Beauty and waxing service franchise European Wax Center (NASDAQ:EWCZ) beat analysts' expectations in Q4 FY2023, with revenue up 5.2% year on year to $56.33 million. On the other hand, the company's full-year revenue guidance of $228.5 million at the midpoint came in 2.3% below analysts' estimates. It made a GAAP profit of $0.07 per share, improving from its profit of $0.02 per share in the same quarter last year.

European Wax Center (EWCZ) Q4 FY2023 Highlights:

- Revenue: $56.33 million vs analyst estimates of $54.07 million (4.2% beat)

- EPS: $0.07 vs analyst estimates of $0.04 ($0.03 beat)

- Management's revenue guidance for the upcoming financial year 2024 is $228.5 million at the midpoint, missing analyst estimates by 2.3% and implying 3.4% growth (vs 6.8% in FY2023) (adjusted EBITDA guidance for the period also missed)

- Free Cash Flow of $16.74 million, similar to the previous quarter

- Gross Margin (GAAP): 72.4%, up from 70% in the same quarter last year

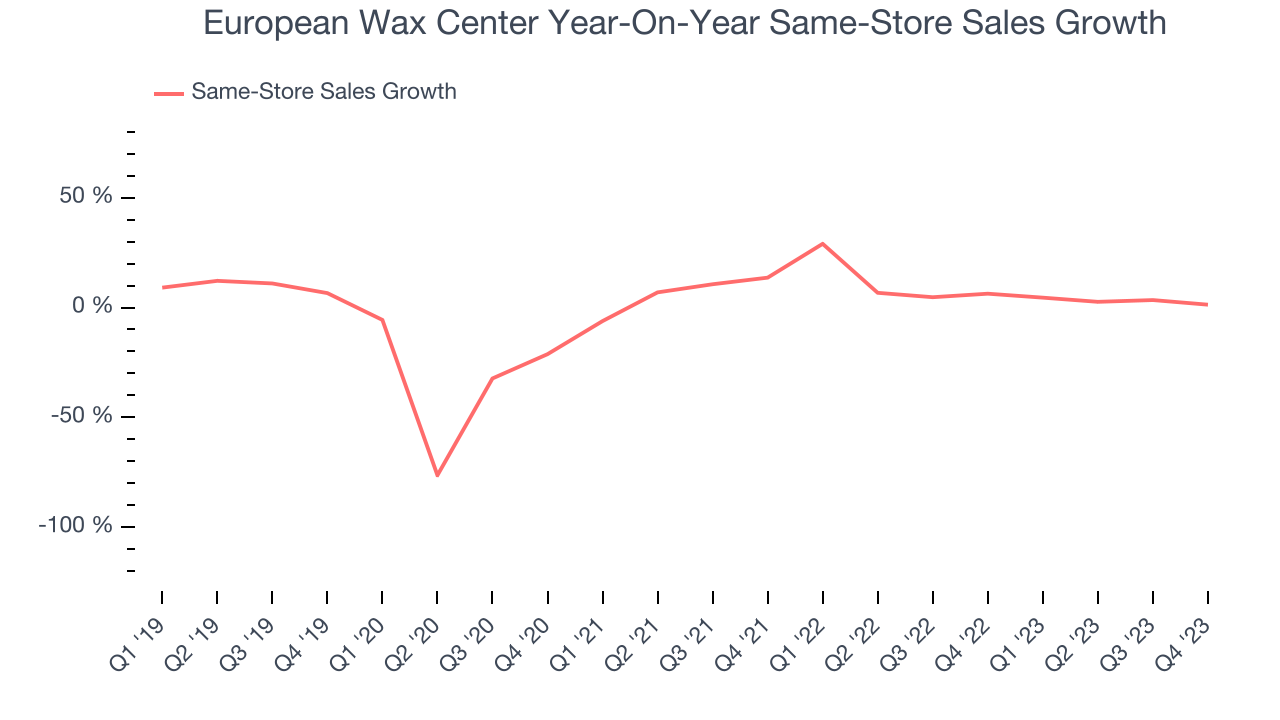

- Same-Store Sales were up 1.3% year on year (beat vs. expectations of roughly flat or no growth year on year)

- Market Capitalization: $656.8 million

Founded by two siblings, European Wax Center (NASDAQ:EWCZ) is a beauty and waxing salon chain specializing in professional wax services and skincare products.

European Wax Center recognized the need for a waxing experience focused on comfort and hygiene. The company aimed to provide a luxurious experience, prioritizing customer care and high-quality products. It began with a single salon and has since expanded into a prominent chain.

