The end of an earnings season can be a great time to assess how companies are handling the current business environment and discover new stocks. Let’s take a look at how European Wax Center (NASDAQ:EWCZ) and the rest of the leisure facilities stocks fared in Q4.

Leisure facilities companies often sell experiences rather than tangible products, and in the last decade-plus, consumers have slowly shifted their spending from "things" to "experiences". Leisure facilities seek to benefit but must innovate to do so because of the industry's high competition and capital intensity.

The 10 leisure facilities stocks we track reported a weaker Q4; on average, revenues beat analyst consensus estimates by 3.4% while next quarter's revenue guidance was 21.6% below consensus. Stocks have faced challenges as investors prioritize near-term cash flows, but leisure facilities stocks held their ground better than others, with the share prices up 13.6% on average since the previous earnings results.

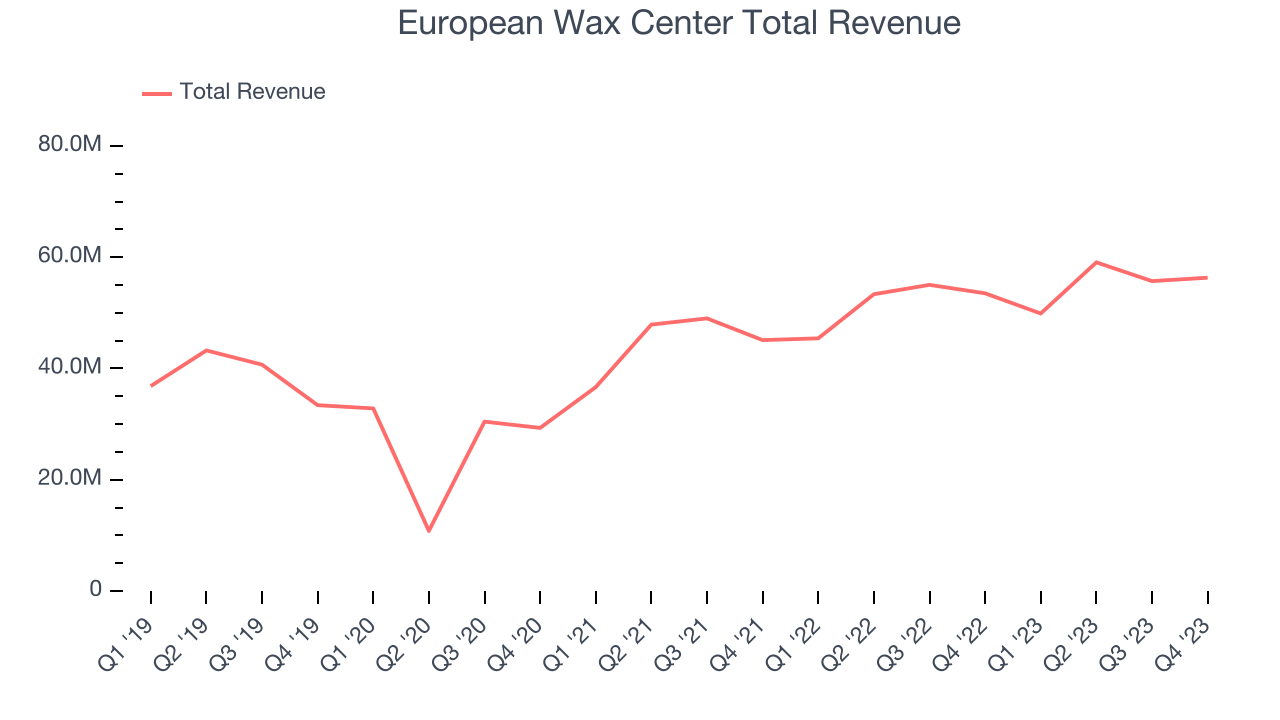

European Wax Center (NASDAQ:EWCZ)

Founded by two siblings, European Wax Center (NASDAQ:EWCZ) is a beauty and waxing salon chain specializing in professional wax services and skincare products.

European Wax Center reported revenues of $56.33 million, up 5.2% year on year, topping analyst expectations by 4.2%. It was a decent quarter for the company, with an impressive beat of analysts' earnings estimates but full-year revenue guidance missing analysts' expectations.

David Willis, Chief Executive Officer of European Wax Center, Inc. stated: “European Wax Center delivered a strong fourth quarter and equally strong full year 2023 performance. We opened 100 net new centers in 2023, all of which were developed by existing operators, demonstrating continued demand from our franchisees. Further, our core guests, Wax Pass and routine guests, remained firmly committed to their personal care routines, demonstrated by their recurring, predictable revenue stream comprising more than 75% of our $955 million in full year system-wide sales.”

European Wax Center delivered the weakest full-year guidance update of the whole group. The stock is down 5.8% since the results and currently trades at $12.33.

Is now the time to buy European Wax Center? Access our full analysis of the earnings results here, it's free.

