Data visualisation and business intelligence company Domo (NASDAQ:DOMO) reported results ahead of analyst expectations in the Q4 FY2022 quarter, with revenue up 23.1% year on year to $69.9 million. On top of that, guidance for next quarter's revenue was surprisingly good, being $74 million at the midpoint, 5.64% above what analysts were expecting. Domo made a GAAP loss of $33.2 million, down on its loss of $19.6 million, in the same quarter last year.

Is now the time to buy Domo? Access our full analysis of the earnings results here, it's free.

Domo (DOMO) Q4 FY2022 Highlights:

- Revenue: $69.9 million vs analyst estimates of $67.1 million (4.31% beat)

- EPS (non-GAAP): -$0.41 vs analyst estimates of -$0.40

- Revenue guidance for Q1 2023 is $74 million at the midpoint, above analyst estimates of $70 million

- Management's revenue guidance for upcoming financial year 2023 is $316.5 million at the midpoint, beating analyst estimates by 4.21% and predicting 22.6% growth (vs 22.7% in FY2022)

- Free cash flow was negative $643 thousand, compared to negative free cash flow of $1.51 million in previous quarter

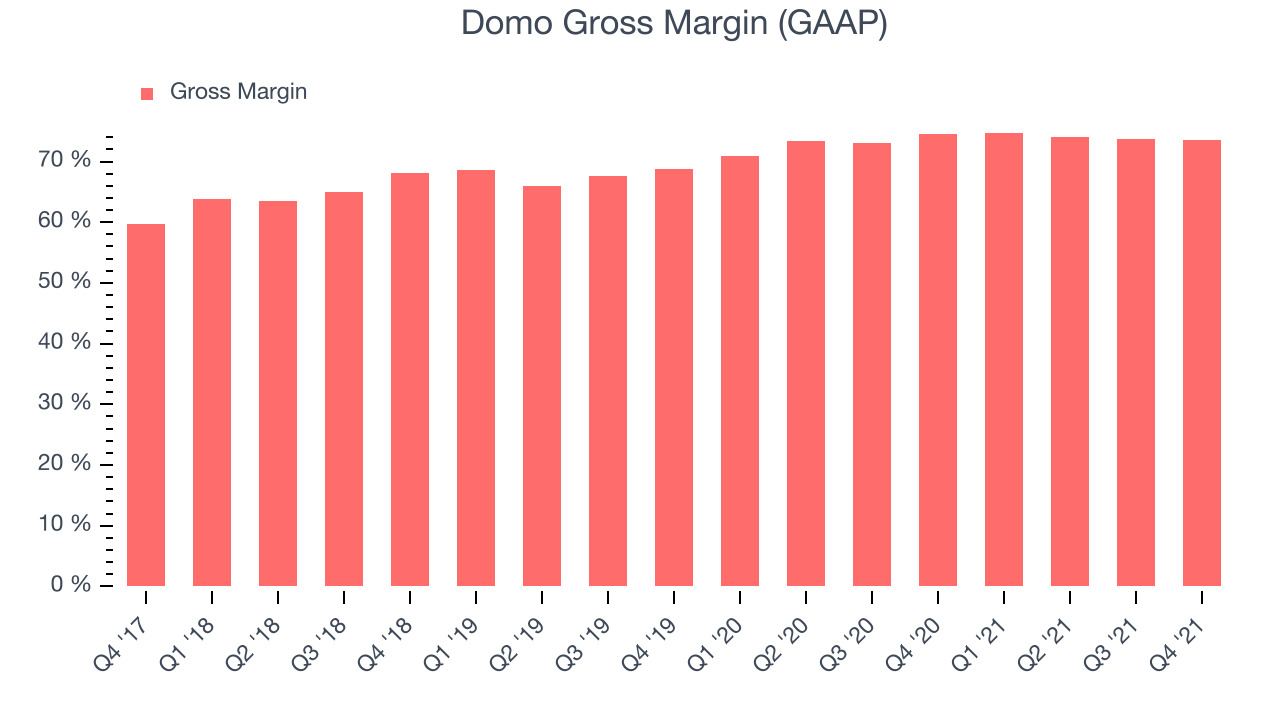

- Gross Margin (GAAP): 73.5%, down from 74.4% same quarter last year

“We see companies continuing to drive digital transformation across all areas of their organizations, and we believe the ability to rapidly build apps on top of our platform is one of the most exciting growth engines for us," said John Mellor, Domo CEO.

Founded by Josh James after selling his former business Omniture to Adobe, Domo (NASDAQ:DOMO) provides business intelligence software that allows managers to access and visualize critical business metrics in real-time, using their smartphones.

Organizations generate a lot of data that is stored in silos, often in incompatible formats, making it slow and costly to extract actionable insights, which in turn drives demand for modern cloud-based data analysis platforms that can efficiently analyze the silo-ed data.