The company offers a wide range of waxing services for both men and women, including facial and body waxing. European Wax Center's appeal is in its proprietary Comfort Wax, made from natural beeswax. The popularity of Comfort Wax has incentivized the company to market other skincare products that complement its core services.

Revenue is generated through a combination of service fees and product sales. Its business model includes franchise and corporate-owned locations, allowing for scalability and flexibility in expansion. European Wax Center's revenue model is further bolstered by royalty fees from franchisees, which typically come with higher margins.

Leisure Facilities

Leisure facilities companies often sell experiences rather than tangible products, and in the last decade-plus, consumers have slowly shifted their spending from "things" to "experiences". Leisure facilities seek to benefit but must innovate to do so because of the industry's high competition and capital intensity.

As a niche business, European Wax Center has no direct public competitors. Privately owned competitors include Bluemercury, Radiant Waxing, and Waxing the City.Sales Growth

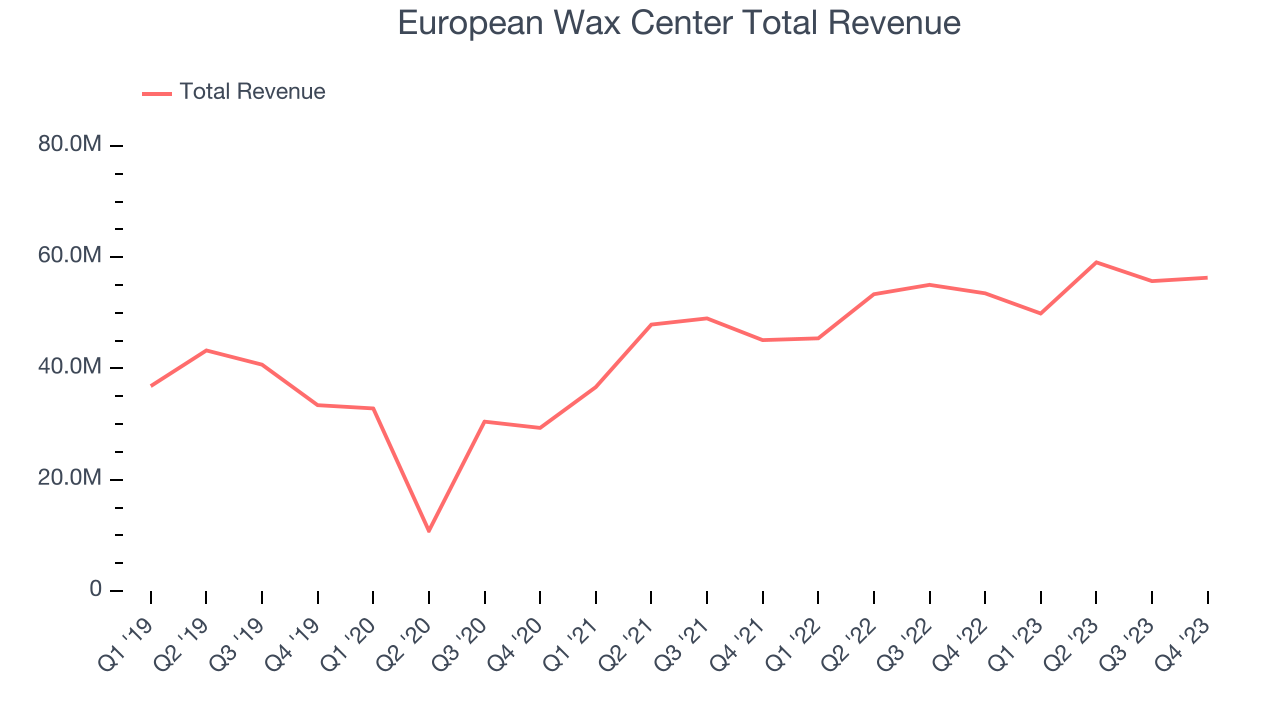

Examining a company's long-term performance can provide clues about its business quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul. European Wax Center's annualized revenue growth rate of 9.4% over the last four years was weak for a consumer discretionary business.  Within consumer discretionary, a long-term historical view may miss a company riding a successful new product or emerging trend. That's why we also follow short-term performance. European Wax Center's annualized revenue growth of 11.2% over the last two years is above its four-year trend, suggesting some bright spots.

