Optical retailer National Vision (NYSE:EYE) beat analysts' expectations in Q4 FY2023, with revenue up 8% year on year to $506.4 million. The company expects the full year's revenue to be around $1.99 billion, in line with analysts' estimates. It made a non-GAAP loss of $0.02 per share, improving from its loss of $0.08 per share in the same quarter last year.

National Vision (EYE) Q4 FY2023 Highlights:

- Revenue: $506.4 million vs analyst estimates of $499.7 million (1.4% beat)

- EPS (non-GAAP): -$0.02 vs analyst estimates of -$0.08 ($0.06 beat)

- Management's revenue guidance for the upcoming financial year 2024 is $1.99 billion at the midpoint, in line with analyst expectations and implying 6.7% decline (vs 6.1% growth in FY2023)

- Free Cash Flow was -$13.05 million compared to -$29.57 million in the same quarter last year

- Gross Margin (GAAP): 51.2%, down from 52.6% in the same quarter last year

- Same-Store Sales were up 6% year on year

- Store Locations: 1,413 at quarter end, increasing by 59 over the last 12 months

- Market Capitalization: $1.56 billion

Operating under multiple brands, National Vision (NYSE:EYE) sells optical products such as eyeglasses and provides optical services such as eye exams.

These brands are America's Best Contacts & Eyeglasses, Eyeglass World, and Vista Optical. There are minor differences between these brands but in general, all three sell eyeglasses, contact lenses, and sunglasses as well as offering eye exams. All three brands also focus on offering affordable options for a product category that can be costly, especially for customers without vision insurance.

National Vision’s core customer base includes value-conscious consumers who want solid-quality vision products and services without breaking the bank. These customers tend to care less about luxury brands and the latest trends, instead prioritizing affordability and convenience.

The average National Vision store is around 3,000 square feet and is typically located in strip malls and shopping centers. Many are located within Walmart supercenters or large supermarket chains. National Vision benefits from the foot traffic drawn by Walmart or Fred Meyer, and those large retailers receive some economic benefits from these arrangements and can offer their own customers a true one-stop shop with services like vision and photo as well as products like gas and petrol.

Specialty Retail

Some retailers try to sell everything under the sun, while others—appropriately called Specialty Retailers—focus on selling a narrow category and aiming to be exceptional at it. Whether it’s eyeglasses, sporting goods, or beauty and cosmetics, these stores win with depth of product in their category as well as in-store expertise and guidance for shoppers who need it. E-commerce competition exists and waning retail foot traffic impacts these retailers, but the magnitude of the headwinds depends on what they sell and what extra value they provide in their stores.

Competitors offering vision products and services include EssilorLuxottica (ENXTPA:EL) and Warby Parker (NYSE:WRBY). Private companies include Zenni Optical and MyEyeDr.Sales Growth

National Vision is a small retailer, which sometimes brings disadvantages compared to larger competitors that benefit from economies of scale.

