Online health insurance comparison site eHealth (NASDAQ:EHTH) reported Q1 CY2024 results beating Wall Street analysts' expectations, with revenue up 26.1% year on year to $92.96 million. The company expects the full year's revenue to be around $462.5 million, in line with analysts' estimates. It made a GAAP loss of $0.96 per share, down from its loss of $0.72 per share in the same quarter last year.

eHealth (EHTH) Q1 CY2024 Highlights:

- Revenue: $92.96 million vs analyst estimates of $80.61 million (15.3% beat)

- EPS: -$0.96 vs analyst expectations of -$0.81 (19% miss)

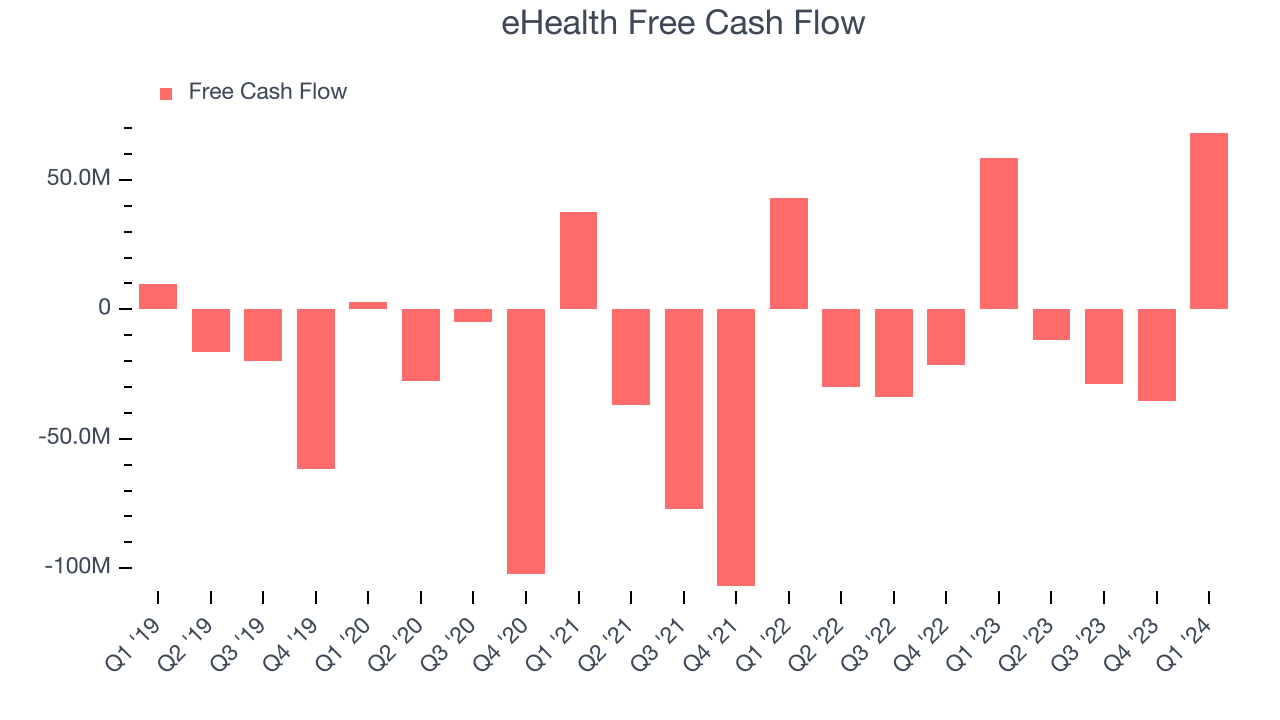

- Free Cash Flow of $68.27 million is up from -$35.38 million in the previous quarter

- Estimated Membership: 1.18 billion, down 57.59 million year on year

- Market Capitalization: $138.9 million

Aiming to address a high-stakes and often confusing decision, eHealth (NASDAQ:EHTH) guides consumers through health insurance enrollment and related topics.

The company was founded to provide customers with a convenient way to compare and purchase health insurance policies online by providing them with clear and concise information about plan options. The company's primary product is its online health insurance marketplace, where customers compare different health insurance plans, including Medicare Advantage, Medicare Supplement, and individual and family health insurance plans.

