Industrial distributor DXP Enterprises (NASDAQ:DXPE) reported Q2 CY2024 results exceeding Wall Street analysts' expectations, with revenue up 4.1% year on year to $445.6 million. It made a GAAP profit of $1 per share, down from its profit of $1.06 per share in the same quarter last year.

Is now the time to buy DXP? Find out by accessing our full research report, it's free.

DXP (DXPE) Q2 CY2024 Highlights:

- Revenue: $445.6 million vs analyst estimates of $434 million (2.7% beat)

- EPS: $1 vs analyst estimates of $0.80 (25% beat)

- Gross Margin (GAAP): 30.9%, in line with the same quarter last year

- EBITDA Margin: 10.8%, up from 9.3% in the same quarter last year

- Free Cash Flow of $5.91 million, down 75.5% from the previous quarter

- Market Capitalization: $775.7 million

David R. Little, Chairman and Chief Executive Officer commented, "Second quarter results reflect the execution of our growth strategy and the resilience and durability of DXP’s business. We are pleased with our sequential sales growth and strength in our gross profit margins. This resulted in operating leverage that produced earnings per share of $1.00. DXP’s second quarter 2024 sales were $445.6 million, or an 8.0 percent increase over the first quarter of 2024. Sequential organic sales for the quarter increased 5.3 percent or $21.3 million and acquisitions added another $23.4 million in sales during Q2. Adjusted EBITDA grew $7.9 million, or 19.5 percent over the first quarter of 2024. During the second quarter of 2024, sales were $306.5 million for Service Center, $73.4 million for Innovative Pumping Solutions, and $65.7 million for Supply Chain Services. Overall, we are very pleased with our performance and the progress DXP continues to make as a growth company.”

Founded during the emergence of Big Oil in Texas, DXP (NASDAQ:DXPE) provides pumps, valves, and other industrial components.

Maintenance and Repair Distributors

Supply chain and inventory management are themes that grew in focus after COVID wreaked havoc on the global movement of raw materials and components. Maintenance and repair distributors that boast reliable selection and quickly deliver products to customers can benefit from this theme. While e-commerce hasn’t disrupted industrial distribution as much as consumer retail, it is still a real threat, forcing investment in omnichannel capabilities to serve customers everywhere. Additionally, maintenance and repair distributors are at the whim of economic cycles that impact the capital spending and construction projects that can juice demand.

