Electricity storage and software provider Fluence (NASDAQ:FLNC) reported Q2 CY2024 results beating Wall Street analysts' expectations, with revenue down 9.9% year on year to $483.3 million. On the other hand, the company's full-year revenue guidance of $2.75 billion at the midpoint came in 5.9% below analysts' estimates. It made a GAAP loss of $0 per share, improving from its loss of $0.20 per share in the same quarter last year.

Is now the time to buy Fluence Energy? Find out by accessing our full research report, it's free.

Fluence Energy (FLNC) Q2 CY2024 Highlights:

- Revenue: $483.3 million vs analyst estimates of $462.8 million (4.4% beat)

- EPS: $0 vs analyst estimates of -$0.12 ($0.12 beat)

- The company dropped its revenue guidance for the full year from $3 billion to $2.75 billion at the midpoint, a 8.3% decrease

- EBITDA guidance for the full year is $60 million at the midpoint, below analyst estimates of $65.78 million

- Gross Margin (GAAP): 17.2%, up from 4.1% in the same quarter last year

- EBITDA Margin: 3.2%, up from -4.9% in the same quarter last year

- Free Cash Flow was -$32.06 million, down from $65.99 million in the previous quarter

- Backlog: $4.5 billion at quarter end

- Market Capitalization: $1.84 billion

"We delivered a tremendous quarter highlighted by achieving approximately $15.6 million Adjusted EBITDA1, our highest order intake, and a record backlog of $4.5 billion," said Julian Nebreda, the Company’s President and Chief Executive Officer.

Pioneering the use of lithium-ion batteries for grid storage, Fluence (NASDAQ:FLNC) helps store renewable energy sources with battery systems.

Renewable Energy

Renewable energy companies are buoyed by the secular trend of green energy that is upending traditional power generation. Those who innovate and evolve with this dynamic market can win share while those who continue to rely on legacy technologies can see diminishing demand, which includes headwinds from increasing regulation against “dirty” energy. Additionally, these companies are at the whim of economic cycles, as interest rates can impact the willingness to invest in renewable energy projects.

