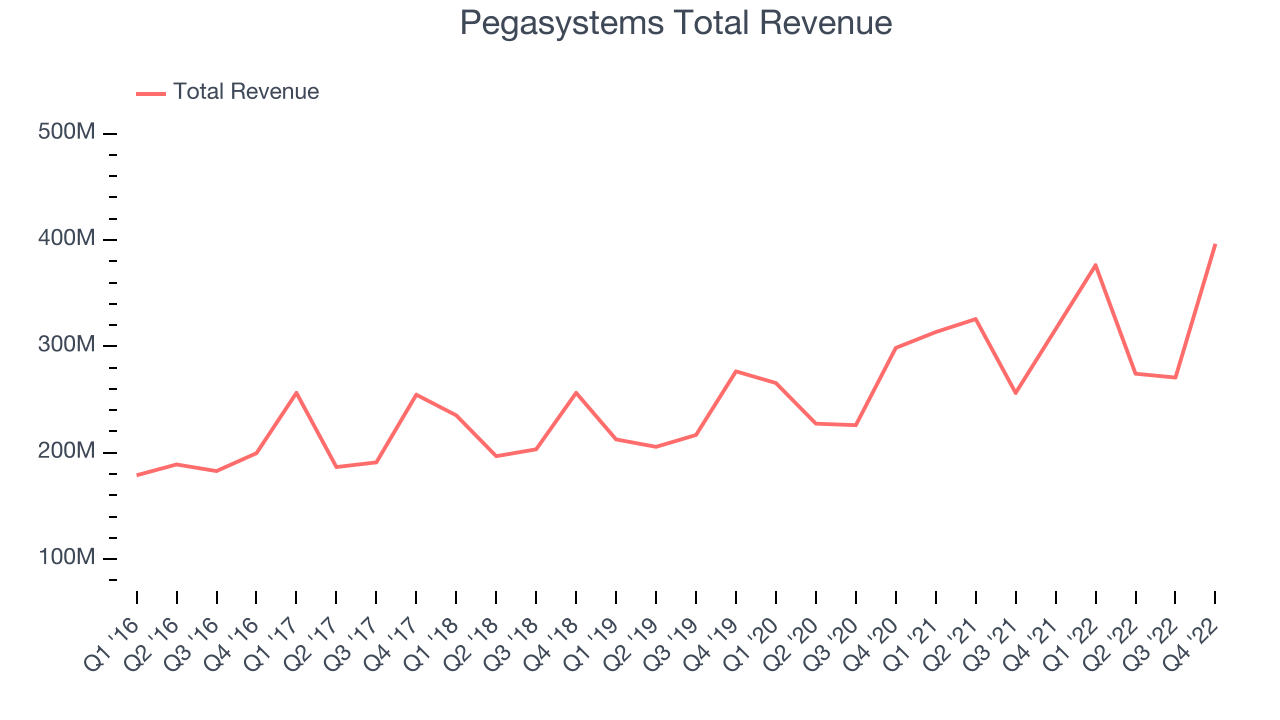

Best Q4: Pegasystems (NASDAQ:PEGA)

Founded by Alan Trefler in 1983, Pegasystems (NASDAQ:PEGA) offers a software-as-a-service platform to automate and optimize workflows in customer service and engagement.

Pegasystems reported revenues of $396.5 million, up 25.4% year on year, beating analyst expectations by 18.8%. It was a strong quarter for the company, with a significant improvement in gross margin and an impressive beat of analyst estimates.

Pegasystems achieved the strongest analyst estimates beat among its peers. The stock is up 11.6% since the results and currently trades at $47.64.

Is now the time to buy Pegasystems? Access our full analysis of the earnings results here, it's free.

Weakest Q4: Jamf (NASDAQ:JAMF)

Founded in 2002 by Zach Halmstad and Chip Pearson, right around the time when Apple began to dominate the personal computing market, Jamf (NASDAQ:JAMF) provides software for companies to manage Apple devices such as Macs, iPads, and iPhones.

Jamf reported revenues of $130.3 million, up 25.5% year on year, beating analyst expectations by 1.09%. It was a weak quarter for the company, with revenue guidance for the next quarter and the full year missing analysts' expectations.

The stock is down 9.47% since the results and currently trades at $19.21.

Read our full analysis of Jamf's results here.

Everbridge (NASDAQ:EVBG)

Founded as a reaction to the catastrophic events of 9/11, Everbridge (NASDAQ:EVBG) supplies software that helps governments and businesses keep people and infrastructure safe in emergencies.

Everbridge reported revenues of $117.1 million, up 13.9% year on year, in line with analyst expectations. It was a slower quarter for the company, with revenue guidance for the next quarter and the full year missing analysts' expectations.

The company added 96 customers to a total of 6,513. The stock is down 2.83% since the results and currently trades at $32.97.

Read our full, actionable report on Everbridge here, it's free.

Dropbox (NASDAQ:DBX)

Founded by the long-serving CEO Drew Houston and Arash Ferdowsi in 2007, Dropbox (NASDAQ:DBX) provides a file hosting cloud platform that helps organizations collaborate and share documents.

Dropbox reported revenues of $598.8 million, up 5.89% year on year, in line with analyst expectations. It was a mixed quarter for the company, with accelerating customer growth but slow revenue growth.

The company added 220,000 customers to a total of 17,770,000. The stock is down 10.9% since the results and currently trades at $21.35.

Read our full, actionable report on Dropbox here, it's free.

The author has no position in any of the stocks mentioned