Within consumer discretionary, a long-term historical view may miss a company riding a successful new product or emerging trend. That's why we also follow short-term performance. European Wax Center's annualized revenue growth of 11.2% over the last two years is above its four-year trend, suggesting some bright spots.

We can better understand the company's revenue dynamics by analyzing its same-store sales, which show how much revenue its established locations generate. Over the last two years, European Wax Center's same-store sales averaged 7.3% year-on-year growth. Because this number is lower than its revenue growth, we can see the opening of new locations is boosting the company's top-line performance.

This quarter, European Wax Center reported solid year-on-year revenue growth of 5.2%, and its $56.33 million of revenue outperformed Wall Street's estimates by 4.2%. Looking ahead, Wall Street expects sales to grow 6.1% over the next 12 months, an acceleration from this quarter.

Operating Margin

Operating margin is a key measure of profitability. Think of it as net income–the bottom line–excluding the impact of taxes and interest on debt, which are less connected to business fundamentals.

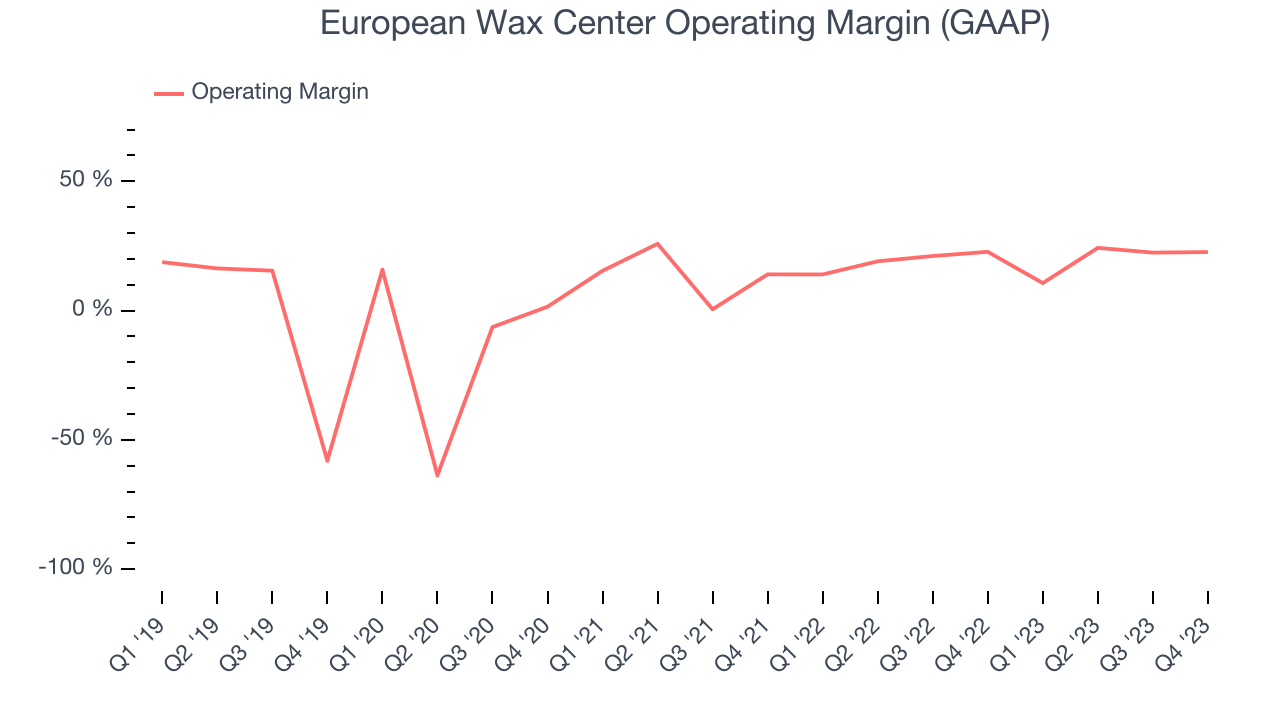

European Wax Center has been a well-managed company over the last eight quarters. It's demonstrated it can be one of the more profitable businesses in the consumer discretionary sector, boasting an average operating margin of 19.9%.

In Q4, European Wax Center generated an operating profit margin of 22.6%, in line with the same quarter last year. This indicates the company's costs have been relatively stable.