Buying health insurance is high stakes because it involves an individual, their entire family, or a workforce’s healthcare. It is also complex because of myriad plan options and their nuances - cost, coverage, provider networks, deductibles, etc. eHealth's online marketplace provides customers with transparency and clarity when selecting a health insurance plan. For example, an individual shopping for his/her family’s insurance may specify certain coverage needs and a certain budget, and the platform will surface and compare the best options based on those criteria.

eHealth’s customers include individuals and families, as well as small businesses and Medicare beneficiaries. The company generates revenue by earning commissions from insurance companies when customers purchase policies through its platform. Less significant sources of revenue include advertising and lead referral.

Online Marketplace

Marketplaces have existed for centuries. Where once it was a main street in a small town or a mall in the suburbs, sellers benefitted from proximity to one another because they could draw customers by offering convenience and selection. Today, a myriad of online marketplaces fulfill that same role, aggregating large customer bases, which attracts commission-paying sellers, generating flywheel scale effects that feed back into further customer acquisition.

Competitors either offering insurance products or digital healthcare management platforms include SelectQuote (NYSE:SLQT), HealthEquity (NASDAQ:HQY), and GoHealth (NASDAQ:GOCO).Sales Growth

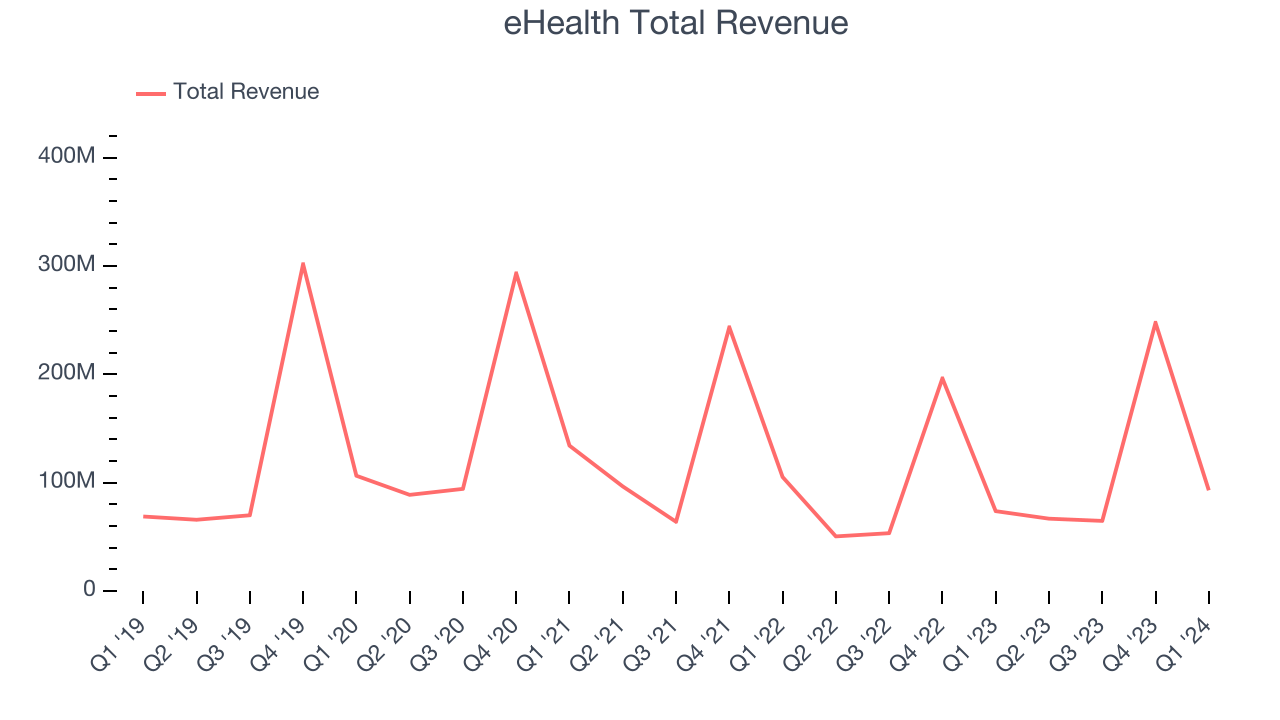

eHealth's revenue has been declining over the last three years, dropping on average by 5.8% annually. This quarter, eHealth beat analysts' estimates and reported decent 26.1% year-on-year revenue growth.

