DXP has been on fire lately. In the past six months alone, the company’s stock price has rocketed 91.5%, setting a new 52-week high of $86 per share. This was partly thanks to its solid quarterly results, and the run-up might have investors contemplating their next move.

Is there a buying opportunity in DXP, or does it present a risk to your portfolio? Check out our in-depth research report to see what our analysts have to say, it’s free.We’re glad investors have benefited from the price increase, but we're cautious about DXP. Here are three reasons why there are better opportunities than DXPE and a stock we'd rather own.

Why Is DXP Not Exciting?

Founded during the emergence of Big Oil in Texas, DXP (NASDAQ:DXPE) provides pumps, valves, and other industrial components.

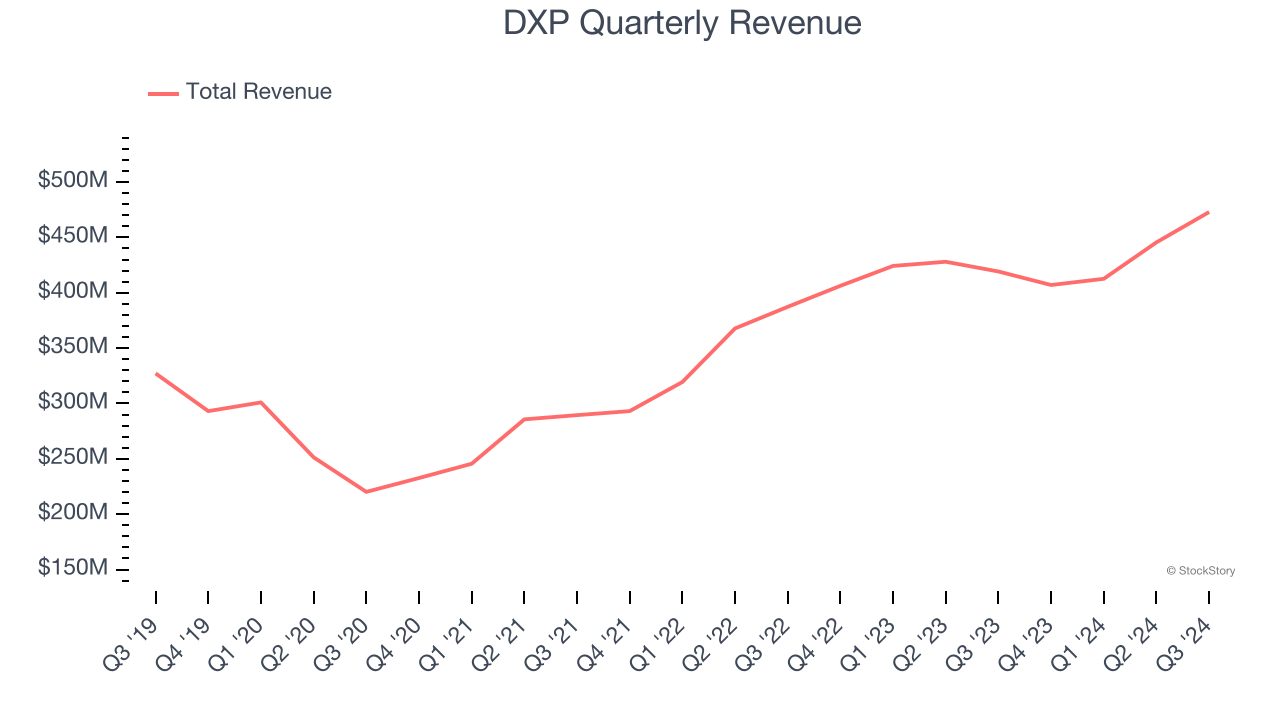

1. Long-Term Revenue Growth Disappoints

A company’s long-term performance is an indicator of its overall quality. While any business can experience short-term success, top-performing ones enjoy sustained growth for years. Regrettably, DXP’s sales grew at a mediocre 6.3% compounded annual growth rate over the last five years. This was below our standard for the industrials sector.

