Data visualisation and business intelligence company Domo (Nasdaq:DOMO) reported Q1 FY2022 results beating Wall St's expectations, with revenue up 23.6% year on year to $60 million. Domo made a GAAP loss of $18.1 million, improving on its loss of $24.8 million, in the same quarter last year.

Is now the time to buy Domo? Get early access to our full analysis of the earnings results here

Domo (Nasdaq:DOMO) Q1 FY2022 Highlights:

- Revenue: $60 million vs analyst estimates of $57.2 million (4.93% beat)

- EPS (non-GAAP): -$0.26 vs analyst estimates of -$0.44

- Revenue guidance for Q2 2022 is $60.5 million at the midpoint, above analyst estimates of $59.3 million

- The company lifted revenue guidance for the full year, from $242.5 million to $249 million at the midpoint, a 2.68% increase

- Free cash flow was negative -$373 thousand, down from positive free cash flow of $2.1 million in previous quarter

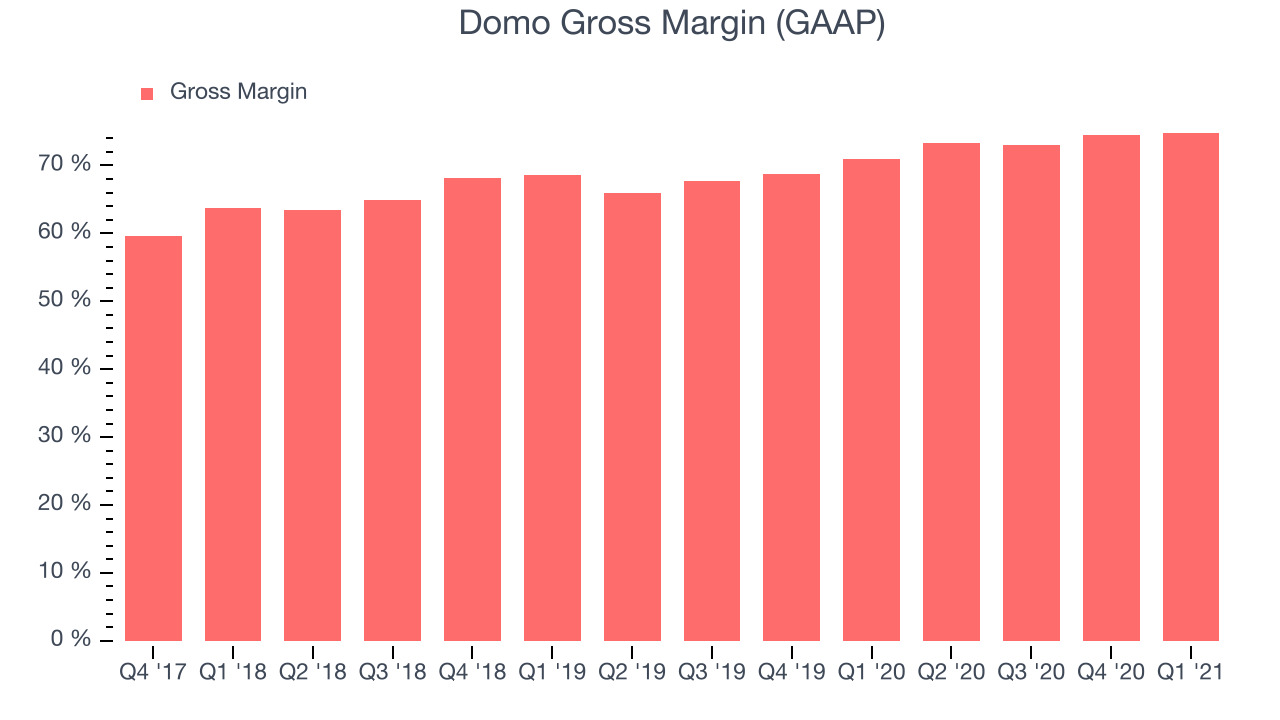

- Gross Margin (GAAP): 74.7%, in line with previous quarter

- Updated valuation: Domo is up at $67.5 and now trades at 9.2x price-to-sales (LTM), compared to 9.4x just before the results.

"With a record Q1 across many metrics including new business and retention, our performance this quarter puts us in a great position to execute well for the remainder of FY22," said Josh James, founder and CEO, Domo.

Bring Disparate Data Together

Serial entrepreneur Josh James founded Domo in 2010 in Utah, after selling his prior company, Omniture, to Adobe (Nasdaq:ADBE). He had noticed that it was very difficult for a CEO to understand the vital signs of their company since data around various metrics such as staff numbers, retention rates, and customer acquisition costs were often held in disparate systems. Today Domo (Nasdaq:DOMO) allows a CEO to monitor all these things and more from their phone, and can draw data from thousands of sources, such as disparate points of sales across a large franchisee network.

It's no secret that corporations everywhere are monitoring more and more data sources for insights about their business, and as this trend continues, demand for visualisation and monitoring tools increases.