Before the earnings results were announced, analysts were projecting revenue to decline -8.8% over the next 12 months.

Usage Growth

As an online marketplace, eHealth generates revenue growth by increasing both the number of users on its platform and the average order size in dollars.

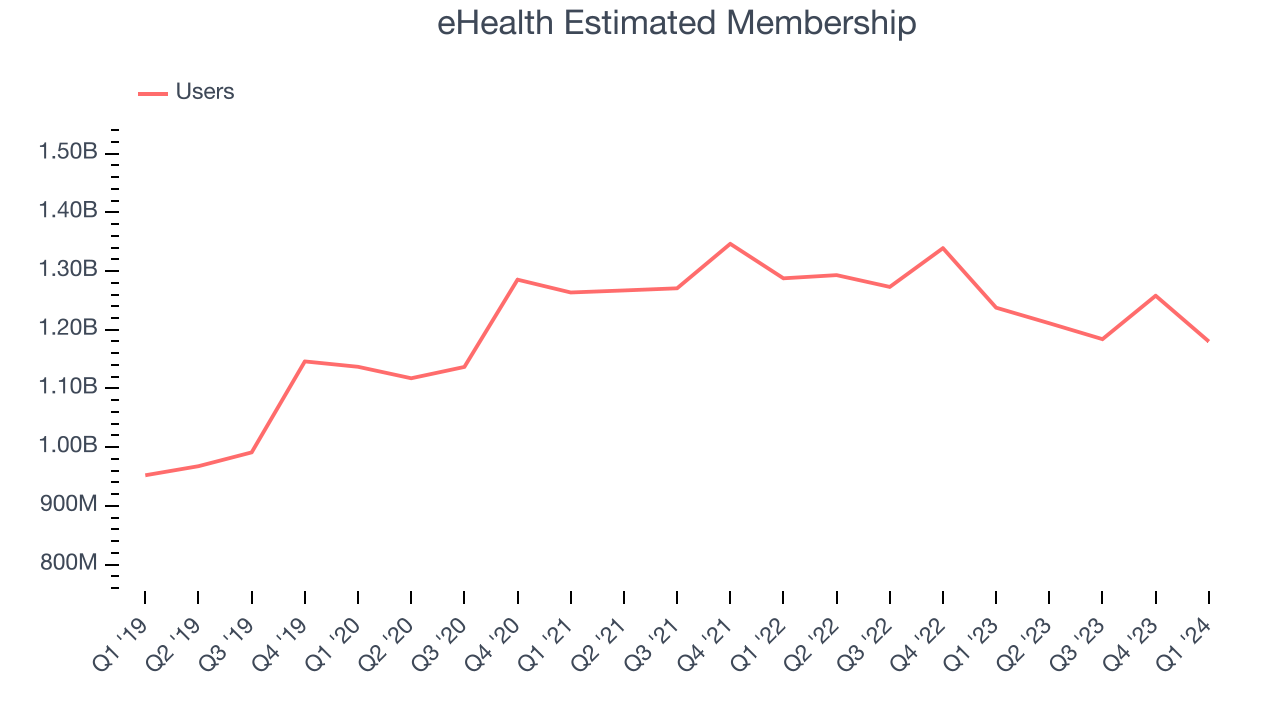

eHealth has been struggling to grow its users, a key performance metric for the company. Over the last two years, its users have declined 3.3% annually to 1.18 billion. This is one of the lowest rates of growth in the consumer internet sector.

In Q1, eHealth's users decreased by 57.59 million, a 4.7% drop since last year.