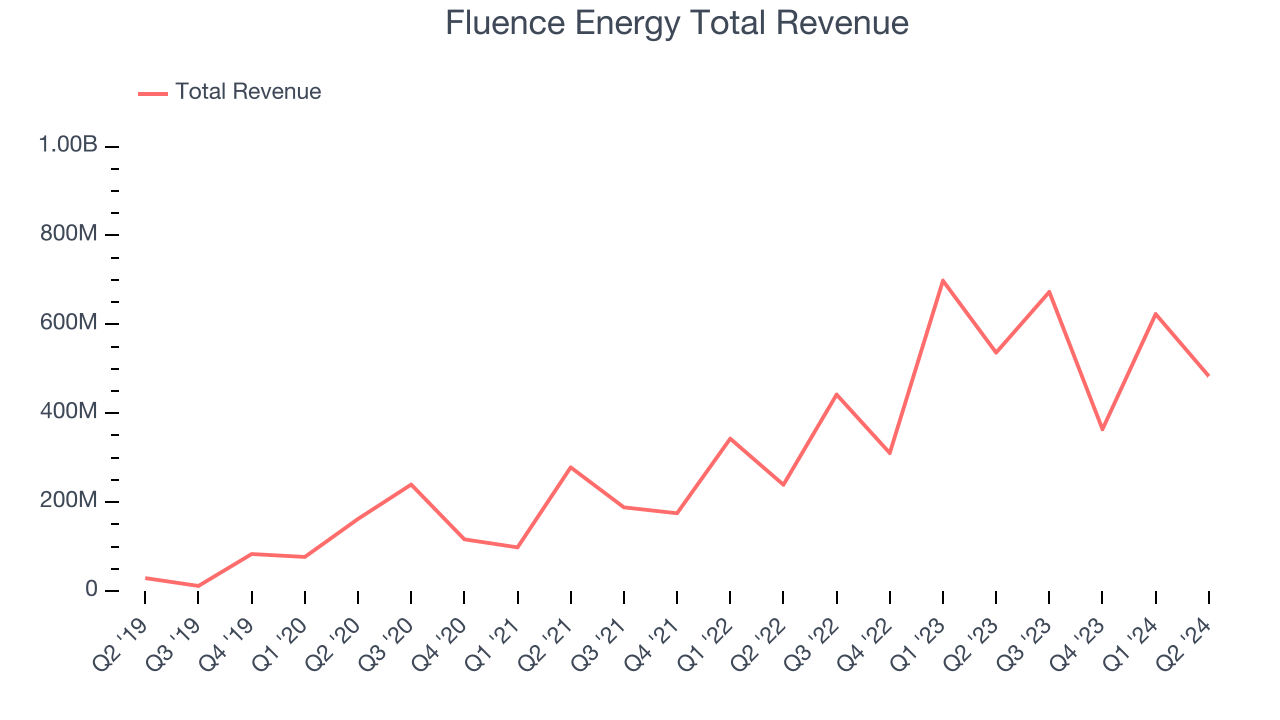

Sales Growth

A company’s long-term performance can give signals about its business quality. Even a bad business can shine for one or two quarters, but a top-tier one tends to grow for years. Luckily, Fluence Energy's sales grew at an incredible 78.7% compounded annual growth rate over the last five years. This is a great starting point for our analysis because it shows Fluence Energy's offerings resonate with customers.

We at StockStory place the most emphasis on long-term growth, but within industrials, a half-decade historical view may miss cycles, industry trends, or a company capitalizing on catalysts such as a new contract win or a successful product line. Fluence Energy's annualized revenue growth of 50.6% over the last two years is below its five-year trend, but we still think the results were good and suggest demand was strong.

This quarter, Fluence Energy's revenue fell 9.9% year on year to $483.3 million but beat Wall Street's estimates by 4.4%. Looking ahead, Wall Street expects sales to grow 90.4% over the next 12 months, an acceleration from this quarter.

Today’s young investors won’t have read the timeless lessons in Gorilla Game: Picking Winners In High Technology because it was written more than 20 years ago when Microsoft and Apple were first establishing their supremacy. But if we apply the same principles, then enterprise software stocks leveraging their own generative AI capabilities may well be the Gorillas of the future. So, in that spirit, we are excited to present our Special Free Report on a profitable, fast-growing enterprise software stock that is already riding the automation wave and looking to catch the generative AI next.

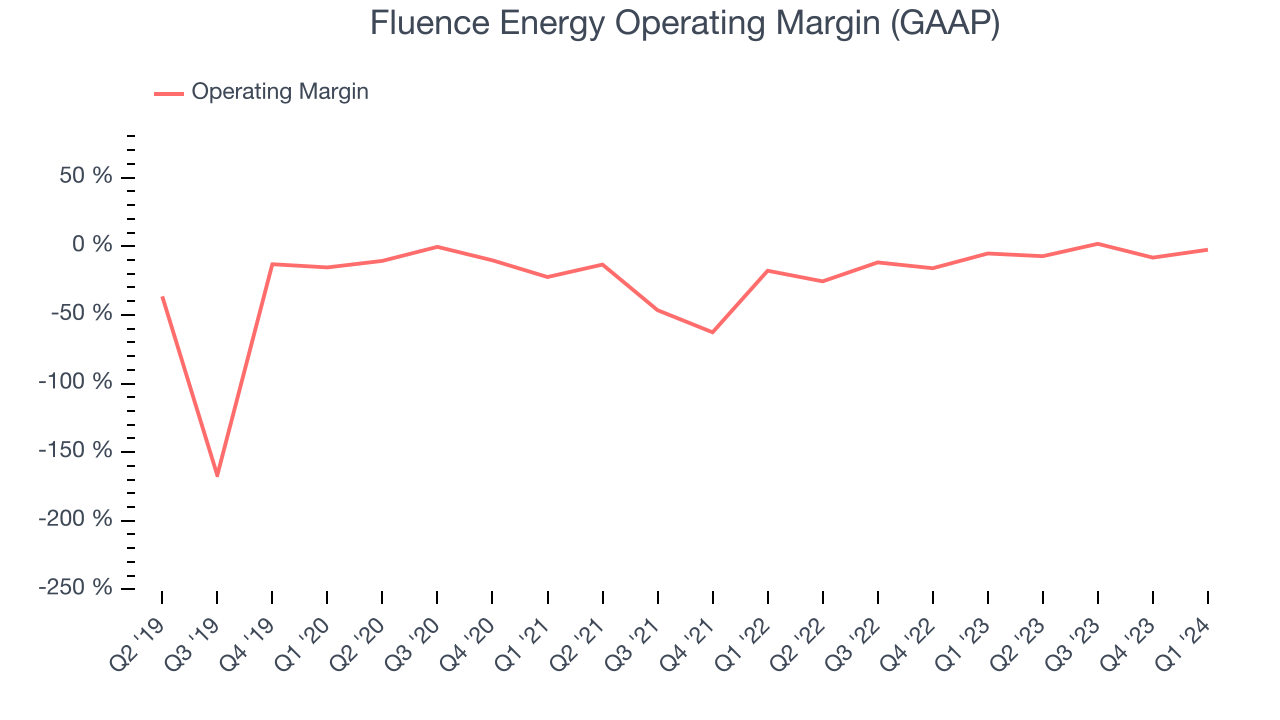

Operating Margin

Operating margin is a key measure of profitability. Think of it as net income–the bottom line–excluding the impact of taxes and interest on debt, which are less connected to business fundamentals.

