Call center software provider Five9 (NASDAQ: FIVN) reported results ahead of analysts' expectations in Q1 CY2024, with revenue up 13.1% year on year to $247 million. On the other hand, next quarter's revenue guidance of $244.5 million was less impressive, coming in 1.4% below analysts' estimates. It made a non-GAAP profit of $0.48 per share, improving from its profit of $0.41 per share in the same quarter last year.

Five9 (FIVN) Q1 CY2024 Highlights:

- Revenue: $247 million vs analyst estimates of $240.1 million (2.9% beat)

- EPS (non-GAAP): $0.48 vs analyst estimates of $0.39 (24.5% beat)

- Revenue Guidance for Q2 CY2024 is $244.5 million at the midpoint, below analyst estimates of $248.1 million

- The company reconfirmed its revenue guidance for the full year of $1.06 billion at the midpoint

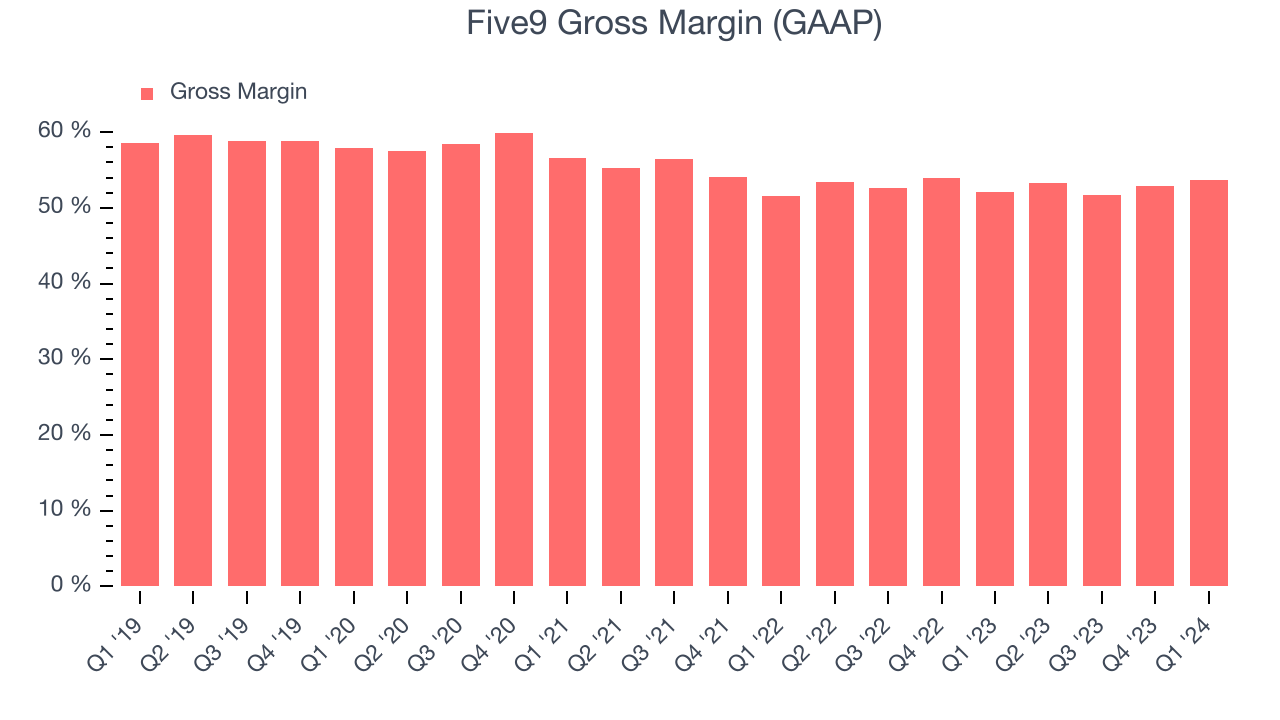

- Gross Margin (GAAP): 53.6%, up from 52% in the same quarter last year

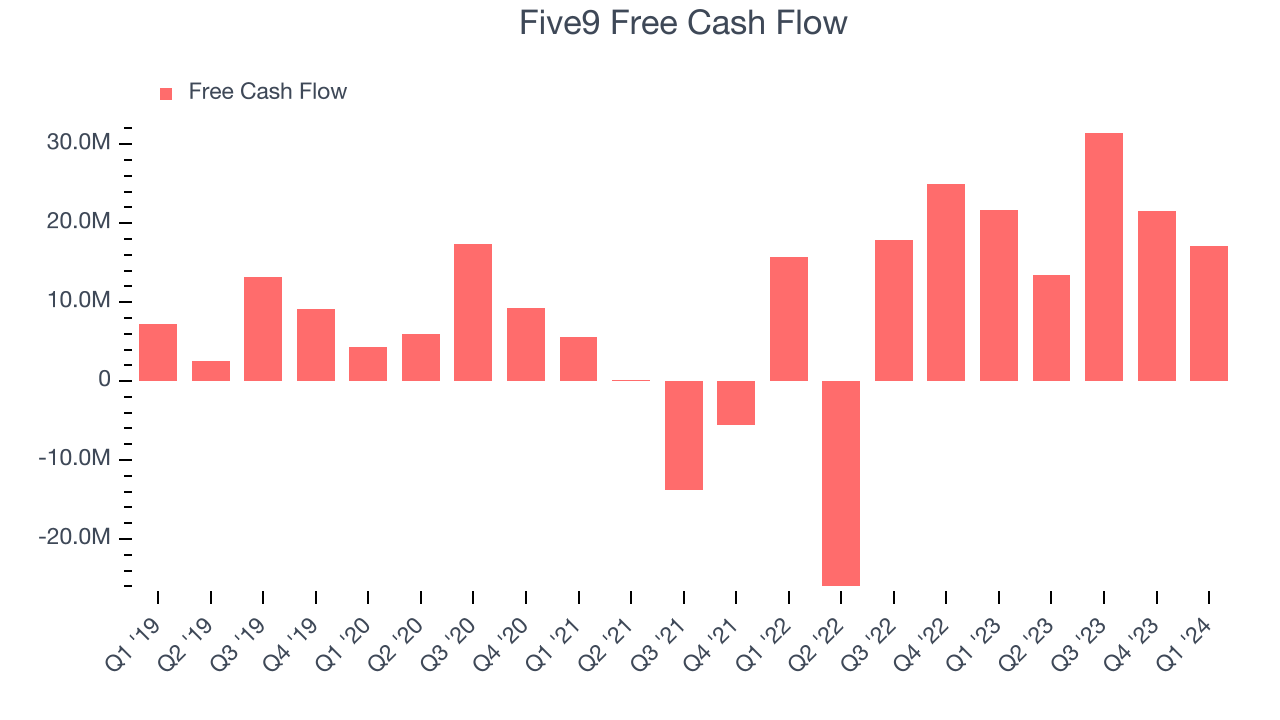

- Free Cash Flow of $17.16 million, down 20.3% from the previous quarter

- Market Capitalization: $4.30 billion

Started in 2001, Five9 (NASDAQ: FIVN) offers software as a service that makes it easier for companies to set up and efficiently run call centers, and offer more tailored customer support.

Its virtual contact center software provides phone connectivity, monitors agent performance, and guides agents through conversations to make them more effective. Arguably, the key advantage of a virtual contact center is that the software can automate some of the processes, including substituting humans with robot “intelligent virtual agents” for the easier requests. Crucially, Five9 integrates with multiple major enterprise software platforms, for example integration with Salesforce allows contact center agents to access customer profiles and manage customer data during interactions.

As more of our commercial interactions take place over the internet, the need for call centres and online support will only grow. Furthermore, the virtual call centre software providers can benefit from the remote work trend because they allow contact center agents to work from home using just a computer and a headset.

In early 2021 Zoom Communications (ZM) attempted to buy Five9 in an all stock deal, but the acquisition fell through due to lack of shareholder support, after it was revealed that regulators were reviewing the planned deal due to concerns about foreign participation.

Video Conferencing

Work is becoming more distributed, both across geographies and devices. In order for businesses to keep functioning efficiently, they need to be able to communicate as well as they did when the teams were co-located, which drives the demand for integrated communication platforms.

Five9’s closest competitor in this space is a fellow cloud software provider Nice Systems (NASDAQ:NICE), but it also competes with legacy on-premise systems from Oracle (NYSE:ORCL) and Avaya (NYSE:AVYA), which are losing market share.

