Online travel agency Expedia (NASDAQ:EXPE) reported Q1 CY2024 results topping analysts' expectations, with revenue up 8.4% year on year to $2.89 billion. It made a non-GAAP profit of $0.21 per share, improving from its loss of $0.20 per share in the same quarter last year.

Expedia (EXPE) Q1 CY2024 Highlights:

- Revenue: $2.89 billion vs analyst estimates of $2.81 billion (2.8% beat)

- EPS (non-GAAP): $0.21 vs analyst estimates of -$0.17 ($0.38 beat)

- Gross Margin (GAAP): 87.6%, up from 84.5% in the same quarter last year

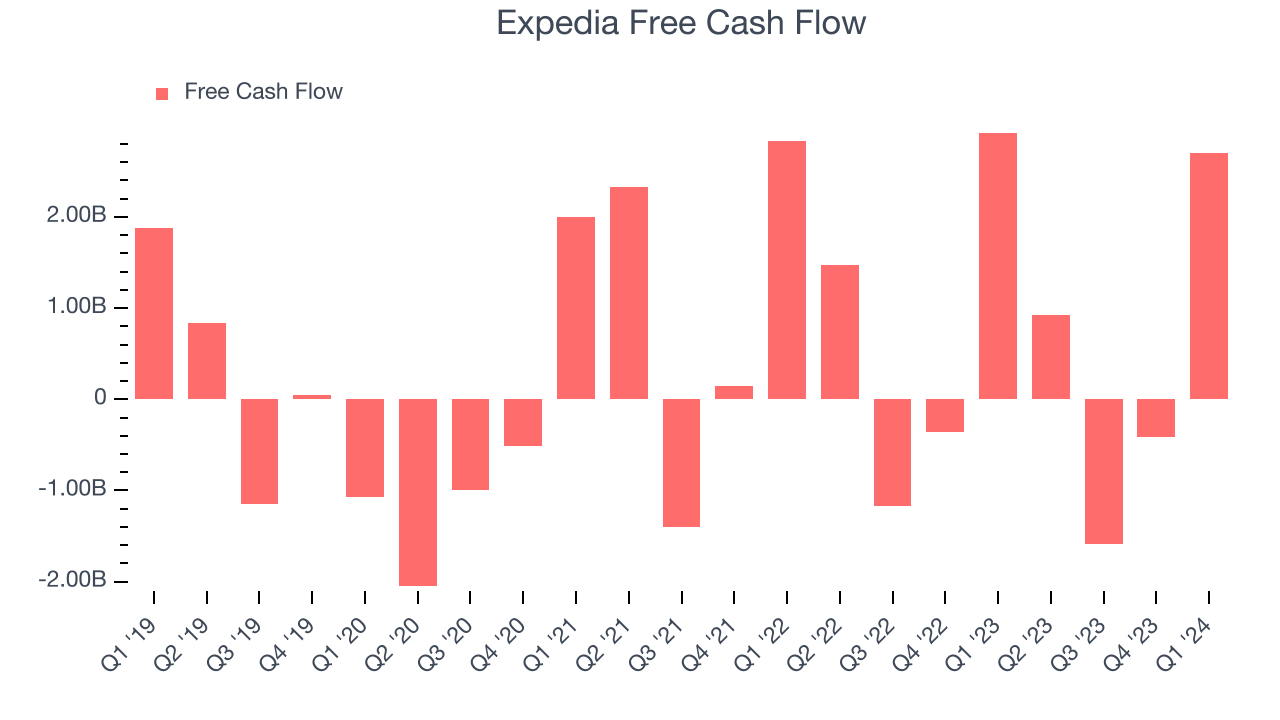

- Free Cash Flow of $2.70 billion is up from -$415 million in the previous quarter

- Room Nights Booked: 101.2 million, up 6.7 million year on year

- Market Capitalization: $17.64 billion

Originally founded as a part of Microsoft, Expedia (NASDAQ:EXPE) is one of the world’s leading online travel agencies.

Expedia owns a wide portfolio of online travel brands, and owns stakes in many others. Its core Expedia site is a full service online travel agency (OTA) featuring airfare, lodging, car rentals, cruises, and insurance. Hotels.com is focused exclusively on hotels globally, Vrbo (previously HomeAway) is Expedia’s alternative accommodations property. Other properties include Orbitz, CheapTickets, Travelocity and business travel unit Egencia. Expedia also owns a majority stake in trivago, a hotel metasearch company, that generates revenues through advertising.