Over the next 12 months, Wall Street expects European Wax Center to become more profitable. Analysts are expecting the company’s LTM operating margin of 20.3% to rise to 23.7%.EPS

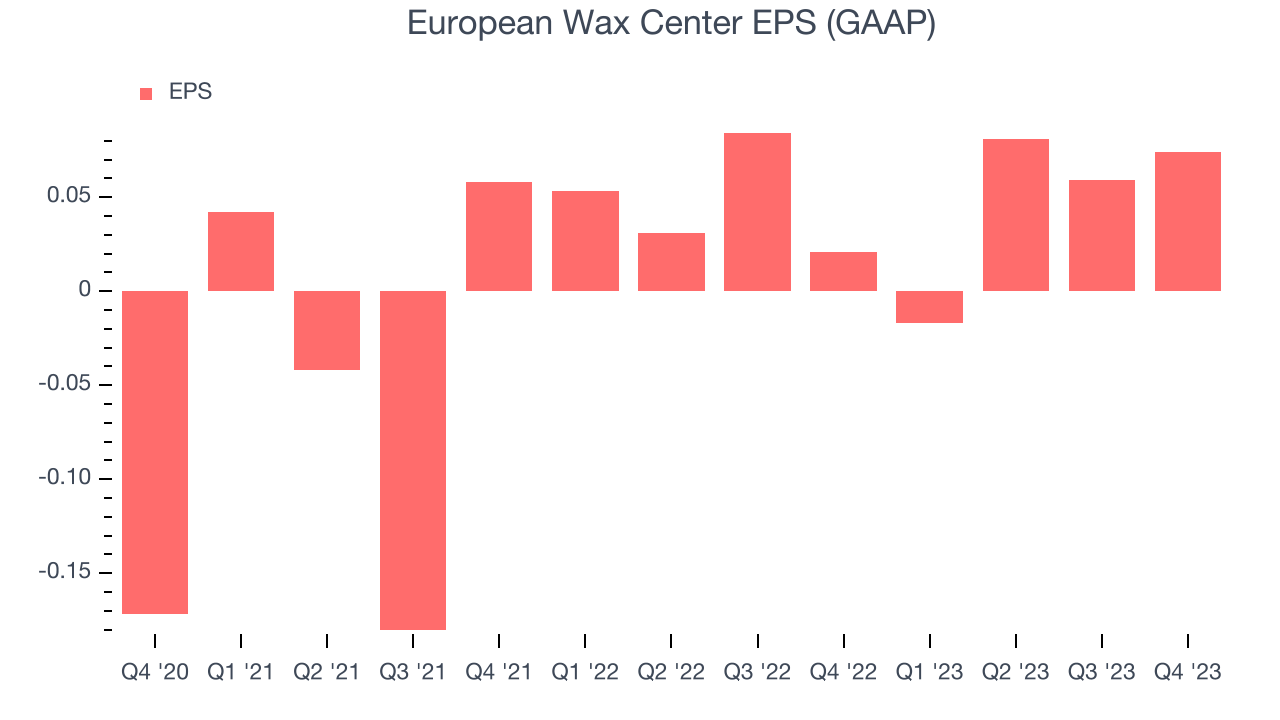

Analyzing revenue trends tells us about a company's historical growth, but earnings per share (EPS) growth points to the profitability and efficiency of that growth–for example, a company could inflate sales through excessive spending on advertising and promotions.

Over the last two years, European Wax Center cut its earnings losses and improved its EPS by 90.2% each year.

In Q4, European Wax Center reported EPS at $0.07, up from $0.02 in the same quarter a year ago. This print beat analysts' estimates by 75.5%. Over the next 12 months, Wall Street expects European Wax Center to grow its earnings. Analysts are projecting its LTM EPS of $0.20 to climb by 85% to $0.36.

Cash Is King

Although earnings are undoubtedly valuable for assessing company performance, we believe cash is king because you can't use accounting profits to pay the bills.

