Call center software provider Five9 (NASDAQ: FIVN) reported results in line with analysts' expectations in Q4 FY2023, with revenue up 14.7% year on year to $239.1 million. On the other hand, next quarter's revenue guidance of $239.5 million was less impressive, coming in 2.5% below analysts' estimates. It made a non-GAAP profit of $0.61 per share, improving from its profit of $0.54 per share in the same quarter last year.

Five9 (FIVN) Q4 FY2023 Highlights:

- Revenue: $239.1 million vs analyst estimates of $238.1 million (small beat)

- EPS (non-GAAP): $0.61 vs analyst estimates of $0.49 (25.5% beat)

- Revenue Guidance for Q1 2024 is $239.5 million at the midpoint, below analyst estimates of $245.6 million

- Management's revenue guidance for the upcoming financial year 2024 is $1.06 billion at the midpoint, in line with analyst expectations and implying 15.9% growth (vs 17% in FY2023)

- Free Cash Flow of $21.53 million, down 31.6% from the previous quarter

- Gross Margin (GAAP): 52.9%, down from 53.9% in the same quarter last year

- Market Capitalization: $5.18 billion

Started in 2001, Five9 (NASDAQ: FIVN) offers software as a service that makes it easier for companies to set up and efficiently run call centers, and offer more tailored customer support.

Its virtual contact center software provides phone connectivity, monitors agent performance, and guides agents through conversations to make them more effective. Arguably, the key advantage of a virtual contact center is that the software can automate some of the processes, including substituting humans with robot “intelligent virtual agents” for the easier requests. Crucially, Five9 integrates with multiple major enterprise software platforms, for example integration with Salesforce allows contact center agents to access customer profiles and manage customer data during interactions.

As more of our commercial interactions take place over the internet, the need for call centres and online support will only grow. Furthermore, the virtual call centre software providers can benefit from the remote work trend because they allow contact center agents to work from home using just a computer and a headset.

In early 2021 Zoom Communications (ZM) attempted to buy Five9 in an all stock deal, but the acquisition fell through due to lack of shareholder support, after it was revealed that regulators were reviewing the planned deal due to concerns about foreign participation.

Video Conferencing

Work is becoming more distributed, both across geographies and devices. In order for businesses to keep functioning efficiently, they need to be able to communicate as well as they did when the teams were co-located, which drives the demand for integrated communication platforms.

Five9’s closest competitor in this space is a fellow cloud software provider Nice Systems (NASDAQ:NICE), but it also competes with legacy on-premise systems from Oracle (NYSE:ORCL) and Avaya (NYSE:AVYA), which are losing market share.