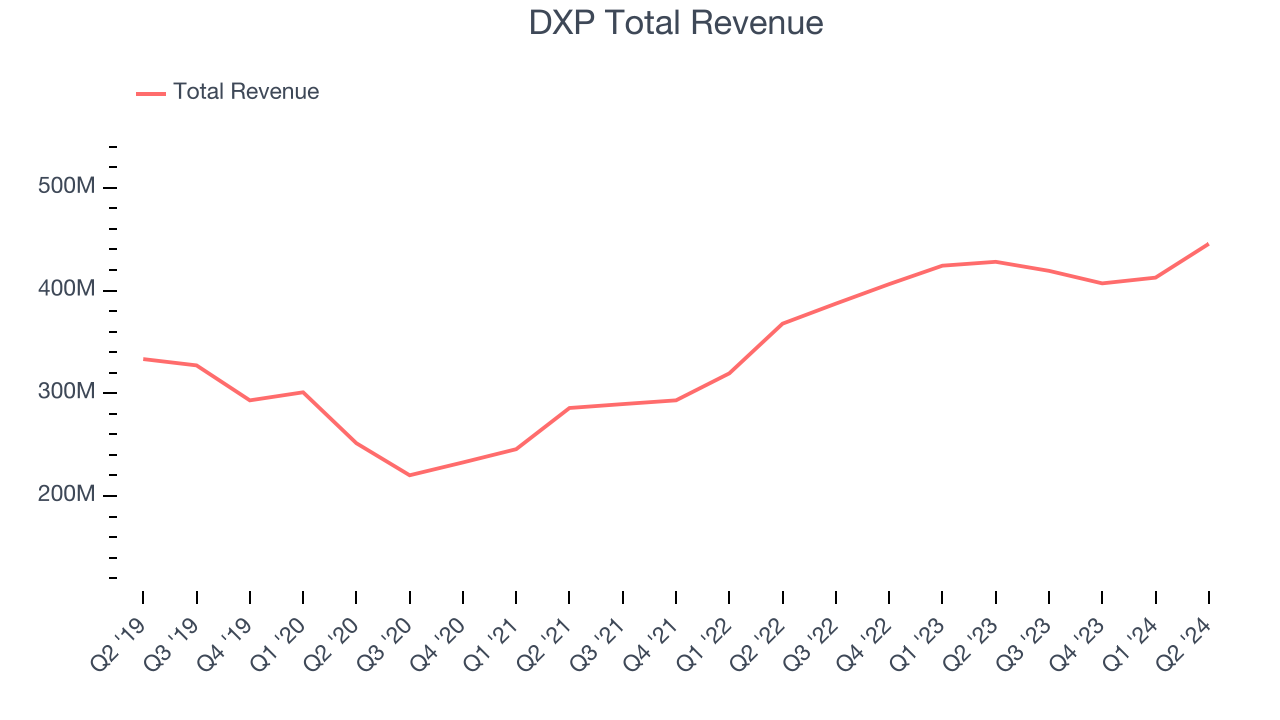

Sales Growth

Examining a company's long-term performance can provide clues about its business quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul. Over the last five years, DXP grew its sales at a weak 5.8% compounded annual growth rate. This shows it failed to expand in any major way and is a rough starting point for our analysis.

Long-term growth is the most important, but within industrials, a half-decade historical view may miss new industry trends or demand cycles. DXP's annualized revenue growth of 15.2% over the last two years is above its five-year trend, suggesting its demand recently accelerated.

This quarter, DXP reported reasonable year-on-year revenue growth of 4.1%, and its $445.6 million of revenue topped Wall Street's estimates by 2.7%. Looking ahead, Wall Street expects sales to grow 4.5% over the next 12 months.

Today’s young investors won’t have read the timeless lessons in Gorilla Game: Picking Winners In High Technology because it was written more than 20 years ago when Microsoft and Apple were first establishing their supremacy. But if we apply the same principles, then enterprise software stocks leveraging their own generative AI capabilities may well be the Gorillas of the future. So, in that spirit, we are excited to present our Special Free Report on a profitable, fast-growing enterprise software stock that is already riding the automation wave and looking to catch the generative AI next.

