Business communications software company 8x8 (NYSE:EGHT) reported results in line with analysts' expectations in Q1 CY2024, with revenue down 2.8% year on year to $179.4 million. On the other hand, next quarter's revenue guidance of $178.5 million was less impressive, coming in 1.5% below analysts' estimates. It made a non-GAAP profit of $0.08 per share, down from its profit of $0.11 per share in the same quarter last year.

8x8 (EGHT) Q1 CY2024 Highlights:

- Revenue: $179.4 million vs analyst estimates of $178.8 million (small beat)

- EPS (non-GAAP): $0.08 vs analyst estimates of $0.06 (23.7% beat)

- Revenue Guidance for Q2 CY2024 is $178.5 million at the midpoint, below analyst estimates of $181.2 million

- Management's revenue guidance for the upcoming financial year 2025 is $729 million at the midpoint, missing analyst estimates by 0.6% and implying flat revenue (0% growth) (vs -2% in FY2024)

- Gross Margin (GAAP): 68.2%, down from 70.1% in the same quarter last year

- Free Cash Flow of $62.05 million, up from $18.14 million in the previous quarter

- Market Capitalization: $290 million

Founded in 1987, 8x8 (NYSE:EGHT) provides software for organizations to efficiently communicate and collaborate with their customers, employees, and partners.

Most organizations still rely on a patchwork of technologies for employees and customers to communicate and collaborate. These technologies are often expensive, do not connect to each other, and are not suited for the modern world of remote communication across multiple devices, channels, and locations.

Using 8x8’s cloud-based software (Unified Communications as a Service) solution, organizations can efficiently integrate business phones, video, and messages in one app for internal communication and also use solutions such as the call centre software to manage external communication.

8x8’s software provides companies with insights based on communications data, and helps them ensure that their call centers are run efficiently and customer enquiries are fulfilled in a satisfactory manner. It also integrates with other business apps such as calendars and email, allowing all communication to be managed in one place.

Importantly, cloud-based integrated communications software free companies from being tied to a physical office. For example when a hurricane forced Live Oak, a lending company, to shut down its offices, it depended on 8x8 to migrate all its communication facilities to the cloud to continue operations. 8x8 provided remote communication solutions for Live Oak employees to communicate with each other as if they were in the office and for sales agents to communicate with customers. As a result, Live Oak was able to continue approving loans and providing customer support without customers noticing the office was shut down.

Video Conferencing

Work is becoming more distributed, both across geographies and devices. In order for businesses to keep functioning efficiently, they need to be able to communicate as well as they did when the teams were co-located, which drives the demand for integrated communication platforms.

The cloud communication space is competitive, and it includes companies such as RingCentral (NYSE:RNG), Vonage Holdings (NASDAQ:VG) or Twilio (NYSE:TWLO), and LogMeIn (NASDAQ:LOGM) as well as remote collaboration platforms such as Zoom Video Communications (NASDAQ:ZM) and Slack (WORK).

