Call center software provider Five9 (NASDAQ: FIVN) reported Q1 CY2024 results exceeding Wall Street analysts' expectations, with revenue up 13.1% year on year to $247 million. On the other hand, next quarter's revenue guidance of $244.5 million was less impressive, coming in 1.4% below analysts' estimates. It made a non-GAAP profit of $0.48 per share, improving from its profit of $0.41 per share in the same quarter last year.

Is now the time to buy Five9? Find out by accessing our full research report, it's free.

Five9 (FIVN) Q1 CY2024 Highlights:

- Revenue: $247 million vs analyst estimates of $240.1 million (2.9% beat)

- EPS (non-GAAP): $0.48 vs analyst estimates of $0.39 (24.5% beat)

- Revenue Guidance for Q2 CY2024 is $244.5 million at the midpoint, below analyst estimates of $248.1 million

- The company reconfirmed its revenue guidance for the full year of $1.06 billion at the midpoint

- Gross Margin (GAAP): 53.6%, up from 52% in the same quarter last year

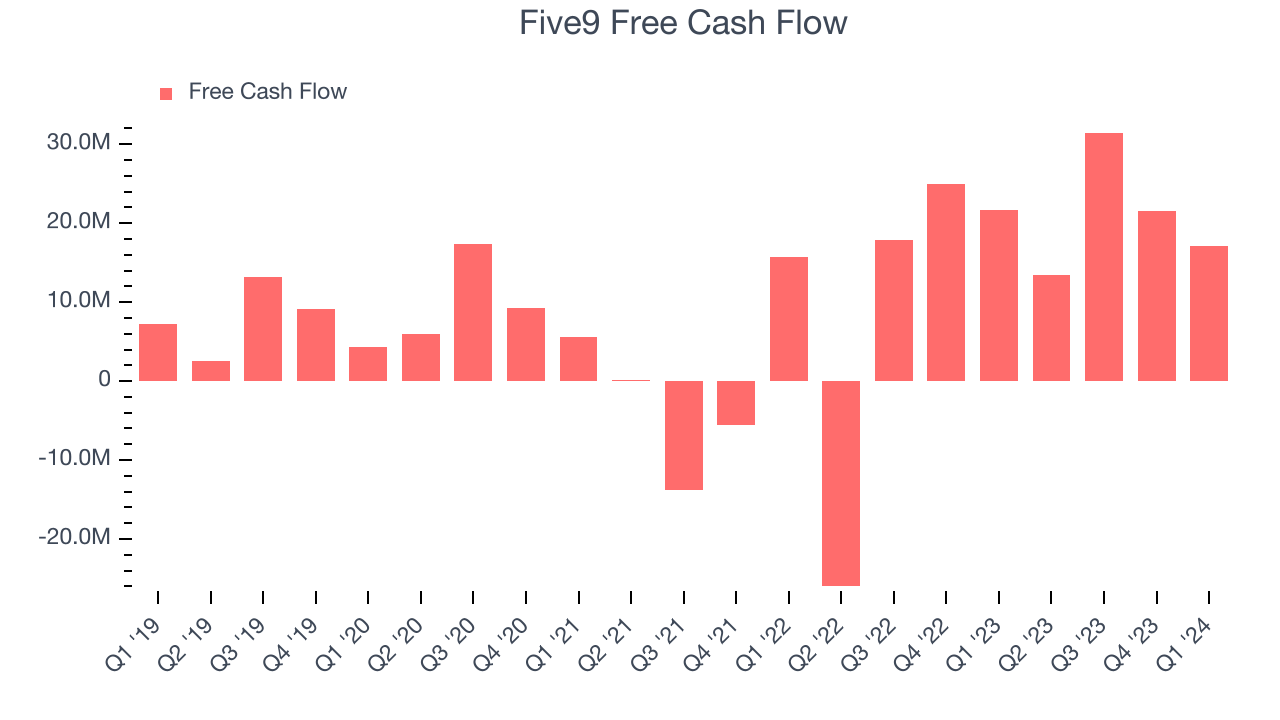

- Free Cash Flow of $17.16 million, down 20.3% from the previous quarter

- Market Capitalization: $4.30 billion

“We are pleased to report strong first quarter results with subscription revenue growing 20% year-over-year and adjusted EBITDA margin of 15%, helping drive robust LTM operating cash flow of $128 million. Five9 is changing the game for many of the largest brands in the world as we help them reimagine CX with our AI-infused data-centric platform combined with our passionate experts. We are also very excited to share that we signed our largest deal ever, a Fortune 50 financial services company, which is a testament to our continuing success in marching up-market. The market remains massive and underpenetrated, we believe we are a clear market leader, and we see a long runway ahead for durable growth.”

Started in 2001, Five9 (NASDAQ: FIVN) offers software as a service that makes it easier for companies to set up and efficiently run call centers, and offer more tailored customer support.

Video Conferencing

Work is becoming more distributed, both across geographies and devices. In order for businesses to keep functioning efficiently, they need to be able to communicate as well as they did when the teams were co-located, which drives the demand for integrated communication platforms.

