Quarterly earnings results are a good time to check in on a company’s progress, especially compared to its peers in the same sector. Today we are looking at Fluence Energy (NASDAQ:FLNC) and the best and worst performers in the renewable energy industry.

Renewable energy companies are buoyed by the secular trend of green energy that is upending traditional power generation. Those who innovate and evolve with this dynamic market can win share while those who continue to rely on legacy technologies can see diminishing demand, which includes headwinds from increasing regulation against “dirty” energy. Additionally, these companies are at the whim of economic cycles, as interest rates can impact the willingness to invest in renewable energy projects.

The 15 renewable energy stocks we track reported a mixed Q2. As a group, revenues missed analysts’ consensus estimates by 2.2% while next quarter’s revenue guidance was 9.3% below.

Valuation multiples for many growth stocks have not yet reverted to their early 2021 highs, but the market was optimistic at the end of 2023 due to cooling inflation. This year has been a different story as mixed inflation signals have led to market volatility, and while some renewable energy stocks have fared somewhat better than others, they have collectively declined. On average, share prices are down 1% since the latest earnings results.

Fluence Energy (NASDAQ:FLNC)

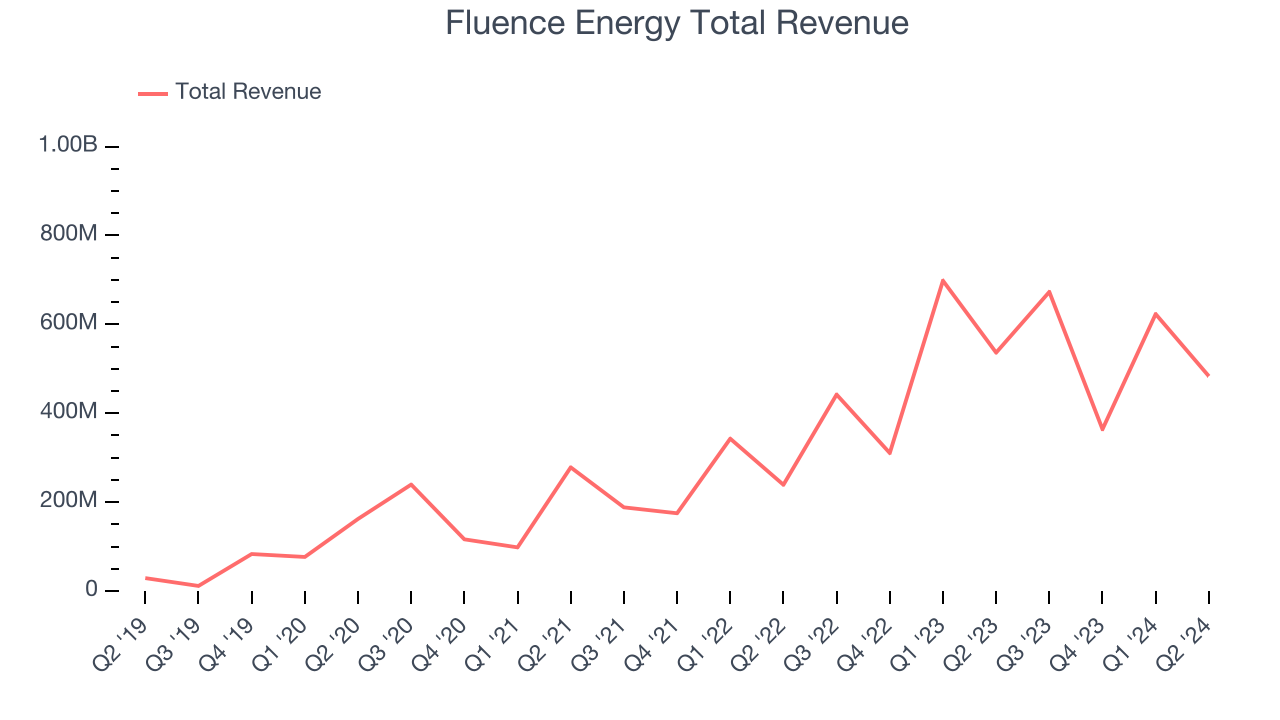

Pioneering the use of lithium-ion batteries for grid storage, Fluence (NASDAQ:FLNC) helps store renewable energy sources with battery systems.

Fluence Energy reported revenues of $483.3 million, down 9.9% year on year. This print exceeded analysts’ expectations by 4.4%. Overall, it was a satisfactory quarter for the company with an impressive beat of analysts’ earnings estimates but full-year revenue guidance missing analysts’ expectations.

"We delivered a tremendous quarter highlighted by achieving approximately $15.6 million Adjusted EBITDA1, our highest order intake, and a record backlog of $4.5 billion," said Julian Nebreda, the Company’s President and Chief Executive Officer.

Interestingly, the stock is up 57.6% since reporting and currently trades at $21.85.

Is now the time to buy Fluence Energy? Access our full analysis of the earnings results here, it’s free.

