Beauty and waxing service franchise European Wax Center (NASDAQ:EWCZ) reported results in line with analysts' expectations in Q1 CY2024, with revenue up 4% year on year to $51.87 million. On the other hand, the company's full-year revenue guidance of $228.5 million at the midpoint came in slightly below analysts' estimates. It made a GAAP profit of $0.08 per share, improving from its loss of $0.02 per share in the same quarter last year.

Is now the time to buy European Wax Center? Find out by accessing our full research report, it's free.

European Wax Center (EWCZ) Q1 CY2024 Highlights:

- Revenue: $51.87 million vs analyst estimates of $52.02 million (small miss)

- Adjusted EBITDA: $17.5 million vs analyst estimates of $16.6 million (5.4% beat)

- EPS: $0.08 vs analyst estimates of $0.03 ($0.05 beat)

- The company reconfirmed its revenue guidance for the full year of $228.5 million at the midpoint (slight miss, adjusted EBITDA guidance for the full year roughly in line)

- Gross Margin (GAAP): 73.9%, up from 71% in the same quarter last year

- Free Cash Flow of $10.69 million, down 36.1% from the previous quarter

- Same-Store Sales were down 1.2% year on year (miss)

- Market Capitalization: $529.8 million

David Willis, Chief Executive Officer of European Wax Center, Inc. stated, “We began 2024 with stable frequency and spend among our existing guests which led to positive system-wide sales and revenue growth in the first quarter and underpins our predictable, recurring business model. Further, continued franchisee demand drove new center growth in-line with our expectations. We’re pleased that our development pipeline remains robust and supported by our well-capitalized and committed franchisees.”

Founded by two siblings, European Wax Center (NASDAQ:EWCZ) is a beauty and waxing salon chain specializing in professional wax services and skincare products.

Leisure Facilities

Leisure facilities companies often sell experiences rather than tangible products, and in the last decade-plus, consumers have slowly shifted their spending from "things" to "experiences". Leisure facilities seek to benefit but must innovate to do so because of the industry's high competition and capital intensity.

