Critical event management software company Everbridge (NASDAQ: EVBG) reported Q1 FY2021 results topping analyst expectations, with revenue up 39.5% year on year to $82.2 million. Everbridge made a GAAP loss of $21.7 million, improving on its loss of $25.3 million, in the same quarter last year.

Get access to the fastest analysis of earnings results on the market. Get investing superpowers with StockStory. Signup here for early access.

Everbridge (NASDAQ:EVBG) Q1 FY2021 Highlights:

- Revenue: $82.2 million vs analyst estimates of $75.5 million (8.8% beat)

- EPS (non-GAAP): $0.18 vs analyst estimates of -$0.11 ($0.29 beat)

- Revenue guidance for Q2 2021 is $83.9 million at the midpoint, above analyst estimates of $82.6 million

- The company lifted revenue guidance for the full year, from $343.1 million to $358.8 million at the midpoint, a 4.57% increase

- Free cash flow of $15.5 million, roughly flat from previous quarter

- Customers: 5,748, up from 5,613 in previous quarter

- Gross Margin (GAAP): 69.2%, down from 71.1% previous quarter

“We are off to a great start to the year, delivering a record revenue beat with continued momentum for large transactions and establishing a new high watermark for our average selling price,” said David Meredith, Chief Executive Officer of Everbridge. “Our top-line outperformance flowed through to our bottom line results. During the first quarter, we saw healthy demand for our Critical Event Management SaaS platform and we announced an expansion of our offering to provide the most comprehensive integrated suite of digital and physical resiliency solutions for global organizations in the post-pandemic world.”

The Timely SMS Warning, And Everything Behind It

Everbridge was founded in 2002 to better supply companies and government bodies with mass notification systems. In time, management saw that customers were combining this system with other products, leading the development of the product into a critical event management software as a service allowing critical event management from a single platform. Essentially, Everbridge (NASDAQ:EVBG) supplies software that helps governments and businesses keep people and infrastructure safe in emergencies.

From school shootings to storm surges, Everbridge can help organisations automate the initiation of incident response, alert people to threats via their phones, and proactively assess risk levels before critical events emerge. Importantly, the Everbridge private network allows groups of our customers to opt in to share data on a confidential basis with each other around specific problems or critical events. This means that Everbridge’s platform becomes more valuable as more organizations use it.

Everbridge has global market penetration but it faces established competition from firms like Juvare, which owns WebEOC, an extremely widely used emergency management software. And there are a plethora of smaller competitors in mass notification, though Everbridge’s cell broadcast and location-based SMS solutions cannot be replicated by all of them. Climate change is expected to result in an increasing number of extreme weather events, globally, impacting both supply chains and personal security. This in turn increases the need for automated systems for critical events, meaning there should be increasing demand for software such as that sold by Everbridge.

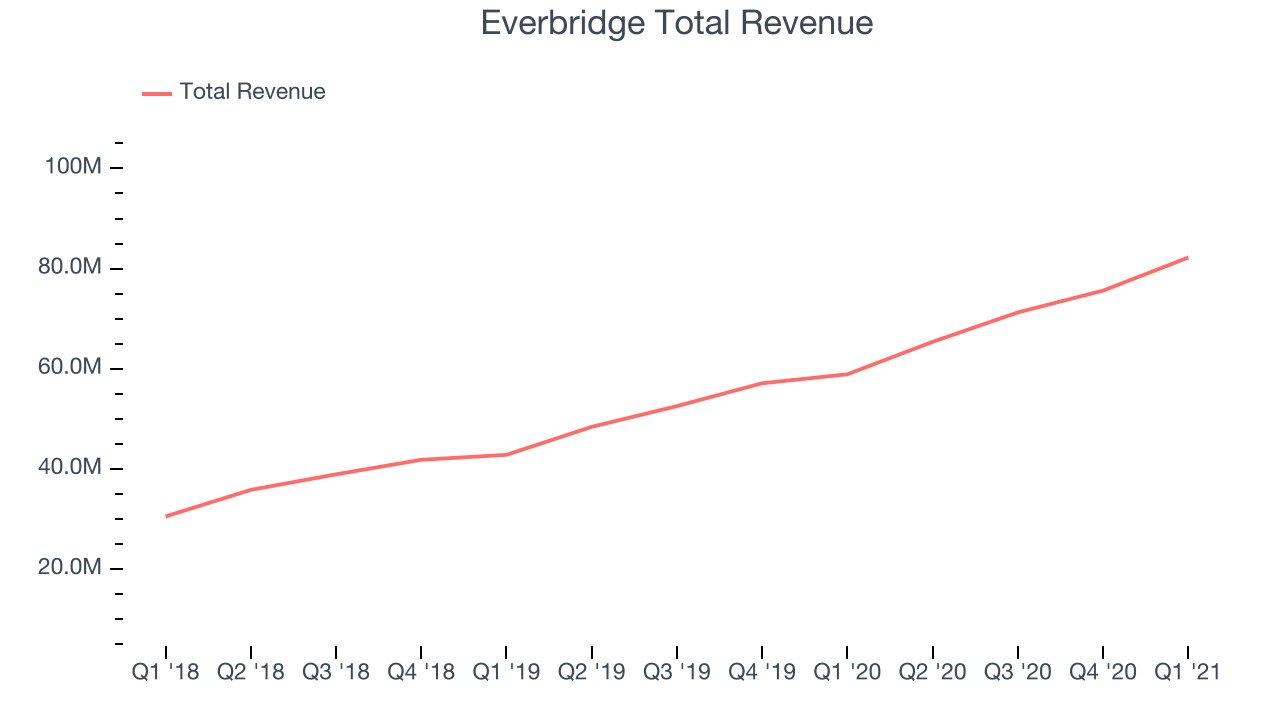

As you can see below, Everbridge's revenue growth has been very strong over the last twelve months, growing from $58.9 million to $82.2 million.

