Network application delivery and security specialist F5 (NASDAQ:FFIV) beat analysts' expectations in Q1 FY2024, with revenue down 1.1% year on year to $692.6 million. Guidance for next quarter's revenue was also better than expected at $685 million at the midpoint, 1.7% above analysts' estimates. It made a non-GAAP profit of $3.43 per share, improving from its profit of $2.47 per share in the same quarter last year.

F5 (FFIV) Q1 FY2024 Highlights:

- Market Capitalization: $10.8 billion

- Revenue: $692.6 million vs analyst estimates of $685.1 million (1.1% beat)

- EPS (non-GAAP): $3.43 vs analyst estimates of $3.04 (12.9% beat)

- Revenue Guidance for Q2 2024 is $685 million at the midpoint, above analyst estimates of $673.6 million

- Management upgraded its FY 2024 EPS guidance to growth of 6% to 8% from 5% to 7%

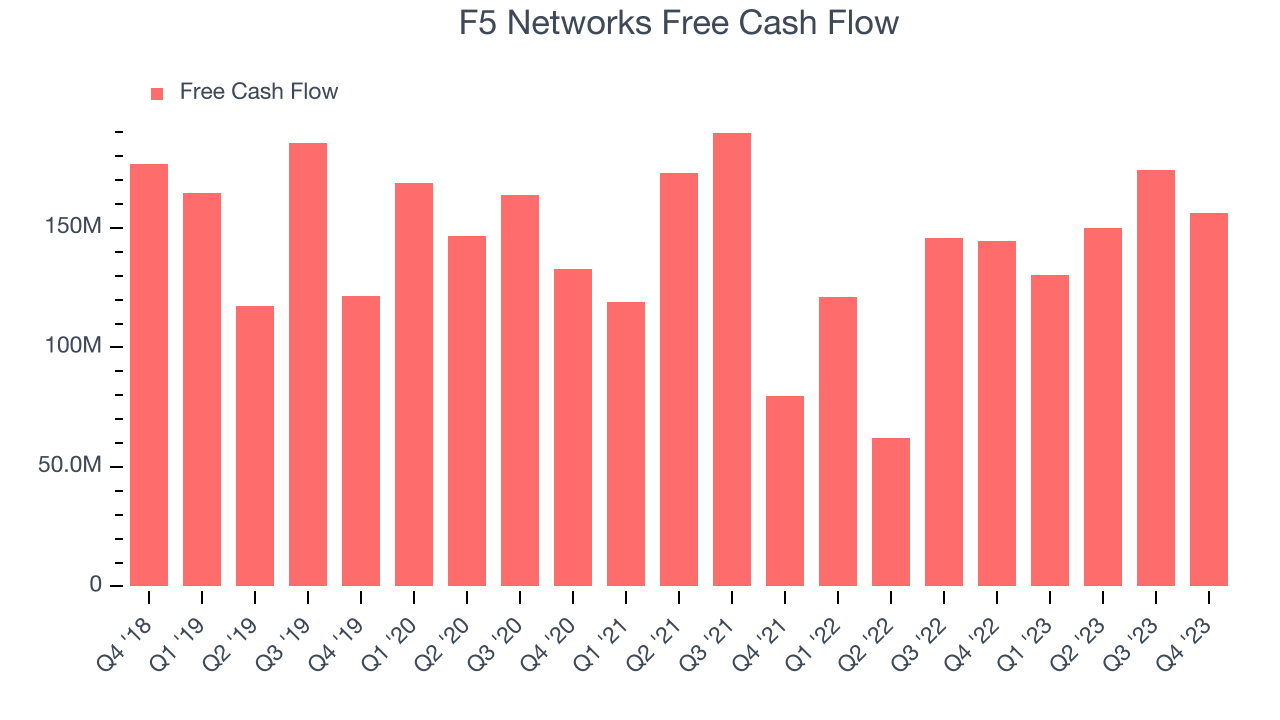

- Free Cash Flow of $156.3 million, down 10.4% from the previous quarter

- Gross Margin (GAAP): 80.3%, up from 77.9% in the same quarter last year

Initially started as a hardware appliances company in the late 1990s, F5 (NASDAQ:FFIV) makes software that helps large enterprises ensure their web applications are always available by distributing network traffic and protecting them from cyberattacks.

Large organizations are often running multiple online applications with complex connections across geographical locations, on-premise servers, and cloud environments. Even though these companies theoretically do have enough computing power, their servers still can get overwhelmed when there is a lot of concentrated demand in one location, resulting in internal apps being slow (hindering employee productivity) and customers not being able to shop online or consume the content they want.

F5 provides technology that filters and distributes internet traffic across a company’s servers to improve page load speed and website availability while preventing cyber-attacks. To ensure users have an uninterrupted experience when visiting web applications, F5 uses load-balancing technology to spread the demand across multiple servers and send traffic to the best-performing web server. Instead of using a content delivery network such as Cloudflare or Akamai to store temporary copies of web pages, F5 allows companies to use servers under their own control, whether in the cloud or on-premises, which can be important for compliance, privacy or other reasons.