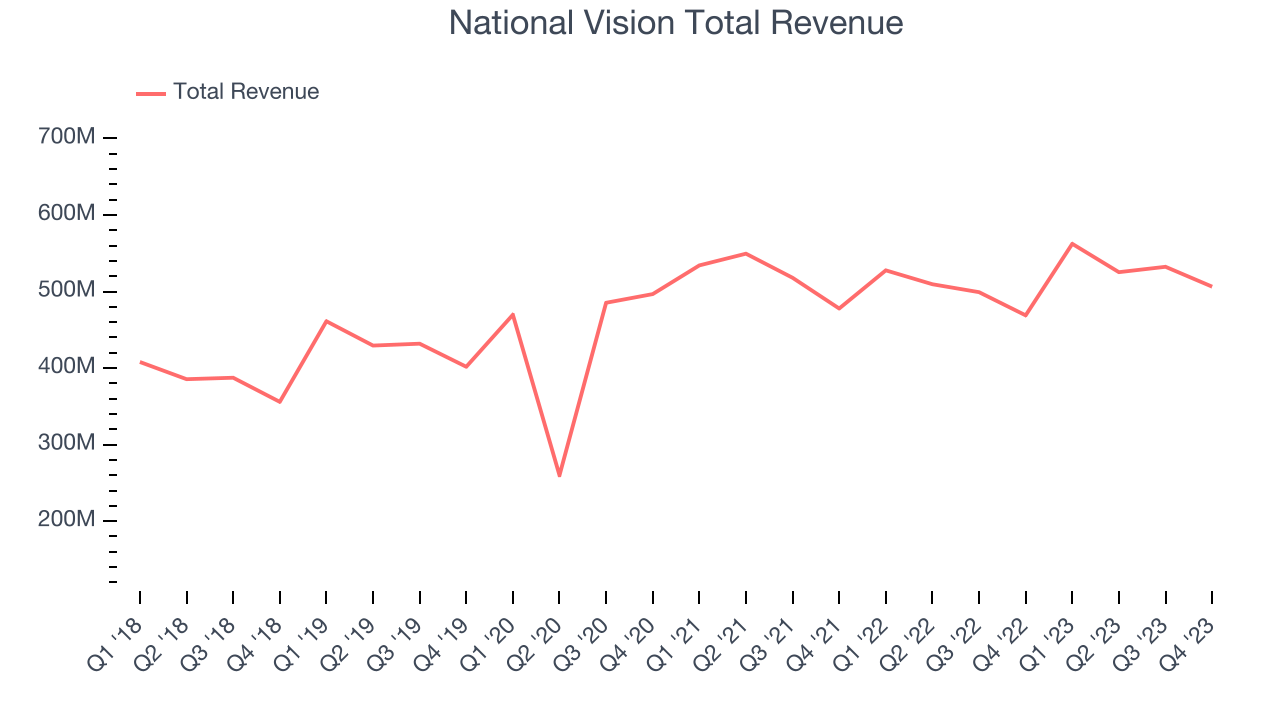

As you can see below, the company's annualized revenue growth rate of 5.4% over the last four years (we compare to 2019 to normalize for COVID-19 impacts) was weak, but to its credit, it opened new stores and expanded its reach.

This quarter, National Vision reported solid year-on-year revenue growth of 8%, and its $506.4 million in revenue outperformed Wall Street's estimates by 1.4%. Looking ahead, Wall Street expects revenue to decline 6.3% over the next 12 months, a deceleration from this quarter.

