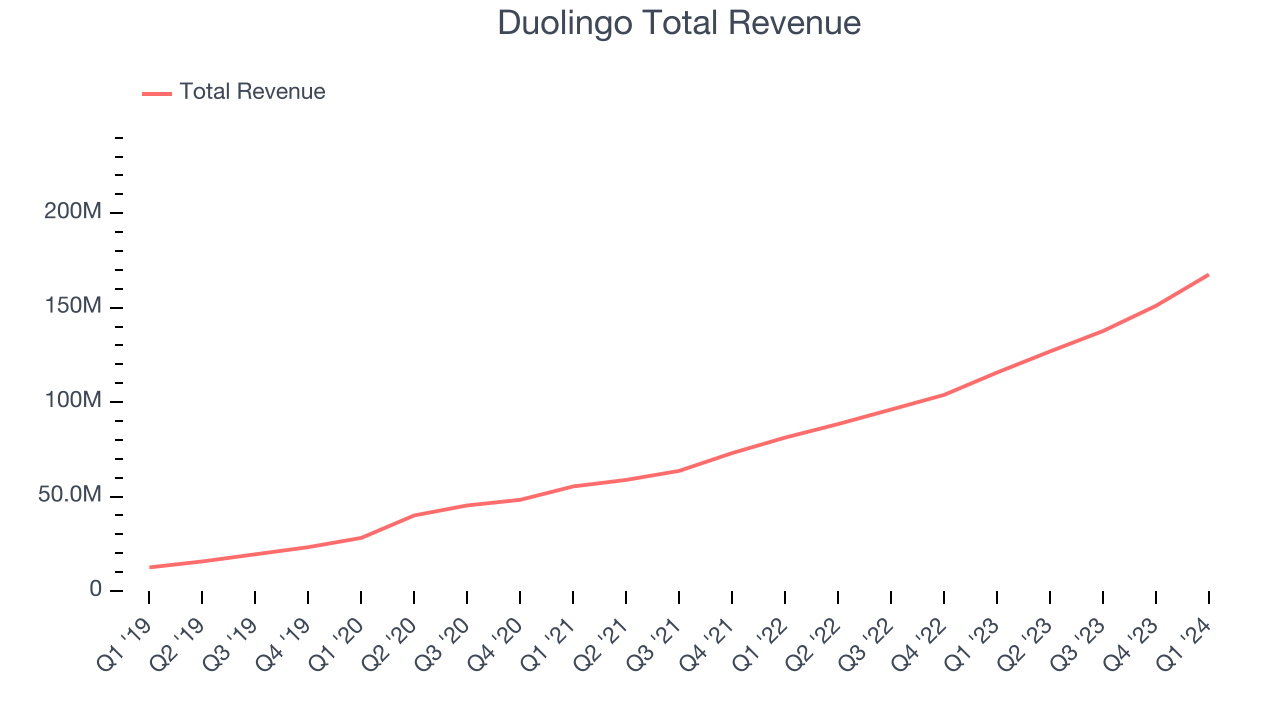

Language-learning app Duolingo (NASDAQ:DUOL) beat analysts' expectations in Q1 CY2024, with revenue up 44.9% year on year to $167.6 million. The company expects next quarter's revenue to be around $176.3 million, in line with analysts' estimates. It made a GAAP profit of $0.57 per share, improving from its loss of $0.06 per share in the same quarter last year.