Using AI-based technology, the company is also able to inspect web traffic to detect suspicious activities and malicious users who try to steal sensitive information or overwhelm a web server with fake traffic. It also provides the features to automate the management of applications so that engineers can focus on more important tasks.

Content Delivery

The amount of content on the internet is exploding, whether it is music, movies and or e-commerce stores. Consumer demand for this content creates network congestion, much like a digital traffic jam which drives demand for specialized content delivery networks (CDN) services that alleviate potential network bottlenecks.

F5 faces competition from providers of application management and web security solutions such as Citrix (NASDAQ:CTXS) , Cisco (NASDAQ:CSCO), and Akamai (NASDAQ:AKAM) as well as cloud vendors such as Amazon (NASDAQ:AMZN), Microsoft (NASDAQ:MSFT), and Google Cloud.

Sales Growth

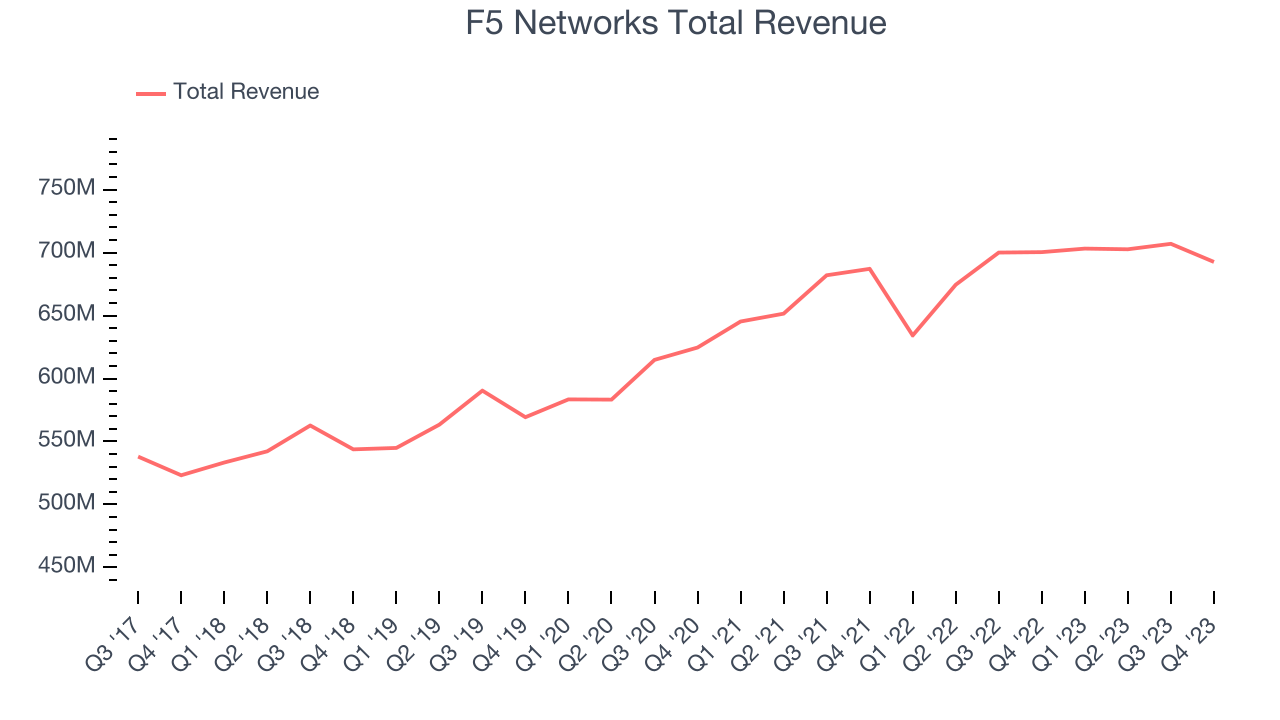

As you can see below, F5's revenue growth has been unimpressive over the last two years, growing from $687.1 million in Q1 FY2022 to $692.6 million this quarter.

This quarter, F5's revenue was down 1.1% year on year, which might disappointment some shareholders.

Next quarter, F5 is guiding for a 2.6% year-on-year revenue decline to $685 million, a further deceleration from the 10.9% year-on-year decrease it recorded in the same quarter last year. Looking ahead, Wall Street was expecting revenue to decline 0.3% over the next 12 months before the earnings results announcement.