Unprofitable industrials companies require extra attention because they could get caught swimming naked if the tide goes out. It's hard to trust that Fluence Energy can endure a full cycle as its high expenses have contributed to an average operating margin of negative 11.7% over the last five years. This result isn't too surprising given its low gross margin as a starting point.

On the bright side, Fluence Energy's annual operating margin rose by 22.3 percentage points over the last five years, as its sales growth gave it immense operating leverage. Still, it will take much more for the company to reach long-term profitability.

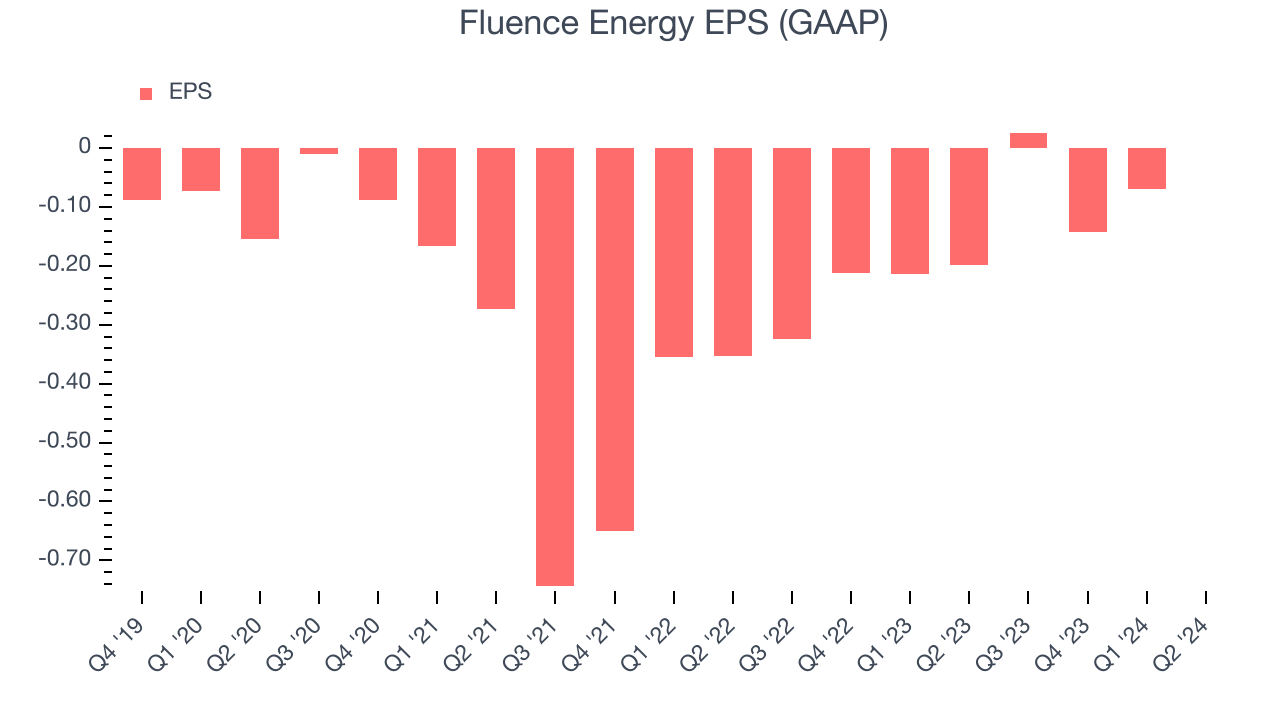

EPS

We track the long-term growth in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company's growth was profitable.

Although Fluence Energy's full-year earnings are still negative, it reduced its losses and improved its EPS by 9.3% annually over the last four years. The next few quarters will be critical for assessing its long-term profitability. We hope to see an inflection point soon.

In Q2, Fluence Energy reported EPS at $0, up from negative $0.20 in the same quarter last year. This print easily cleared analysts' estimates, and shareholders should be content with the results. Over the next 12 months, Wall Street is optimistic. Analysts are projecting Fluence Energy's EPS of negative $0.19 in the last year to flip to positive $0.64.

Key Takeaways from Fluence Energy's Q2 Results

We were impressed by how significantly Fluence Energy blew past analysts' EPS expectations this quarter. We were also excited its revenue outperformed Wall Street's estimates. On the other hand, its full-year guidance was below expectations, but the market seems to be looking past this. The stock traded up 12.2% to $15.55 immediately following the results.

So should you invest in Fluence Energy right now? When making that decision, it's important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it's free.