Looking back on data and analytics software stocks' Q2 earnings, we examine this quarters’ best and worst performers, including Domo (NASDAQ:DOMO) and its peers.

Data is the lifeblood of the internet and software in general, and its importance to businesses continues to accelerate. Tracking sensors, ubiquitous mobile devices, every action in every app are producing an explosion of analyzable data which increasingly gets stored in public cloud environments. But in order to be useful, the data needs to be moved around and analyzed. This drives demand for a variety of software solutions, from databases to analytics software, helping companies derive insights from this data to better understand customer preferences, supply chains, and forecast at ever more granular levels as a means of improving competitive advantage.

The 8 data and analytics software stocks we track reported a a strong Q2; on average, revenues beat analyst consensus estimates by 6.86%, while on average next quarter revenue guidance was 3.58% above consensus. The market rewarded the results with the average return the day after earnings coming in at 4.2%.

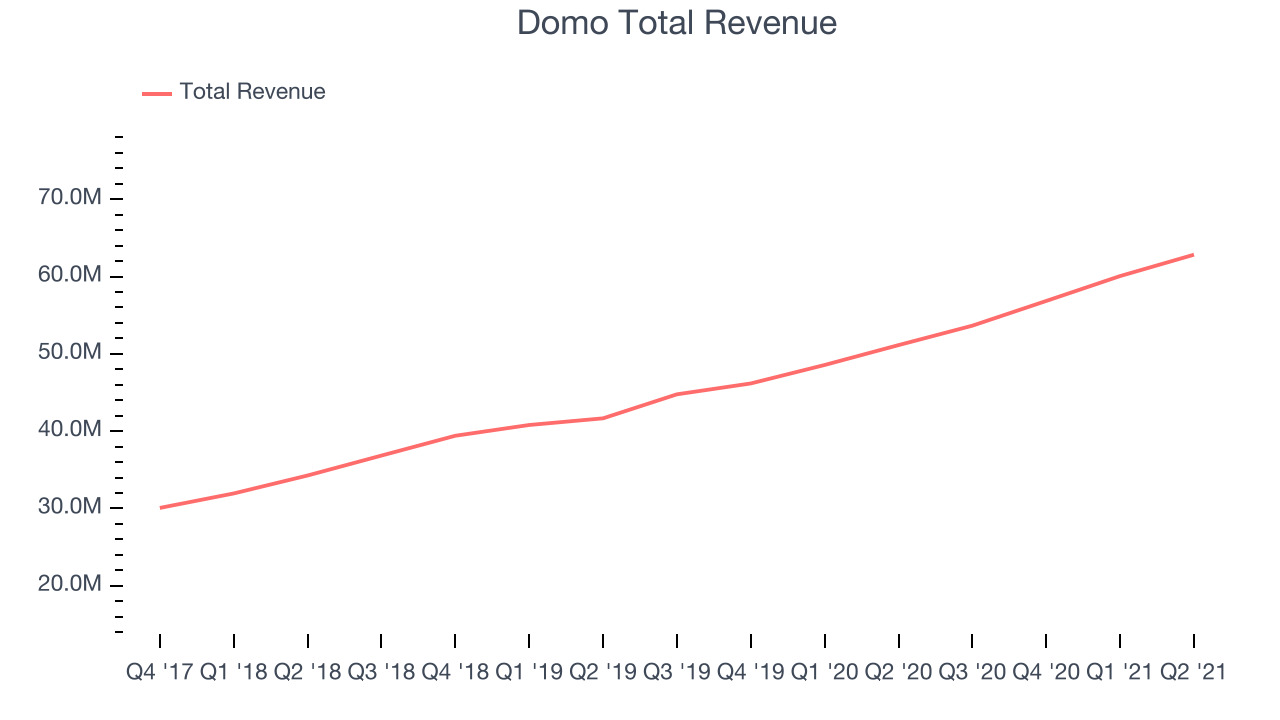

Domo (NASDAQ:DOMO)

Founded by Josh James after selling his former business Omniture to Adobe, Domo provides business intelligence software that allows managers to access and visualize critical business metrics in real-time, using their smartphones.

Domo reported revenues of $62.8 million, up 22.8% year on year, beating analyst expectations by 3.22%. It was a good quarter for the company, with a decent beat of analyst estimates.

"We have seen the demand for modern BI continue as companies look to unlock and democratize data for every person and every action that moves their business forward,” said Josh James, founder and CEO, Domo. "

Domo delivered the slowest revenue growth of the whole group. The stock is down 13.2% since the results and currently trades at $84.88.

Is now the time to buy Domo? Access our full analysis of the earnings results here, it's free.

