E-commerce florist and gift retailer 1-800-FLOWERS (NASDAQ:FLWS) missed analysts' expectations in Q1 CY2024, with revenue down 9.1% year on year to $379.4 million. It made a GAAP loss of $0.26 per share, improving from its loss of $1.10 per share in the same quarter last year.

1-800-FLOWERS (FLWS) Q1 CY2024 Highlights:

- Revenue: $379.4 million vs analyst estimates of $383.8 million (1.2% miss)

- EPS: -$0.26 vs analyst expectations of -$0.25 (6.1% miss)

- Gross Margin (GAAP): 36.6%, up from 33.6% in the same quarter last year

- Free Cash Flow was -$121.4 million, down from $345.8 million in the previous quarter

- Market Capitalization: $584.3 million

Founded in 1976, 1-800-FLOWERS (NASDAQ:FLWS) is an online retailer of flowers, gifts, and gourmet foods, serving customers globally.

1-800-FLOWERS began as a single flower shop in 1976. The company's early adoption of a toll-free number and its domain name offered a new method of direct consumer access and convenience in the flower delivery service industry.

Today, 1-800-FLOWERS offers a range of products beyond flowers, including gourmet foods, gift baskets, and unique presents. This expansion reflects the company's desire to become a one-stop shop for thoughtful gifts.

The company's revenue is primarily generated through its e-commerce platform, with seasonal peaks around Valentine’s Day and Mother’s Day, and its business relies on efficient delivery networks and convenience.

Specialized Consumer Services

Some consumer discretionary companies don’t fall neatly into a category because their products or services are unique. Although their offerings may be niche, these companies have often found more efficient or technology-enabled ways of doing or selling something that has existed for a while. Technology can be a double-edged sword, though, as it may lower the barriers to entry for new competitors and allow them to do serve customers better.

Competitors operating in the online retail of flowers and gifts industry include Amazon (NASDAQ:AMZN), Kroger (NYSE:KR), and Walmart (NYSE:WMT).Sales Growth