Number of Stores

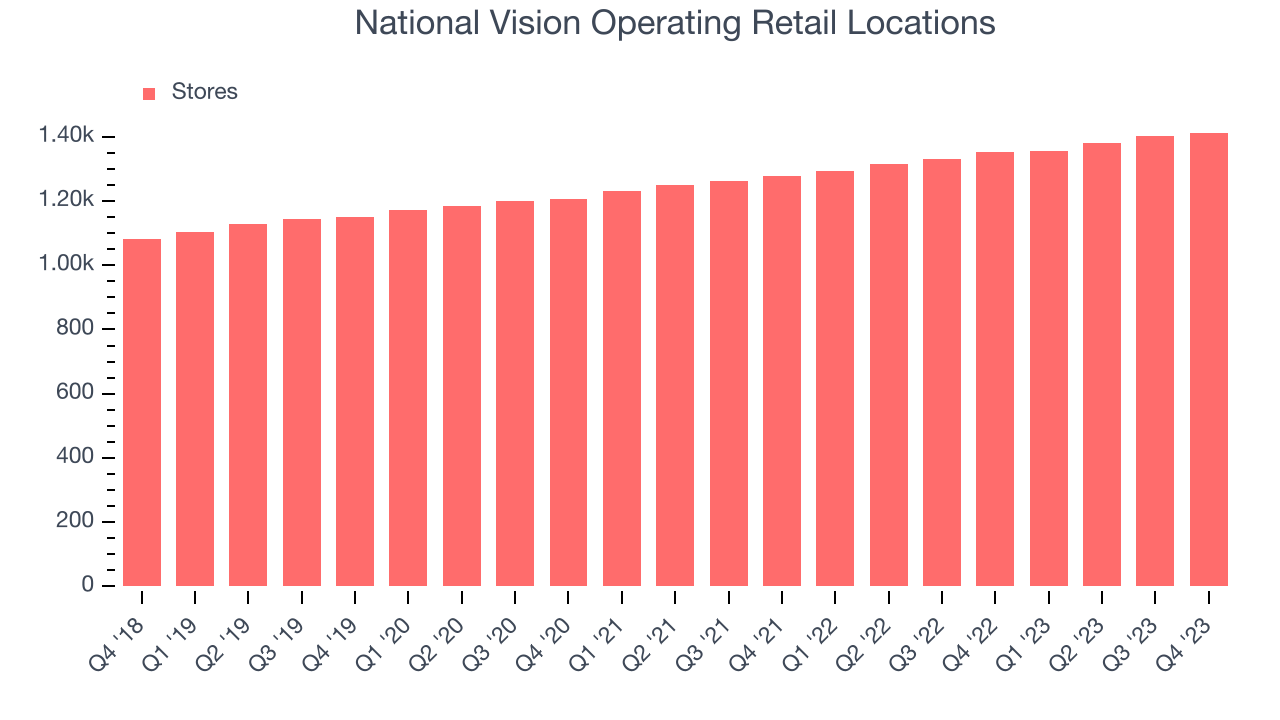

A retailer's store count often determines on how much revenue it can generate.

When a retailer like National Vision is opening new stores, it usually means it's investing for growth because demand is greater than supply. National Vision's store count increased by 59 locations, or 4.4%, over the last 12 months to 1,413 total retail locations in the most recently reported quarter.

Taking a step back, the company has opened new stores quickly over the last eight quarters, averaging 5.2% annual growth in new locations. This store growth outpaces the broader consumer retail sector. With an expanding store base and demand, revenue growth can come from multiple vectors: sales from new stores, sales from e-commerce, or increased foot traffic and higher sales per customer at existing stores.

Same-Store Sales

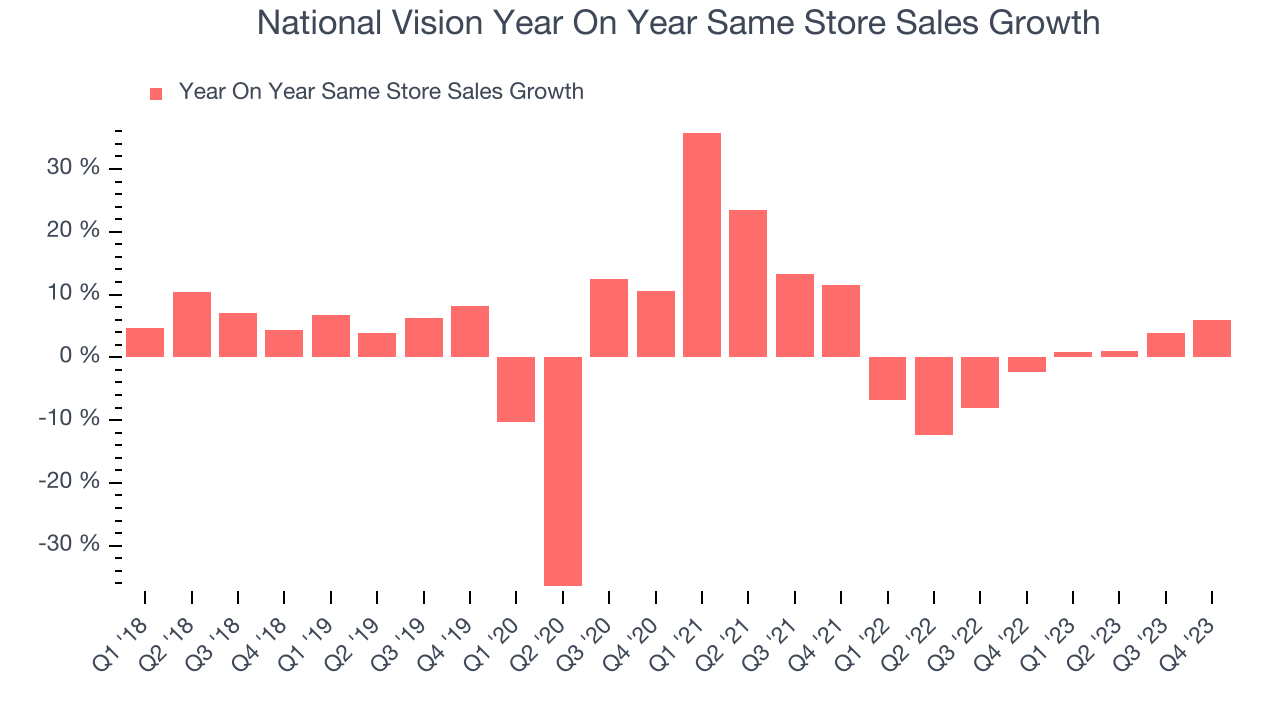

Same-store sales growth is an important metric that tracks demand for a retailer's established brick-and-mortar stores and e-commerce platform.

