A Look Back at Consumer Internet Stocks' Q4 Earnings: Expedia (NASDAQ:EXPE) Vs The Rest Of The Pack

Jabin Bastian 2022/04/12 7:18 am EDT

Earnings results often give us a good indication of what direction the company will take in the months ahead. With Q4 now behind us, let’s have a look at Expedia (NASDAQ:EXPE) and its peers.

The ways people shop, transport, communicate, learn and play are undergoing a tremendous, technology-enabled change. Consumer internet companies are playing a key role in lives being transformed, simplified and made more accessible.

The 17 consumer internet stocks we track reported a decent Q4; on average, revenues beat analyst consensus estimates by 2.91%, while on average next quarter revenue guidance was 0.08% under consensus. Tech stocks have had a rocky start in 2022, but consumer internet stocks held their ground better than others, with share price down 7.44% since earnings, on average.

Expedia (NASDAQ:EXPE)

Originally founded as a part of Microsoft, Expedia (NASDAQ: EXPE) is one of the world’s leading online travel agencies.

Expedia reported revenues of $2.27 billion, up 147% year on year, slightly missing analyst expectations by 0.82%. Despite that, it was still decent quarter for the company, with a strong revenue growth and growing number of users.

“While we experienced yet another significant travel disruption from Covid this quarter, we were pleased to see that the impact was less severe and of shorter duration than previous waves. Notably, the travel industry and traveling public prove more resilient with each passing wave, and we continue to expect a solid overall recovery in 2022, barring a change in the trajectory of the virus," said Peter Kern, Vice Chairman and CEO, Expedia Group.

The company reported 62.9 million nights booked, up 74.2% year on year. The stock is down 9.93% since the results and currently trades at $177.99.

We think Expedia is a good business, but is it a buy today? Read our full report here, it's free.

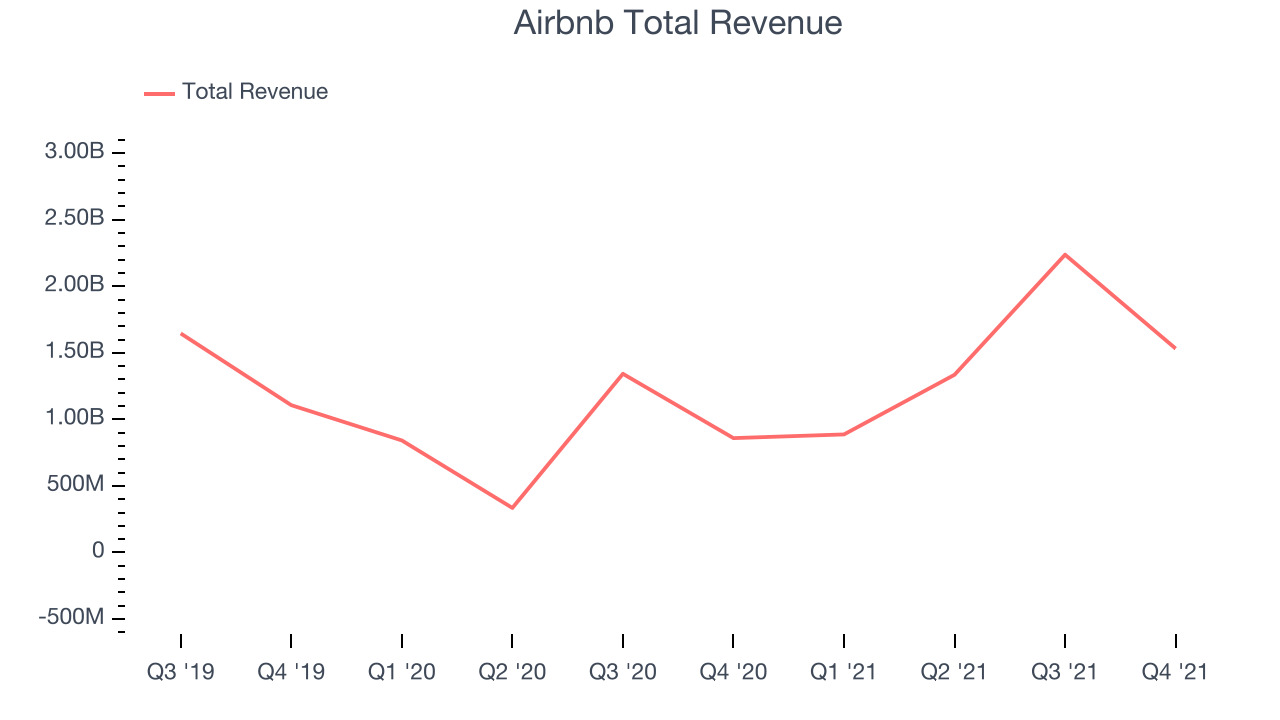

Best Q4: Airbnb (NASDAQ:ABNB)

Founded by Joe Gebbia and Brian Chesky by renting out a blowup bed on the floor of their San Francisco apartment, Airbnb (NASDAQ: ABNB) is the world’s largest online marketplace for lodging, primarily homestays.

Airbnb reported revenues of $1.53 billion, up 78.3% year on year, beating analyst expectations by 5.02%. It was a stunning quarter for the company, with a very optimistic guidance for the next quarter and an exceptional revenue growth.

The company reported 73.4 million nights booked, up 58.5% year on year. The stock is down 11.5% since the results and currently trades at $159.35.

Is now the time to buy Airbnb? Access our full analysis of the earnings results here, it's free.

Slowest Q4: Wayfair (NYSE:W)

Launched in 2002 by founder Niraj Shah, Wayfair (NYSE: W) is a leading online retailer for mass market home goods in the US, UK, Canada, and Germany.

Wayfair reported revenues of $3.25 billion, down 11.5% year on year, missing analyst expectations by 0.75%. It was a weak quarter for the company, with declining number of users and a slow revenue growth.

Wayfair had the slowest revenue growth in the group. The company reported 27.3 million active buyers, down 12.5% year on year. The stock is down 6.28% since the results and currently trades at $113.76.

Read our full analysis of Wayfair's results here.

Etsy (NASDAQ:ETSY)

Founded by a struggling amateur furniture maker Robert Kalin and his two friends, Etsy (NASDAQ: ETSY) is one of the world’s largest online marketplaces, focusing on handmade or vintage items.

Etsy reported revenues of $717.1 million, up 16.1% year on year, beating analyst expectations by 4.62%. It was a weaker quarter for the company, with an underwhelming revenue guidance for the next quarter and a decline in gross margin.

The company reported 90.1 million active buyers, up 10% year on year. The stock is down 9.25% since the results and currently trades at $116.50.

Read our full, actionable report on Etsy here, it's free.

Twitter (NYSE:TWTR)

Born out of a failed podcasting startup, Twitter (NYSE: TWTR) is the town square of the internet, one part social network, one part media distribution platform.

Twitter reported revenues of $1.57 billion, up 21.7% year on year, missing analyst expectations by 0.22%. It was an ok quarter for the company, with underwhelming revenue guidance for the next quarter and top-line results in-line with analysts' estimates.

The company reported 217 million daily active users, up 13% year on year. The stock is up 23.7% since the results and currently trades at $46.80.

Read our full, actionable report on Twitter here, it's free.

The author has no position in any of the stocks mentioned