Earnings results often give us a good indication of what direction the company will take in the months ahead. With Q1 now behind us, let’s have a look at Meta (NASDAQ:META) and its peers.

Businesses must meet their customers where they are, which over the past decade has come to mean on social networks. In 2020, users spent over 2.5 hours a day on social networks, a figure that has increased every year since measurement began. As a result, businesses continue to shift their advertising and marketing dollars online.

The 4 social networking stocks we track reported a weak Q1; on average, revenues missed analyst consensus estimates by 0.83%, while on average next quarter revenue guidance was 5.48% under consensus. Tech stocks have had a rocky start in 2022 and while some of the social networking stocks have fared somewhat better, they have not been spared, with share price declining 14.2% since earnings, on average.

Slowest Q1: Meta (NASDAQ:META)

Famously founded by Mark Zuckerberg in his Harvard dorm, Meta Platforms (NASDAQ: META) operates a collection of the largest social networks in the world - Facebook, Instagram, WhatsApp, and Messenger, along with its metaverse focused Facebook Reality Labs.

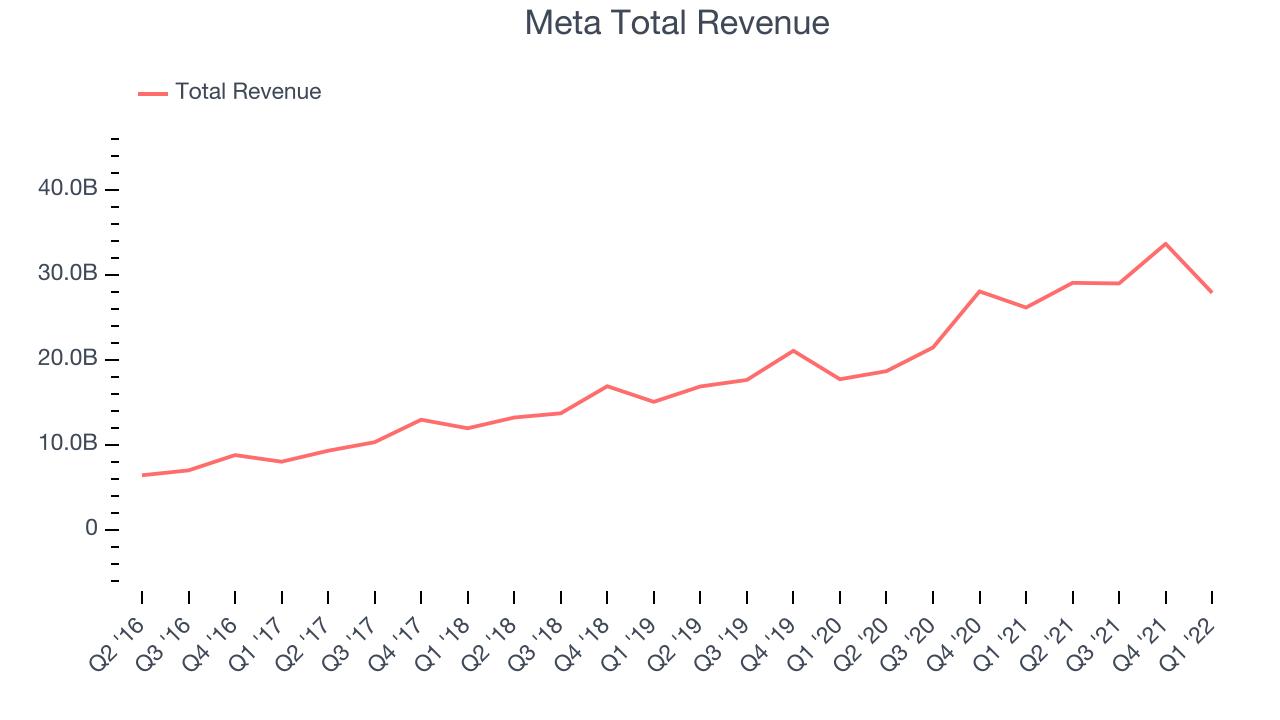

Meta reported revenues of $27.9 billion, up 6.63% year on year, missing analyst expectations by 1.11%. It was a weak quarter for the company, with an underwhelming revenue guidance for the next quarter and a miss of the top line analyst estimates.

"We made progress this quarter across a number of key company priorities and we remain confident in the long-term opportunities and growth that our product roadmap will unlock," said Mark Zuckerberg, Meta founder and CEO.

Meta delivered the slowest revenue growth of the whole group. The company reported 3.64 billion monthly active users, up 5.5% year on year. The stock is up 12.2% since the results and currently trades at $196.29.

Is now the time to buy Meta? Access our full analysis of the earnings results here, it's free.

Best Q1: Snap (NYSE:SNAP)

Founded by Stanford University students Evan Spiegel, Reggie Brown, and Bobby Murphy, and originally called Picaboo, Snapchat (NYSE: SNAP) is an image centric social media network.