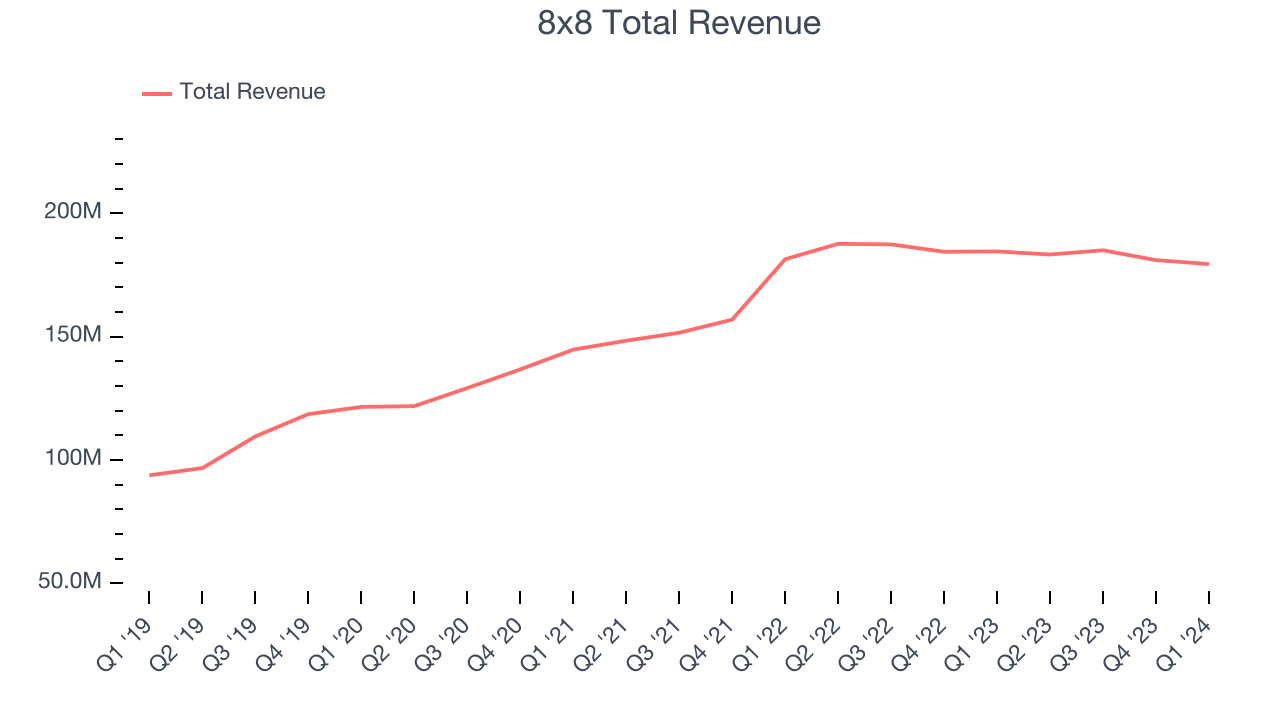

Sales Growth

As you can see below, 8x8's revenue growth has been unremarkable over the last three years, growing from $144.7 million in Q4 2021 to $179.4 million this quarter.

This quarter, 8x8's revenue was down 2.8% year on year, which might disappointment some shareholders.

Next quarter, 8x8 is guiding for a 2.6% year-on-year revenue decline to $178.5 million, a further deceleration from the 2.3% year-on-year decrease it recorded in the same quarter last year. For the upcoming financial year, management expects revenue to be $729 million at the midpoint, flat year on year compared to the 2% drop in FY2024.

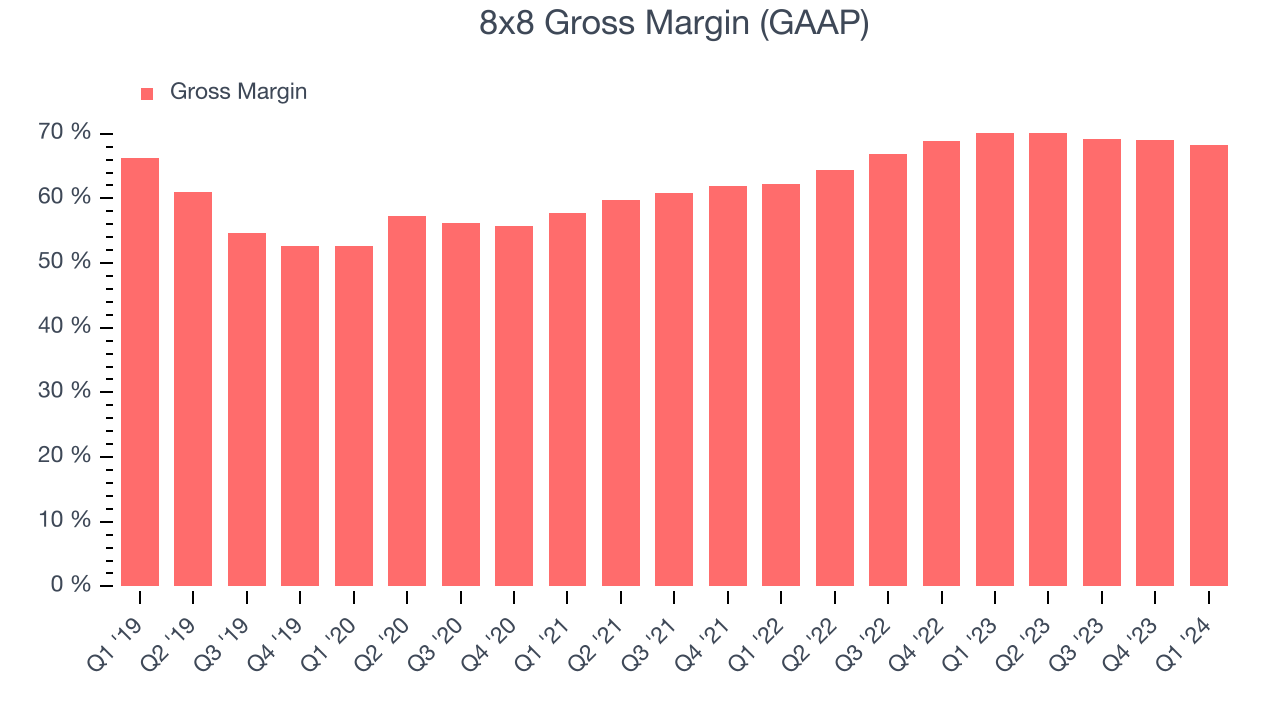

Profitability

What makes the software as a service business so attractive is that once the software is developed, it typically shouldn't cost much to provide it as an ongoing service to customers. 8x8's gross profit margin, an important metric measuring how much money there's left after paying for servers, licenses, technical support, and other necessary running expenses, was 68.2% in Q1.