Revenue Per User

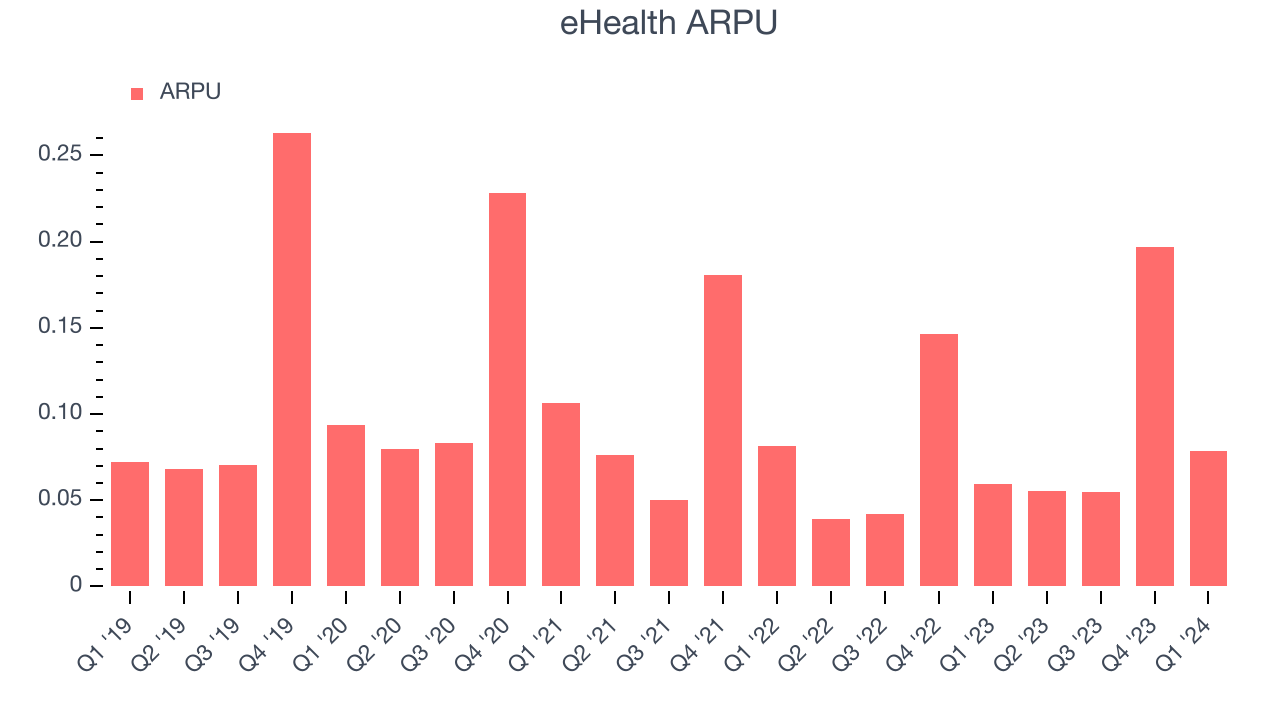

Average revenue per user (ARPU) is a critical metric to track for consumer internet businesses like eHealth because it measures how much the company earns in transaction fees from each user. Furthermore, ARPU gives us unique insights as it's a function of a user's average order size and eHealth's take rate, or "cut", on each order.

eHealth's ARPU growth has been mediocre over the last two years, averaging 3.3%. Although its users have shrunk during this time, the company's ability to increase prices shows that existing users still value its platform. This quarter, ARPU grew 32.3% year on year to $0.08 per user.

User Acquisition Efficiency

Unlike enterprise software that's typically sold by dedicated sales teams, consumer internet businesses like eHealth grow from a combination of product virality, paid advertisement, and incentives.

It's very expensive for eHealth to acquire new users as the company has spent 84% of its gross profit on sales and marketing expenses over the last year. This inefficiency indicates a highly competitive environment with little differentiation between eHealth and its peers.