And unsurprisingly, this was another great quarter for Everbridge with revenue up an absolutely stunning 39.5% year on year. On top of that, revenue increased $6.6 million quarter on quarter, a very strong improvement on the $4.35 million increase in Q4 2020, and a sign of acceleration of growth.

Everbridge Gets Stronger As It Grows

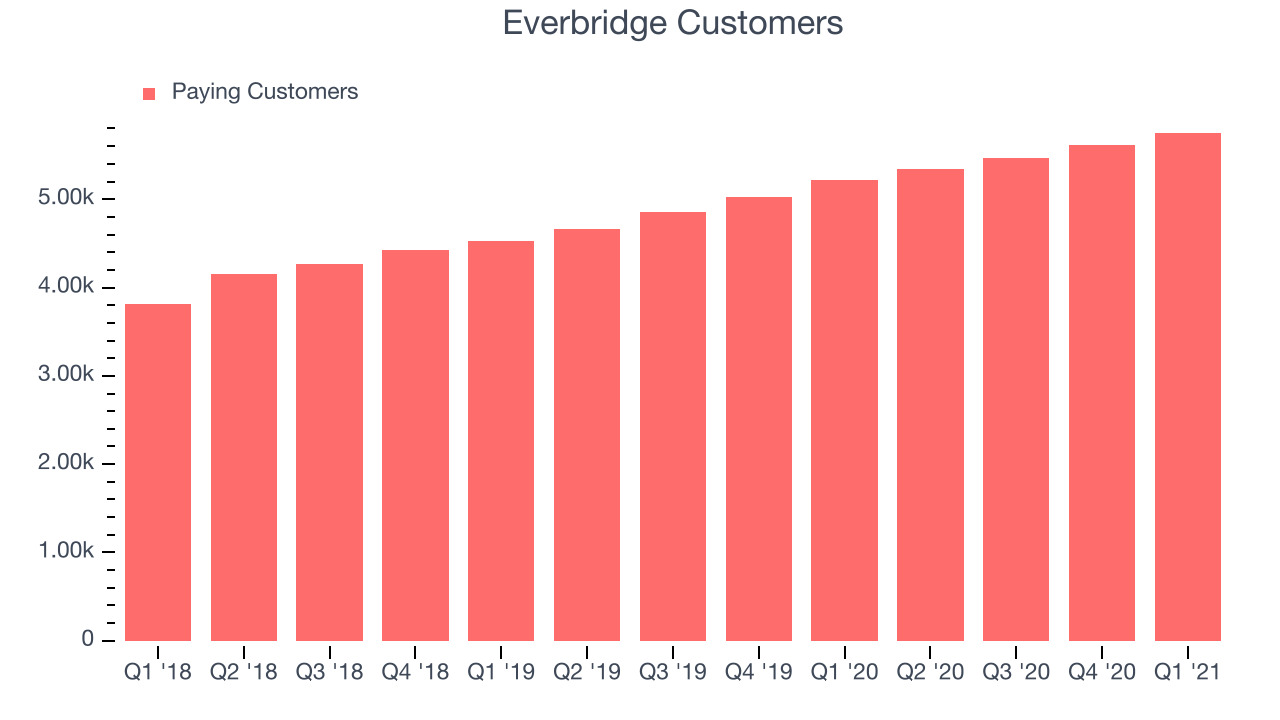

Everbridge gains competitive advantage as more customers anonymously share data with each other, so it’s important that it continues to win more customers. And the more Everbridge is deployed by varied customers, the more data and opportunities it has to help streamline responses; and derive insights about how critical events can be better managed in the future.

You can see below that Everbridge reported 5,748 customers at the end of the quarter, an increase of 135 on last quarter. That's in line with the customer growth we have seen over the last couple of quarters, suggesting that the company can maintain its current sales momentum.

Key Takeaways from Everbridge's Q1 Results

With market capitalisation of $4.36 billion Everbridge is among smaller companies, but its more than $734.7 million in cash and positive free cash flow over the last twelve months put it in a very strong position to invest in growth.

We were impressed by how strongly Everbridge outperformed analysts’ revenue expectations this quarter. And we were also excited to see the really strong revenue growth. Overall, we think this was a really good quarter, that should leave shareholders feeling very positive. Therefore, we think Everbridge will become more attractive to investors, compared to before these results.

Get access to insights until now only reserved for the top hedge funds. Discover great tech investments the market is overlooking. Get investing superpowers with StockStory. Signup here for early access.

The author has no position in any of the stocks mentioned.