Discount retailer Five Below (NASDAQ:FIVE) fell short of analysts' expectations in Q2 FY2023, with revenue up 13.5% year on year to $759 million. However, next quarter's revenue guidance of $722.5 million was less impressive, coming in 2.05% below analysts' estimates. Turning to EPS, Five Below made a GAAP profit of $0.84 per share, improving from its profit of $0.74 per share in the same quarter last year.

Is now the time to buy Five Below? Find out by accessing our full research report, it's free.

Five Below (FIVE) Q2 FY2023 Highlights:

- Revenue: $759 million vs analyst estimates of $760 million (small miss)

- EPS: $0.84 vs analyst estimates of $0.83 (1.11% beat)

- Revenue Guidance for Q3 2023 is $722.5 million at the midpoint, below analyst estimates of $737.6 million

- The company reconfirmed its revenue guidance for the full year of $3.54 billion at the midpoint

- Free Cash Flow of $12.6 million is up from -$47.6 million in the same quarter last year

- Gross Margin (GAAP): 34.9%, up from 34.2% in the same quarter last year

- Same-Store Sales were up 2.7% year on year (in line)

- Store Locations: 1,400 at quarter end, increasing by 148 over the last 12 months

Joel Anderson, President and CEO of Five Below, said, “We are pleased to deliver second quarter results in line with our guidance on the top and bottom line. Notably, the 2.7% comparable sales increase was driven by a 4.5% increase in comp transactions, illustrating the success of our Five Beyond conversion strategy and the appeal of our extreme value, WOW offering."

Often facilitating a treasure hunt shopping experience, Five Below (NASDAQ:FIVE) is an American discount retailer that sells a variety of products from mobile phone cases to candy to sports equipment for largely $5 or less.

Broadline discount retailers understand that many shoppers love a good deal, and they focus on providing excellent value to shoppers by selling general merchandise at major discounts. They can do this because of unique purchasing, procurement, and pricing strategies that involve scouring the market for trendy goods or buying excess inventory from manufacturers and other retailers. They then turn around and sell these snacks, paper towels, toys, and myriad other products at highly enticing prices. Despite the unique draw and lure of discounts, these discount retailers must also contend with the secular headwinds of online shopping and challenged retail foot traffic in places like suburban strip malls.

Sales Growth

Five Below is a mid-sized retailer, which sometimes brings disadvantages compared to larger competitors benefiting from better economies of scale. On the other hand, it has an edge over smaller competitors with fewer resources and can still flex high growth rates because it's growing off a smaller base than its larger counterparts.