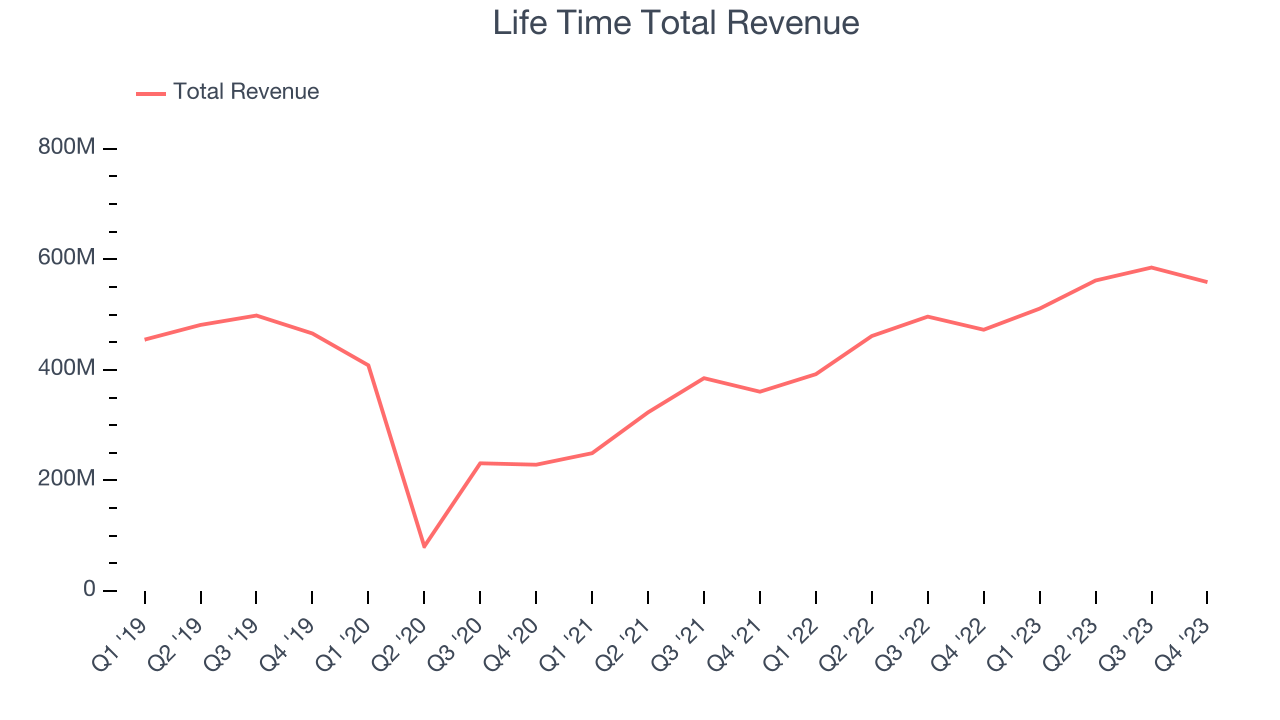

Best Q4: Life Time (NYSE:LTH)

With over 150 locations and gyms that include saunas and steam rooms, Life Time (NYSE:LTH) is an upscale fitness club emphasizing holistic well-being and fitness.

Life Time reported revenues of $558.8 million, up 18.2% year on year, in line with analyst expectations. It was a strong quarter for the company, with a solid beat of analysts' earnings estimates and revenue guidance for next quarter exceeding analysts' expectations.

Life Time pulled off the highest full-year guidance raise among its peers. The stock is up 18.5% since the results and currently trades at $14.72.

Is now the time to buy Life Time? Access our full analysis of the earnings results here, it's free.

Slowest Q4: Six Flags (NYSE:SIX)

Sporting the fastest rollercoaster in the United States, Six Flags (NYSE:SIX) is a regional theme park operator offering thrilling rides, entertainment, and family-friendly attractions.

Six Flags reported revenues of $292.6 million, up 4.5% year on year, falling short of analyst expectations by 1.7%. It was a weak quarter for the company, with a miss of analysts' earnings estimates.

The stock is up 5% since the results and currently trades at $25.8.

Read our full analysis of Six Flags's results here.

Planet Fitness (NYSE:PLNT)

Founded by two brothers who purchased a struggling gym, Planet Fitness (NYSE:PLNT) is a gym franchise which caters to casual fitness users by providing a friendly and inclusive atmosphere.

Planet Fitness reported revenues of $285.1 million, up 1.4% year on year, surpassing analyst expectations by 1%. It was a mixed quarter for the company, with a narrow beat of analysts' revenue estimates. Looking ahead, the company's full-year 2024 revenue and EPS guidance fell short as Planet Fitness focuses on rolling out its New Growth Model to franchisees.

The stock is down 7.1% since the results and currently trades at $61.2.

Read our full, actionable report on Planet Fitness here, it's free.

Vail Resorts (NYSE:MTN)

Founded by two Aspen, Colorado ski patrol guides, Vail Resorts (NYSE:MTN) is a mountain resort company offering luxury experiences in over 30 locations across the globe.

Vail Resorts reported revenues of $1.08 billion, down 2.2% year on year, falling short of analyst expectations by 6.5%. It was a weak quarter for the company, with a miss of analysts' visitors and revenue estimates.

Vail Resorts had the weakest performance against analyst estimates and slowest revenue growth among its peers. The stock is down 2.6% since the results and currently trades at $218.72.

Read our full, actionable report on Vail Resorts here, it's free.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.