National Vision's demand has been shrinking over the last eight quarters, and on average, its same-store sales have declined by 2.2% year on year. This performance is quite concerning and the company should reconsider its strategy before investing its precious capital into new store buildouts.

In the latest quarter, National Vision's same-store sales rose 6% year on year. This growth was a well-appreciated turnaround from the 2.4% year-on-year decline it posted 12 months ago, showing the business is regaining momentum.

Gross Margin & Pricing Power

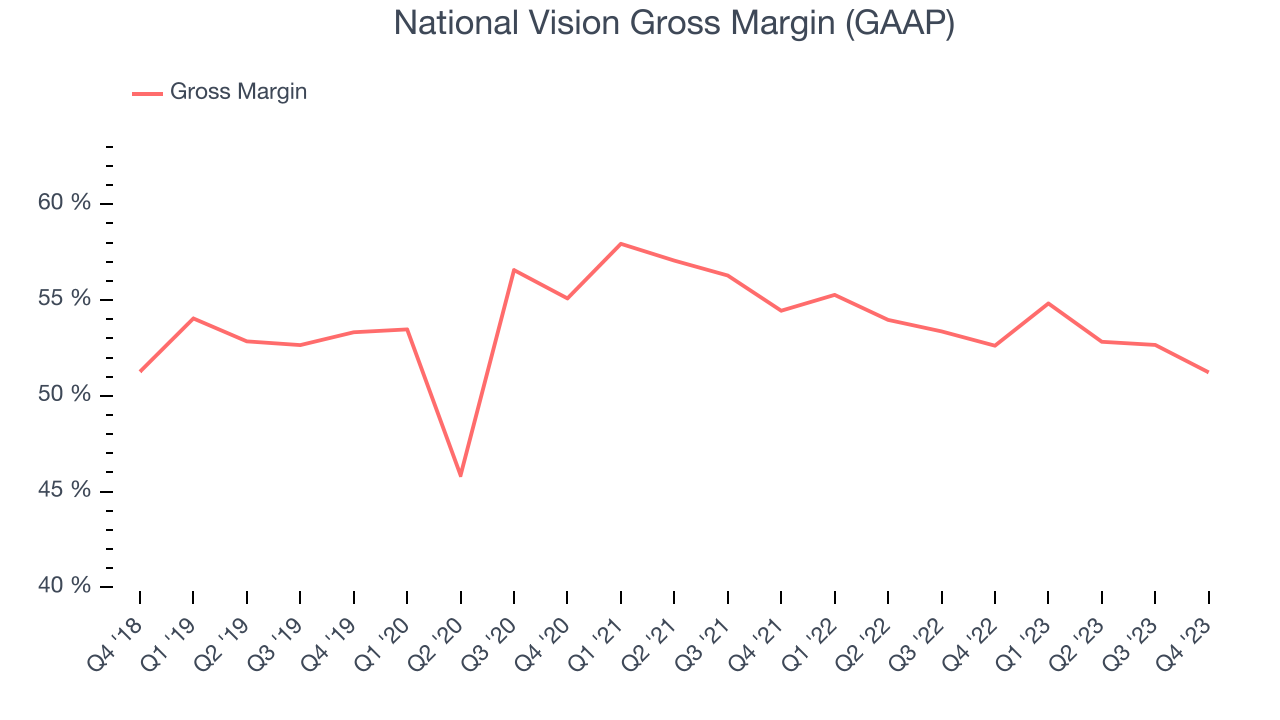

National Vision has best-in-class unit economics for a retailer, enabling it to invest in areas such as marketing and talent to stay one step ahead of the competition. As you can see below, it's averaged an exceptional 53.4% gross margin over the last two years. This means the company makes $0.53 for every $1 in revenue before accounting for its operating expenses.

National Vision produced a 51.2% gross profit margin in Q4, marking a 1.4 percentage point decrease from 52.6% in the same quarter last year. One quarter of margin contraction shouldn't worry investors as a retailer's gross margin can often change due to factors such as product discounting and dynamic input costs (think distribution and freight expenses to move goods).

