Online travel agency Expedia (NASDAQ:EXPE) reported Q3 FY2023 results topping analysts' expectations, with revenue up 8.57% year on year to $3.93 billion. Turning to EPS, Expedia made a non-GAAP profit of $5.41 per share, improving from its profit of $2.98 per share in the same quarter last year.

Is now the time to buy Expedia? Find out by accessing our full research report, it's free.

Expedia (EXPE) Q3 FY2023 Highlights:

- Revenue: $3.93 billion vs analyst estimates of $3.86 billion (1.87% beat)

- EPS (non-GAAP): $5.41 vs analyst estimates of $5 (8.23% beat)

- Free Cash Flow was -$1.59 billion, down from $923 million in the previous quarter

- Gross Margin (GAAP): 89.5%, up from 87.4% in the same quarter last year

- Booked Room Nights: 89.3 million, up 7.7 million year on year

"Our strong third quarter results with record revenue and profitability came in ahead of our guidance and reflect the resilience of travel demand and continued improvements stemming from the execution of our strategy. Our B2B business continues to demonstrate strong year-over-year revenue growth, while more importantly, our B2C revenue growth accelerated over 400 basis points sequentially,” said Peter Kern, Vice Chairman and CEO, Expedia Group.

Originally founded as a part of Microsoft, Expedia (NASDAQ:EXPE) is one of the world’s leading online travel agencies.

Online Travel

Because of the enormous number of flights, hotels, and accommodations available, travel is a natural fit for marketplaces that aggregate suppliers, simplifying the shopping process for consumers. Online travel platforms today make up over 50% of the industry’s bookings, a percentage that has been rising for 20 years, and will likely continue in the years ahead.

Sales Growth

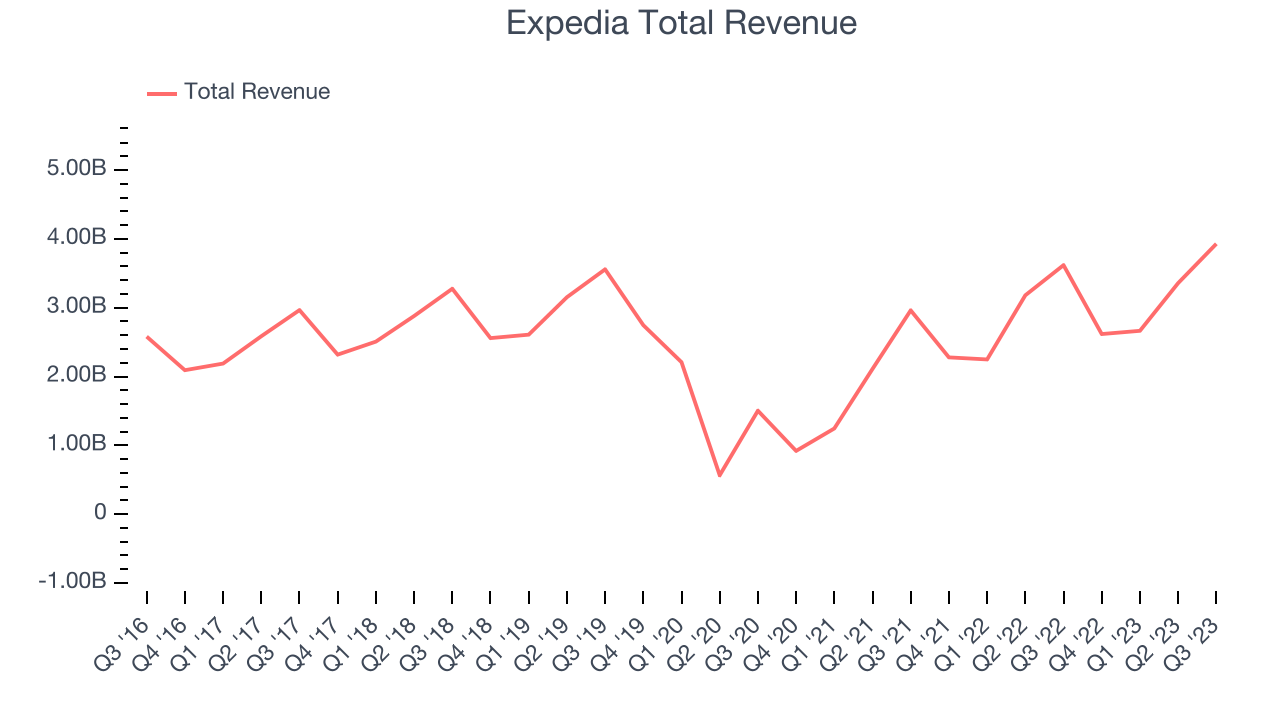

Expedia's revenue growth over the last three years has been exceptional, averaging 50.7% annually. This quarter, Expedia beat analysts' estimates but reported mediocre 8.57% year-on-year revenue growth.

Ahead of the earnings results, analysts covering the company were projecting sales to grow 8.99% over the next 12 months.

The pandemic fundamentally changed several consumer habits. There is a founder-led company that is massively benefiting from this shift. The business has grown astonishingly fast, with 40%+ free cash flow margins. Its fundamentals are undoubtedly best-in-class. Still, the total addressable market is so big that the company has room to grow many times in size. You can find it on our platform for free.

Usage Growth

As an online travel company, Expedia generates revenue growth by increasing both the number of stays (or experiences) booked and the commission charged on those bookings.

Over the last two years, Expedia's nights booked, a key performance metric for the company, grew 21.1% annually to 89.3 million. This is strong growth for a consumer internet company.

In Q3, Expedia added 7.7 million nights booked, translating into 9.44% year-on-year growth.

Key Takeaways from Expedia's Q3 Results

Sporting a market capitalization of $13.4 billion, more than $6.49 billion in cash on hand, and positive free cash flow over the last 12 months, we believe that Expedia is attractively positioned to invest in growth.

It was good to see Expedia narrowly top analysts' revenue expectations this quarter, driven by strong performance in its B2B division. We were also glad it expanded its user base and beat Wall Street's EPS and adjusted EBITDA estimates.

Management's commentary around the business this quarter was positive: its new One Key initiative, which unifies the company's different brands into one loyalty program, is showing traction and it completed the final phase of its Vrbo unit's integration. Zooming out, we think this was a decent quarter, showing that the company is staying on track. Investors are likely happy the company's integration efforts are largely completed, and the stock is up 10.2% after reporting. It currently trades at $104.5 per share.

So should you invest in Expedia right now? When making that decision, it's important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it's free.

One way to find opportunities in the market is to watch for generational shifts in the economy. Almost every company is slowly finding itself becoming a technology company and facing cybersecurity risks and as a result, the demand for cloud-native cybersecurity is skyrocketing. This company is leading a massive technological shift in the industry and with revenue growth of 50% year on year and best-in-class SaaS metrics it should definitely be on your radar.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.

The author has no position in any of the stocks mentioned in this report.