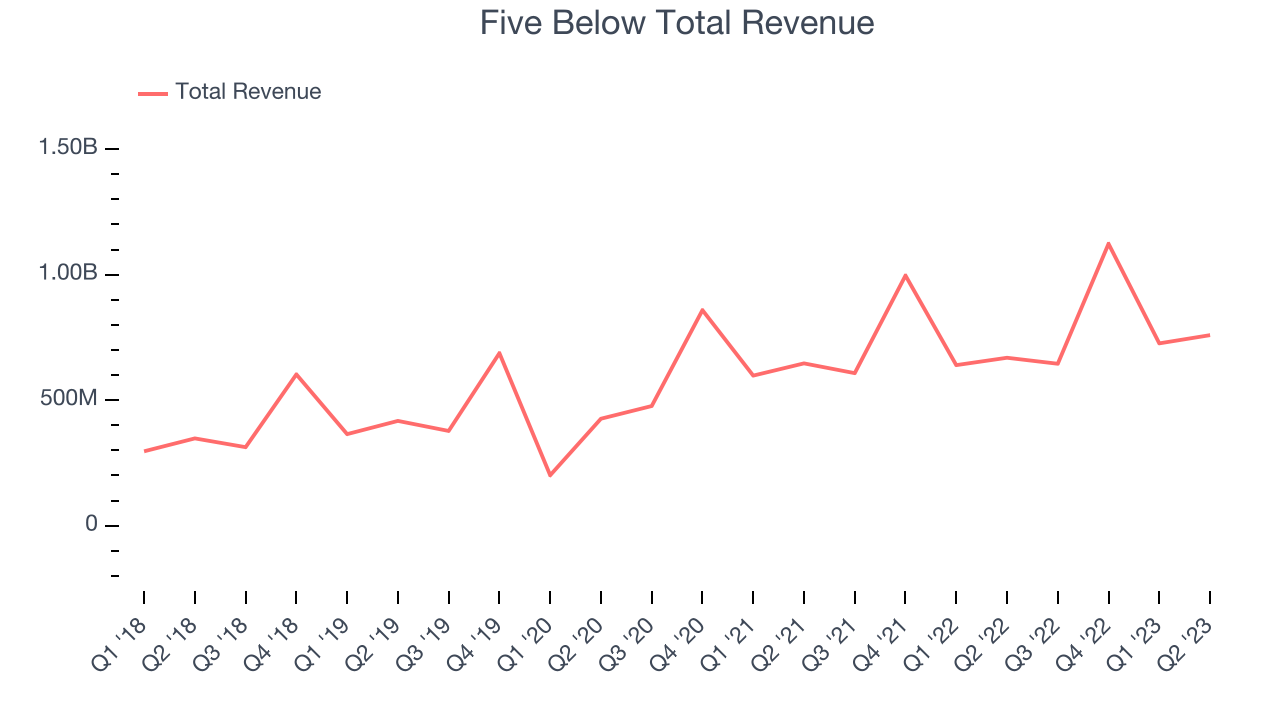

As you can see below, the company's annualized revenue growth rate of 17.7% over the last four years (we compare to 2019 to normalize for COVID-19 impacts) was excellent as it added more brick-and-mortar locations and increased sales at existing, established stores.

This quarter, Five Below's year-on-year revenue growth clocked in at 13.5%, falling short of Wall Street's estimates. The company is guiding for revenue to rise 12% year on year to $722.5 million next quarter, improving from the 6.15% year-on-year increase it recorded in the same quarter last year. Looking ahead, the analysts covering the company expect sales to grow 17.6% over the next 12 months.

While most things went back to how they were before the pandemic, a few consumer habits fundamentally changed. One founder-led company is benefiting massively from this shift and is set to beat the market for years to come. The business has grown astonishingly fast, with 40%+ free cash flow margins, and its fundamentals are undoubtedly best-in-class. Still, its total addressable market is so big that the company has room to grow many times in size. You can find it on our platform for free.

Number of Stores

A retailer's store count is a crucial factor influencing how much it can sell, and store growth is a critical driver of how quickly its sales can grow.

When a retailer like Five Below is opening new stores, it usually means that demand is greater than supply, and in turn, it's investing for growth. Since last year, Five Below's store count increased by 148 locations, or 11.8%, to 1,400 total retail locations in the most recently reported quarter.

Taking a step back, the company has opened new stores rapidly over the last eight quarters, averaging 12.8% annual growth in its physical footprint. This store growth is much higher than other retailers. With an expanding store base and demand, revenue growth can come from multiple vectors: sales from new stores, sales from e-commerce, or increased foot traffic and higher sales per customer at existing stores.