For consumers, Expedia simplifies planning travel, by aggregating supply of hotels, flights, and experiences and using its scale and rewards programs to offer the best prices, while for suppliers, Expedia delivers one of the largest audiences of travel shoppers online.

Historically, Expedia has held its largest market share in North America, specifically in Hotels, while it has long sought to take market share from market leader Booking.com and Priceline in Europe. It acquired HomeAway in recent years and has begun building up an alternative accommodations business to compete with AirBnB.

Online Travel

Because of the enormous number of flights, hotels, and accommodations available, travel is a natural fit for marketplaces that aggregate suppliers, simplifying the shopping process for consumers. Online travel platforms today make up over 50% of the industry’s bookings, a percentage that has been rising for 20 years, and will likely continue in the years ahead.

Expedia (NASDAQ:EXPE) competes with a range of online travel companies such as Booking Holdings (NASDAQ:BKNG), Airbnb (NASDAQ:ABNB), TripAdvisor (NASDAQ:TRIP), Trivago (NASDAQ:TRIV) and Alphabet (NASDAQ:GOOG.L).

Sales Growth

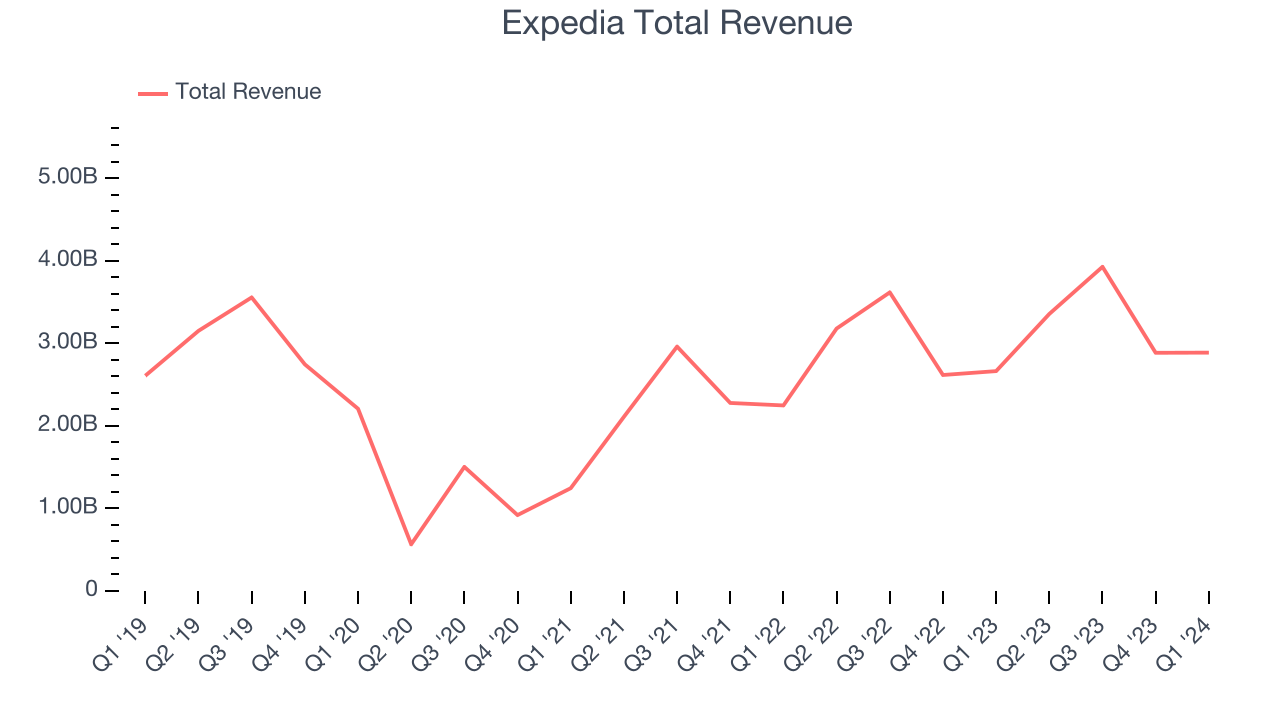

Expedia's revenue growth over the last three years has been incredible, averaging 61.4% annually. This quarter, Expedia beat analysts' estimates but reported mediocre 8.4% year-on-year revenue growth.

Ahead of the earnings results, analysts were projecting sales to grow 9.1% over the next 12 months.

Usage Growth

As an online travel company, Expedia generates revenue growth by increasing both the number of stays (or experiences) booked and the commission charged on those bookings.

