Industrial and safety product distributor Distribution Solutions (NASDAQ:DSGR) reported revenue ahead of Wall Street’s expectations in Q3 CY2024, with sales up 6.6% year on year to $468 million. Its GAAP profit of $0.46 per share was also 66.3% above analysts’ consensus estimates.

Is now the time to buy Distribution Solutions? Find out by accessing our full research report, it’s free.

Distribution Solutions (DSGR) Q3 CY2024 Highlights:

- Revenue: $468 million vs analyst estimates of $462.7 million (1.2% beat)

- EPS: $0.46 vs analyst estimates of $0.28 ($0.18 beat)

- EBITDA: $49.11 million vs analyst estimates of $47.6 million (3.2% beat)

- Gross Margin (GAAP): 33.9%, in line with the same quarter last year

- Operating Margin: 4%, in line with the same quarter last year

- EBITDA Margin: 10.5%, up from 3.3% in the same quarter last year

- Market Capitalization: $1.88 billion

Bryan King, CEO and Chairman of the Board, said, "We are pleased with DSG’s third quarter results, which delivered sales and profitability growth over the prior-year quarter. Total sales, including acquisitions, grew 6.6% to $468 million despite organic revenue compression of 2.1% compared to the year-ago quarter. Adjusted EBITDA for the quarter grew by 12.4% to $49.1 million, or 10.5% as a percentage of sales. Acquisitions in 2024 drove the quarterly sales increase, and we reported average daily sales for Lawson up 1.4%, for Gexpro Services up 12.5%, and for TestEquity down 7.4% for the period. Sequentially, compared to the second quarter, total sales grew by 6.5%, organic sales were up slightly at 0.2%, and the Adjusted EBITDA margin of 10.5% expanded by 20 basis points.

Company Overview

Founded in 1952, Distribution Solutions (NASDAQ:DSGR) provides supply chain solutions and distributes industrial, safety, and maintenance products to various industries.

Maintenance and Repair Distributors

Supply chain and inventory management are themes that grew in focus after COVID wreaked havoc on the global movement of raw materials and components. Maintenance and repair distributors that boast reliable selection and quickly deliver products to customers can benefit from this theme. While e-commerce hasn’t disrupted industrial distribution as much as consumer retail, it is still a real threat, forcing investment in omnichannel capabilities to serve customers everywhere. Additionally, maintenance and repair distributors are at the whim of economic cycles that impact the capital spending and construction projects that can juice demand.

