Q4 Earnings Outperformers: F5 Networks (NASDAQ:FFIV) And The Rest Of The Software Development Stocks

Petr Huřťák 2023/04/07 6:12 am EDT

As the craze of earnings season draws to a close, here's a look back at some of the most exciting (and some less so) results from Q4. Today we are looking at the software development stocks, starting with F5 Networks (NASDAQ:FFIV).

Software is eating the world, as Marc Andreessen says, and there is virtually no industry left that has been untouched by it. That in turn drives increasing demand for tools that help software developers do their jobs, whether it is monitoring critical cloud infrastructure, integrating audio and video functionality or ensuring smooth streaming of content.

The 14 software development stocks we track reported a slower Q4; on average, revenues beat analyst consensus estimates by 3.04%, while on average next quarter revenue guidance was 1.28% under consensus. There has been a stampede out of high valuation technology stocks as raising interest rates encourage investors to value profits over growth again, but software development stocks held their ground better than others, with share prices down 2.29% since the previous earnings results, on average.

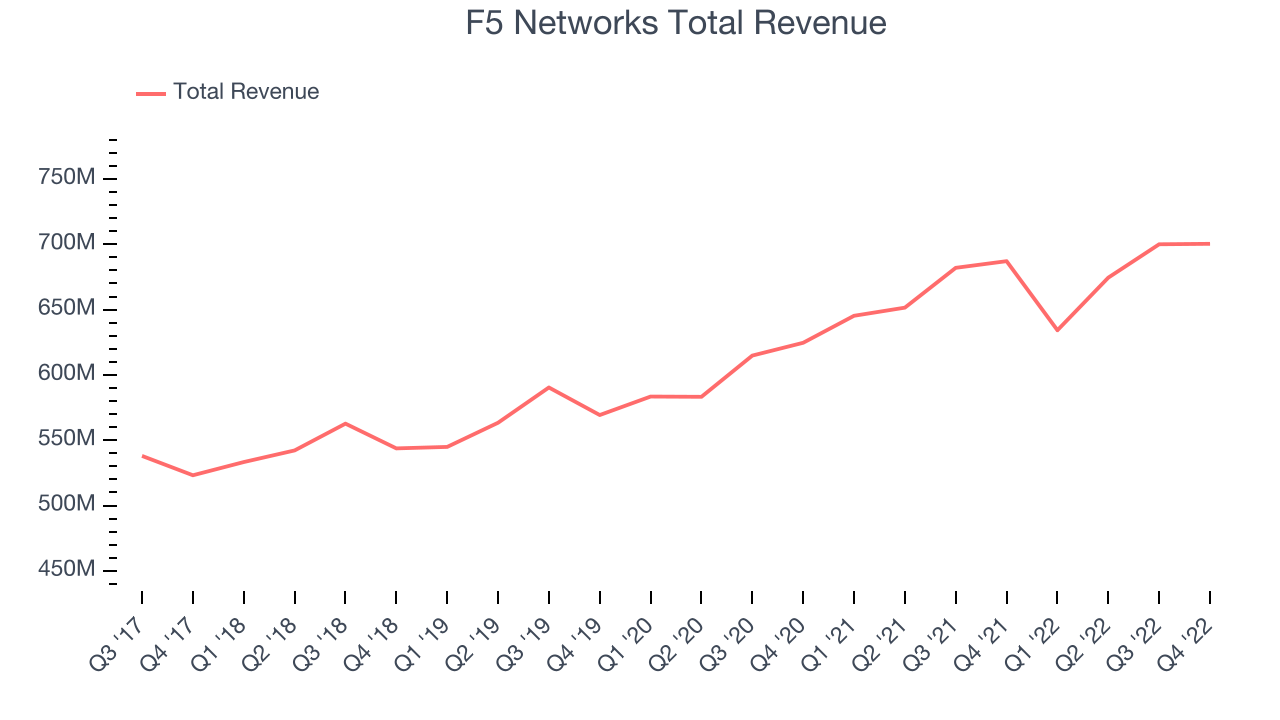

F5 Networks (NASDAQ:FFIV)

While the company initially started in the late 90s by selling hardware appliances, these days F5 (NASDAQ:FFIV) is making software that helps large enterprises ensure their web applications are always available, by distributing network traffic and protecting them from cyber attacks.

F5 Networks reported revenues of $700.4 million, up 1.93% year on year, missing analyst expectations by 0.05%. It was a weak quarter for the company, with slow revenue growth and underwhelming revenue guidance for the next quarter.

“Customers are focused on minimizing their spend and optimizing their existing investments while also continuing to drive revenue,” said François Locoh-Donou, F5’s President and CEO.

The stock is up 0.18% since the results and currently trades at $146.71.

Read our full report on F5 Networks here, it's free.