Over the last two years, Expedia's nights booked, a key performance metric for the company, grew 15.2% annually to 101.2 million. This is solid growth for a consumer internet company.

In Q1, Expedia added 6.7 million nights booked, translating into 7.1% year-on-year growth.

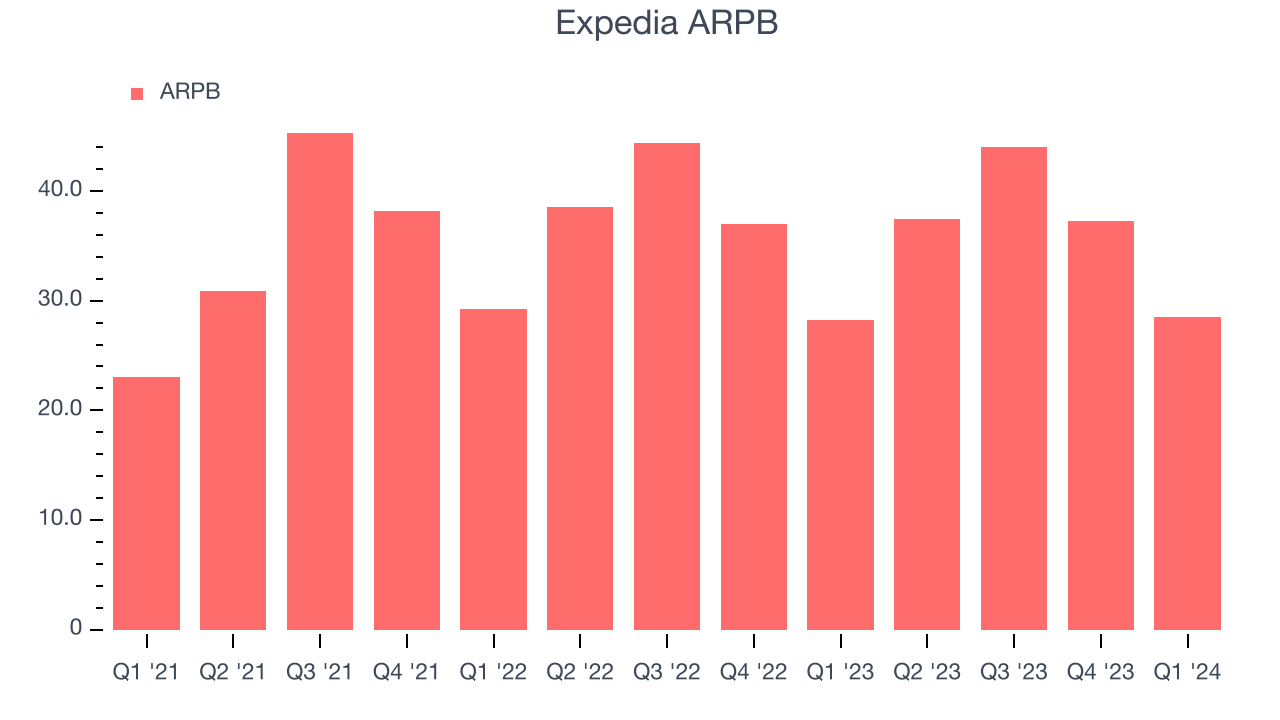

Revenue Per Booking

Average revenue per booking (ARPB) is a critical metric to track for consumer internet businesses like Expedia because it not only measures how much users book on its platform but also the commission that Expedia can charge.

Expedia's ARPB growth has been subpar over the last two years, averaging 1.8%. The company's ability to increase prices while maintaining its nights booked, however, shows the value of its platform. This quarter, ARPB grew 1.2% year on year to $28.55 per booking.

