Looking back on productivity software stocks' Q3 earnings, we examine this quarters’ best and worst performers, including Everbridge (NASDAQ:EVBG) and its peers.

Rising employee costs and the shift to more remote work has increased the ever-present pressure to improve corporate productivity, which in turn has driven rising demand for productivity software that enables remote work, streamline project management and automate business tasks.

The 12 productivity software stocks we track reported a decent Q3; on average, revenues beat analyst consensus estimates by 3.2%, while on average next quarter revenue guidance was 1.8% above consensus. But the whole tech sector has been facing a sell-off since late last year and productivity software stocks have not been spared, with many of the names down 30% and more from their all time highs.

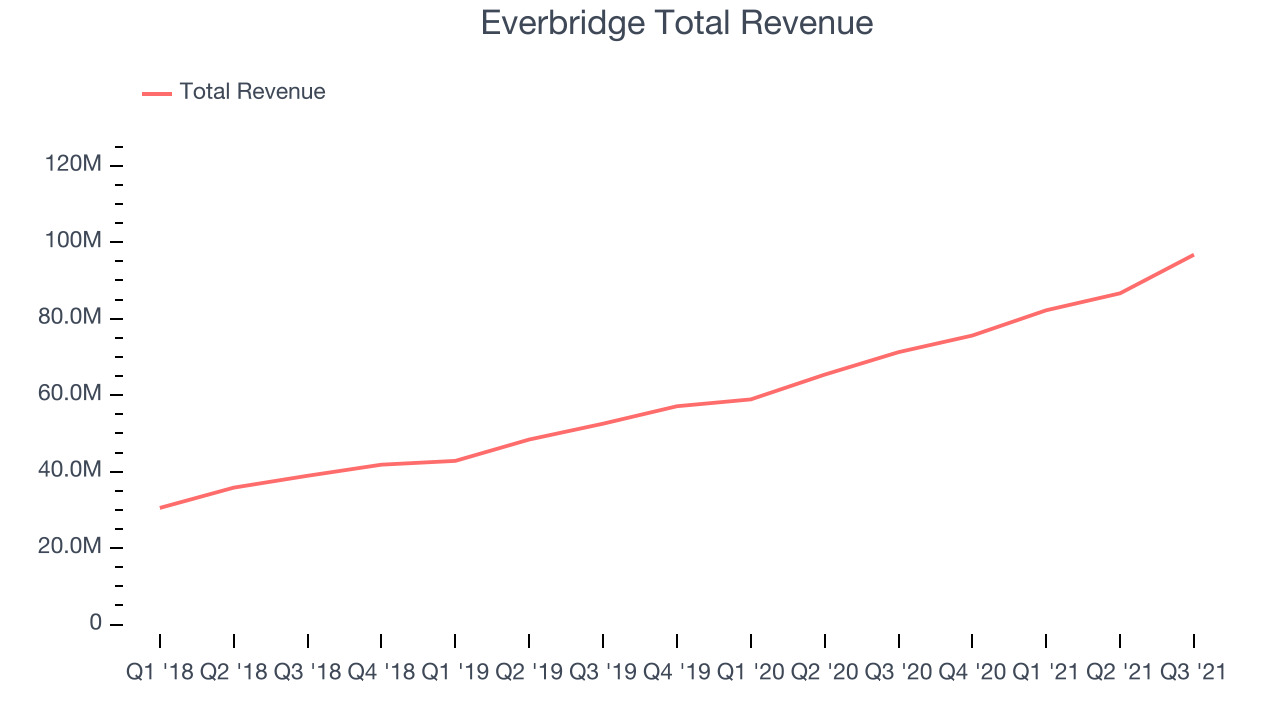

Everbridge (NASDAQ:EVBG)

Founded as a reaction to the catastrophic events of 9/11, Everbridge (NASDAQ:EVBG) supplies software that helps governments and businesses keep people and infrastructure safe in emergencies.

Everbridge reported revenues of $96.7 million, up 35.7% year on year, beating analyst expectations by 2.61%. It was a decent quarter for the company, with a strong revenue growth but decelerating customer growth.

“We exceeded our guidance ranges for revenue and profitability in the third quarter, with continued demand for our Critical Event Management Suite and Public Warning solutions,” said David Meredith, Chief Executive Officer of Everbridge.

The company reported 6,010 customers, up from 5,890 in previous quarter. The stock is down 61.6% since the results and currently trades at $60.95.

Is now the time to buy Everbridge? Access our full analysis of the earnings results here, it's free.

