Online travel agency Expedia (NASDAQ: EXPE) reported results in line with analyst expectations in Q1 FY2023 quarter, with revenue up 18.5% year on year to $2.67 billion. Expedia made a GAAP loss of $140 million, down on its loss of $123 million, in the same quarter last year.

Is now the time to buy Expedia? Access our full analysis of the earnings results here, it's free.

Expedia (EXPE) Q1 FY2023 Highlights:

- Revenue: $2.67 billion vs analyst estimates of $2.66 billion (small beat)

- EPS (non-GAAP): -$0.26 vs analyst estimates of $0.03 (-$0.29 miss)

- Free cash flow of $2.92 billion, up from negative free cash flow of $359 million in previous quarter

- Gross Margin (GAAP): 84.5%, up from 83.5% same quarter last year

- Stayed Room Nights: 94.5 million, up 17.5 million year on year

"The first quarter saw strong travel demand driven by increasing international travel, major city travel, and the reopening in Asia. We invested into that demand driving record lodging bookings and continued strength in app usage and loyalty member counts. We also saw strong growth in B2B driven by an expanding partner base and growth from our existing partners. Our performance was enhanced by greater testing velocity and accelerating deployment of AI and ML, including our recent integration of ChatGPT into our iOS experience," said Peter Kern, Vice Chairman and CEO, Expedia Group.

Originally founded as a part of Microsoft, Expedia (NASDAQ: EXPE) is one of the world’s leading online travel agencies.

Because of the enormous number of flights, hotels, and accommodations available, travel is a natural fit for marketplaces that aggregate suppliers, simplifying the shopping process for consumers. Online travel platforms today make up over 50% of the industry’s bookings, a percentage that has been rising for 20 years, and will likely continue in the years ahead.

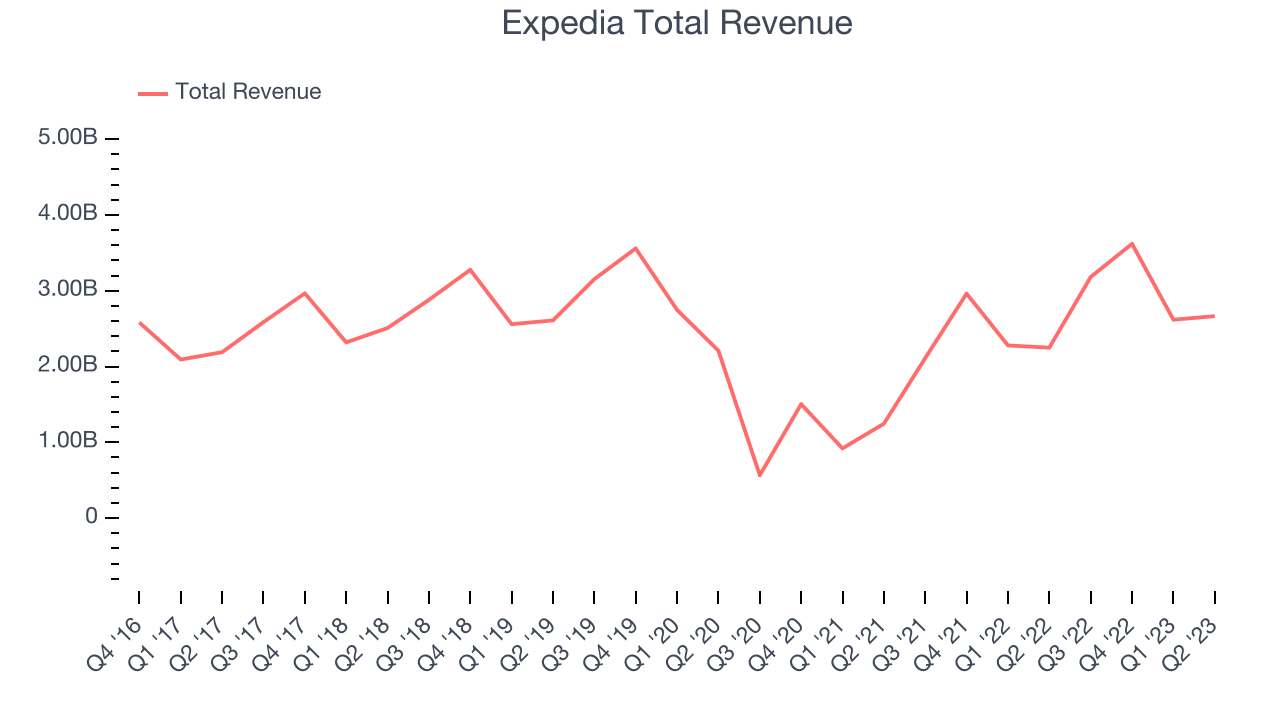

Sales Growth

Expedia's revenue growth over the last three years has been very strong, averaging 37.9% annually. This quarter, Expedia reported a moderate 18.5% year on year revenue growth, in line with analysts' expectations.

Ahead of the earnings results the analysts covering the company were estimating sales to grow 8.65% over the next twelve months.

In volatile times like these we look for robust businesses with strong pricing power. Unknown to most investors, this company is one of the highest-quality software companies in the world, and their software products have been the default standard in critical industries for decades. The result is an impressive business that is up an incredible 18,152% since the IPO. You can find it on our platform for free.

Usage Growth

As an online travel company, Expedia generates revenue growth by a combination of increasing the number of stays (or experiences) booked, as well as the level of commission charged on those bookings.

Over the last two years the number of Expedia's nights booked, a key usage metric for the company, grew 25.9% annually to 94.5 million. This is a fast growth for a consumer internet company.

In Q1 the company added 17.5 million nights booked, translating to a 22.7% growth year on year.

Key Takeaways from Expedia's Q1 Results

Sporting a market capitalization of $13.5 billion, more than $5.95 billion in cash and with positive free cash flow over the last twelve months, we're confident that Expedia has the resources it needs to pursue a high growth business strategy.

We enjoyed seeing Expedia’s strong user growth this quarter. That feature of these results really stood out as a positive. Gross bookings also beat although operating profit missed. Overall, this quarter's results seemed pretty positive and shareholders can feel optimistic. The company is up 4.62% on the results and currently trades at $93.28 per share.

Should you invest in Expedia right now? It is important that you take into account its valuation and business qualities, as well as what happened in the latest quarter. We look at that in our actionable report which you can read here, it's free.

One way to find opportunities in the market is to watch for generational shifts in the economy. Almost every company is slowly finding itself becoming a technology company and facing cybersecurity risks and as a result, the demand for cloud-native cybersecurity is skyrocketing. This company is leading a massive technological shift in the industry and with revenue growth of 70% year on year and best-in-class SaaS metrics it should definitely be on your radar.

The author has no position in any of the stocks mentioned.