Earnings results often give us a good indication of what direction a company will take in the months ahead. With Q3 now behind us, let’s have a look at Everbridge (NASDAQ:EVBG) and its peers.

The whole purpose of software is to automate tasks to increase productivity. Today, innovative new software techniques, often involving AI and machine learning, are finally allowing automation that has graduated from simple one- or two-step workflows to more complex processes integral to enterprises. The result is surging demand for modern automation software.

The 6 automation software stocks we track reported a solid Q3; on average, revenues beat analyst consensus estimates by 3.4% while next quarter's revenue guidance was 1.1% below consensus. Valuation multiples for growth stocks have reverted to their historical means after reaching highs in early 2021, but automation software stocks held their ground better than others, with the share prices up 11.3% on average since the previous earnings results.

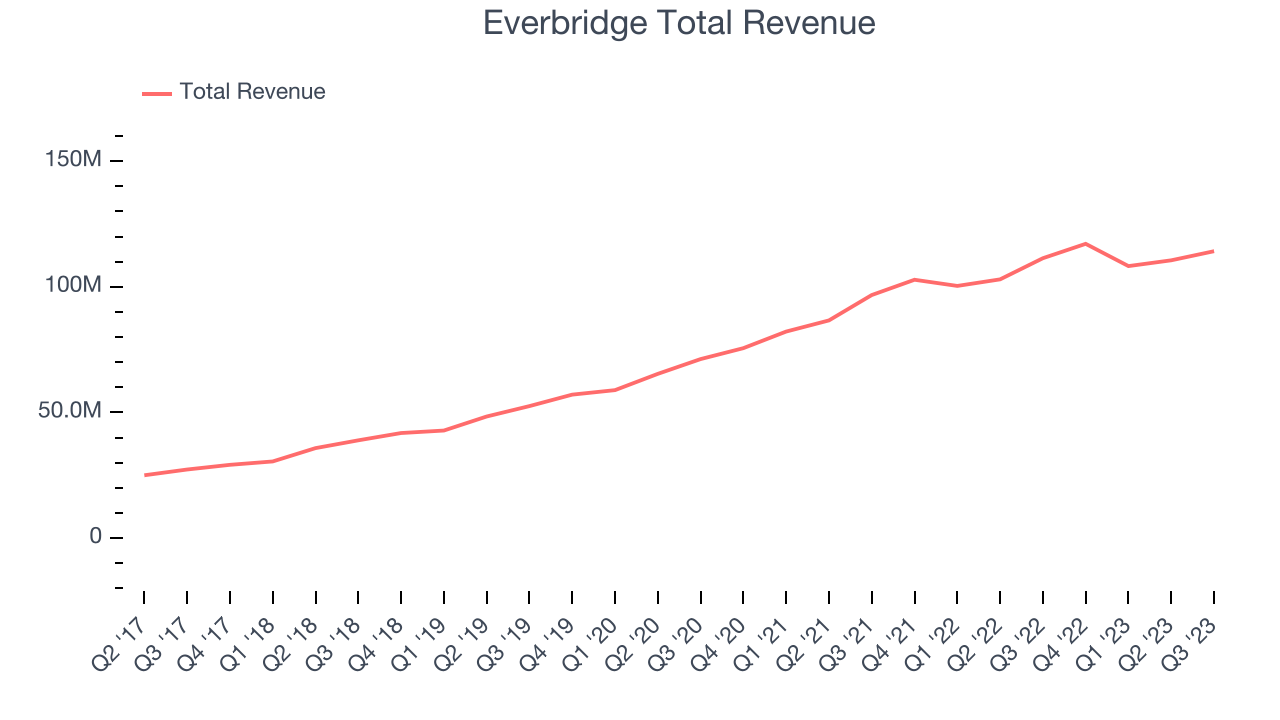

Everbridge (NASDAQ:EVBG)

Founded as a reaction to the catastrophic events of 9/11, Everbridge (NASDAQ:EVBG) supplies software that helps governments and businesses keep people and infrastructure safe in emergencies.

Everbridge reported revenues of $114.2 million, up 2.5% year on year, in line with analyst expectations. It was a slower quarter for the company, with underwhelming revenue guidance for the next quarter and full-year.

“We delivered solid third quarter results as we continue to improve our go-to-market execution and overall operating efficiency,” said David Wagner, President and CEO of Everbridge.

Everbridge delivered the weakest performance against analyst estimates, slowest revenue growth, and weakest full-year guidance update of the whole group. The company added 32 customers to reach a total of 405. The stock is up 8.9% since the results and currently trades at $21.97.

Read our full report on Everbridge here, it's free.