Pricing Power

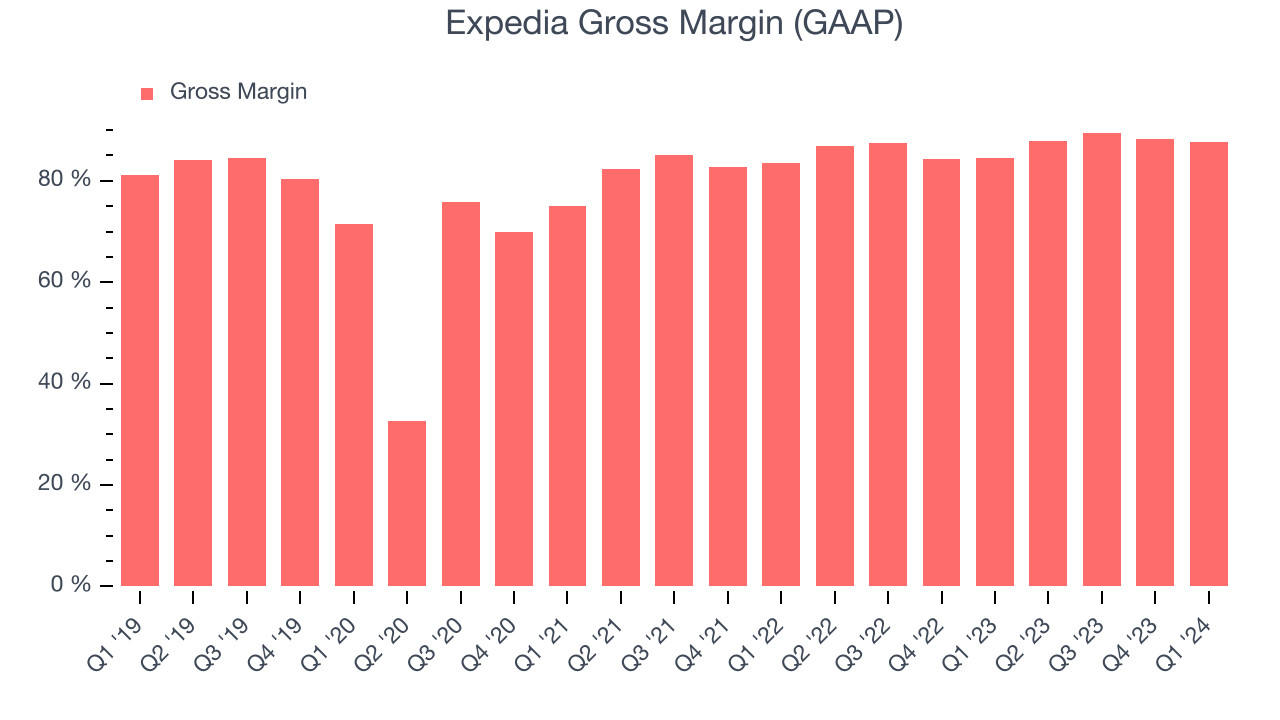

A company's gross profit margin has a major impact on its ability to exert pricing power, develop new products, and invest in marketing. These factors may ultimately determine the winner in a competitive market, making it a critical metric to track for the long-term investor.

Expedia's gross profit margin, which tells us how much money the company gets to keep after covering the base cost of its products and services, came in at 87.6% this quarter, up 3.1 percentage points year on year.

For online travel businesses like Expedia, these aforementioned costs typically include customer support, payment processing, fulfillment fees paid to the airlines, hotels, or car rental companies, and data center costs to keep the app or website online. After paying for these expenses, Expedia had $0.88 for every $1 in revenue to invest in marketing, talent, and the development of new products and services.

Expedia's gross margins have been trending up over the last 12 months, averaging 88.4%. Its margins are some of the highest in the consumer internet sector, enabling it to fund large investments in product and marketing during periods of rapid growth to stay one step ahead of the competition.

User Acquisition Efficiency

Consumer internet businesses like Expedia grow from a combination of product virality, paid advertisement, and incentives (unlike enterprise software products, which are often sold by dedicated sales teams).

It's expensive for Expedia to acquire new users as the company has spent 59.8% of its gross profit on sales and marketing expenses over the last year. This relative inefficiency indicates that Expedia's product offering can be easily replicated and that it must continue investing to maintain its growth trajectory.