Sales Growth

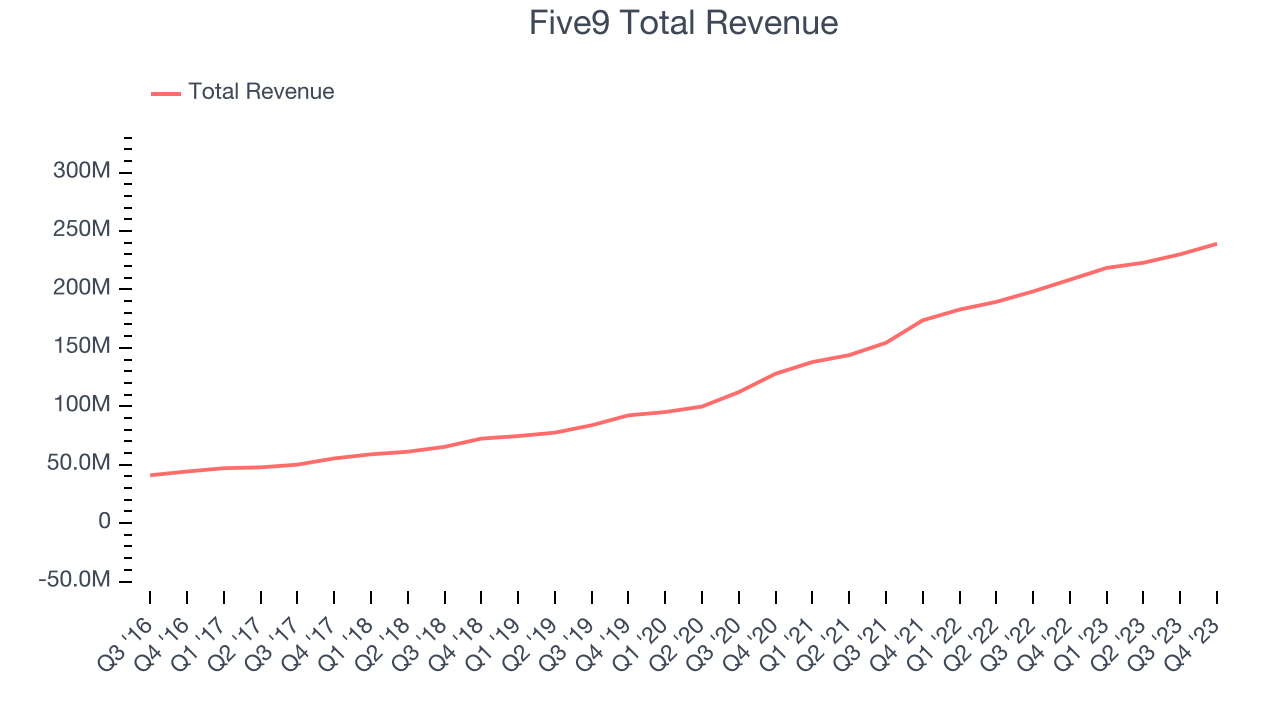

As you can see below, Five9's revenue growth has been strong over the last two years, growing from $173.6 million in Q4 FY2021 to $239.1 million this quarter.

This quarter, Five9's quarterly revenue was once again up 14.7% year on year. We can see that Five9's revenue increased by $8.96 million quarter on quarter, which is a solid improvement from the $7.22 million increase in Q3 2023. Shareholders should applaud the re-acceleration of growth.

Next quarter's guidance suggests that Five9 is expecting revenue to grow 9.6% year on year to $239.5 million, slowing down from the 19.5% year-on-year increase it recorded in the same quarter last year. For the upcoming financial year, management expects revenue to be $1.06 billion at the midpoint, growing 15.9% year on year compared to the 16.9% increase in FY2023.

Profitability

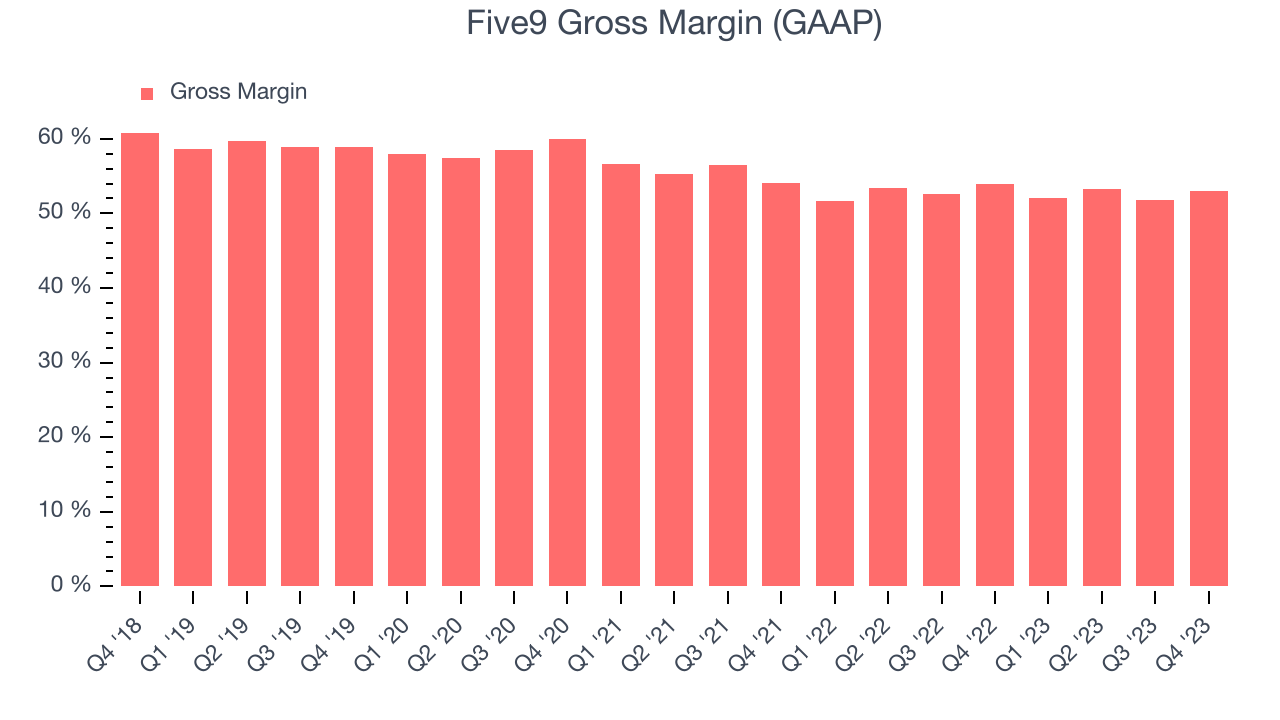

What makes the software as a service business so attractive is that once the software is developed, it typically shouldn't cost much to provide it as an ongoing service to customers. Five9's gross profit margin, an important metric measuring how much money there's left after paying for servers, licenses, technical support, and other necessary running expenses, was 52.9% in Q4.