Profitability

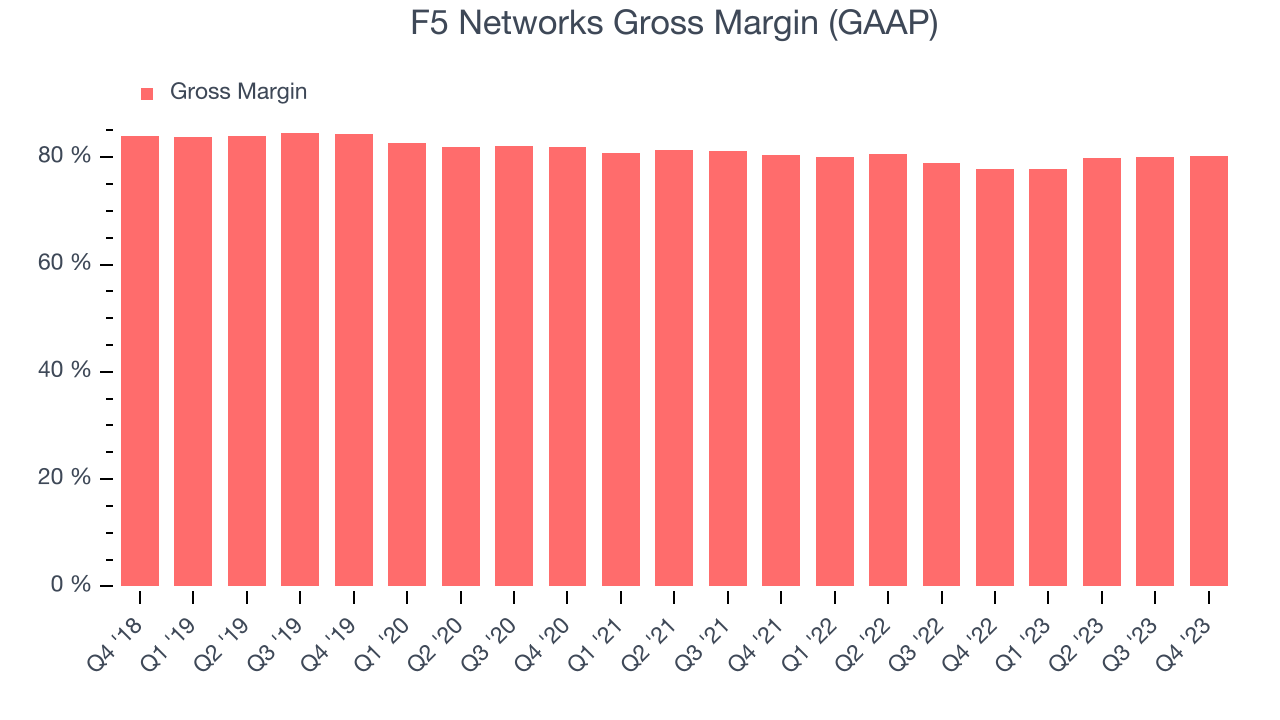

What makes the software as a service business so attractive is that once the software is developed, it typically shouldn't cost much to provide it as an ongoing service to customers. F5's gross profit margin, an important metric measuring how much money there's left after paying for servers, licenses, technical support, and other necessary running expenses, was 80.3% in Q1.

That means that for every $1 in revenue the company had $0.80 left to spend on developing new products, sales and marketing, and general administrative overhead. Trending up over the last year, F5's excellent gross margin allows it to fund large investments in product and sales during periods of rapid growth and achieve profitability when reaching maturity.

Cash Is King

If you've followed StockStory for a while, you know that we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can't use accounting profits to pay the bills. F5's free cash flow came in at $156.3 million in Q1, up 8.1% year on year.

F5 has generated $611 million in free cash flow over the last 12 months, an impressive 21.8% of revenue. This high FCF margin stems from its asset-lite business model and strong competitive positioning, giving it the option to return capital to shareholders or reinvest in its business while maintaining a cash cushion.

Key Takeaways from F5's Q1 Results

It was good to see F5 upgrade its full-year adjusted EPS guidance and provide a strong revenue forecast for next quarter, which topped analysts' expectations. We were also happy this quarter's revenue, adjusted operating profit, and EPS outperformed Wall Street's estimates. Management attributed the company's performance to stabilizing demand trends across all key geographies. Overall, this quarter's results seemed fairly positive and shareholders should feel optimistic. The stock is up 10.6% after reporting and currently trades at $205 per share.

Is Now The Time?

When considering an investment in F5, investors should take into account its valuation and business qualities as well as what's happened in the latest quarter.

We cheer for everyone who's making the lives of others easier through technology, but in case of F5, we'll be cheering from the sidelines. Its revenue growth has been very weak over the last two years, and analysts expect growth to deteriorate from here. And while its impressive gross margins indicate excellent business economics, unfortunately, its customer acquisition is less efficient than many comparable companies.

F5's price-to-sales ratio based on the next 12 months is 4.0x, suggesting that the market does have lower expectations of the business, relative to the high-growth tech stocks. While we have no doubt one can find things to like about the company, we think there might be better opportunities in the market and at the moment don't see many reasons to get involved.

Wall Street analysts covering the company had a one-year price target of $170.1 per share right before these results (compared to the current share price of $205), implying they didn't see much short-term potential in the F5.

To get the best start with StockStory check out our most recent Stock picks, and then sign up to our earnings alerts by adding companies to your watchlist here. We typically have the quarterly earnings results analyzed within seconds of the data being released, and especially for the companies reporting pre-market, this often gives investors the chance to react to the results before the market has fully absorbed the information.