As we are heading into the Q4 earnings season we look back on social networking stocks' Q3 earnings and we examine this quarters’ best and worst performers, including Meta (NASDAQ:FB) and its peers.

Businesses must meet their customers where they are, which over the past decade has come to mean on social networks. In 2020, users spent over 2.5 hours a day on social networks, a figure that has increased every year since measurement began. As a result, businesses continue to shift their advertising and marketing dollars online. According to eMarketer, worldwide digital ad spending is expected to increase from $335bn in FY19 to $645bn in FY24e, with a CAGR of 11.5%. We expect this trend of increased digital ad spending to provide tailwinds for the social networks moving forward.

The 4 social networking stocks we track reported a weaker Q3; on average, revenues missed analyst consensus estimates by 1.06%, while on average next quarter revenue guidance was 6.74% under consensus. Technology stocks have been hit hard on fears of higher interest rates and social networking stocks have not been spared, with share price down 36.7% since earnings, on average.

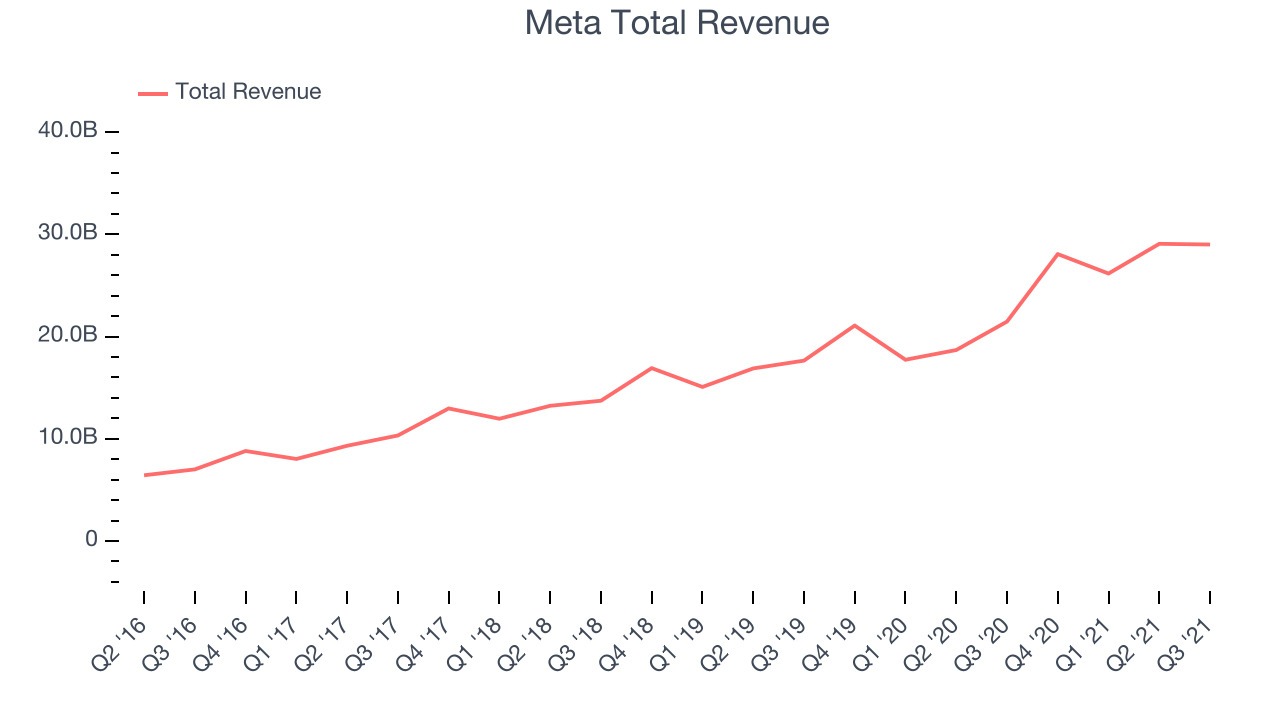

Slowest Q3: Meta (NASDAQ:FB)

Famously founded by Mark Zuckerberg in his Harvard dorm, Meta Platforms (NASDAQ: FB) operates a collection of the largest social networks in the world - Facebook, Instagram, WhatsApp, and Messenger, along with its metaverse focused Facebook Reality Labs.

Meta reported revenues of $29 billion, up 35.1% year on year, missing analyst expectations by 1.73%. It was a complicated quarter for the company, with user growth narrowly beating expectations but an underwhelming revenue guidance for the next quarter and a miss of the top line analyst estimates.

"We made good progress this quarter and our community continues to grow," said Mark Zuckerberg, Facebook founder and CEO.

Family Monthly Active People: 3.58 billion, up 370 million year on year, beating analyst consensus of 3.52 billion

Meta delivered the slowest revenue growth of the whole group. The stock is down 7.87% since the results and currently trades at $303.09.

Is now the time to buy Meta? Access our full analysis of the earnings results here, it's free.