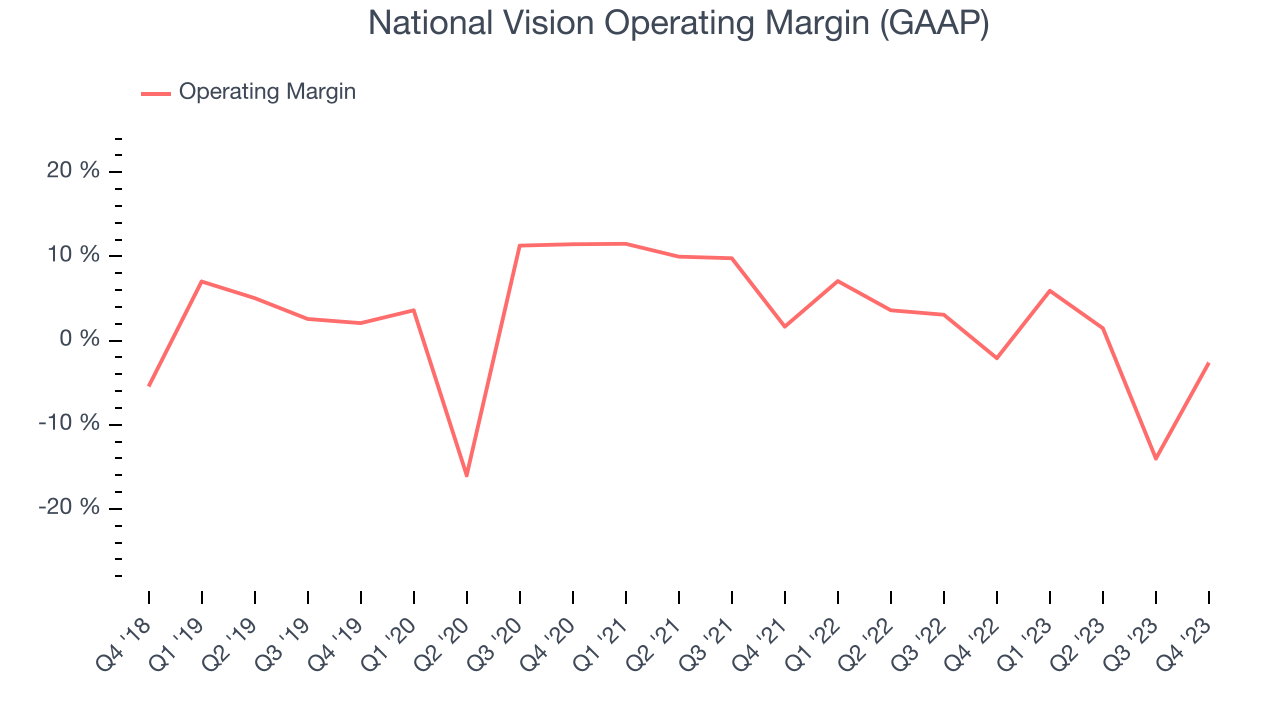

Operating Margin

Operating margin is a key profitability metric for retailers because it accounts for all expenses keeping the lights on, including wages, rent, advertising, and other administrative costs.

In Q4, National Vision generated an operating profit margin of negative 2.6%, in line with the same quarter last year. This indicates the company's costs have been relatively stable.

Zooming out, National Vision over the last eight quarters but held back by its large expense base. Its average operating margin of 0.3% has been among the worst in consumer retail. On top of that, National Vision's margin has declined, on average, by 5.3 percentage points year on year. This shows the company is heading in the wrong direction, and investors were likely hoping for better results.

Zooming out, National Vision over the last eight quarters but held back by its large expense base. Its average operating margin of 0.3% has been among the worst in consumer retail. On top of that, National Vision's margin has declined, on average, by 5.3 percentage points year on year. This shows the company is heading in the wrong direction, and investors were likely hoping for better results.EPS