Profitability & Free Cash Flow

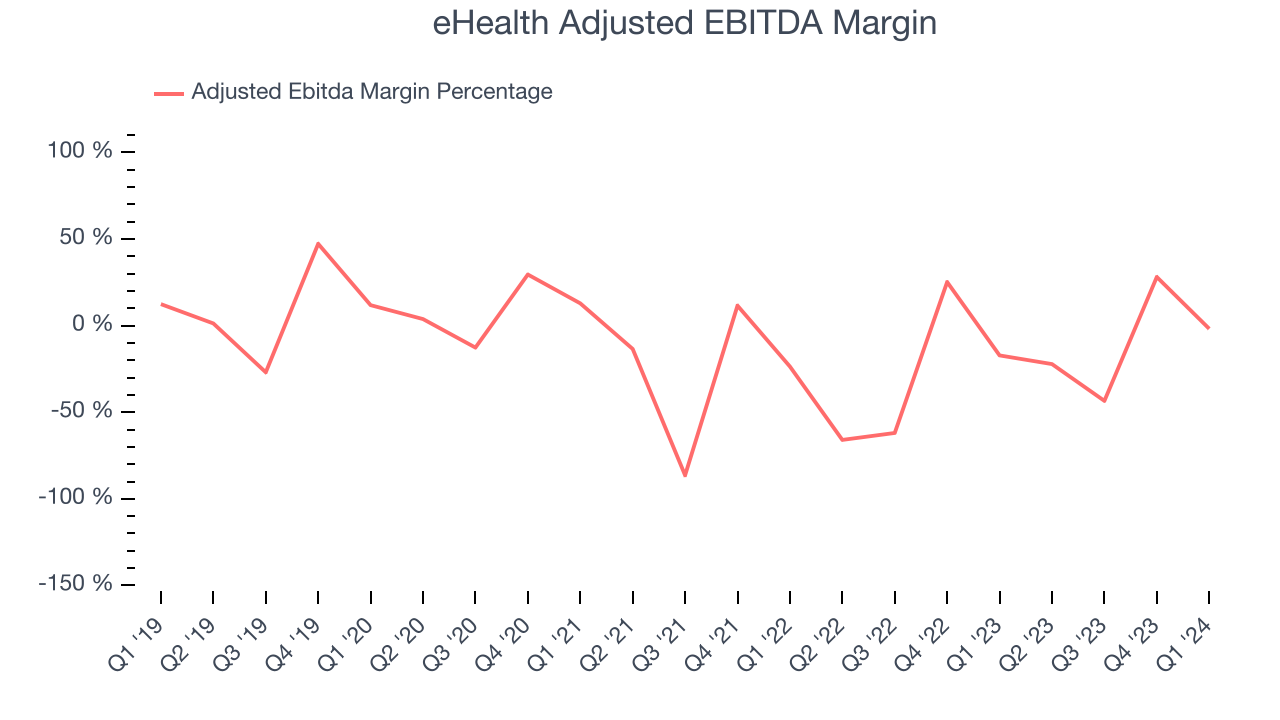

Investors frequently analyze operating income to understand a business's core profitability. Similar to operating income, adjusted EBITDA is the most common profitability metric for consumer internet companies because it removes various one-time or non-cash expenses, offering a more normalized view of a company's profit potential.

eHealth reported EBITDA of negative $1.65 million this quarter, resulting in a negative 1.8% margin. The company has also shown above-average profitability for a consumer internet business over the last four quarters, with average EBITDA margins of 5.3%.

If you've followed StockStory for a while, you know that we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can't use accounting profits to pay the bills. eHealth's free cash flow came in at $68.27 million in Q1, up 16.6% year on year.

eHealth has burned through $7.77 million of cash over the last 12 months, resulting in a negative 1.6% free cash flow margin. This below-average FCF margin stems from eHealth's continuous need to reinvest in its business to penetrate the market.

Key Takeaways from eHealth's Q1 Results

We were impressed by how significantly eHealth blew past analysts' revenue expectations this quarter. It came at a cost, however, as its EPS missed estimates by a wide margin. Looking ahead, eHealth's full-year revenue guidance aligned with Wall Street's projections while its EPS was much higher. We think this was a decent quarter, showing that the company is staying on track. The market is rewarding eHealth for its revenue beat and strong earnings guidance, and the stock is up 8.6% after reporting. It currently trades at $5.2 per share.

Is Now The Time?

When considering an investment in eHealth, investors should take into account its valuation and business qualities as well as what's happened in the latest quarter.

We cheer for everyone who's making the lives of others easier through technology, but in the case of eHealth, we'll be cheering from the sidelines. Its revenue has declined over the last three years, and analysts expect growth to deteriorate from here. And while its impressive gross margins are a wonderful starting point for the overall profitability of the business, the downside is its sales and marketing spend is very high compared to other consumer internet businesses. On top of that, its users have declined.

At the moment, eHealth trades at 6.7x next 12 months EV-to-EBITDA. While we've no doubt one can find things to like about eHealth, we think there are better opportunities elsewhere in the market. We don't see many reasons to get involved at the moment.

Wall Street analysts covering the company had a one-year price target of $8.33 per share right before these results (compared to the current share price of $5.20).

To get the best start with StockStory check out our most recent Stock picks, and then sign up to our earnings alerts by adding companies to your watchlist here. We typically have the quarterly earnings results analyzed within seconds of the data being released, and especially for the companies reporting pre-market, this often gives investors the chance to react to the results before the market has fully absorbed the information.