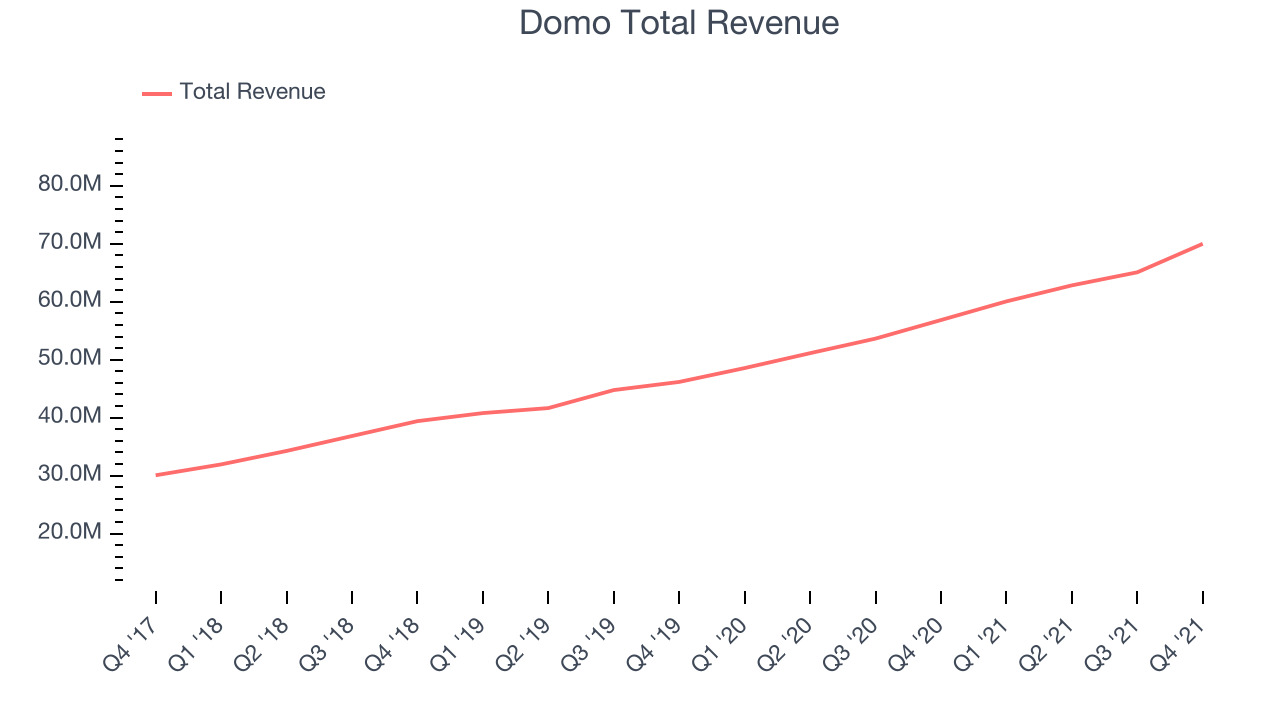

Sales Growth

As you can see below, Domo's revenue growth has been strong over the last year, growing from quarterly revenue of $56.8 million, to $69.9 million.

This quarter, Domo's quarterly revenue was once again up a very solid 23.1% year on year. On top of that, revenue increased $4.91 million quarter on quarter, a very strong improvement on the $2.25 million increase in Q3 2022, which shows acceleration of growth, and is great to see.

Guidance for the next quarter indicates Domo is expecting revenue to grow 23.2% year on year to $74 million, in line with the 23.6% year-over-year increase in revenue the company had recorded in the same quarter last year. For the upcoming financial year management expects revenue to be $316.5 million at the midpoint, growing 22.6% compared to 22.7% increase in FY2022.

There are others doing even better than Domo. Founded by ex-Google engineers, a small company making software for banks has been growing revenue 90% year on year and is already up more than 150% since the IPO last December. You can find it on our platform for free.

Profitability

What makes the software as a service business so attractive is that once the software is developed, it typically shouldn't cost much to provide it as an ongoing service to customers. Domo's gross profit margin, an important metric measuring how much money there is left after paying for servers, licenses, technical support and other necessary running expenses was at 73.5% in Q4.

That means that for every $1 in revenue the company had $0.73 left to spend on developing new products, marketing & sales and the general administrative overhead. This is around the average of what we typically see in SaaS businesses, but it is good to see that the gross margin is staying stable which indicates that Domo is doing a good job controlling costs and is not under pressure from competition to lower prices.

Key Takeaways from Domo's Q4 Results

With a market capitalization of $1.45 billion Domo is among smaller companies, but its more than $83.5 million in cash and the fact it is operating close to free cash flow break-even put it in a robust financial position to invest in growth.

We were impressed by the very optimistic revenue guidance Domo provided for the next quarter. And we were also glad that the revenue guidance for the rest of the year exceeded expectations. Overall, we think this was a really good quarter, that should leave shareholders feeling very positive. The company is up 4.87% on the results and currently trades at $46 per share.

Domo may have had a good quarter, so should you invest right now? It is important that you take into account its valuation and business qualities, as well as what happened in the latest quarter. We look at that in our actionable report which you can read here, it's free.

One way to find opportunities in the market is to watch for generational shifts in the economy. Almost every company is slowly finding itself becoming a technology company and facing cybersecurity risks and as a result, the demand for cloud-native cybersecurity is skyrocketing. This company is leading a massive technological shift in the industry and with revenue growth of 70% year on year and best-in-class SaaS metrics it should definitely be on your radar.

The author has no position in any of the stocks mentioned.