Duolingo (DUOL) Q1 CY2024 Highlights:

- Revenue: $167.6 million vs analyst estimates of $165.7 million (1.1% beat)

- EPS: $0.57 vs analyst estimates of $0.26 (117% beat)

- Revenue Guidance for Q2 CY2024 is $176.3 million at the midpoint, roughly in line with what analysts were expecting

- The company lifted its revenue guidance for the full year from $723.5 million to $731 million at the midpoint, a 1% increase

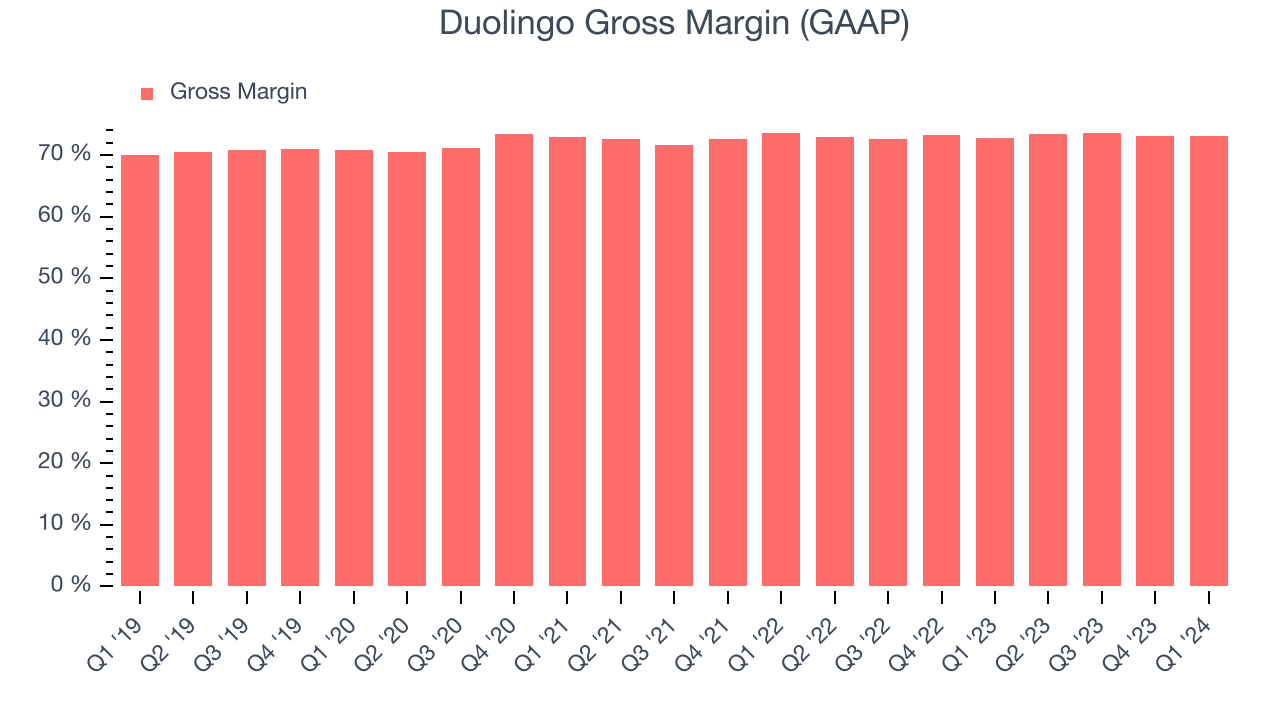

- Gross Margin (GAAP): 73%, in line with the same quarter last year

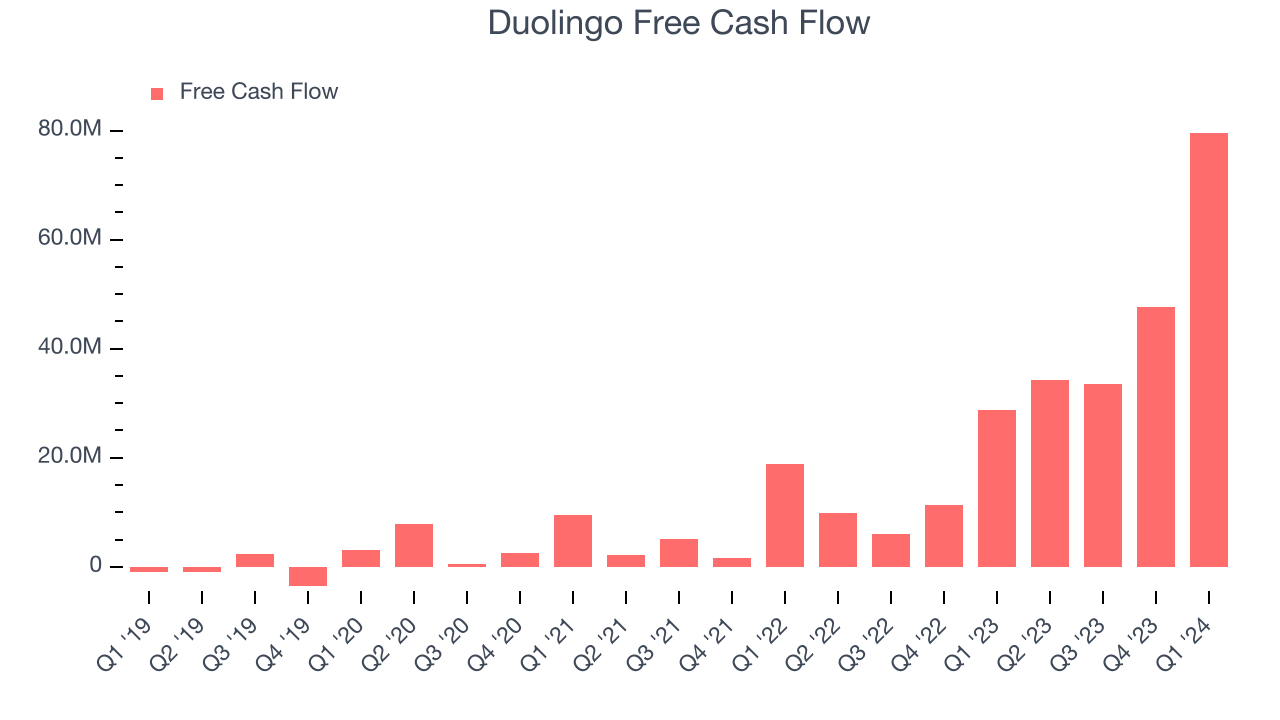

- Free Cash Flow of $79.62 million, up 67% from the previous quarter

- Paid Subscribers: 7.4 million

- Market Capitalization: $10.72 billion

Founded by a Carnegie Mellon computer science professor and his Ph.D. student, Duolingo (NASDAQ:DUOL) is a mobile app helping people learn new languages.

The company offers courses in widely-spoken languages such as Spanish, Mandarin, and French as well as less-known ones like Navajo. Duolingo primarily operates through a mobile app that can be downloaded on the app store and uses gamification to engage its users - for example, the app motivates users by awarding points for streaks of consistent practice. Additionally, adaptive learning is used to personalize the learning experience, where content and difficulty are adjusted based on the student's progress and performance.

The pain points Duolingo addresses are the difficulty and expense of learning new languages. Traditional language courses require people to be physically present at a scheduled time and can really put a dent in the wallet. Classes might also move at a certain speed, which can be too fast or slow for certain learners. With Duolingo, users can learn wherever there is an internet connection, on their own schedule, and at their own pace. All this for free (ad-supported tier) or a reasonable cost.

The company utilizes both a free version (ad-supported tier) and a paid version. Its main source of revenue is from subscriptions, and there are various tiers with more expensive ones providing more courses, features, and practice or assessment materials. Duolingo also generates revenue through advertising, partnerships, and language proficiency tests where the company offers assessments that are accepted by many universities and institutions around the world. For example, the Duolingo English Test is used by thousands of universities and institutions worldwide as a measure of proficiency.

Consumer Subscription

Consumers today expect goods and services to be hyper-personalized and on demand. Whether it be what music they listen to, what movie they watch, or even finding a date, online consumer businesses are expected to delight their customers with simple user interfaces that magically fulfill demand. Subscription models have further increased usage and stickiness of many online consumer services.

