E-commerce florist and gift retailer 1-800-FLOWERS (NASDAQ:FLWS) missed Wall Street’s revenue expectations in Q3 CY2024, with sales falling 10% year on year to $242.1 million. Its GAAP loss of $0.53 per share was 1.4% above analysts’ consensus estimates.

Is now the time to buy 1-800-FLOWERS? Find out by accessing our full research report, it’s free.

1-800-FLOWERS (FLWS) Q3 CY2024 Highlights:

- Revenue: $242.1 million vs analyst estimates of $246.1 million (1.6% miss)

- EPS (GAAP): -$0.53 vs analyst estimates of -$0.54 (beat by $0.01)

- EBITDA: -$27.95 million vs analyst estimates of -$25.64 million (9% miss)

- EBITDA guidance for the full year is $90 million at the midpoint, above analyst estimates of $88.1 million

- Gross Margin (GAAP): 38.1%, in line with the same quarter last year

- Operating Margin: -19.4%, down from -14.2% in the same quarter last year

- EBITDA Margin: -11.5%, down from -9.1% in the same quarter last year

- Free Cash Flow was -$189.3 million compared to -$150.9 million in the same quarter last year

- Market Capitalization: $511.9 million

“Our first quarter performance generally came in-line with our expectations, as we began to see a slight improvement in our e-commerce revenue trends during the quarter, our gross profit margin continued to grow, and we reduced expenses as a result of our Work Smarter initiatives to operate more efficiently,” said Jim McCann, Chairman and Chief Executive Officer of 1-800-FLOWERS.COM,

Company Overview

Founded in 1976, 1-800-FLOWERS (NASDAQ:FLWS) is an online retailer of flowers, gifts, and gourmet foods, serving customers globally.

Specialized Consumer Services

Some consumer discretionary companies don’t fall neatly into a category because their products or services are unique. Although their offerings may be niche, these companies have often found more efficient or technology-enabled ways of doing or selling something that has existed for a while. Technology can be a double-edged sword, though, as it may lower the barriers to entry for new competitors and allow them to do serve customers better.