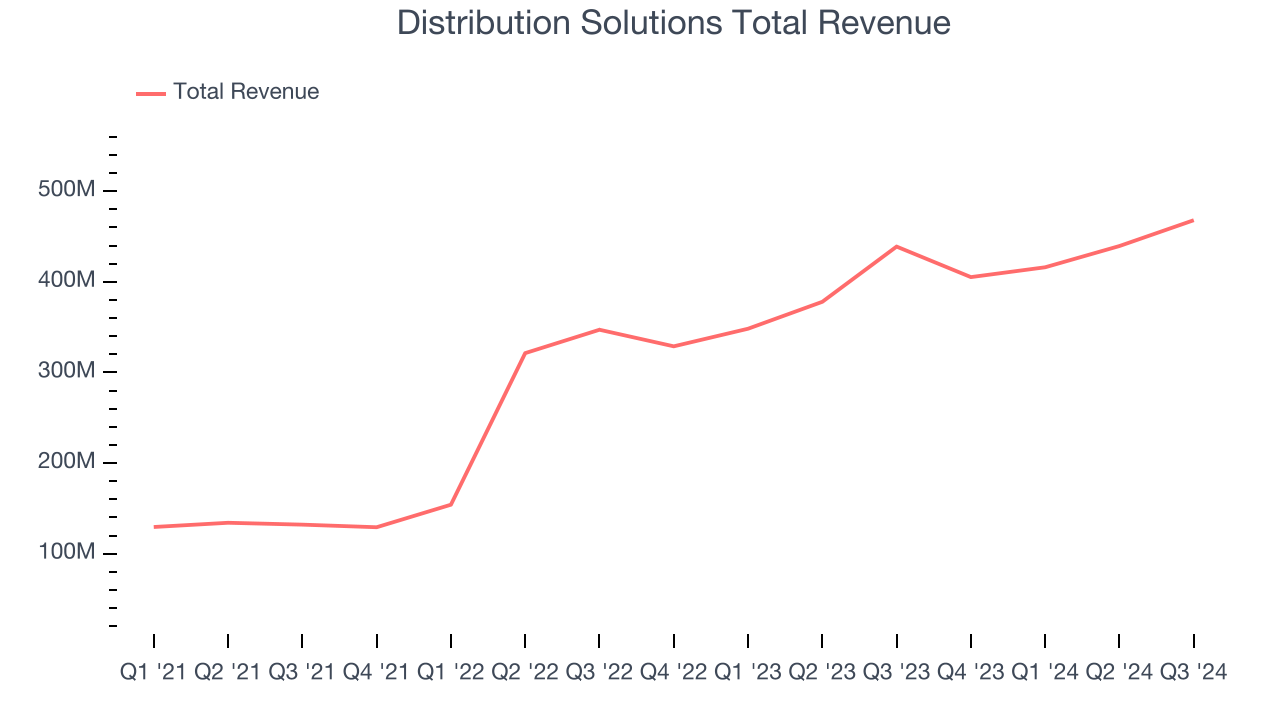

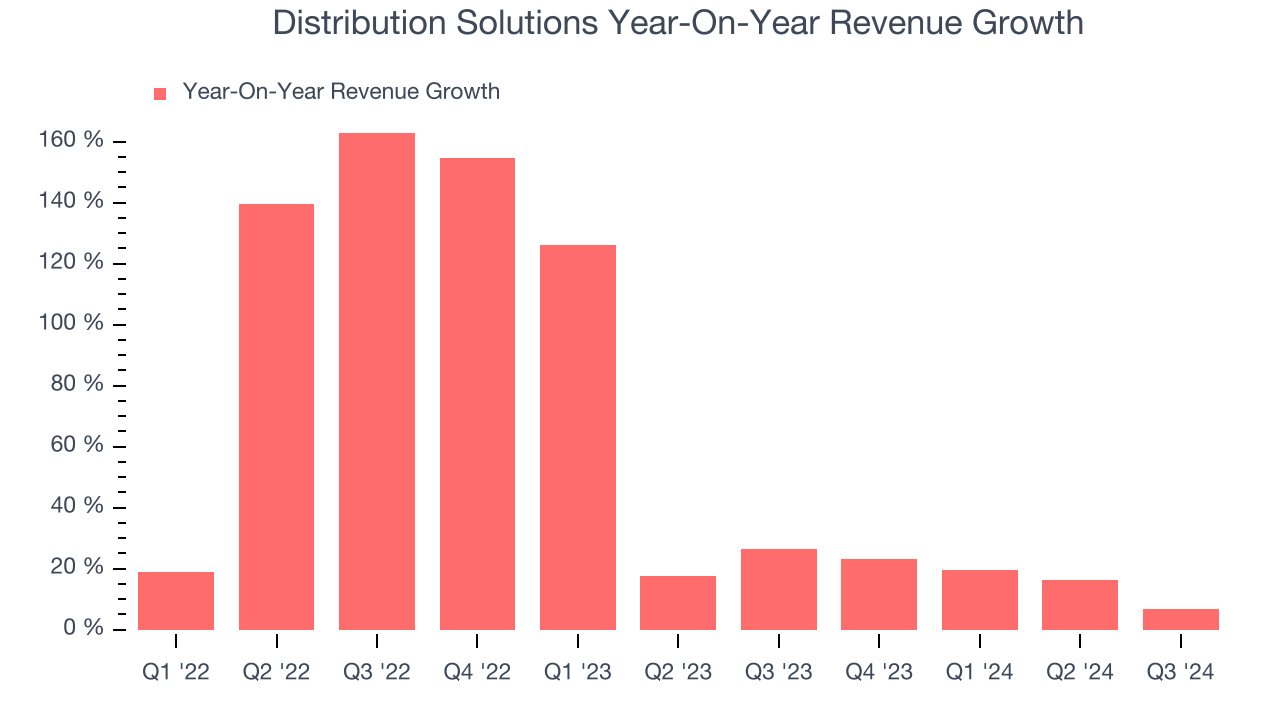

Sales Growth

A company’s long-term performance is an indicator of its overall business quality. While any business can experience short-term success, top-performing ones enjoy sustained growth for multiple years. Luckily, Distribution Solutions’s sales grew at an incredible 49.6% compounded annual growth rate over the last three years. This is a great starting point for our analysis because it shows Distribution Solutions’s offerings resonate with customers.