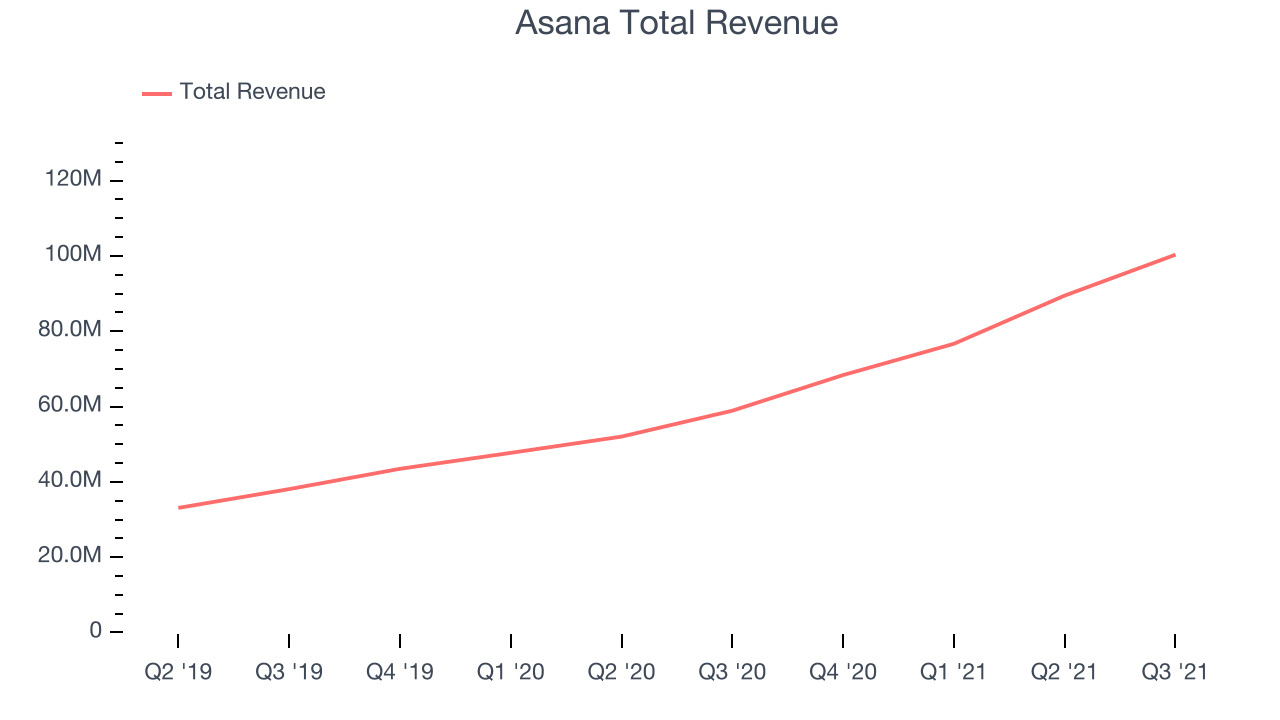

Best Q3: Asana (NYSE:ASAN)

Founded by Facebook’s co-founder Dustin Moskovitz, Asana (NYSE:ASAN) is a cloud-based project management software, where you can plan and assign tasks to employees and monitor and discuss progress of work.

Asana reported revenues of $100.3 million, up 70.3% year on year, beating analyst expectations by 6.85%. It was a very strong quarter for the company, with a very optimistic guidance for the next quarter and an exceptional revenue growth.

Asana achieved the strongest analyst estimates beat, fastest revenue growth, and highest full year guidance raise among its peers. The company added 1,337 enterprise customers paying more than $5,000 annually to a total of 14,143. The stock is down 33.4% since the results and currently trades at $60.49.

Is now the time to buy Asana? Access our full analysis of the earnings results here, it's free.

Weakest Q3: 8x8 (NYSE:EGHT)

Founded in 1987, 8x8 (NYSE:EGHT) provides software for organizations to efficiently communicate and collaborate with their customers, employees, and partners.

8x8 reported revenues of $151.5 million, up 17.3% year on year, beating analyst expectations by 2.39%. It was a weaker quarter for the company, with a meaningful improvement in gross margin but decelerating growth in large customers and top line guidance for Q4 narrowly missed estimates.

The stock is down 28.2% since the results and currently trades at $16.62.

Read our full analysis of 8x8's results here.

Zoom (NASDAQ:ZM)

Started by Eric Yuan who once ran engineering for Cisco’s video conferencing business, Zoom (NASDAQ:ZM) offers an easy to use, cloud-based platform for video conferencing, audio conferencing and screen sharing.

Zoom reported revenues of $1.05 billion, up 35.1% year on year, beating analyst expectations by 3.07%. It was a decent quarter for the company, with a very optimistic guidance for the next quarter but once again we saw decelerating growth in large customers.

The company added 7,200 enterprise customers with more than 10 employees to a total of 512,100. The stock is down 29.3% since the results and currently trades at $170.99.

Read our full, actionable report on Zoom here, it's free.

Box (NYSE:BOX)

Founded in 2005 by Aaron Levie and Dylan Smith, Box (NYSE:BOX) provides organizations with software to securely store, share and collaborate around work documents in the cloud.

Box reported revenues of $224 million, up 14.3% year on year, beating analyst expectations by 2.48%. It was a decent quarter for the company, with a strong sales guidance for the next quarter.

Due to its slower growth, Box has been priced more conservatively compared to its high growth peers and its shares have survived the sell-off unscathed. The stock is up 9.42% since the results and currently trades at $25.66.

Read our full, actionable report on Box here, it's free.

The author has no position in any of the stocks mentioned