Call center software provider Five9 (NASDAQ: FIVN) announced better-than-expected results in the Q1 FY2021 quarter, with revenue up 45% year on year to $137 million. Five9 made a GAAP loss of $12.3 million, down on its loss of $7.43 million, in the same quarter last year.

Five9 (NASDAQ:FIVN) Q1 FY2021 Highlights:

- Revenue: $137 million vs analyst estimates of $122 million (12.4% beat)

- EPS (non-GAAP): $0.23 vs analyst estimates of $0.13 ($0.10 beat)

- Revenue guidance for Q2 2021 is $132 million at the midpoint, above analyst estimates of $122 million

- The company lifted revenue guidance for the full year from $520 million to $550 million at the midpoint, a 5.76% increase

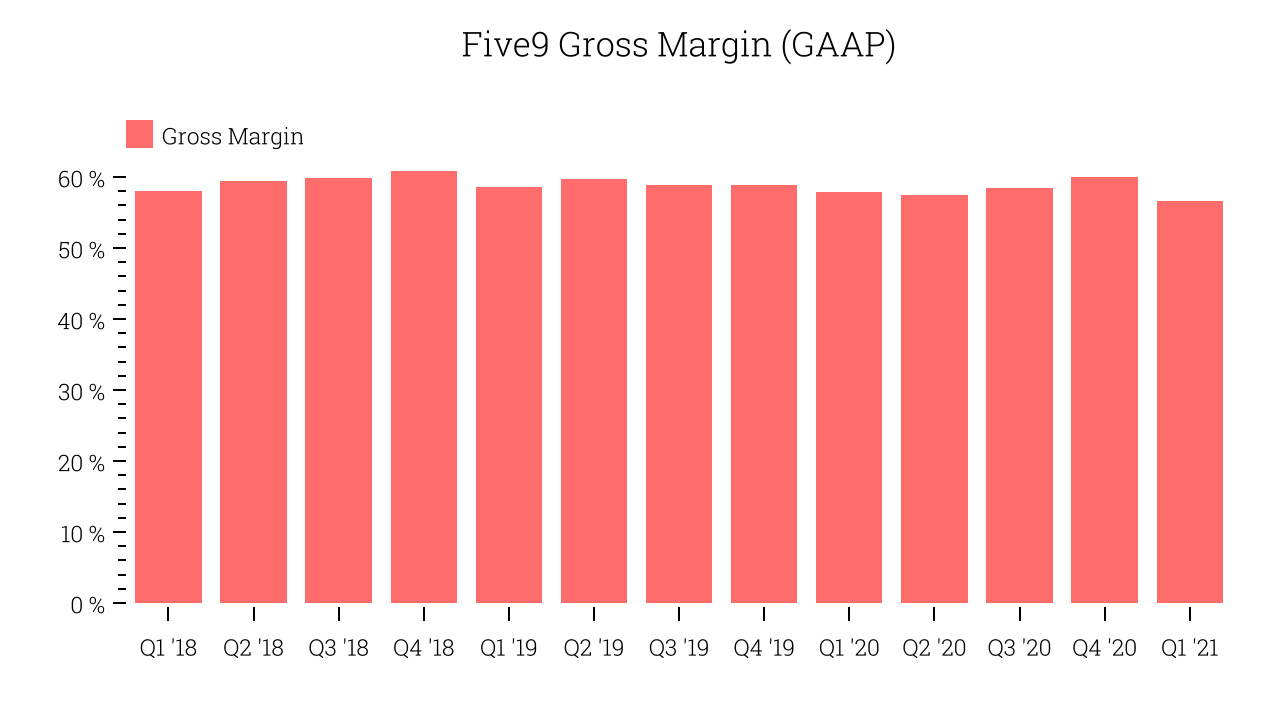

- Gross Margin (GAAP): 56.6%, down from 59.9% previous quarter

The Rise Of The Virtual Contact Center

Five9 started in 2001, by providing PC-based software for very small call centres before making the leap to providing cloud software; which they initially hosted on servers running in the kitchen of a San Francisco apartment.

Five9 offers software as a service that makes it easier for companies to set up and efficiently run call centers, and offer more tailored customer support. Its virtual contact center software provides phone connectivity, monitors agent performance, and guides agents through conversations to make them more effective. Arguably, the key advantage of a virtual contact center is that the software can automate some of the processes, including substituting humans with robot “intelligent virtual agents” for the easier requests. Crucially, Five9 integrates with multiple major enterprise software platforms, for example integration with Salesforce allows contact center agents to access customer profiles and manage customer data during interactions.

As more of our commercial interactions take place over the internet, the need for call centres and online support will only grow. Furthermore, the virtual call centre software providers can benefit from the remote work trend because they allow contact center agents to work from home using just a computer and a headset. Five9’s closest competitor in this space is a fellow cloud software provider Nice Systems (NASDAQ:NICE), but it also competes with legacy on-premise systems from Oracle (NYSE:ORCL) and Avaya (NYSE:AVYA), which are losing market share.