Competitors offering language-learning services include Coursera (NYSE:COUR) and private companies Rosetta Stone, Babbel, Busuu, and Lingvist.Sales Growth

Duolingo's revenue growth over the last three years has been impressive, averaging 45.7% annually. This quarter, Duolingo beat analysts' estimates and reported excellent 44.9% year-on-year revenue growth.

Guidance for the next quarter indicates Duolingo is expecting revenue to grow 39% year on year to $176.3 million, slowing from the 43.5% year-on-year increase it recorded in the comparable quarter last year. Ahead of the earnings results, analysts were projecting sales to grow 33.4% over the next 12 months.

Pricing Power

A company's gross profit margin has a major impact on its ability to exert pricing power, develop new products, and invest in marketing. These factors may ultimately determine the winner in a competitive market, making it a critical metric to track for the long-term investor.

Duolingo's gross profit margin, which tells us how much money the company gets to keep after covering the base cost of its products and services, came in at 73% this quarter, up 0.3 percentage points year on year.

For internet subscription businesses like Duolingo, these aforementioned costs typically include customer service, data center and infrastructure expenses, and royalties and other content-related costs if the company's offering includes features such as video or music services. After paying for these expenses, Duolingo had $0.73 for every $1 in revenue to invest in marketing, talent, and the development of new products and services.

Duolingo's gross margins have been stable over the past year, averaging 73.3%. These robust unit economics, driven by the company's asset-lite business model and strong pricing power, are higher than its peer group and allow Duolingo to make more investments in product and marketing.

User Acquisition Efficiency

Unlike enterprise software that's typically sold by dedicated sales teams, consumer internet businesses like Duolingo grow from a combination of product virality, paid advertisement, and incentives.

Duolingo is extremely efficient at acquiring new users, spending only 18.7% of its gross profit on sales and marketing expenses over the last year. This efficiency indicates that it has a highly differentiated product offering and customer acquisition advantages from scale, giving Duolingo the freedom to invest its resources into new growth initiatives while maintaining optionality.