That means that for every $1 in revenue the company had $0.68 left to spend on developing new products, sales and marketing, and general administrative overhead. 8x8's gross margin is poor for a SaaS business and it's dropped significantly since the previous quarter. This is probably the exact opposite of what shareholders would like to see.

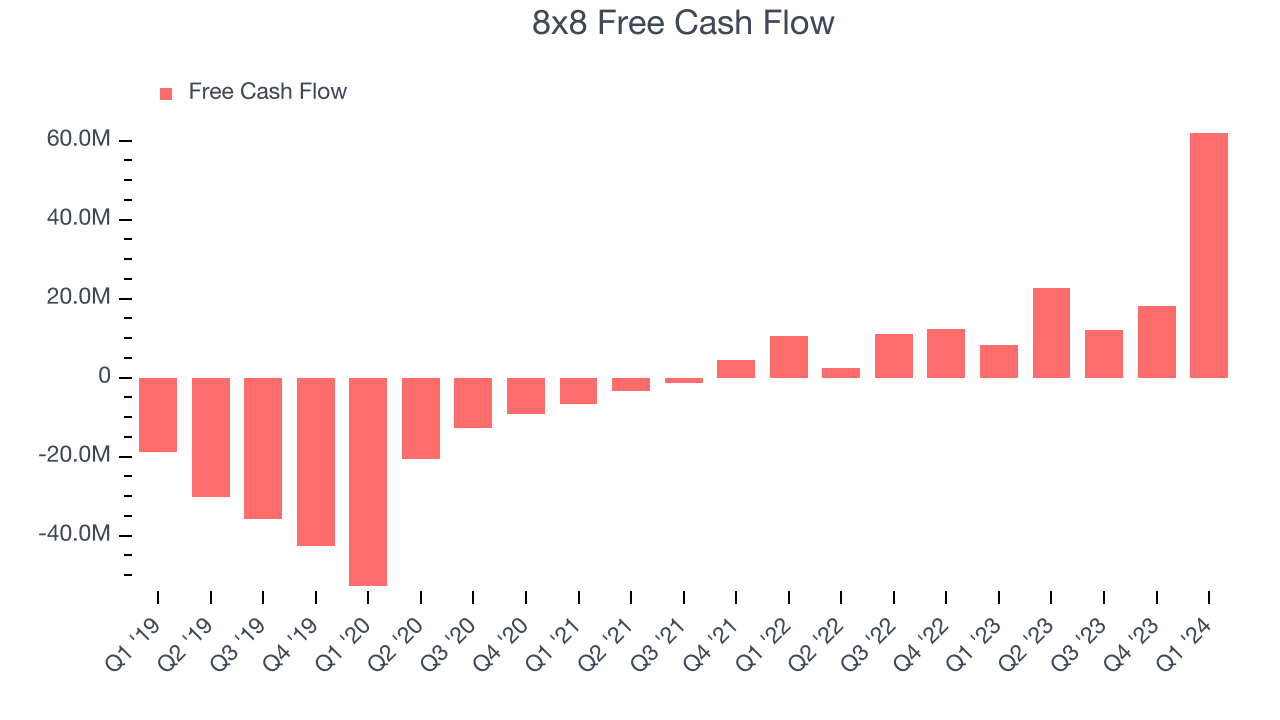

Cash Is King

If you've followed StockStory for a while, you know that we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can't use accounting profits to pay the bills. 8x8's free cash flow came in at $62.05 million in Q1, up 658% year on year.

8x8 has generated $115.1 million in free cash flow over the last 12 months, a solid 15.8% of revenue. This strong FCF margin stems from its asset-lite business model, giving it optionality and plenty of cash to reinvest in its business.

Key Takeaways from 8x8's Q1 Results

8x8 expects revenue to stay flat over the next 12 months, missing analysts' expectations and indicating continued demand weakness in its market. On the other hand, strong free cash flow was a positive this quarter. Overall, this was a mixed quarter for 8x8. The stock is flat after reporting and currently trades at $2.34 per share.

Is Now The Time?

When considering an investment in 8x8, investors should take into account its valuation and business qualities as well as what's happened in the latest quarter.

We cheer for everyone who's making the lives of others easier through technology, but in case of 8x8, we'll be cheering from the sidelines. Its revenue growth has been uninspiring over the last three years, and analysts expect growth to deteriorate from here. And while its strong free cash flow generation gives it re-investment options, unfortunately, its customer acquisition is less efficient than many comparable companies.

While we've no doubt one can find things to like about 8x8, we think there are better opportunities elsewhere in the market. We don't see many reasons to get involved at the moment.

Wall Street analysts covering the company had a one-year price target of $4.13 right before these results (compared to the current share price of $2.34).

To get the best start with StockStory, check out our most recent Stock picks, and then sign up for our earnings alerts by adding companies to your watchlist here. We typically have the quarterly earnings results analyzed within seconds of the data being released. Especially for companies reporting pre-market, this often gives investors the chance to react to the results before everyone else has fully absorbed the information.