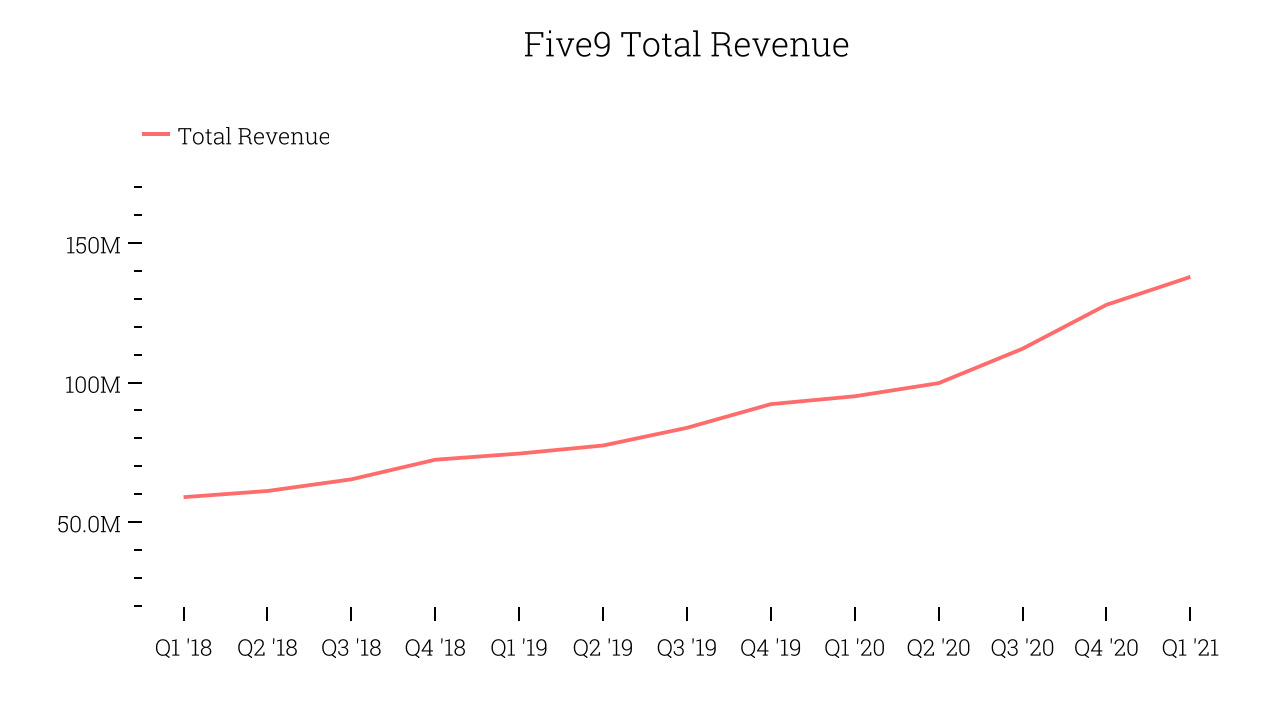

As you can see below, Five9's revenue growth has been very strong over the last twelve months, growing from $95 million to $137 million.

And unsurprisingly, this was another great quarter for Five9 with revenue up an absolutely stunning 45% year on year. But the growth did slow down compared to last quarter, as the revenue increased by just $9.99 million in Q1, compared to $15.7 million in Q4 2020. A one-off fluctuation is usually not concerning, but it is worth keeping in mind.

Profitability With Scale

One of the attractive features of software companies is that once the software is built, it doesn’t cost a lot to run, so margins can be high, and we'd expect them to improve as the company grows. However, Five9 has a lower gross margin than many software companies, because it also has to pay fees to telecommunications providers to keep the virtual contact center connected with its own customers.

Five9's gross profit margin, an important metric measuring how much money there is left after paying for servers, licences, technical support and other necessary running expenses was at 56.6% in Q1. That means that for every $1 in revenue the company had $0.56 left to spend on developing new products, marketing & sales and the general administrative overhead. This is a low gross margin for a SaaS company and it has dropped significantly from the previous quarter, which is exactly the opposite we would want it to do.

Key Takeaways from Five9's Q1 Results

With market capitalisation of $12 billion and more than $643 million in cash, the company has the capacity to continue to prioritise growth.

We were impressed by how strongly Five9 outperformed analysts’ revenue expectations this quarter. And we were also glad that the revenue guidance for the next quarter exceeded analysts' expectations. On the other hand, it was disappointing to see the deterioration in gross margin. Overall, we think this was a strong quarter, that should leave shareholders feeling very positive. Therefore, we think Five9 will look more attractive to growth investors after these results.

The author has no position in any of the stocks mentioned.