Business communications software company 8x8 (NYSE:EGHT) reported results in line with analysts' expectations in Q2 CY2024, with revenue down 2.8% year on year to $178.1 million. On the other hand, next quarter's revenue guidance of $178 million was less impressive, coming in 1.7% below analysts' estimates. It made a non-GAAP profit of $0.08 per share, down from its profit of $0.13 per share in the same quarter last year.

Is now the time to buy 8x8? Find out by accessing our full research report, it's free.

8x8 (EGHT) Q2 CY2024 Highlights:

- Revenue: $178.1 million vs analyst estimates of $178.8 million (small miss)

- Adjusted Operating Income: $20.11 million vs analyst estimates of $20.81 million (3.4% miss)

- EPS (non-GAAP): $0.08 vs analyst expectations of $0.09 (10.7% miss)

- Revenue Guidance for Q3 CY2024 is $178 million at the midpoint, below analyst estimates of $181 million

- The company dropped its revenue guidance for the full year from $729 million to $721 million at the midpoint, a 1.1% decrease

- Gross Margin (GAAP): 67.9%, down from 70.2% in the same quarter last year

- Free Cash Flow of $14.74 million, up 64.4% from the previous quarter

- Billings: $177.4 million at quarter end, down 6% year on year

- Market Capitalization: $323.7 million

"I am pleased to report that we delivered solid results this quarter, with service revenue, total revenue, and non-GAAP operating margin all within our guidance ranges," said Samuel Wilson, Chief Executive Officer at 8x8, Inc.

Founded in 1987, 8x8 (NYSE:EGHT) provides software for organizations to efficiently communicate and collaborate with their customers, employees, and partners.

Video Conferencing

Work is becoming more distributed, both across geographies and devices. In order for businesses to keep functioning efficiently, they need to be able to communicate as well as they did when the teams were co-located, which drives the demand for integrated communication platforms.

Sales Growth

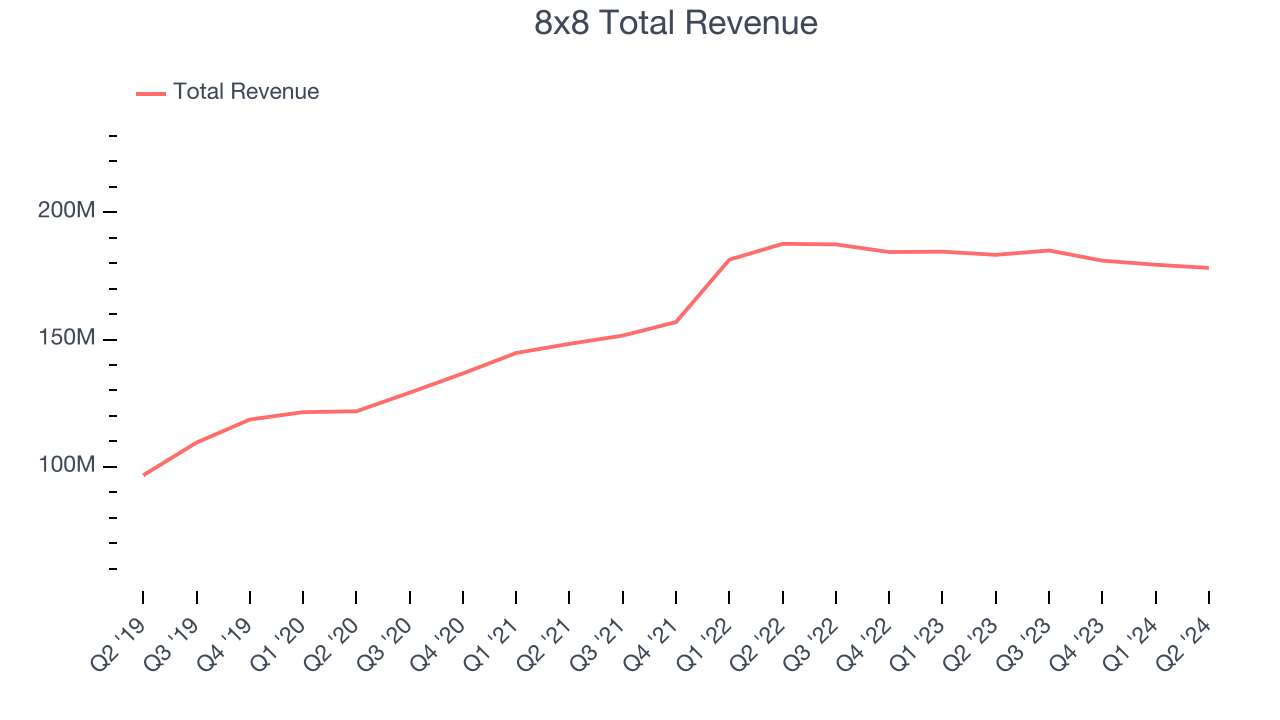

As you can see below, 8x8's 9% annualized revenue growth over the last three years has been weak, and its sales came in at $178.1 million this quarter.