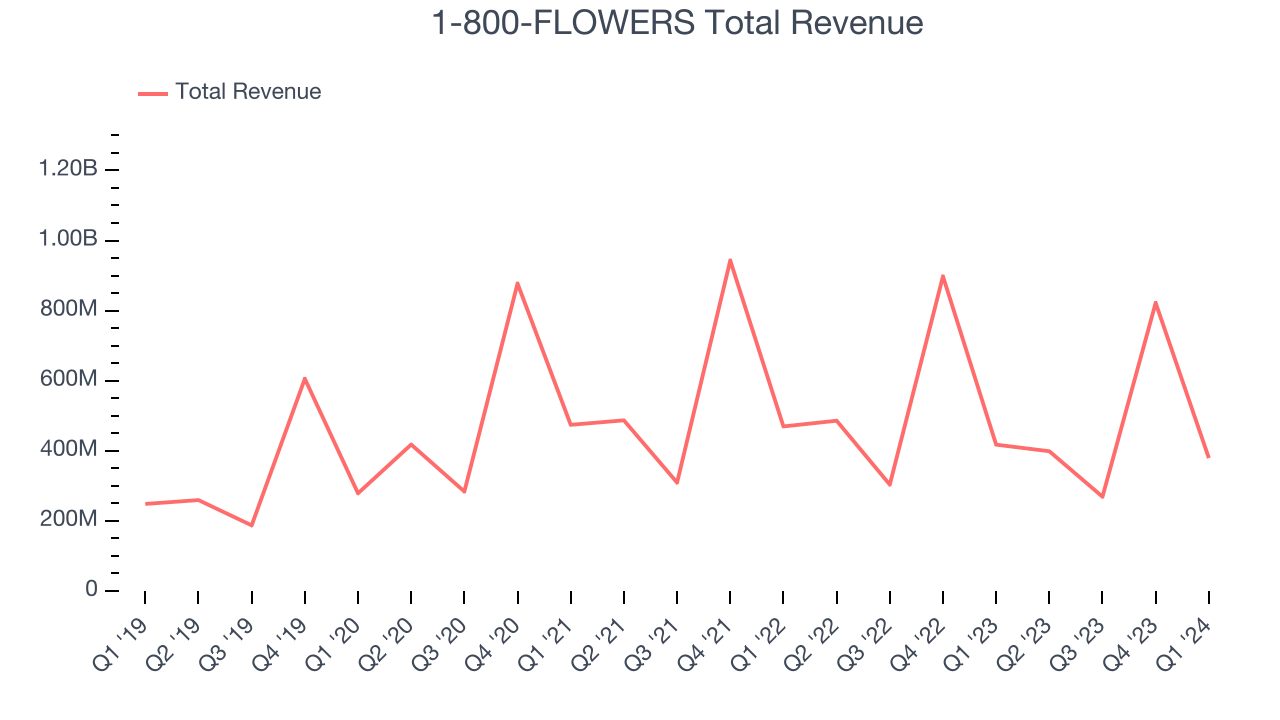

A company’s long-term performance can give signals about its business quality. Even a bad business can shine for one or two quarters, but a top-tier one may grow for years. 1-800-FLOWERS's annualized revenue growth rate of 8.3% over the last five years was weak for a consumer discretionary business.  Within consumer discretionary, a long-term historical view may miss a company riding a successful new product or emerging trend. That's why we also follow short-term performance. 1-800-FLOWERS's recent history shows a reversal from its already weak five-year trend as its revenue has shown annualized declines of 8% over the last two years.

Within consumer discretionary, a long-term historical view may miss a company riding a successful new product or emerging trend. That's why we also follow short-term performance. 1-800-FLOWERS's recent history shows a reversal from its already weak five-year trend as its revenue has shown annualized declines of 8% over the last two years.

This quarter, 1-800-FLOWERS missed Wall Street's estimates and reported a rather uninspiring 9.1% year-on-year revenue decline, generating $379.4 million of revenue. Looking ahead, Wall Street expects revenue to remain flat over the next 12 months.