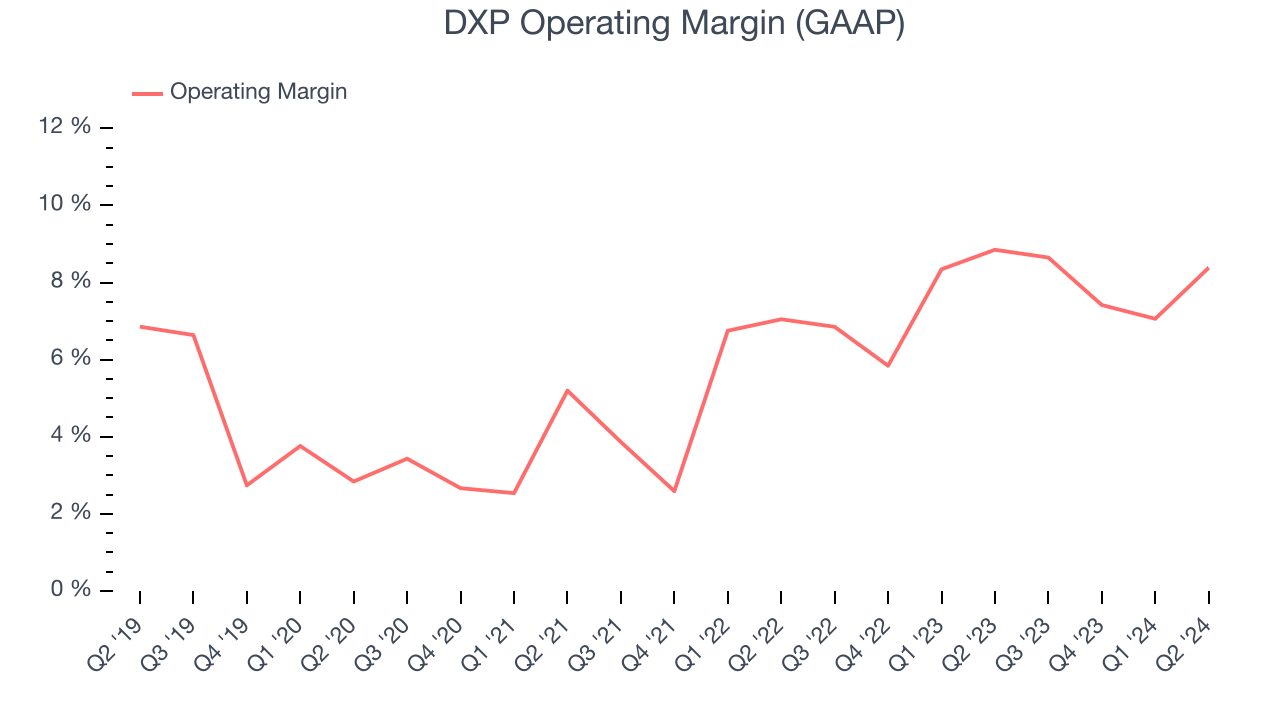

Operating Margin

DXP was profitable over the last five years but held back by its large expense base. It demonstrated paltry profitability for an industrials business, producing an average operating margin of 6%. This result isn't too surprising given its low gross margin as a starting point.

On the bright side, DXP's annual operating margin rose by 3.8 percentage points over the last five years

In Q2, DXP generated an operating profit margin of 8.4%, in line with the same quarter last year. This indicates the company's cost structure has recently been stable.

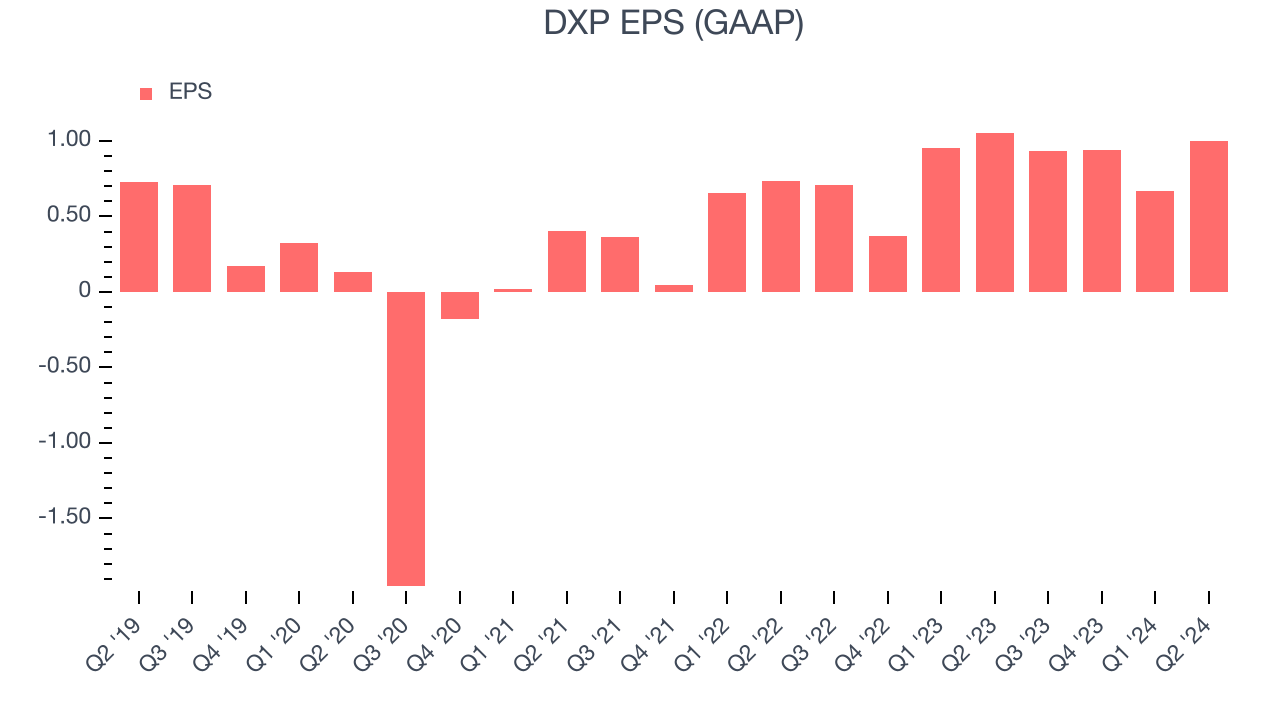

EPS

We track the long-term growth in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company's growth was profitable.

DXP's EPS grew at a decent 8.6% compounded annual growth rate over the last five years, higher than its 5.8% annualized revenue growth. This tells us the company became more profitable as it expanded.