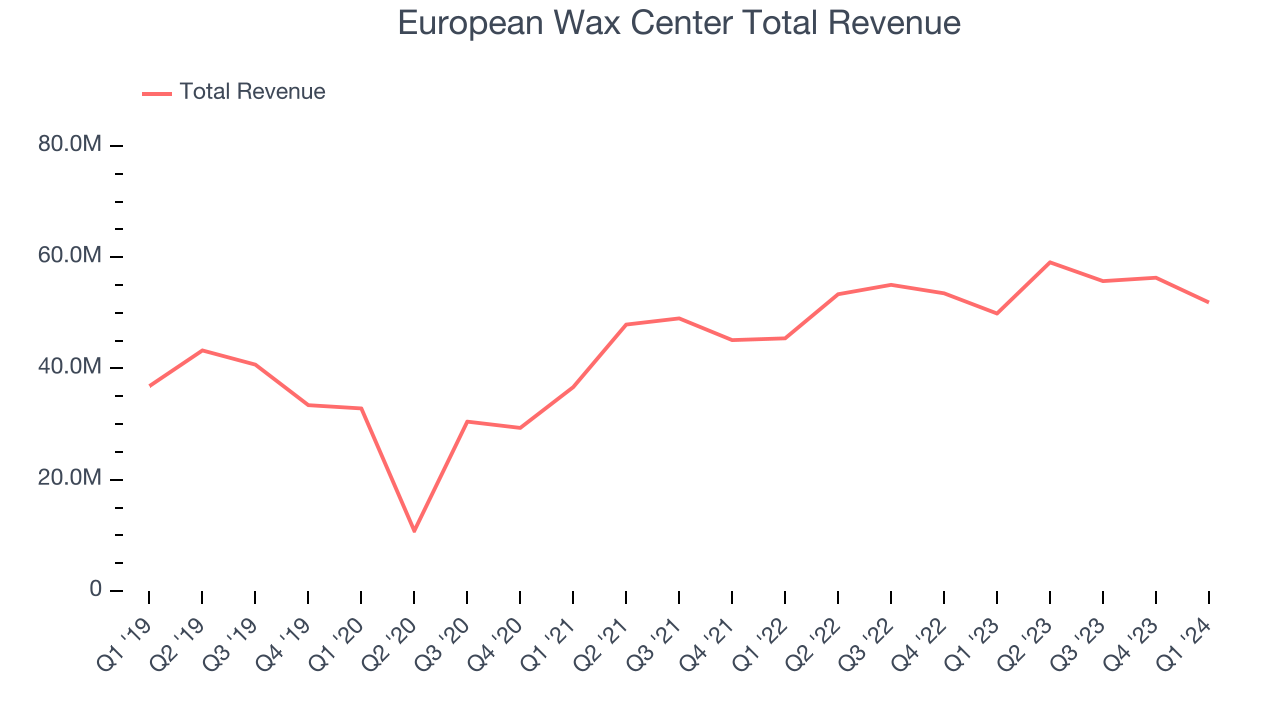

Sales Growth

A company's long-term performance can indicate its business quality. Any business can enjoy short-lived success, but best-in-class ones sustain growth over many years. European Wax Center's annualized revenue growth rate of 10.4% over the last four years was weak for a consumer discretionary business.  Within consumer discretionary, a long-term historical view may miss a company riding a successful new product or emerging trend. That's why we also follow short-term performance. European Wax Center's recent history shows the business has slowed as its annualized revenue growth of 9.1% over the last two years is below its four-year trend.

Within consumer discretionary, a long-term historical view may miss a company riding a successful new product or emerging trend. That's why we also follow short-term performance. European Wax Center's recent history shows the business has slowed as its annualized revenue growth of 9.1% over the last two years is below its four-year trend.

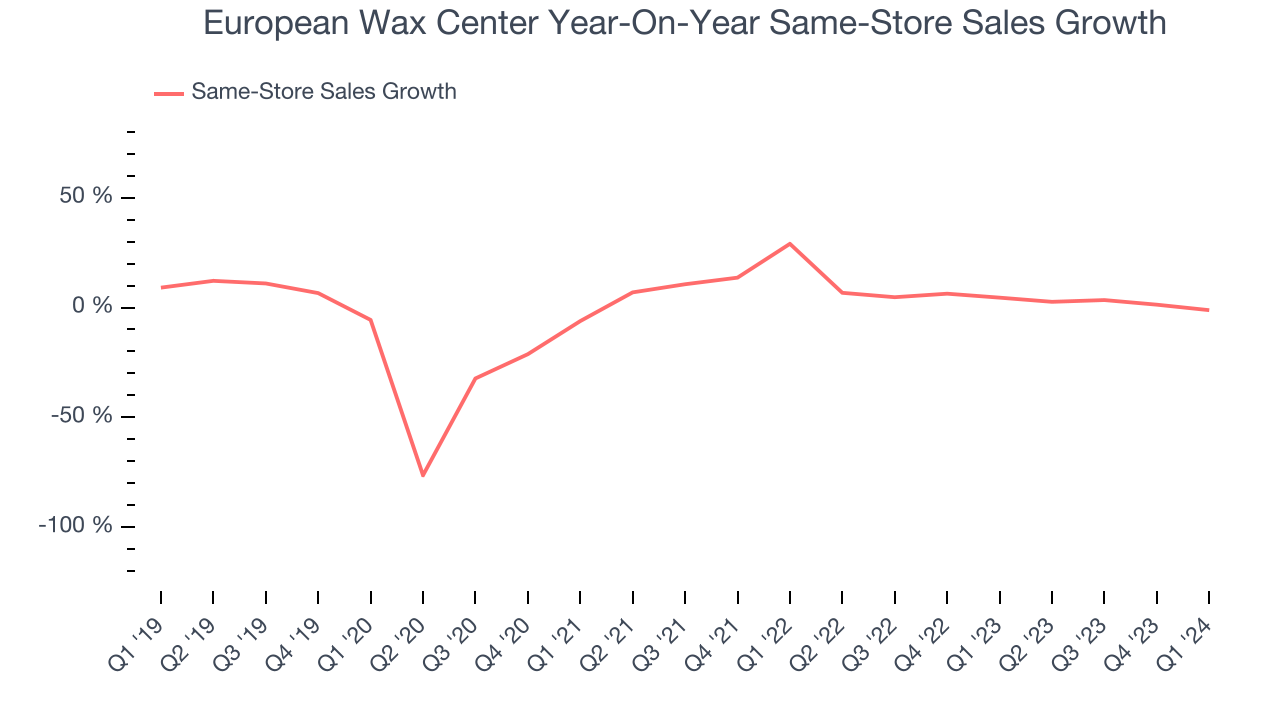

We can dig even further into the company's revenue dynamics by analyzing its same-store sales, which show how much revenue its established locations generate. Over the last two years, European Wax Center's same-store sales averaged 3.5% year-on-year growth. Because this number is lower than its revenue growth, we can see the opening of new locations is boosting the company's top-line performance.

This quarter, European Wax Center grew its revenue by 4% year on year, and its $51.87 million of revenue was in line with Wall Street's estimates. Looking ahead, Wall Street expects sales to grow 5.4% over the next 12 months, an acceleration from this quarter.