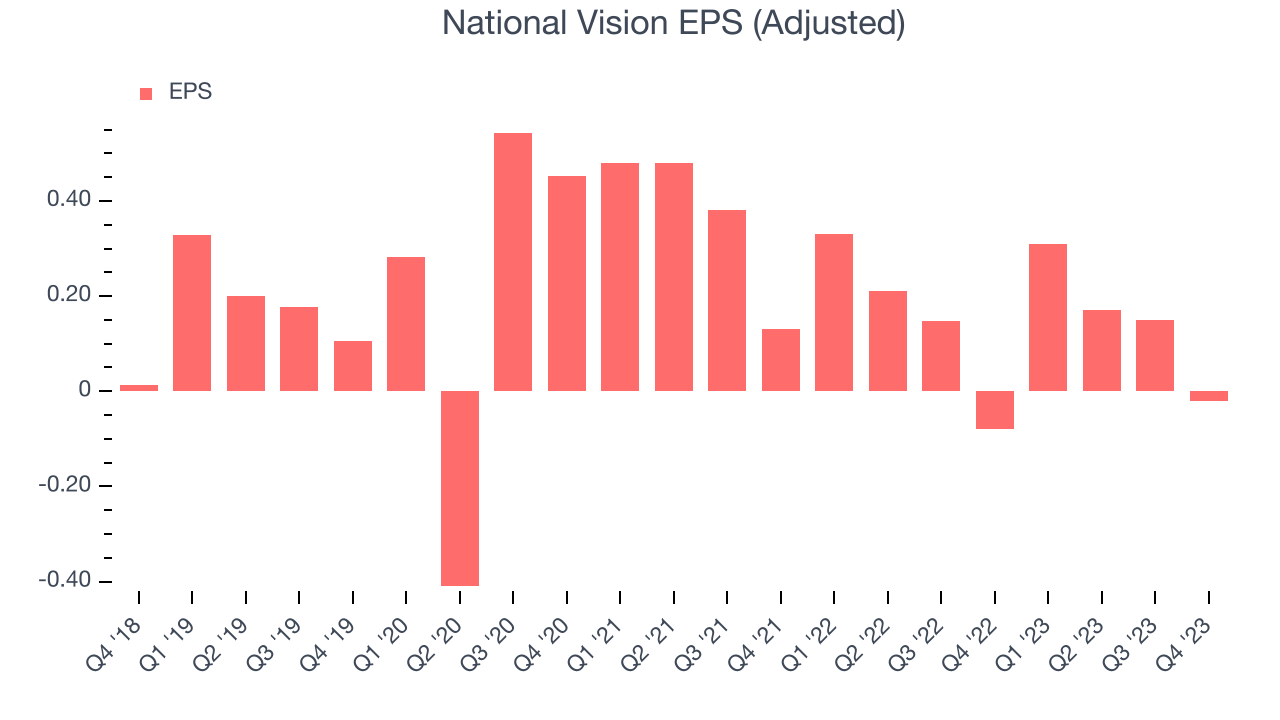

Earnings growth is a critical metric to track, but for long-term shareholders, earnings per share (EPS) is more telling because it accounts for dilution and share repurchases.

In Q4, National Vision reported EPS at negative $0.02, up from negative $0.08 in the same quarter a year ago. This print beat Wall Street's estimates by 75.9%.

Between FY2019 and FY2023, National Vision's adjusted diluted EPS dropped 24.8%, translating into 6.9% annualized declines.

Wall Street expects National Vision to continue performing poorly over the next 12 months, with analysts projecting an average 7.2% year-on-year decline in EPS.