This quarter, 8x8's revenue was down 2.8% year on year, which might disappointment some shareholders.

Next quarter, 8x8 is guiding for a 3.8% year-on-year revenue decline to $178 million, a further deceleration from the 1.3% year-on-year decrease it recorded in the same quarter last year. Looking ahead, analysts covering the company were expecting sales to grow 1.6% over the next 12 months before the earnings results announcement.

Unless you’ve been living under a rock, it should be obvious by now that generative AI is going to have a huge impact on how large corporations do business. While Nvidia and AMD are trading close to all-time highs, we prefer a lesser-known (but still profitable) semiconductor stock benefitting from the rise of AI. Click here to access our free report on our favorite semiconductor growth story.

Cash Is King

Although earnings are undoubtedly valuable for assessing company performance, we believe cash is king because you can't use accounting profits to pay the bills.

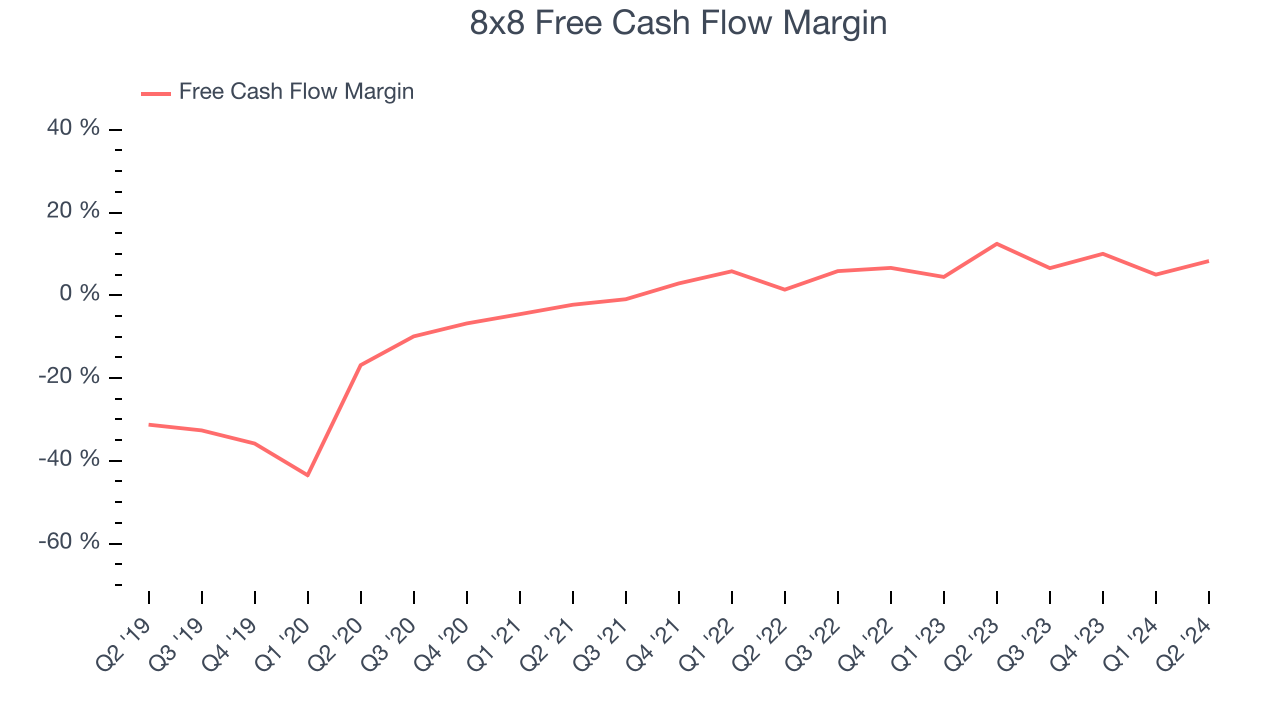

8x8 has shown mediocre cash profitability over the last year, giving the company limited opportunities to return capital to shareholders. Its free cash flow margin averaged 7.5%, subpar for a software business.

8x8's free cash flow clocked in at $14.74 million in Q2, equivalent to a 8.3% margin. The company's cash profitability regressed as it was 4.2 percentage points lower than in the same quarter last year, prompting us to pay closer attention. Short-term fluctuations typically aren't a big deal because investment needs can be seasonal, but we'll be watching to see if the trend extrapolates into future quarters.

Over the next year, analysts' consensus estimates show they're expecting 8x8's free cash flow margin of 7.5% for the last 12 months to remain the same.

Key Takeaways from 8x8's Q2 Results

We struggled to find many strong positives in these results. Its full-year revenue guidance was below expectations and its revenue guidance for next quarter missed Wall Street's estimates. This quarter featured some positives but overall could have been better. The stock traded down 2.7% to $2.51 immediately following the results.

8x8 may have had a tough quarter, but does that actually create an opportunity to invest right now? When making that decision, it's important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it's free.