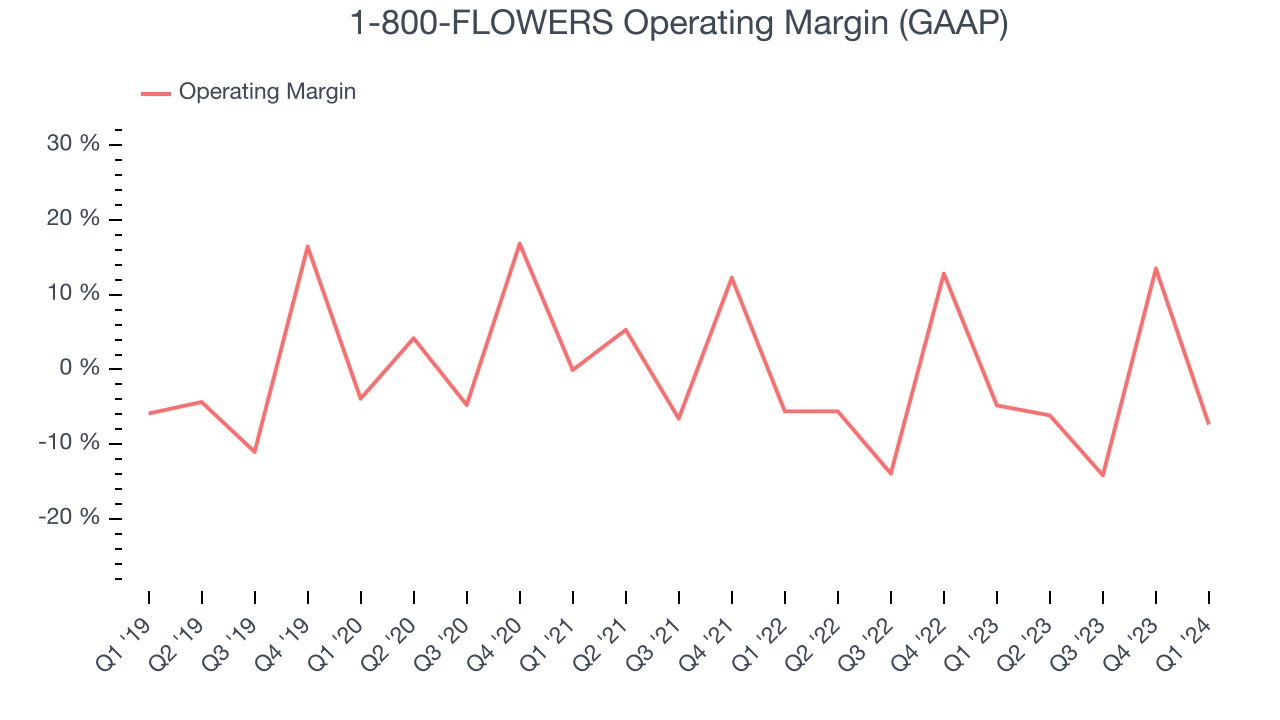

Operating Margin

Operating margin is an important measure of profitability. It’s the portion of revenue left after accounting for all core expenses–everything from the cost of goods sold to advertising and wages. Operating margin is also useful for comparing profitability across companies with different levels of debt and tax rates because it excludes interest and taxes.

1-800-FLOWERS was profitable over the last eight quarters but held back by its large expense base. Its average operating margin of 1.2% has been among the worst in the consumer discretionary sector.

In Q1, 1-800-FLOWERS generated an operating profit margin of negative 7.4%, down 2.6 percentage points year on year.

Over the next 12 months, Wall Street expects 1-800-FLOWERS to become more profitable. Analysts are expecting the company’s LTM operating margin of 1.1% to rise to 2.2%.EPS

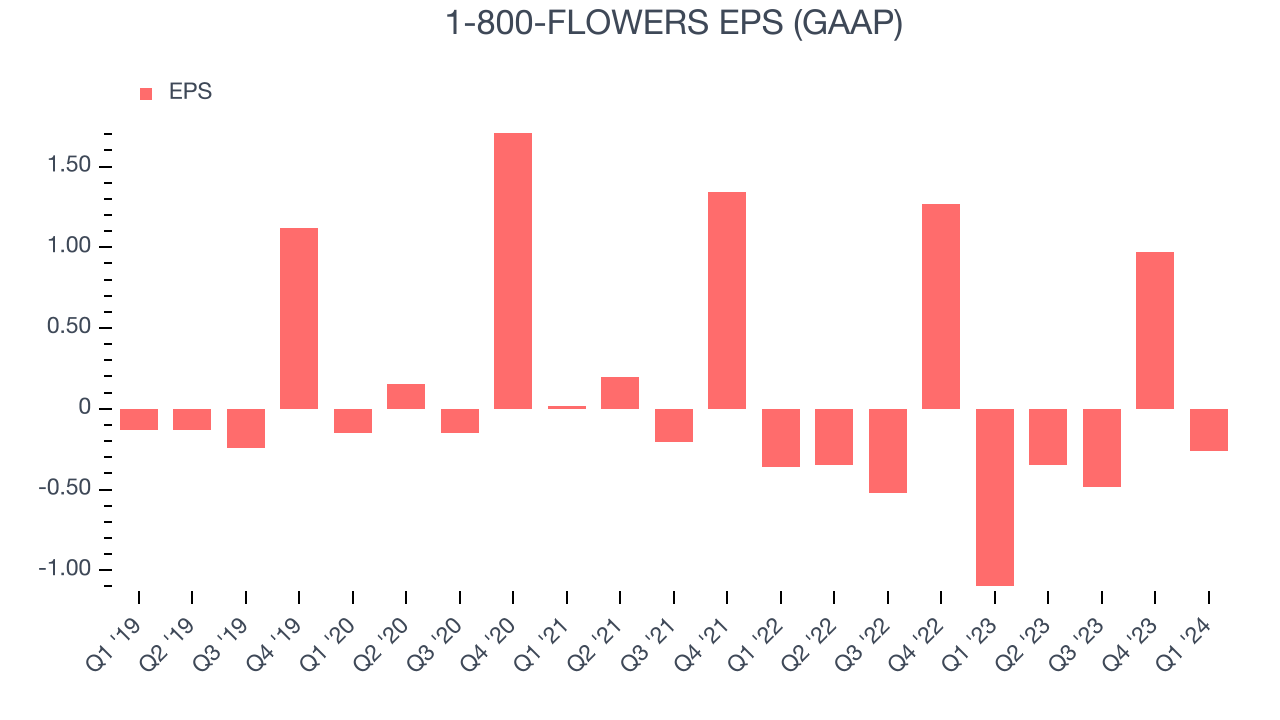

We track long-term historical earnings per share (EPS) growth for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company's growth was profitable.