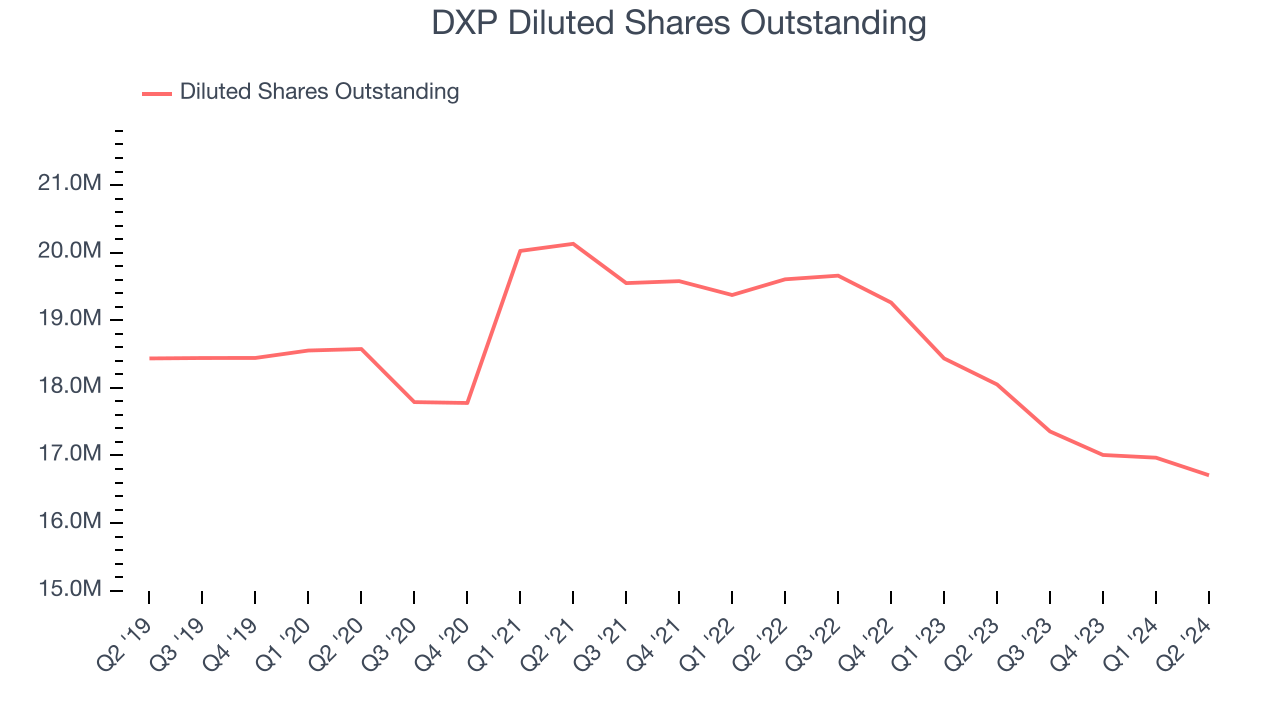

We can take a deeper look into DXP's earnings quality to better understand the drivers of its performance. As we mentioned earlier, DXP's operating margin was flat this quarter but expanded by 3.8 percentage points over the last five years. On top of that, its share count shrank by 9.4%. These are positive signs for shareholders because improving profitability and share buybacks turbocharge EPS growth relative to revenue growth.

Like with revenue, we also analyze EPS over a shorter period to see if we are missing a change in the business. For DXP, its two-year annual EPS growth of 40.3% was higher than its five-year trend. This acceleration made it one of the faster-growing industrials companies in recent history.

In Q2, DXP reported EPS at $1, down from $1.06 in the same quarter last year. Despite falling year on year, this print easily cleared analysts' estimates. Over the next 12 months, Wall Street expects DXP to perform poorly. Analysts are projecting its EPS of $3.54 in the last year to shrink by 5.7% to $3.34.

Key Takeaways from DXP's Q2 Results

We were impressed by how significantly DXP blew past analysts' EPS expectations this quarter. We were also excited its revenue outperformed Wall Street's estimates. Zooming out, we think this quarter featured some important positives. The stock traded up 2.8% to $49.11 immediately after reporting.

DXP may have had a good quarter, but does that mean you should invest right now? When making that decision, it's important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it's free.