We at StockStory place the most emphasis on long-term growth, but within industrials, a stretched historical view may miss cycles, industry trends, or a company capitalizing on catalysts such as a new contract win or a successful product line. Distribution Solutions’s annualized revenue growth of 34.8% over the last two years is below its three-year trend, but we still think the results were good and suggest demand was strong.

This quarter, Distribution Solutions reported year-on-year revenue growth of 6.6%, and its $468 million of revenue exceeded Wall Street’s estimates by 1.2%.

Looking ahead, sell-side analysts expect revenue to grow 9.8% over the next 12 months, a deceleration versus the last two years. This projection is still healthy and illustrates the market is baking in success for its products and services.

Today’s young investors won’t have read the timeless lessons in Gorilla Game: Picking Winners In High Technology because it was written more than 20 years ago when Microsoft and Apple were first establishing their supremacy. But if we apply the same principles, then enterprise software stocks leveraging their own generative AI capabilities may well be the Gorillas of the future. So, in that spirit, we are excited to present our Special Free Report on a profitable, fast-growing enterprise software stock that is already riding the automation wave and looking to catch the generative AI next.

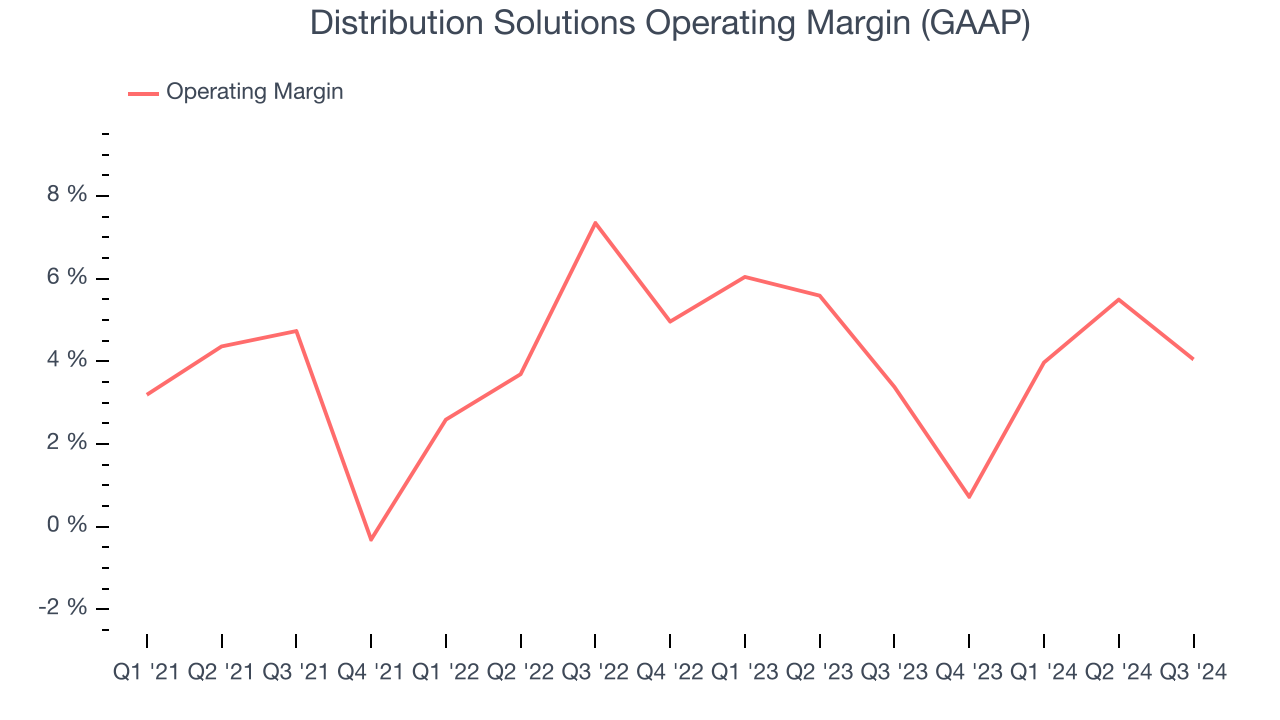

Operating Margin

Distribution Solutions was profitable over the last four years but held back by its large cost base. Its average operating margin of 4.2% was weak for an industrials business. This result is surprising given its high gross margin as a starting point.