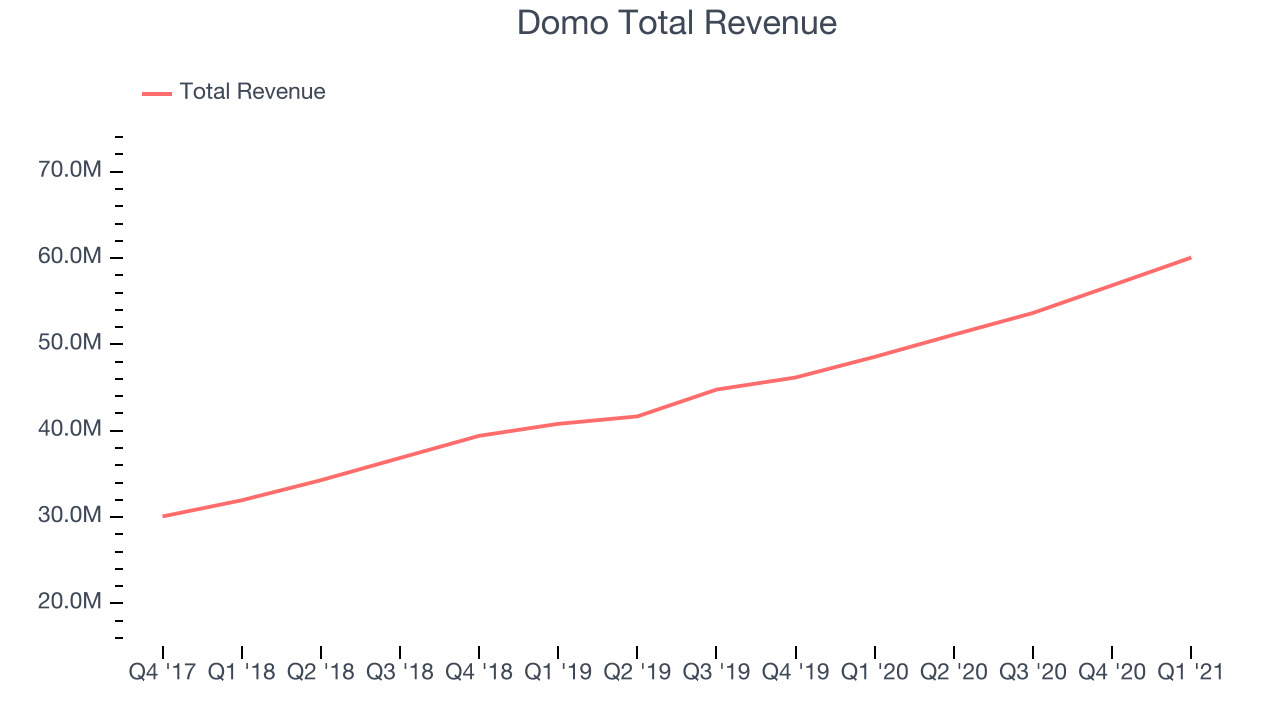

As you can see below, Domo's revenue growth has been strong over the last twelve months, growing from $48.5 million to $60 million.

This quarter, Domo's quarterly revenue was once again up a very solid 23.6% year on year. Quarter on quarter the revenue increased by $3.21 million in Q1, which was in line with Q4 2021. This steady quarter-on-quarter growth shows the company is able to maintain its steady growth trajectory.

There are others doing even better. Founded by ex-Google engineers, a small company making software for banks has been growing revenue 90% year on year and is already up more than 400% since the IPO in December. You can find it on our platform for free.

Profitability With Scale

The key strength in the Domo business model is that as companies use the platform to analyse and combine more and more data sources, it becomes more and more valuable to the clients, and more of a hassle to leave. Since it charges per user per month, it should grow with its clients, and since provisioning an additional user costs very little, gross margins should improve over time.

Domo's gross profit margin, an important metric measuring how much money there is left after paying for servers, licences, technical support and other necessary running expenses was at 74.7% in Q1. That means that for every $1 in revenue the company had $0.74 left to spend on developing new products, marketing & sales and the general administrative overhead. Trending up over the last year this is around the average of what we typically see in SaaS businesses. Gross margin has a major impact on a company’s ability to invest in developing new products and sales & marketing, which may ultimately determine the winner in a competitive market, so it is important to track.

Key Takeaways from Domo's Q1 Results

With market capitalisation of $2.06 billion Domo is among smaller companies, but its more than $84.8 million in cash and positive free cash flow over the last twelve months give us confidence that Domo has the resources it needs to pursue a high growth business strategy.

We liked to see that Domo beat analysts’ revenue expectations pretty strongly this quarter. And we were also glad that the revenue guidance for the next quarter exceeded analysts' expectations. Overall, this quarter's results seemed pretty positive and shareholders can feel optimistic. Therefore, we think Domo will become more attractive to investors, compared to before these results.

PS. If you found this analysis useful, you will love our earnings alerts! We publish so fast, you often have the opportunity to buy or sell before the market has fully absorbed the information. Never miss out on the right time to invest again. Signup here for free early access.

The author has no position in any of the stocks mentioned.