Sales Growth

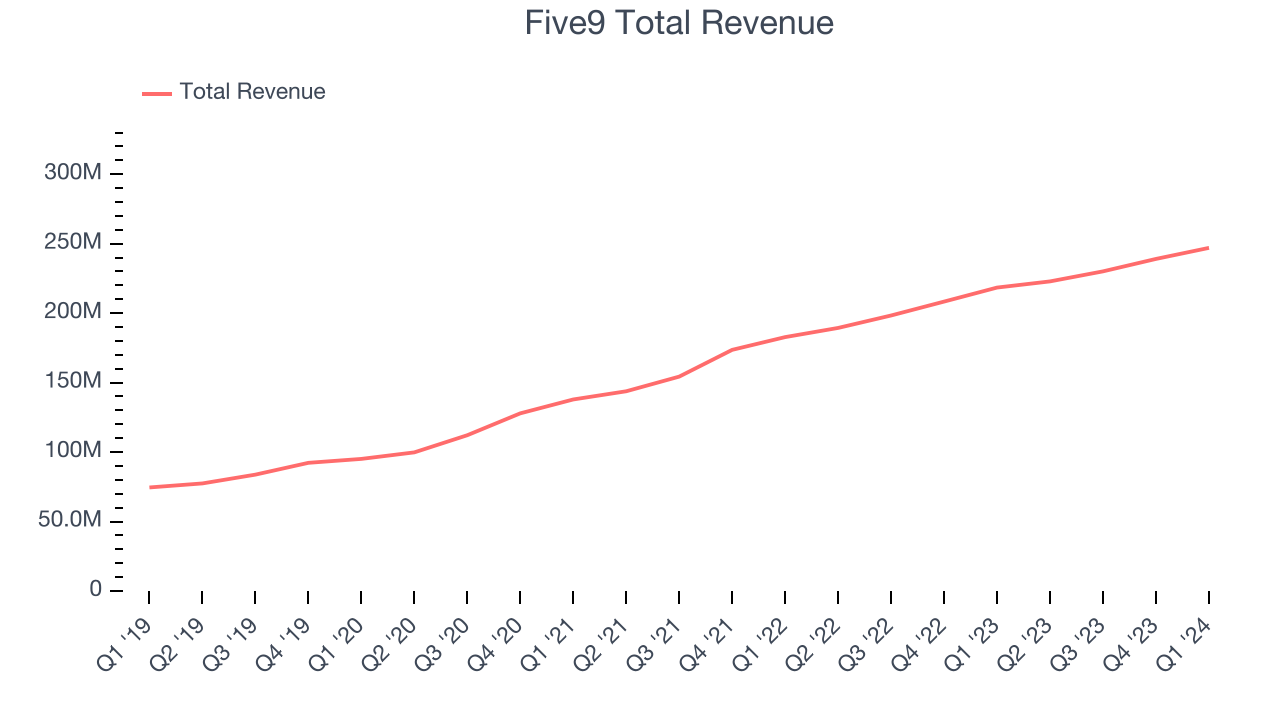

As you can see below, Five9's revenue growth has been strong over the last three years, growing from $137.9 million in Q1 2021 to $247 million this quarter.

This quarter, Five9's quarterly revenue was once again up 13.1% year on year. However, its growth did slow down a little compared to last quarter as the company increased revenue by $7.95 million in Q1 compared to $8.96 million in Q4 CY2023. While we'd like to see revenue increase by a greater amount each quarter, a one-off fluctuation is usually not concerning.

Next quarter's guidance suggests that Five9 is expecting revenue to grow 9.7% year on year to $244.5 million, slowing down from the 17.7% year-on-year increase it recorded in the same quarter last year. Looking ahead, analysts covering the company were expecting sales to grow 17.7% over the next 12 months before the earnings results announcement.

Here at StockStory, we certainly understand the potential of thematic investing. Diverse winners from Microsoft (MSFT) to Alphabet (GOOG), Coca-Cola (KO) to Monster Beverage (MNST) could all have been identified as promising growth stories with a megatrend driving the growth. So, in that spirit, we’ve identified a relatively under-the-radar profitable growth stock benefitting from the rise of AI, available to you FREE via this link.

Cash Is King

If you've followed StockStory for a while, you know that we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can't use accounting profits to pay the bills. Five9's free cash flow came in at $17.16 million in Q1, down 20.8% year on year.

Five9 has generated $83.55 million in free cash flow over the last 12 months, or 8.9% of revenue. This FCF margin enables it to reinvest in its business without depending on the capital markets.

Key Takeaways from Five9's Q1 Results

It was good to see Five9 beat analysts' revenue, billings, and EPS estimates this quarter. On the other hand, its revenue guidance for next quarter missed analysts' expectations. Overall, this was a solid quarter for Five9. The stock is up 7.7% after reporting and currently trades at $61 per share.

So should you invest in Five9 right now? When making that decision, it's important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it's free.