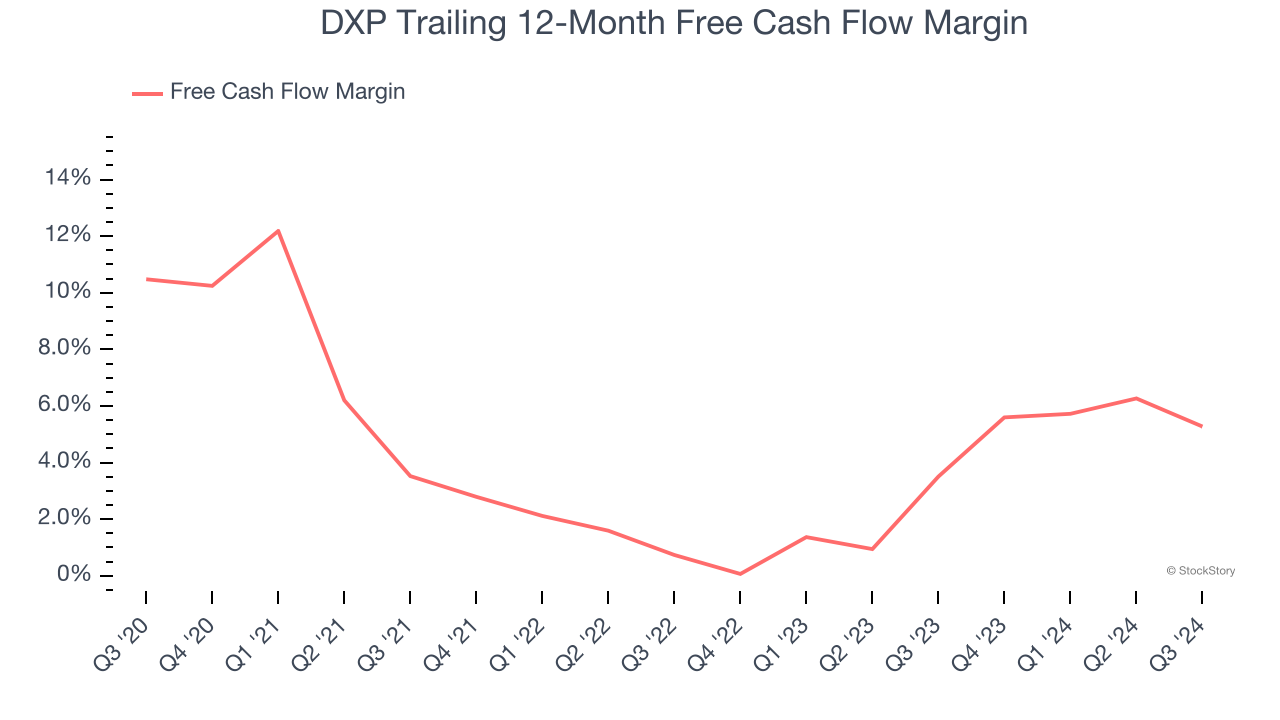

2. Free Cash Flow Margin Dropping

If you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills.

As you can see below, DXP’s margin dropped by 5.2 percentage points over the last five years. This along with its unexciting margin put the company in a tough spot, and shareholders are likely hoping it can reverse course. If the trend continues, it could signal it’s becoming a more capital-intensive business. DXP’s free cash flow margin for the trailing 12 months was 5.3%.

3. Projected Revenue Growth Is Slim

Forecasted revenues by Wall Street analysts signal a company’s potential. Predictions may not always be accurate, but accelerating growth typically boosts valuation multiples and stock prices while slowing growth does the opposite.

Over the next 12 months, sell-side analysts expect DXP’s revenue to rise by 1.5%, a deceleration versus its 12.7% annualized growth for the past two years. This projection is underwhelming and suggests its products and services will see some demand headwinds.

Final Judgment

DXP isn’t a terrible business, but it doesn’t pass our bar. Following the recent rally, the stock trades at 22.3× forward price-to-earnings (or $86 per share). This valuation multiple is fair, but we don’t have much faith in the company. We're fairly confident there are better investments elsewhere. We’d recommend looking at ServiceNow, one of our all-time favorite software stocks with a durable competitive moat.

Stocks We Would Buy Instead of DXP

With rates dropping, inflation stabilizing, and the elections in the rearview mirror, all signs point to the start of a new bull run - and we’re laser-focused on finding the best stocks for this upcoming cycle.

Put yourself in the driver’s seat by checking out our Top 6 Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,691% between September 2019 and September 2024) as well as under-the-radar businesses like Comfort Systems (+783% five-year return). Find your next big winner with StockStory today for free.