Here at StockStory, we certainly understand the potential of thematic investing. Diverse winners from Microsoft (MSFT) to Alphabet (GOOG), Coca-Cola (KO) to Monster Beverage (MNST) could all have been identified as promising growth stories with a megatrend driving the growth. So, in that spirit, we’ve identified a relatively under-the-radar profitable growth stock benefitting from the rise of AI, available to you FREE via this link.

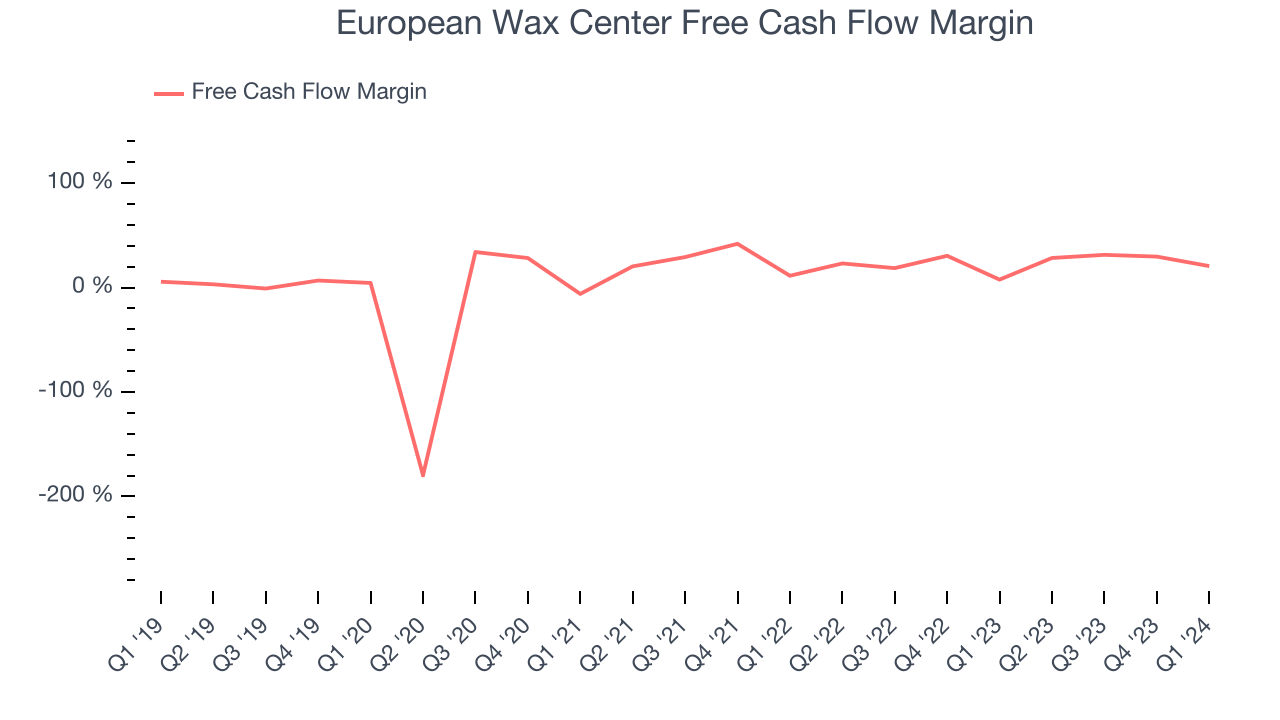

Cash Is King

Although earnings are undoubtedly valuable for assessing company performance, we believe cash is king because you can't use accounting profits to pay the bills.

Over the last two years, European Wax Center has shown terrific cash profitability, enabling it to reinvest, return capital to investors, and stay ahead of the competition while maintaining a robust cash balance. The company's free cash flow margin has been among the best in the consumer discretionary sector, averaging 24%.

European Wax Center's free cash flow came in at $10.69 million in Q1, equivalent to a 20.6% margin and up 180% year on year.

Key Takeaways from European Wax Center's Q1 Results

We were impressed that European Wax Center beat analysts' adjusted EBITDA and EPS expectations this quarter. On the other hand, same-store sales in the quarter underwhelmed and the company's and its full-year revenue guidance slightly fell short of Wall Street's estimates, although full year adjusted EBITDA guidance was roughly in line. Zooming out, we think this was still a decent, albeit mixed, quarter, showing that the company is staying on track. The stock is flat after reporting and currently trades at $10.8 per share.

So should you invest in European Wax Center right now? When making that decision, it's important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it's free.