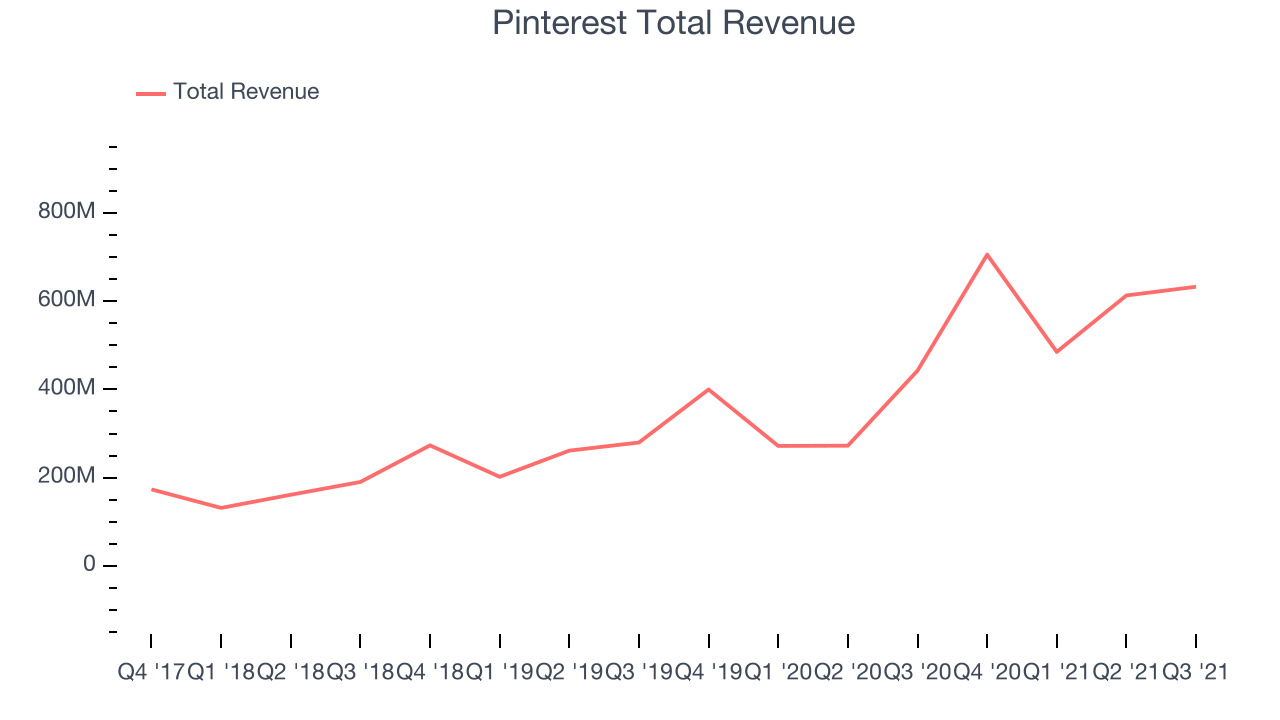

Best Q3: Pinterest (NYSE:PINS)

Created with the idea of virtually replacing paper catalogues, Pinterest (NYSE: PINS) is an online image and social discovery platform.

Pinterest reported revenues of $632.9 million, up 42.9% year on year, in line with analyst expectations. It was a mixed quarter for the company, with an exceptional revenue growth and a narrow beat of the top line analyst estimates, but user growth lagging behind expectations.

Global Monthly Active Users: 444 million, up 2 million year on year, missing analyst expectations of 463 million

The stock is down 37.5% since the results and currently trades at $27.25.

Is now the time to buy Pinterest? Access our full analysis of the earnings results here, it's free.

Snap (NYSE:SNAP)

Founded by Stanford University students Evan Spiegel, Reggie Brown, and Bobby Murphy, and originally called Picaboo, Snapchat (NYSE: SNAP) is an image centric social media network.

Snap reported revenues of $1.06 billion, up 57.2% year on year, missing analyst expectations by 2.9%. It was a weaker quarter for the company, with an underwhelming revenue guidance for the next quarter and a miss of the analyst sales estimates.

Daily Active Users: 306 million, up 57 million year on year, beating analyst expectations

Snap achieved the fastest revenue growth but had the biggest revenue estimate miss in the group. The stock is down eye-watering 58.9% since the results and currently trades at $30.83.

Read our full analysis of Snap's results here.

Twitter (NYSE:TWTR)

Born out of a failed podcasting startup, Twitter (NYSE: TWTR) is the town square of the internet, one part social network, one part media distribution platform.

Twitter reported revenues of $1.28 billion, up 37.1% year on year, in line with analyst expectations. It was a slower quarter for the company, with user growth in line with estimates but an underwhelming revenue guidance for the next quarter.

Monetizable Daily Active Users: 211 million, up 24 million year on year, in line with analyst expectations.

The stock is down 42.1% since the results and currently trades at $35.54.

Read our full, actionable report on Twitter here, it's free.

The author has no position in any of the stocks mentioned