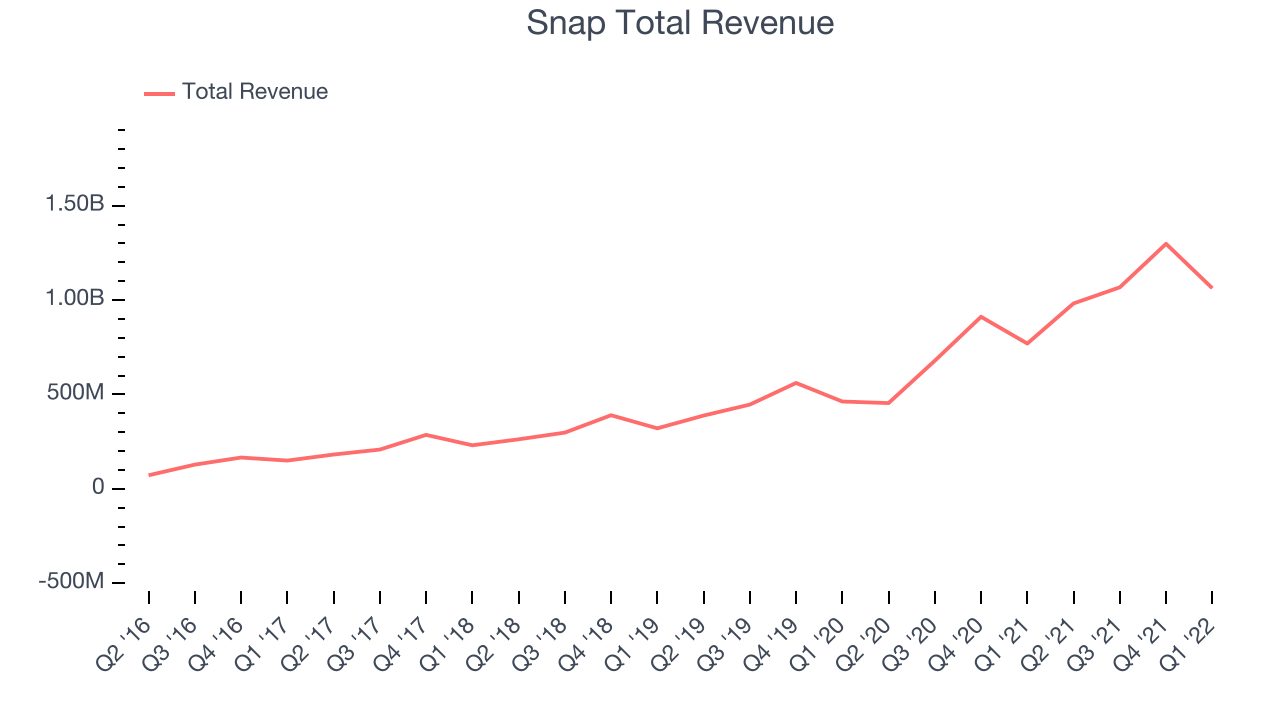

Snap reported revenues of $1.06 billion, up 38% year on year, missing analyst expectations by 0.57%. It was a mixed quarter for the company, with an exceptional revenue growth but a miss of the top line analyst estimates.

Snap delivered the fastest revenue growth among its peers. The company reported 332 million daily active users, up 18.5% year on year. The stock is down 54.5% since the results and currently trades at $13.35.

Is now the time to buy Snap? Access our full analysis of the earnings results here, it's free.

Pinterest (NYSE:PINS)

Created with the idea of virtually replacing paper catalogues, Pinterest (NYSE: PINS) is an online image and social discovery platform.

Pinterest reported revenues of $574.8 million, up 18.4% year on year, in line with analyst expectations. While the stock was up on the results, it was a weak quarter for the company, with declining number of users and topline results in line with analysts' estimates.

Pinterest delivered the strongest analyst estimates beat in the group. The company reported 433 million monthly active users, down 9.42% year on year. The stock is up 3.05% since the results and currently trades at $19.20.

Read our full analysis of Pinterest's results here.

Twitter (NYSE:TWTR)

Born out of a failed podcasting startup, Twitter (NYSE: TWTR) is the town square of the internet, one part social network, one part media distribution platform.

Twitter reported revenues of $1.2 billion, up 15.9% year on year, missing analyst expectations by 2.04%. It was a weak quarter for the company, with a miss of the top line analyst estimates and a slow revenue growth.

Twitter had the weakest performance against analyst estimates among the peers. The company reported 229 million daily active users, up 15% year on year. The stock is down 17.6% since the results and currently trades at $39.99.

Twitter has previously entered into a definitive agreement to be acquired by Elon Musk, for $54.20 per share in cash in a transaction valued at approximately $44 billion.

Read our full, actionable report on Twitter here, it's free.

The author has no position in any of the stocks mentioned