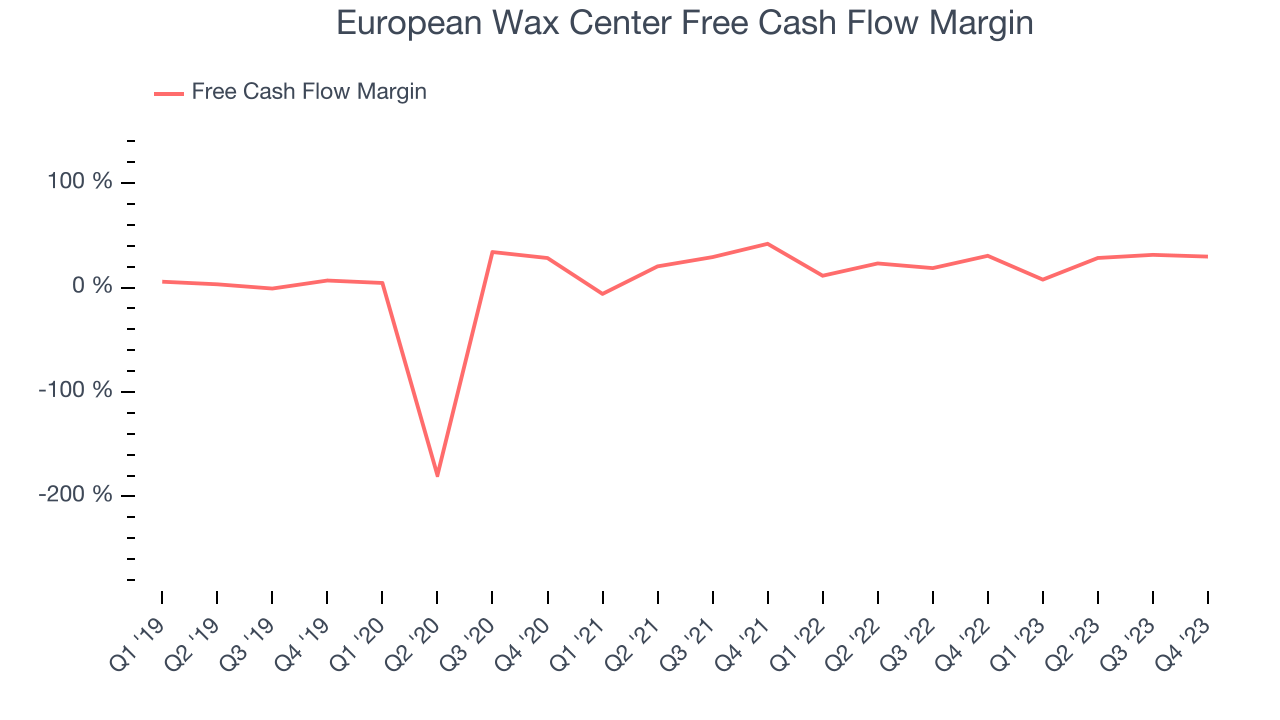

Over the last two years, European Wax Center has shown terrific cash profitability, enabling it to reinvest, return capital to investors, and stay ahead of the competition while maintaining a robust cash balance. The company's free cash flow margin has been among the best in the consumer discretionary sector, averaging 23.1%.

European Wax Center's free cash flow came in at $16.74 million in Q4, equivalent to a 29.7% margin and in line with the same quarter last year.

Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing revenue. But was it capital-efficient? Enter ROIC, a metric showing how much operating profit a company generates relative to how much money the business raised (debt and equity).

European Wax Center's five-year average return on invested capital was 17.2%, higher than most consumer discretionary companies. Just as you’d like your investment dollars to generate returns, European Wax Center's invested capital has produced solid profits.

Key Takeaways from European Wax Center's Q4 Results

We liked how revenue and EPS both outperformed Wall Street's estimates. On the other hand, its full-year revenue and adjusted EBITDA guidance missed. Zooming out, we think this was still a decent, albeit mixed, quarter. The market is shrugging off the guidance, and the stock is up 3.1% after reporting and currently trades at $13.5 per share.

Is Now The Time?

European Wax Center may have had a favorable quarter, but investors should also consider its valuation and business qualities when assessing the investment opportunity.

We think European Wax Center is a solid business. Although its revenue growth has been a little slower over the last four years with analysts expecting growth to slow from here, its projected EPS for the next year implies the company's fundamentals will improve. And while its same-store sales performance has been disappointing, its EPS growth over the last two years has been fantastic.

European Wax Center's price-to-earnings ratio based on the next 12 months is 28.3x. There are definitely things to like about European Wax Center, and looking at the consumer discretionary landscape right now, it seems to be trading at a reasonable price.

Wall Street analysts covering the company had a one-year price target of $18.25 per share right before these results (compared to the current share price of $13.50), implying they saw upside in buying European Wax Center in the short term.

To get the best start with StockStory, check out our most recent stock picks, and then sign up for our earnings alerts by adding companies to your watchlist here. We typically have the quarterly earnings results analyzed within seconds of the data being released, and especially for companies reporting pre-market, this often gives investors the chance to react to the results before the market has fully absorbed the information.