Best Q2: Sunrun (NASDAQ:RUN)

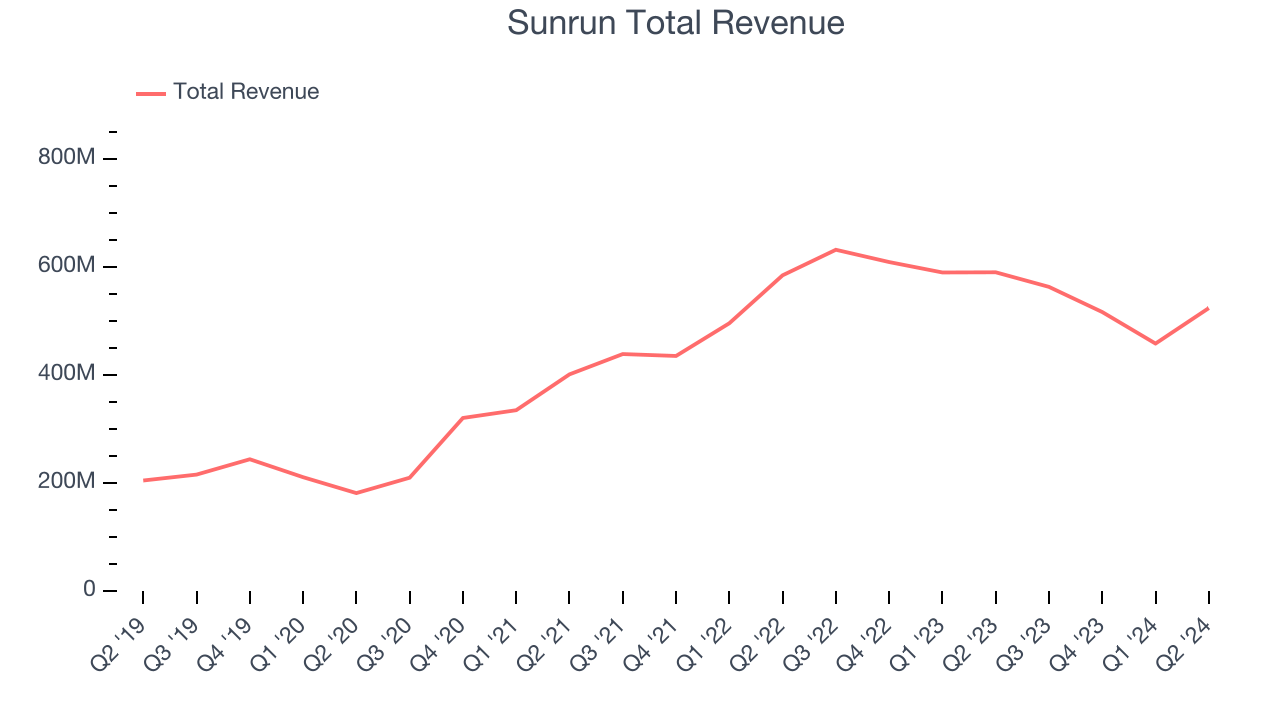

Helping homeowners use solar energy to power their homes, Sunrun (NASDAQ:RUN) provides residential solar electricity, specializing in panel installation and leasing services.

Sunrun reported revenues of $523.9 million, down 11.2% year on year, outperforming analysts’ expectations by 1.2%. The business had a stunning quarter with an impressive beat of analysts’ earnings estimates.

The market seems happy with the results as the stock is up 17.6% since reporting. It currently trades at $19.36.

Is now the time to buy Sunrun? Access our full analysis of the earnings results here, it’s free.

Weakest Q2: Blink Charging (NASDAQ:BLNK)

One of the first EV charging companies to go public, Blink Charging (NASDAQ:BLNK) is a manufacturer, owner, operator, and provider of electric vehicle charging equipment and networked EV charging services.

Blink Charging reported revenues of $33.26 million, up 1.3% year on year, falling short of analysts’ expectations by 14.5%. It was a disappointing quarter as it posted a miss of analysts’ earnings estimates.

As expected, the stock is down 27.3% since the results and currently trades at $1.84.

Read our full analysis of Blink Charging’s results here.

Plug Power (NASDAQ:PLUG)

Powering forklifts for Walmart’s distribution centers, Plug Power (NASDAQ:PLUG) provides hydrogen fuel cells used to power electric motors.

Plug Power reported revenues of $143.4 million, down 44.9% year on year. This number came in 23% below analysts' expectations. It was a softer quarter as it also produced full-year revenue guidance missing analysts’ expectations.

The stock is down 5.3% since reporting and currently trades at $1.98.

Read our full, actionable report on Plug Power here, it’s free.

Array (NASDAQ:ARRY)

Going public in October 2020, Array (NASDAQ:ARRY) is a global manufacturer of ground-mounting tracking systems for utility and distributed generation solar energy projects.

Array reported revenues of $255.8 million, down 49.6% year on year. This result topped analysts’ expectations by 9.2%. Taking a step back, it was a satisfactory quarter as it also recorded an impressive beat of analysts’ volume estimates but full-year revenue guidance missing analysts’ expectations.

The stock is down 23.5% since reporting and currently trades at $6.89.

Read our full, actionable report on Array here, it’s free.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.