Profitability & Free Cash Flow

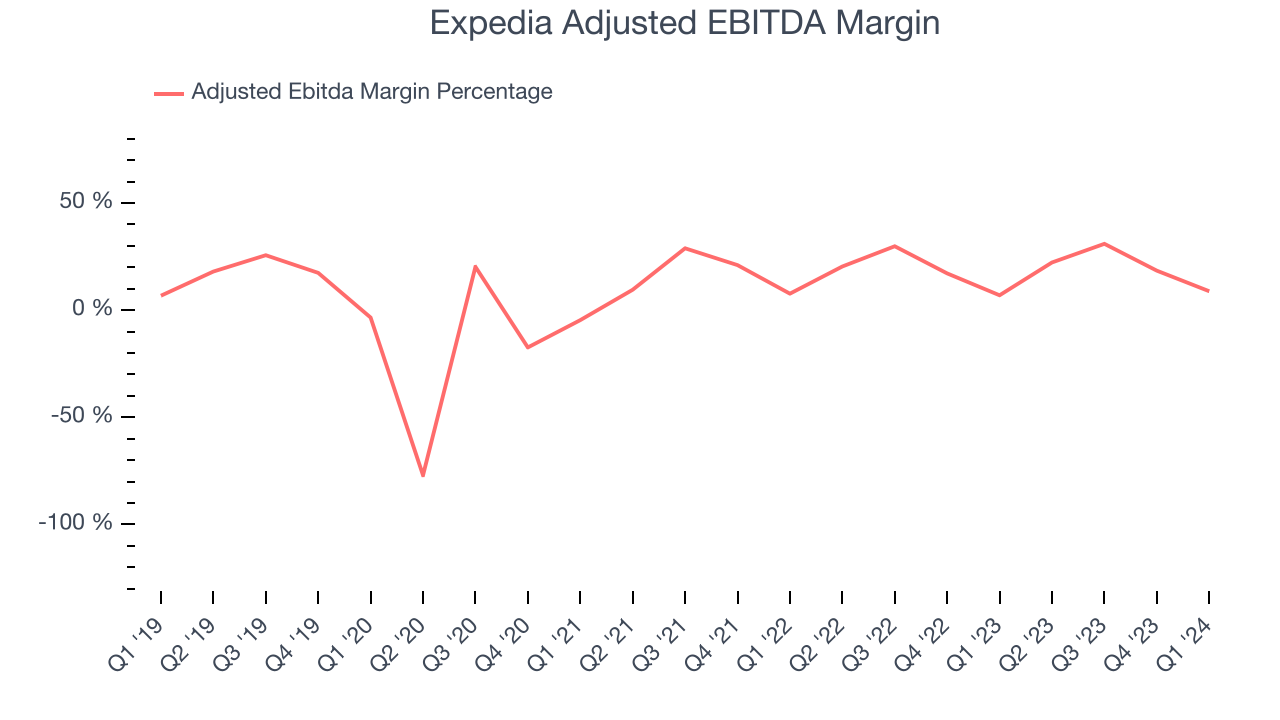

Investors frequently analyze operating income to understand a business's core profitability. Similar to operating income, adjusted EBITDA is the most common profitability metric for consumer internet companies because it removes various one-time or non-cash expenses, offering a more normalized view of a company's profit potential.

Expedia reported EBITDA of $255 million this quarter, resulting in a 8.8% margin. Furthermore, Expedia has shown strong profitability over the last four quarters, with average EBITDA margins of 21.1%.

If you've followed StockStory for a while, you know that we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can't use accounting profits to pay the bills. Expedia's free cash flow came in at $2.70 billion in Q1, down 7.6% year on year.

Expedia has generated $1.62 billion in free cash flow over the last 12 months, a solid 12.4% of revenue. This strong FCF margin stems from its asset-lite business model, giving it optionality and plenty of cash to reinvest in its business.

Key Takeaways from Expedia's Q1 Results

It was great to see Expedia top analysts' revenue and EPS expectations this quarter. Despite the beat, its growth regrettably slowed and its gross bookings fell short of management's expectations, indicating weaker demand going forward. A reason for the lower bookings was Vrbo, whose recent re-platforming is progressing slower than anticipated. Zooming out, we think this was still a decent but mixed quarter due to the lower bookings and demand trends. The market was likely expecting more, and the stock is down 8.5% after reporting, trading at $124.5 per share.

Is Now The Time?

When considering an investment in Expedia, investors should take into account its valuation and business qualities as well as what's happened in the latest quarter.

There are several reasons why we think Expedia is a great business. For starters, its revenue growth has been exceptional over the last three years, and its growth over the next 12 months is expected to exceed that. And while its sales and marketing efficiency is subpar, the good news is its impressive gross margins are a wonderful starting point for the overall profitability of the business. On top of that, its strong free cash flow generation allows it to invest in growth initiatives while maintaining an ample cash cushion.

At the moment, Expedia trades at 6.0x next 12 months EV-to-EBITDA. Looking at the consumer internet landscape today, Expedia's qualities stand out, and we like the stock at this price.

Wall Street analysts covering the company had a one-year price target of $162.42 per share right before these results (compared to the current share price of $124.50), implying they saw upside in buying Expedia in the short term.

To get the best start with StockStory check out our most recent Stock picks, and then sign up to our earnings alerts by adding companies to your watchlist here. We typically have the quarterly earnings results analyzed within seconds of the data being released, and especially for the companies reporting pre-market, this often gives investors the chance to react to the results before the market has fully absorbed the information.