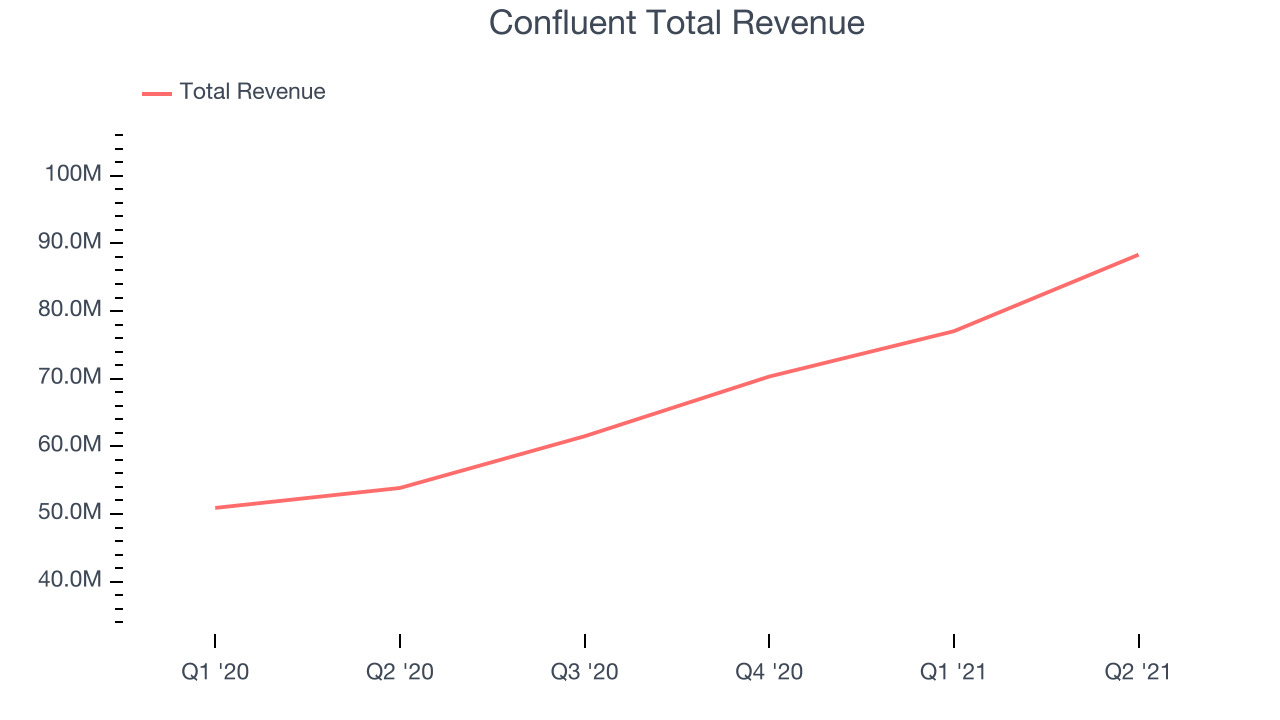

Best Q2: Confluent (NASDAQ:CFLT)

Started in 2014 by the team of engineers at LinkedIn who originally built it as an internal tool, Confluent (NASDAQ:CFLT) provides infrastructure software for organizations that makes it easy and fast to collect and move large amounts of data between different systems.

Confluent reported revenues of $88.3 million, up 64% year on year, beating analyst expectations by 14.9%. It was an exceptional quarter for the company, with an impressive beat of analyst estimates and an exceptional revenue growth.

Confluent pulled off the strongest analyst estimates beat and highest full year guidance raise among its peers. The stock is up 58.3% since the results and currently trades at $63.72.

Is now the time to buy Confluent? Access our full analysis of the earnings results here, it's free.

Weakest Q2: C3.ai (NYSE:AI)

Founded in 2009 by enterprise software veteran Tom Seibel, C3.ai (NYSE:AI) provides software that makes it easy for organizations to add artificial intelligence technology to their applications.

C3.ai reported revenues of $52.4 million, up 29.4% year on year, beating analyst expectations by 2.21%. It was a decent quarter for the company, with a strong top line growth but a decline in gross margin.

C3.ai had the weakest performance against analyst estimates and weakest full year guidance update in the group. The stock is down 14.7% since the results and currently trades at $45.26.

Read our full analysis of C3.ai's results here.

Snowflake (NYSE:SNOW)

Founded in 2013 by three French engineers who spent decades working for Oracle, Snowflake provides a data warehouse-as-a-service in the cloud that allows companies to store large amounts of data and analyze it in real time.

Snowflake reported revenues of $272.1 million, up 104% year on year, beating analyst expectations by 6.01%. It was a very strong quarter for the company, with an exceptional revenue growth.

Snowflake scored the fastest revenue growth among the peers. The company added 12 enterprise customers paying more than $1m annually to a total of 116. The stock is up 10.9% since the results and currently trades at $314.58.

Read our full, actionable report on Snowflake here, it's free.

Elastic (NYSE:ESTC)

Started by Shay Banon as a search engine for his wife's growing list of recipes at Le Cordon Bleu cooking school in Paris, Elastic (NYSE:ESTC) helps companies integrate search into their products and monitor their cloud infrastructure.

Elastic reported revenues of $193 million, up 49.8% year on year, beating analyst expectations by 11.4%. It was a strong quarter for the company, with an impressive beat of analyst estimates.

The company added 50 enterprise customers paying more than $100,000 annually to a total of 780. The stock is up 4.31% since the results and currently trades at $165.

Read our full, actionable report on Elastic here, it's free.

The author has no position in any of the stocks mentioned