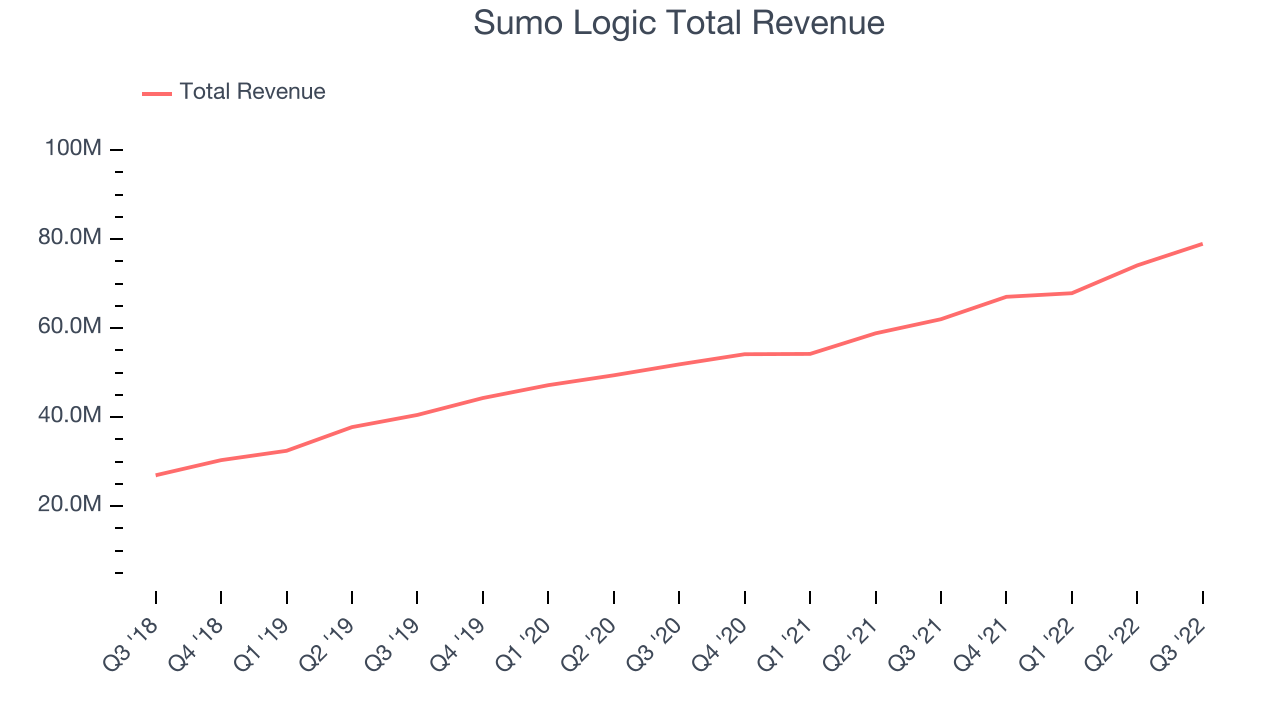

Best Q4: Sumo Logic (NASDAQ:SUMO)

Founded in 2010 by Christian Beegden who went from driving a cab in Germany to landing an internship at Amazon, Sumo Logic (NASDAQ:SUMO) is software as a service data analytics platform that helps companies get insight into what is happening in their servers and applications.

Sumo Logic reported revenues of $79 million, up 27.3% year on year, beating analyst expectations by 6.41%. It was a very strong quarter for the company, with a significant improvement in gross margin and a solid beat of analyst estimates.

Sumo Logic pulled off the highest full year guidance raise among its peers. The stock is up 64.9% since the results and currently trades at $11.87.

Sumo has agreed to be sold to private equity firm Francisco Partners for about $1.7 billion.

Is now the time to buy Sumo Logic? Access our full analysis of the earnings results here, it's free.

Weakest Q4: Agora (NASDAQ:API)

Founded in 2014 by former engineers at WebEx and based in China, Agora (NASDAQ:API) provides a cloud platform that makes it easy for developers to integrate real-time audio and video functionalities in their apps.

Agora reported revenues of $40.1 million, down 0.66% year on year, missing analyst expectations by 1.12%. It was a weak quarter for the company, with a full year guidance missing analysts' expectations and slow revenue growth.

Agora had the weakest performance against analyst estimates and slowest revenue growth in the group. The company added 79 customers to a total of 3,066. The stock is down 4.18% since the results and currently trades at $3.67.

Read our full analysis of Agora's results here.

Dynatrace (NYSE:DT)

Founded in Austria in 2005, Dynatrace (NYSE:DT) provides companies with software that allows them to monitor the performance of their full technology stack, from software applications to the infrastructure they run on.

Dynatrace reported revenues of $297.5 million, up 23.5% year on year, beating analyst expectations by 4.46%. It was a strong quarter for the company, with very optimistic guidance for the next quarter.

The stock is up 6.84% since the results and currently trades at $41.07.

Read our full, actionable report on Dynatrace here, it's free.

New Relic (NYSE:NEWR)

With the name being an anagram of its founder, Lew Cirne, New Relic (NYSE:NEWR) makes a monitoring software that collects, scores, and analyses performance data about a client's IT stack.

New Relic reported revenues of $239.8 million, up 17.8% year on year, beating analyst expectations by 2.93%. It was a solid quarter for the company, with a significant improvement in gross margin and revenue guidance for the next quarter above analysts' expectations.

The stock is up 10.7% since the results and currently trades at $71.47.

Read our full, actionable report on New Relic here, it's free.

The author has no position in any of the stocks mentioned