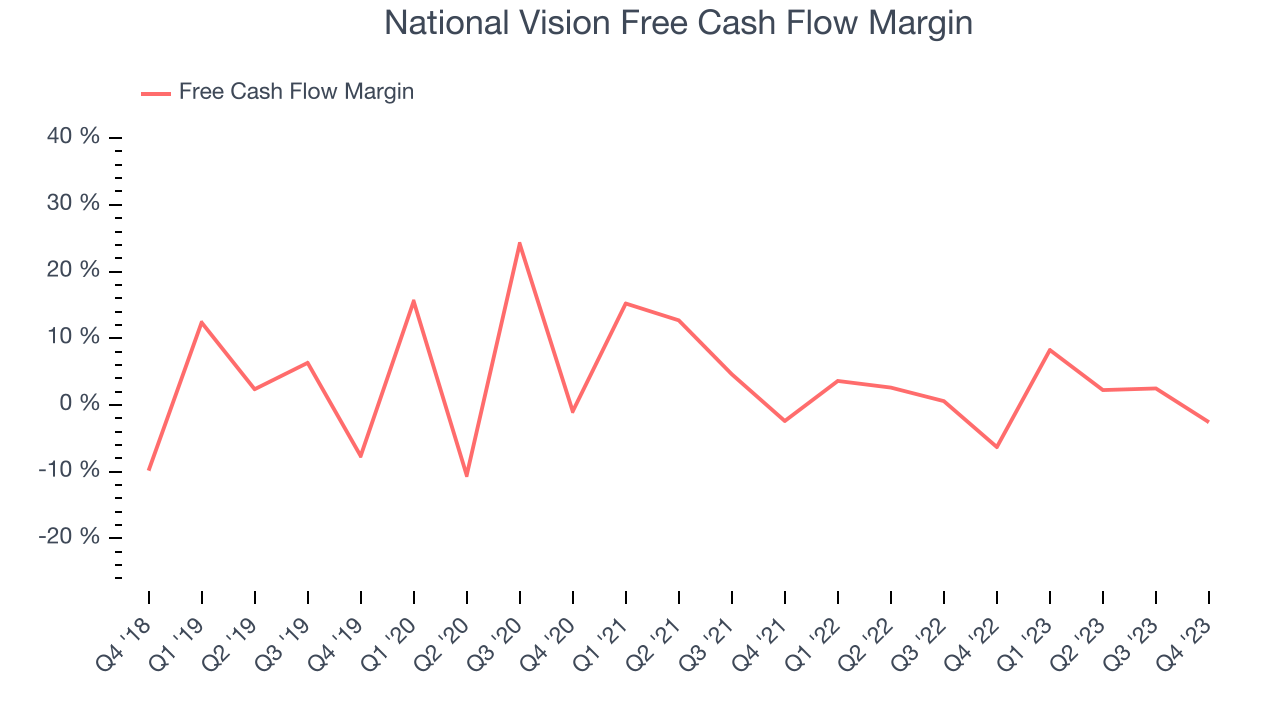

Cash Is King

If you've followed StockStory for a while, you know that we emphasize free cash flow. Why, you ask? We believe in the end, cash is king, and you can't use accounting profits to pay the bills.

National Vision burned through $13.05 million of cash in Q4, representing a negative 2.6% free cash flow margin. The company increased its cash burn by 55.9% year on year.

Over the last eight quarters, National Vision has shown mediocre cash profitability, putting it in a pinch as it gives the company limited opportunities to reinvest, pay down debt, or return capital to shareholders. Its free cash flow margin has averaged 1.5%, subpar for a consumer retail business. However, its margin has averaged year-on-year increases of 2.5 percentage points, a great result that should improve its prospects.

Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing revenue. But was it capital-efficient? A company’s ROIC explains this by showing how much operating profit a company makes compared to how much money the business raised (debt and equity).

National Vision's five-year average ROIC was 3.9%, somewhat low compared to the best retail companies that consistently pump out 25%+. Its returns suggest it historically did a subpar job investing in profitable business initiatives.

The trend in its ROIC, however, is often what surprises the market and drives the stock price. Unfortunately, National Vision's ROIC over the last two years averaged 5.3 percentage point decreases each year. In conjunction with its already low returns, these declines suggest the company's profitable business opportunities are few and far between.

Key Takeaways from National Vision's Q4 Results

We were impressed by how significantly National Vision blew past analysts' EPS expectations this quarter. We were also glad its full-year earnings guidance exceeded Wall Street's estimates. On the other hand, its gross margin missed analysts' expectations. Overall, we think this was a solid quarter that should satisfy shareholders. The stock is flat after reporting and currently trades at $19.96 per share.

Is Now The Time?

National Vision may have had a favorable quarter, but investors should also consider its valuation and business qualities when assessing the investment opportunity.

We cheer for all companies serving consumers, but in the case of National Vision, we'll be cheering from the sidelines. Its revenue growth has been a little slower over the last four years, and analysts expect growth to deteriorate from here. And while its impressive gross margins are a wonderful starting point for the overall profitability of the business, the downside is its relatively low ROIC suggests it has struggled to grow profits historically. On top of that, its shrinking same-store sales suggests it'll need to change its strategy to succeed.

National Vision's price-to-earnings ratio based on the next 12 months is 35.2x. While we've no doubt one can find things to like about National Vision, we think there are better opportunities elsewhere in the market. We don't see many reasons to get involved at the moment.

Wall Street analysts covering the company had a one-year price target of $21.20 per share right before these results (compared to the current share price of $19.96).

To get the best start with StockStory, check out our most recent stock picks, and then sign up to our earnings alerts by adding companies to your watchlist here. We typically have the quarterly earnings results analyzed within seconds of the data being released, and especially for companies reporting pre-market, this often gives investors the chance to react to the results before the market has fully absorbed the information.