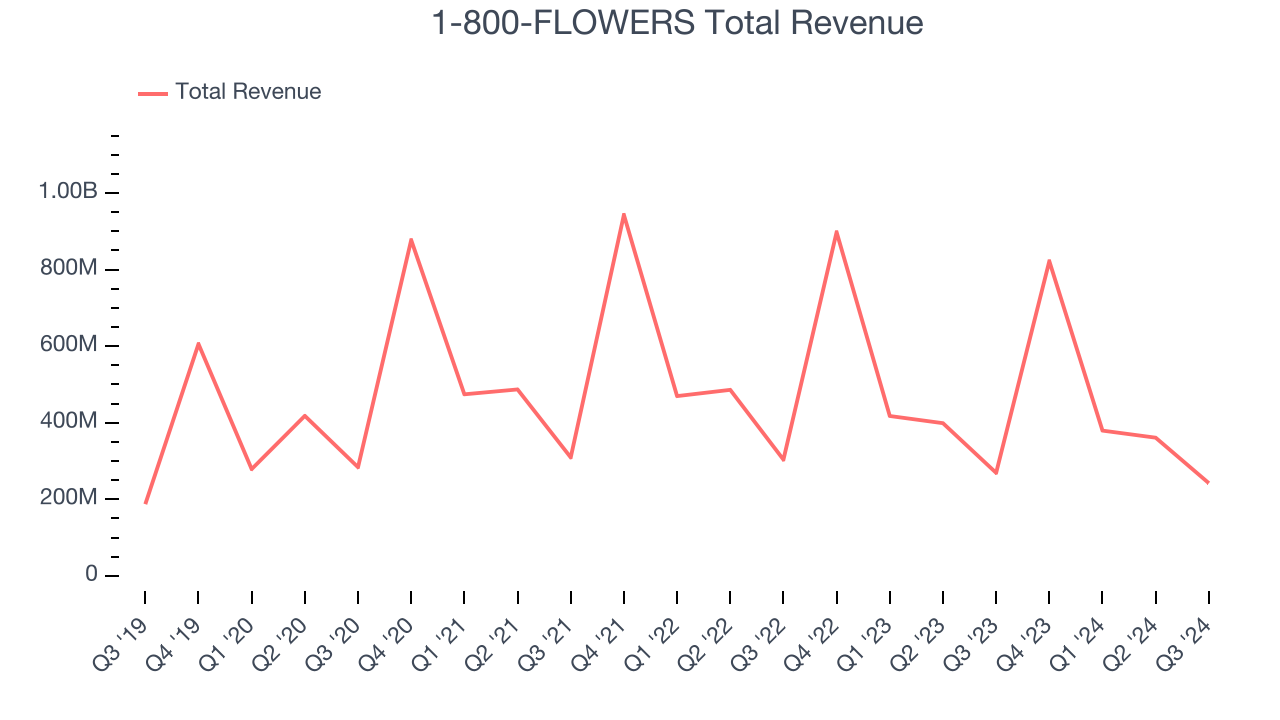

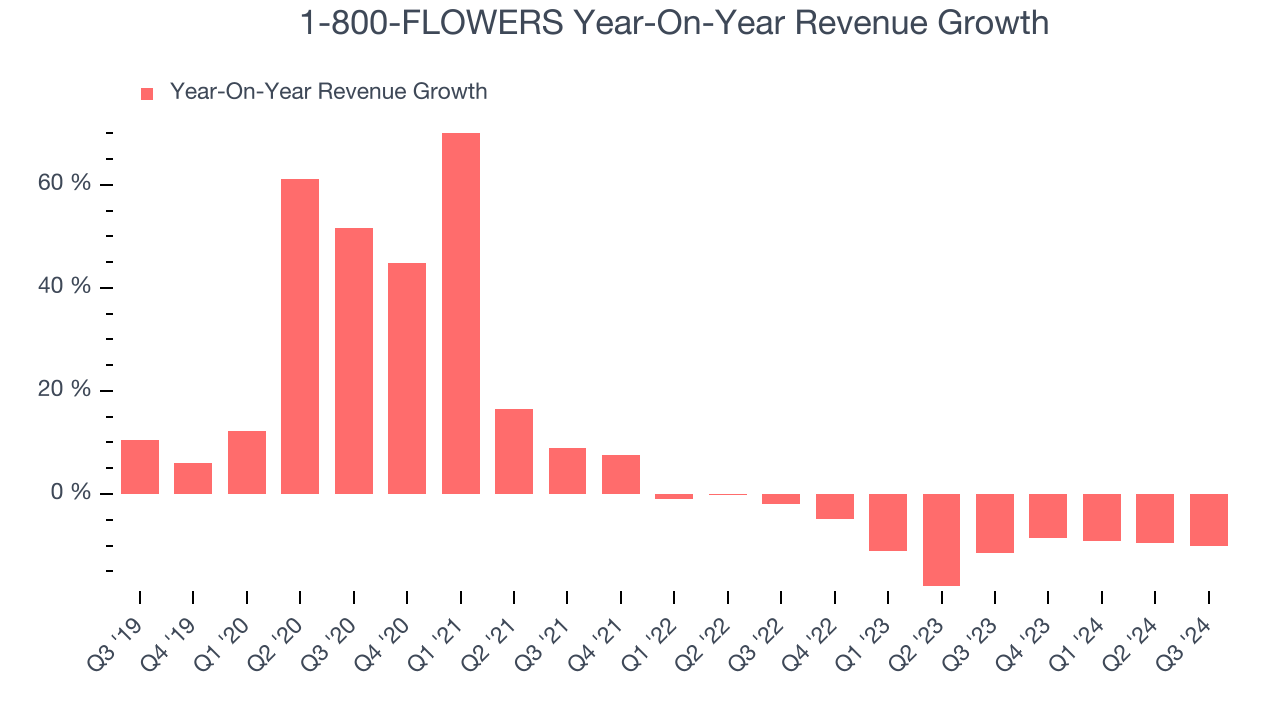

Sales Growth

Examining a company’s long-term performance can provide clues about its business quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul. Unfortunately, 1-800-FLOWERS’s 7.3% annualized revenue growth over the last five years was sluggish. This shows it failed to expand in any major way, a rough starting point for our analysis.

Long-term growth is the most important, but within consumer discretionary, product cycles are short and revenue can be hit-driven due to rapidly changing trends and consumer preferences. 1-800-FLOWERS’s history shows it grew in the past but relinquished its gains over the last two years, as its revenue fell by 9.5% annually.

This quarter, 1-800-FLOWERS missed Wall Street’s estimates and reported a rather uninspiring 10% year-on-year revenue decline, generating $242.1 million of revenue.

Looking ahead, sell-side analysts expect revenue to remain flat over the next 12 months, an improvement versus the last two years. While this projection shows the market thinks its newer products and services will catalyze better performance, it is still below average for the sector.