Analyzing the trend in its profitability, Distribution Solutions’s annual operating margin might have seen some fluctuations but has generally stayed the same over the last four years, meaning it will take a fundamental shift in the business to change.

In Q3, Distribution Solutions generated an operating profit margin of 4%, in line with the same quarter last year. This indicates the company’s cost structure has recently been stable.

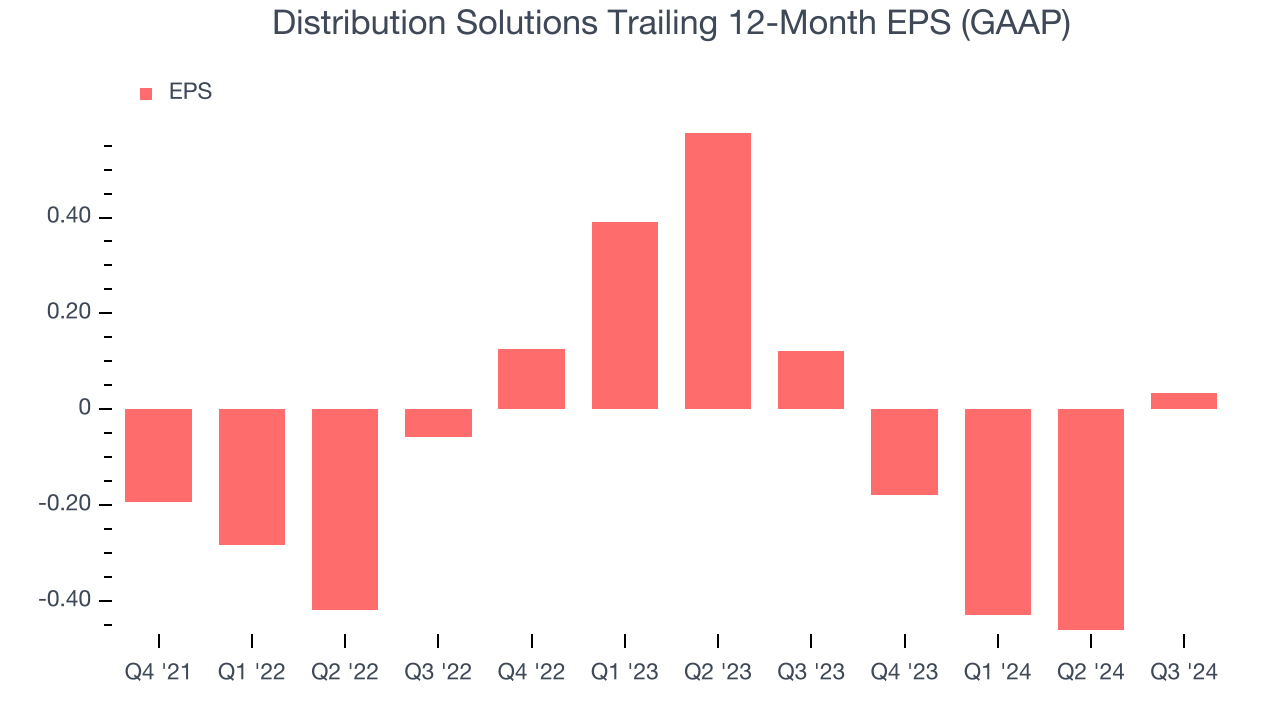

Earnings Per Share

Analyzing revenue trends tells us about a company’s historical growth, but the change in its earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

Distribution Solutions’s full-year EPS flipped from negative to positive over the last two years. This is good sign and shows it’s at an inflection point.

In Q3, Distribution Solutions reported EPS at $0.46, up from negative $0.03 in the same quarter last year. This print easily cleared analysts’ estimates, and shareholders should be content with the results. Over the next 12 months, Wall Street expects Distribution Solutions’s full-year EPS of $0.03 to grow by 3,415%.

Key Takeaways from Distribution Solutions’s Q3 Results

We were impressed by how significantly Distribution Solutions blew past analysts’ EPS expectations this quarter. We were also excited its EBITDA outperformed Wall Street’s estimates. Zooming out, we think this was a good quarter with some key areas of upside. The areas below expectations seem to be driving the move, and shares traded down 1.4% to $39.50 immediately following the results.

Is Distribution Solutions an attractive investment opportunity at the current price? We think that the latest quarter is only one piece of the longer-term business quality puzzle. Quality, when combined with valuation, can help determine if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free.