That means that for every $1 in revenue the company had $0.53 left to spend on developing new products, sales and marketing, and general administrative overhead. While its gross margin has improved significantly since the previous quarter, Five9's gross margin is still poor for a SaaS business.

Cash Is King

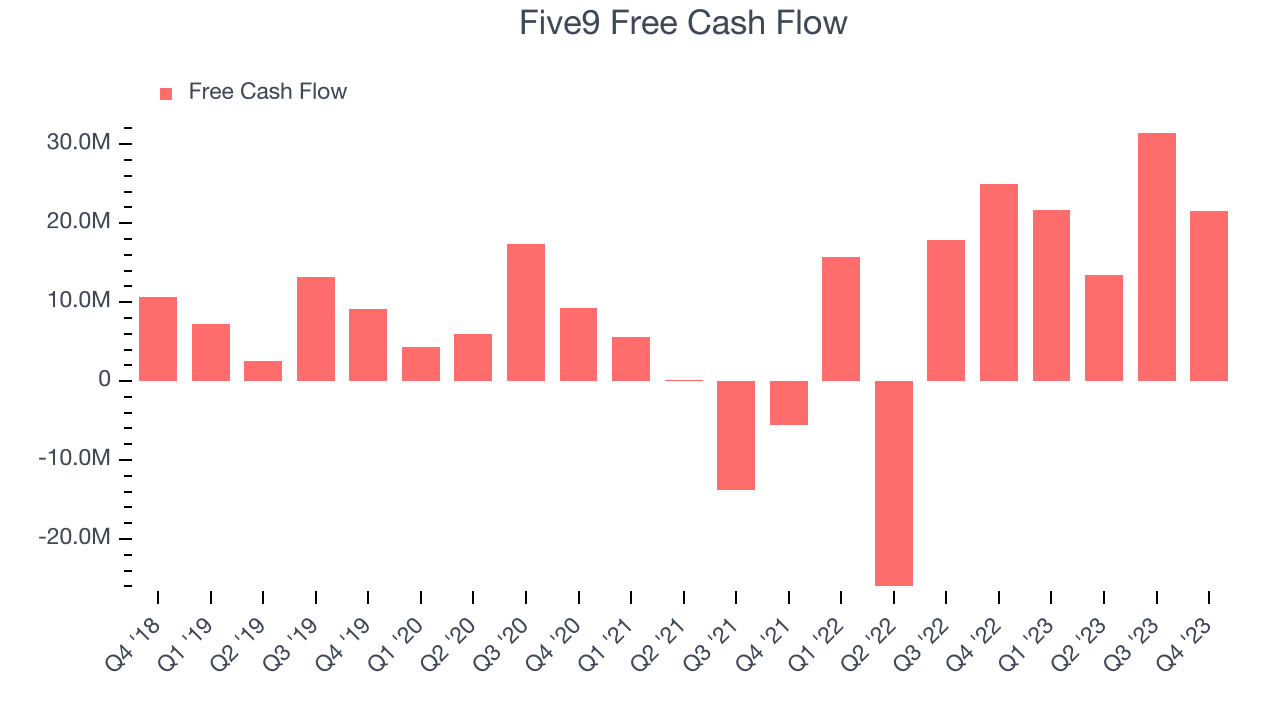

If you've followed StockStory for a while, you know that we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can't use accounting profits to pay the bills. Five9's free cash flow came in at $21.53 million in Q4, down 13.9% year on year.

Five9 has generated $88.07 million in free cash flow over the last 12 months, or 9.7% of revenue. This FCF margin enables it to reinvest in its business without depending on the capital markets.

Key Takeaways from Five9's Q4 Results

Five9's revenue guidance indicates that growth will stay steady, but it did come below Wall St's estimates and the market is likely to punish that. Gross margins and free cash flow were down. Overall, this was a mediocre quarter for Five9. The company is down 6.1% on the results and currently trades at $66.79 per share.

Is Now The Time?

When considering an investment in Five9, investors should take into account its valuation and business qualities as well as what's happened in the latest quarter.

Although Five9 isn't a bad business, it probably wouldn't be one of our picks. Although its , Wall Street expects growth to deteriorate from here. On top of that, its gross margins show its business model is much less lucrative than the best software businesses.

Five9's price-to-sales ratio based on the next 12 months is 4.9x, suggesting that the market has lower expectations of the business, relative to the high growth tech stocks. We can find things to like about Five9 and there's no doubt it's a bit of a market darling, at least for some. But we are wondering whether there might be better opportunities elsewhere right now.

Wall Street analysts covering the company had a one-year price target of $88.10 per share right before these results (compared to the current share price of $66.79).

To get the best start with StockStory check out our most recent Stock picks, and then sign up to our earnings alerts by adding companies to your watchlist here. We typically have the quarterly earnings results analyzed within seconds of the data being released, and especially for the companies reporting pre-market, this often gives investors the chance to react to the results before the market has fully absorbed the information.