Profitability & Free Cash Flow

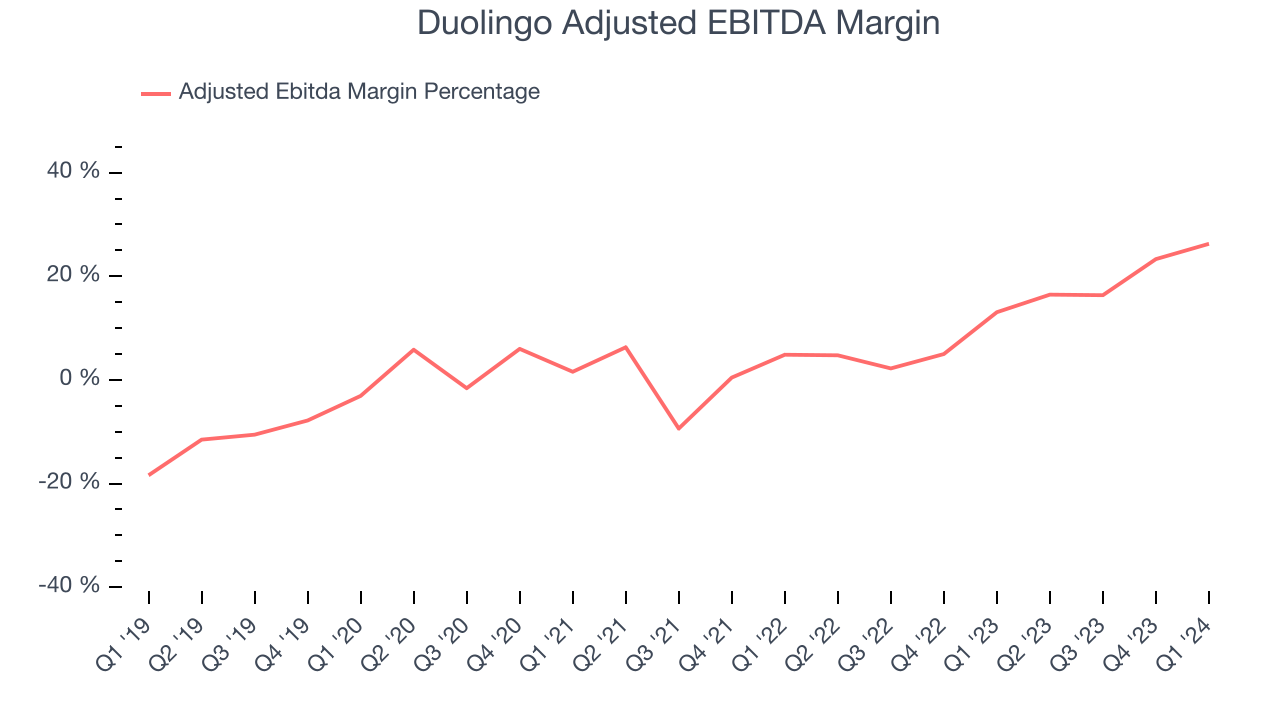

Investors frequently analyze operating income to understand a business's core profitability. Similar to operating income, adjusted EBITDA is the most common profitability metric for consumer internet companies because it removes various one-time or non-cash expenses, offering a more normalized view of a company's profit potential.

This quarter, Duolingo's EBITDA came in at $44.01 million, resulting in a 26.3% margin. Furthermore, Duolingo has shown strong profitability over the last four quarters, with average EBITDA margins of 21%.

If you've followed StockStory for a while, you know that we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can't use accounting profits to pay the bills. Duolingo's free cash flow came in at $79.62 million in Q1, up 177% year on year.

Duolingo has generated $195.1 million in free cash flow over the last 12 months, an eye-popping 33.5% of revenue. This robust FCF margin stems from its asset-lite business model, scale advantages, and strong competitive positioning, giving it the option to return capital to shareholders or reinvest in its business while maintaining a healthy cash balance.

Key Takeaways from Duolingo's Q1 Results

We were impressed by Duolingo's exceptional revenue growth this quarter, driven by more paid subscriber additions than expected. We were also glad its EPS blew past analysts' estimates. On the other hand, its revenue guidance for next quarter was underwhelming, though it upgraded its full-year revenue and EBITDA outlook, topping projections. Zooming out, we think this was a decent quarter, showing the company is staying on track. Investors were likely disappointed by the quarterly guidance, however, and the stock is down 14.7% after reporting. It currently trades at $208.75 per share.

Is Now The Time?

When considering an investment in Duolingo, investors should take into account its valuation and business qualities as well as what's happened in the latest quarter.

There are numerous reasons why we think Duolingo is one of the best consumer internet companies out there. First off, its revenue growth has been exceptional over the last three years. And while its ARPU has declined over the last two years, the good news is its powerful free cash flow generation enables it to stay ahead of the competition through consistent reinvestment of profits. On top of that, its growth in users has been strong.

There's no doubt that the market is optimistic about Duolingo's growth prospects, as its price/gross profit ratio based on the next 12 months of 21.1x would suggest. Looking at the consumer internet landscape today, Duolingo's qualities as one of the best businesses really stand out and there's no doubt that it's a bit of a market darling. We don't mind paying a small premium for a high-quality business and would argue that it's often wise to hold them over the long term even if expectations are high, but we do note that there seems to be a lot of optimism priced into the stock.

Wall Street analysts covering the company had a one-year price target of $251.60 per share right before these results (compared to the current share price of $208.75), implying they saw upside in buying Duolingo in the short term.

To get the best start with StockStory check out our most recent Stock picks, and then sign up to our earnings alerts by adding companies to your watchlist here. We typically have the quarterly earnings results analyzed within seconds of the data being released, and especially for the companies reporting pre-market, this often gives investors the chance to react to the results before the market has fully absorbed the information.