Sales Growth

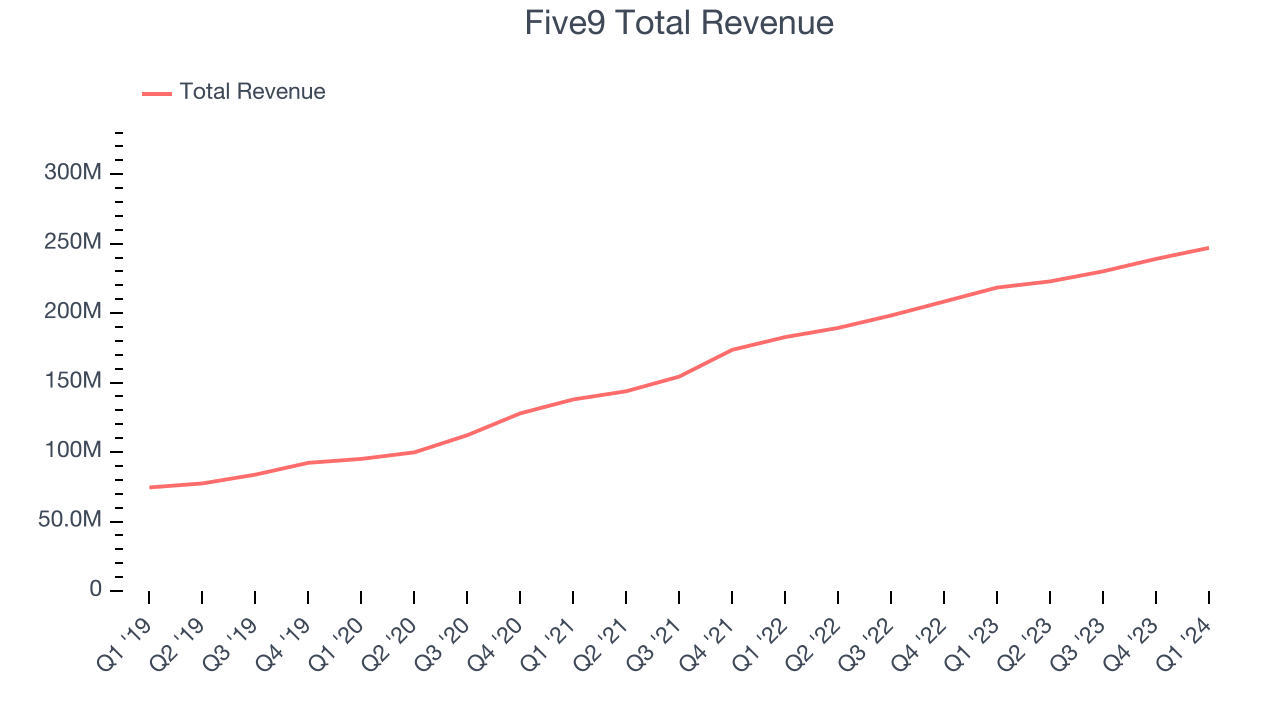

As you can see below, Five9's revenue growth has been strong over the last three years, growing from $137.9 million in Q1 2021 to $247 million this quarter.

This quarter, Five9's quarterly revenue was once again up 13.1% year on year. However, its growth did slow down a little compared to last quarter as the company increased revenue by $7.95 million in Q1 compared to $8.96 million in Q4 CY2023. While we'd like to see revenue increase by a greater amount each quarter, a one-off fluctuation is usually not concerning.

Next quarter's guidance suggests that Five9 is expecting revenue to grow 9.7% year on year to $244.5 million, slowing down from the 17.7% year-on-year increase it recorded in the same quarter last year. Looking ahead, analysts covering the company were expecting sales to grow 17.7% over the next 12 months before the earnings results announcement.

Profitability

What makes the software as a service business so attractive is that once the software is developed, it typically shouldn't cost much to provide it as an ongoing service to customers. Five9's gross profit margin, an important metric measuring how much money there's left after paying for servers, licenses, technical support, and other necessary running expenses, was 53.6% in Q1.

That means that for every $1 in revenue the company had $0.54 left to spend on developing new products, sales and marketing, and general administrative overhead. While its gross margin has improved significantly since the previous quarter, Five9's gross margin is still poor for a SaaS business. It's vital that the company continues to improve this key metric.

Cash Is King

If you've followed StockStory for a while, you know that we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can't use accounting profits to pay the bills. Five9's free cash flow came in at $17.16 million in Q1, down 20.8% year on year.

Five9 has generated $83.55 million in free cash flow over the last 12 months, or 8.9% of revenue. This FCF margin enables it to reinvest in its business without depending on the capital markets.

Key Takeaways from Five9's Q1 Results

It was good to see Five9 beat analysts' revenue, billings, and EPS estimates this quarter. On the other hand, its revenue guidance for next quarter missed analysts' expectations. Overall, this was a solid quarter for Five9. The stock is up 7.7% after reporting and currently trades at $61 per share.

Is Now The Time?

When considering an investment in Five9, investors should take into account its valuation and business qualities as well as what's happened in the latest quarter.

Although we have other favorites, we understand the arguments that Five9 isn't a bad business. Its revenue growth has been solid over the last three years. And while its gross margins show its business model is much less lucrative than the best software businesses, the good news is its customers are spending noticeably more each year, which is great to see.

Five9's price-to-sales ratio based on the next 12 months is 3.8x, suggesting the market is expecting more moderate growth relative to the hottest software stocks. In the end, beauty is in the eye of the beholder. While Five9 wouldn't be our first pick, if you like the business, it seems to be trading at a pretty compelling price right now.

Wall Street analysts covering the company had a one-year price target of $83.55 right before these results (compared to the current share price of $61).

To get the best start with StockStory, check out our most recent Stock picks, and then sign up for our earnings alerts by adding companies to your watchlist here. We typically have the quarterly earnings results analyzed within seconds of the data being released. Especially for companies reporting pre-market, this often gives investors the chance to react to the results before everyone else has fully absorbed the information.