Same-Store Sales

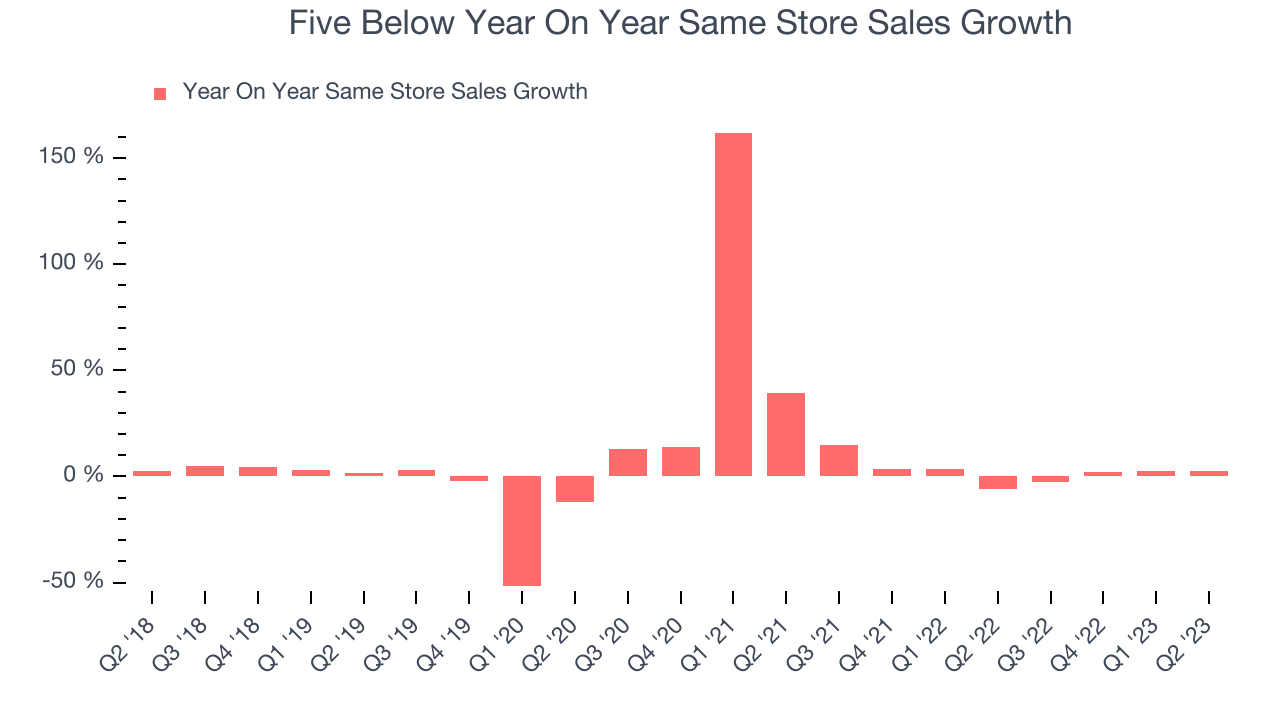

Five Below's demand within its existing stores has generally risen over the last two years but lagged behind the broader consumer retail sector. On average, the company's same-store sales have grown by 2.57% year on year. With positive same-store sales growth amid an increasing physical footprint of stores, Five Below is reaching more customers and growing sales.

In the latest quarter, Five Below's same-store sales rose 2.7% year on year. This growth was a well-appreciated turnaround from the 5.8% year-on-year decline it posted 12 months ago, showing that the business is regaining momentum.

Key Takeaways from Five Below's Q2 Results

With a market capitalization of $10.2 billion, a $436.4 million cash balance, and positive free cash flow over the last 12 months, we're confident that Five Below has the resources needed to pursue a high-growth business strategy.

Revenue missed, but EPS beat in the quarter. Gross margin increased year on year, which was a positive. On the other hand, while Five Below's full-year revenue guidance was maintained, it missed analysts' expectations. The company also reduced full year EPS guidance due to an increase in "shrink reserves", and this reduction is likely a major cause of the stock's weakness. Overall, the results could have been better. The company is down 6.24% on the results and currently trades at $171.4 per share.

So should you invest in Five Below right now? When making that decision, it's important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it's free.

One way to find opportunities in the market is to watch for generational shifts in the economy. Almost every company is slowly finding itself becoming a technology company and facing cybersecurity risks and as a result, the demand for cloud-native cybersecurity is skyrocketing. This company is leading a massive technological shift in the industry and with revenue growth of 50% year on year and best-in-class SaaS metrics it should definitely be on your radar.

The author has no position in any of the stocks mentioned in this report.