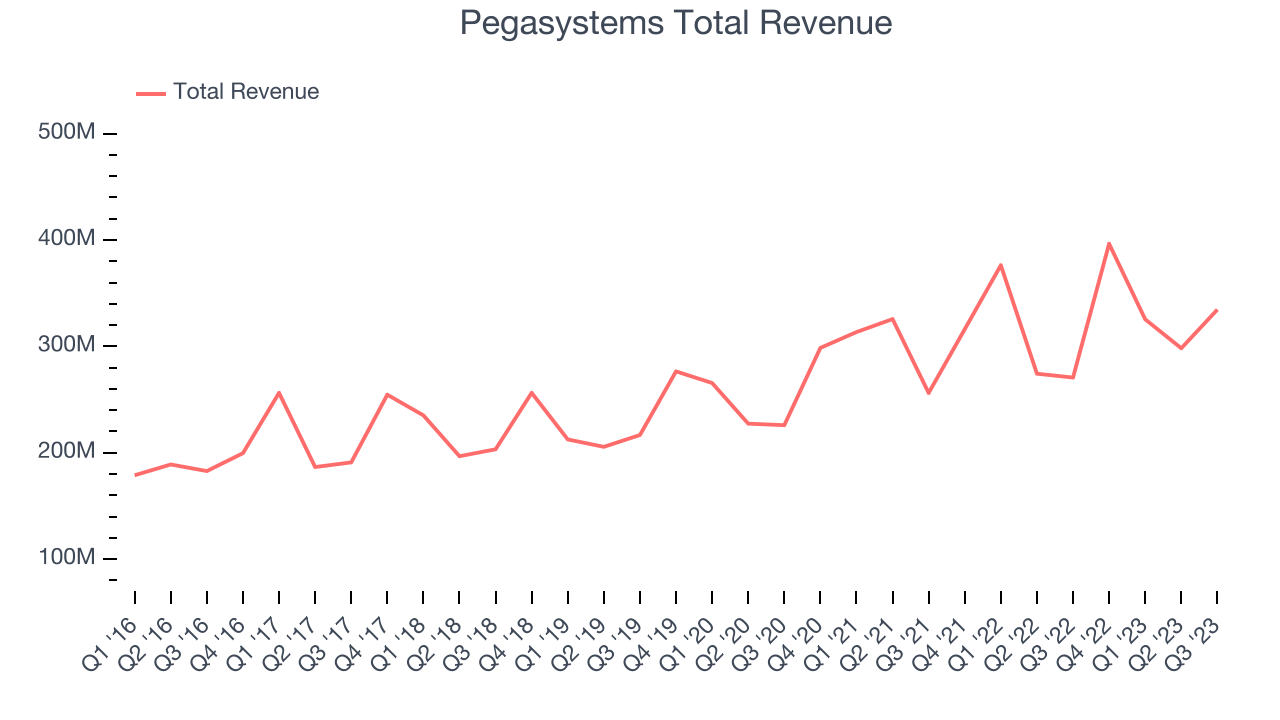

Best Q3: Pegasystems (NASDAQ:PEGA)

Founded by Alan Trefler in 1983, Pegasystems (NASDAQ:PEGA) offers a software-as-a-service platform to automate and optimize workflows in customer service and engagement.

Pegasystems reported revenues of $334.6 million, up 23.6% year on year, outperforming analyst expectations by 12.8%. It was an incredible quarter for the company, with a significant improvement in its gross margin and an impressive beat of analysts' revenue estimates.

Pegasystems pulled off the biggest analyst estimates beat among its peers. The stock is up 21.6% since the results and currently trades at $46.25.

Is now the time to buy Pegasystems? Access our full analysis of the earnings results here, it's free.

Weakest Q3: Appian (NASDAQ:APPN)

Founded by Matt Calkins and his three friends out of an apartment in Northern Virginia, Appian (NASDAQ:APPN) sells a software platform that lets its users build applications without using much code, allowing them to create new software more quickly.

Appian reported revenues of $137.1 million, up 16.3% year on year, exceeding analyst expectations by 1.3%. It was a slower quarter for the company, with underwhelming revenue guidance for the next quarter and full-year.

The stock is down 21.5% since the results and currently trades at $32.73.

Read our full analysis of Appian's results here.

Jamf (NASDAQ:JAMF)

Founded in 2002 by Zach Halmstad and Chip Pearson, right around the time when Apple began to dominate the personal computing market, Jamf (NASDAQ:JAMF) provides software for companies to manage Apple devices such as Macs, iPads, and iPhones.

Jamf reported revenues of $142.6 million, up 14.5% year on year, surpassing analyst expectations by 1.8%. It was a mixed quarter for the company, with a decline in its gross margin and underwhelming revenue guidance for the next quarter.

Jamf achieved the highest full-year guidance raise among its peers. The stock is up 12.2% since the results and currently trades at $18.15.

Read our full, actionable report on Jamf here, it's free.

UiPath (NYSE:PATH)

Started in 2005 in Romania as a tech outsourcing company, UiPath (NYSE:PATH) makes software that helps companies automate repetitive computer tasks.

UiPath reported revenues of $325.9 million, up 24% year on year, surpassing analyst expectations by 3.3%. It was a decent quarter for the company, with ARR (annual recurring revenue), reported revenue, and non-GAAP operating profit exceeding expectations. Guidance for next quarter was fine, with ARR ahead while revenue and non-GAAP operating profit were roughly in line.

The stock is up 9.3% since the results and currently trades at $21.58.

Read our full, actionable report on UiPath here, it's free.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.

The author has no position in any of the stocks mentioned