Unless you’ve been living under a rock, it should be obvious by now that generative AI is going to have a huge impact on how large corporations do business. While Nvidia and AMD are trading close to all-time highs, we prefer a lesser-known (but still profitable) semiconductor stock benefitting from the rise of AI. Click here to access our free report on our favorite semiconductor growth story.

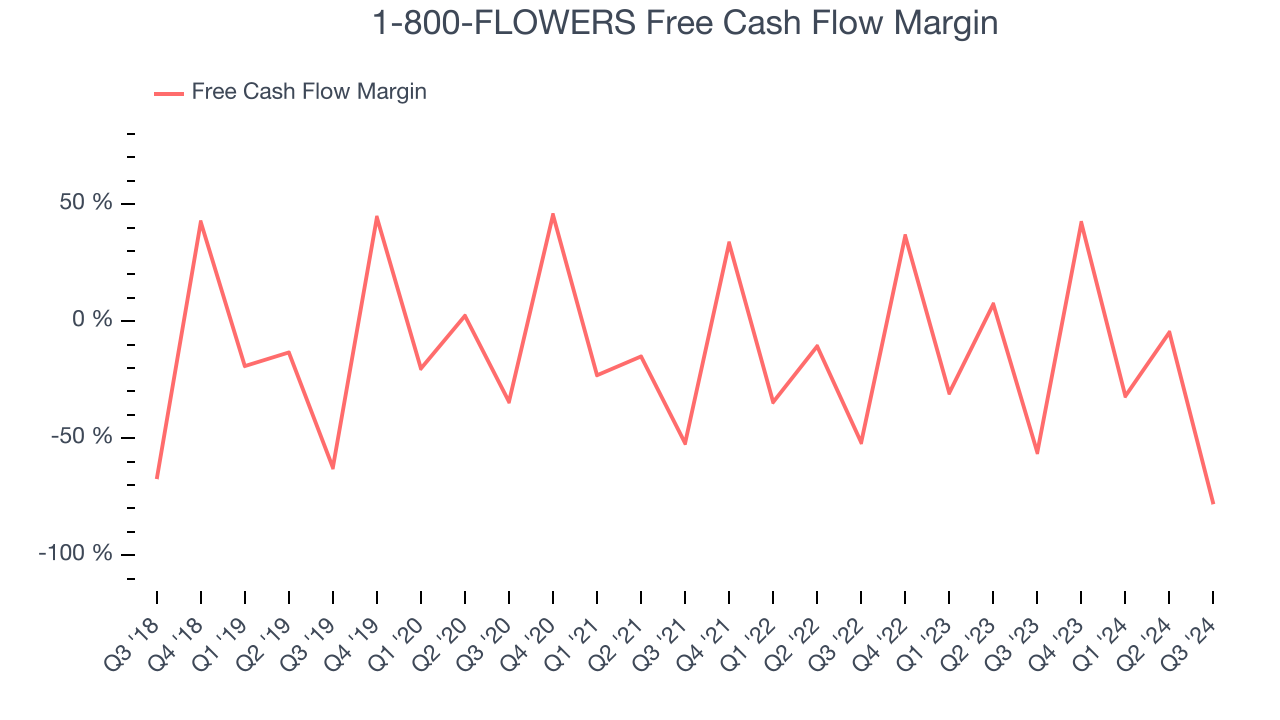

Cash Is King

Although earnings are undoubtedly valuable for assessing company performance, we believe cash is king because you can’t use accounting profits to pay the bills.

1-800-FLOWERS has shown poor cash profitability over the last two years, giving the company limited opportunities to return capital to shareholders. Its free cash flow margin averaged 2.5%, lousy for a consumer discretionary business.

1-800-FLOWERS burned through $189.3 million of cash in Q3, equivalent to a negative 78.2% margin. The company’s cash burn increased from $150.9 million of lost cash in the same quarter last year . These numbers deviate from its longer-term margin, raising some eyebrows.

Key Takeaways from 1-800-FLOWERS’s Q3 Results

We struggled to find many strong positives in these results as its revenue and EBITDA fell short of Wall Street’s estimates. On the bright side, its full-year EBITDA guidance was better than expected. Overall, this was a weaker quarter, but the stock traded up 5.4% to $8.42 immediately following the results due to the outlook.

So do we think 1-800-FLOWERS is an attractive buy at the current price? We think that the latest quarter is only one piece of the longer-term business quality puzzle. Quality, when combined with valuation, can help determine if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free.