Over the last five years, 1-800-FLOWERS's EPS dropped 136%, translating into 18.7% annualized declines. We tend to steer our readers away from companies with falling EPS, where diminishing earnings could imply changing secular trends or consumer preferences. Consumer discretionary companies are particularly exposed to this, leaving a low margin of safety around the company (making the stock susceptible to large downward swings).

In Q1, 1-800-FLOWERS reported EPS at negative $0.26, up from negative $1.10 in the same quarter last year. Despite growing year on year, this print unfortunately missed analysts' estimates. Over the next 12 months, Wall Street is optimistic. Analysts are projecting 1-800-FLOWERS's LTM EPS of negative $0.12 to reach break even.

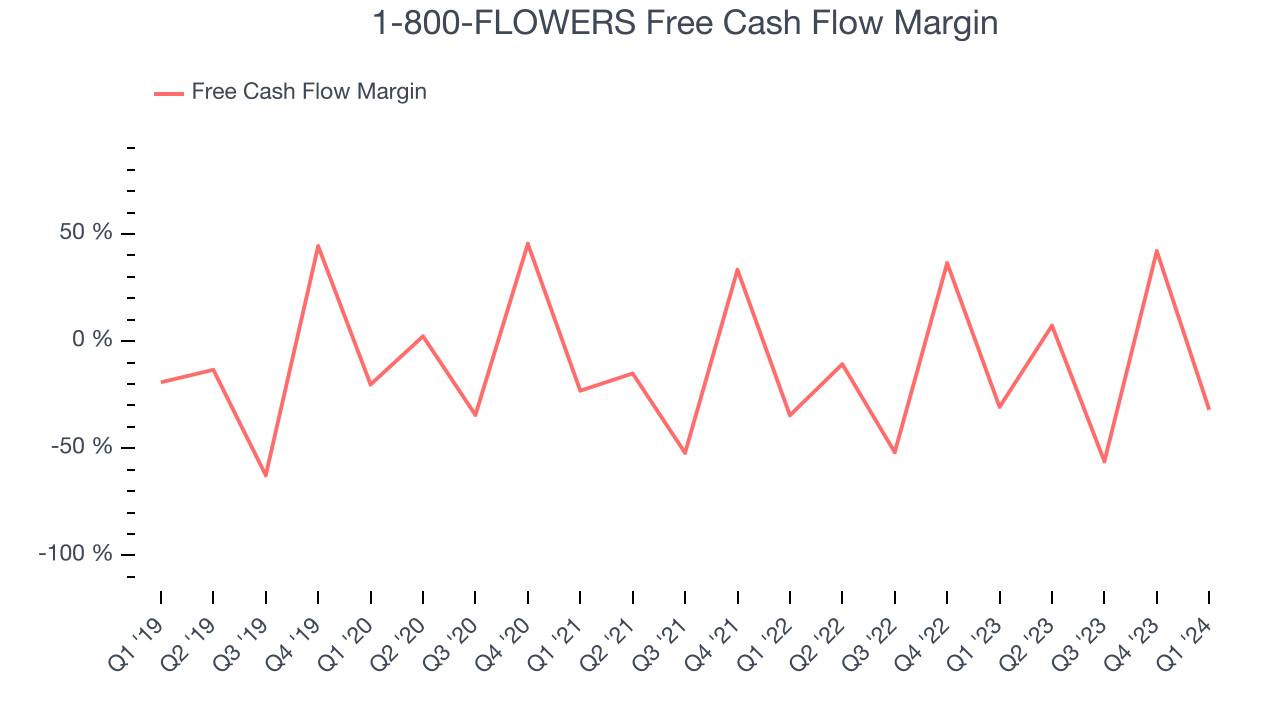

Cash Is King

Although earnings are undoubtedly valuable for assessing company performance, we believe cash is king because you can't use accounting profits to pay the bills.

Over the last two years, 1-800-FLOWERS has shown mediocre cash profitability, putting it in a pinch as it gives the company limited opportunities to reinvest, pay down debt, or return capital to shareholders. Its free cash flow margin has averaged 2.3%, subpar for a consumer discretionary business.

1-800-FLOWERS burned through $121.4 million of cash in Q1, equivalent to a negative 32% margin, increasing its cash burn by 5.2% year on year. Over the next year, analysts predict 1-800-FLOWERS's cash profitability will fall. Their consensus estimates imply its LTM free cash flow margin of 5.5% will decrease to 1.6%.

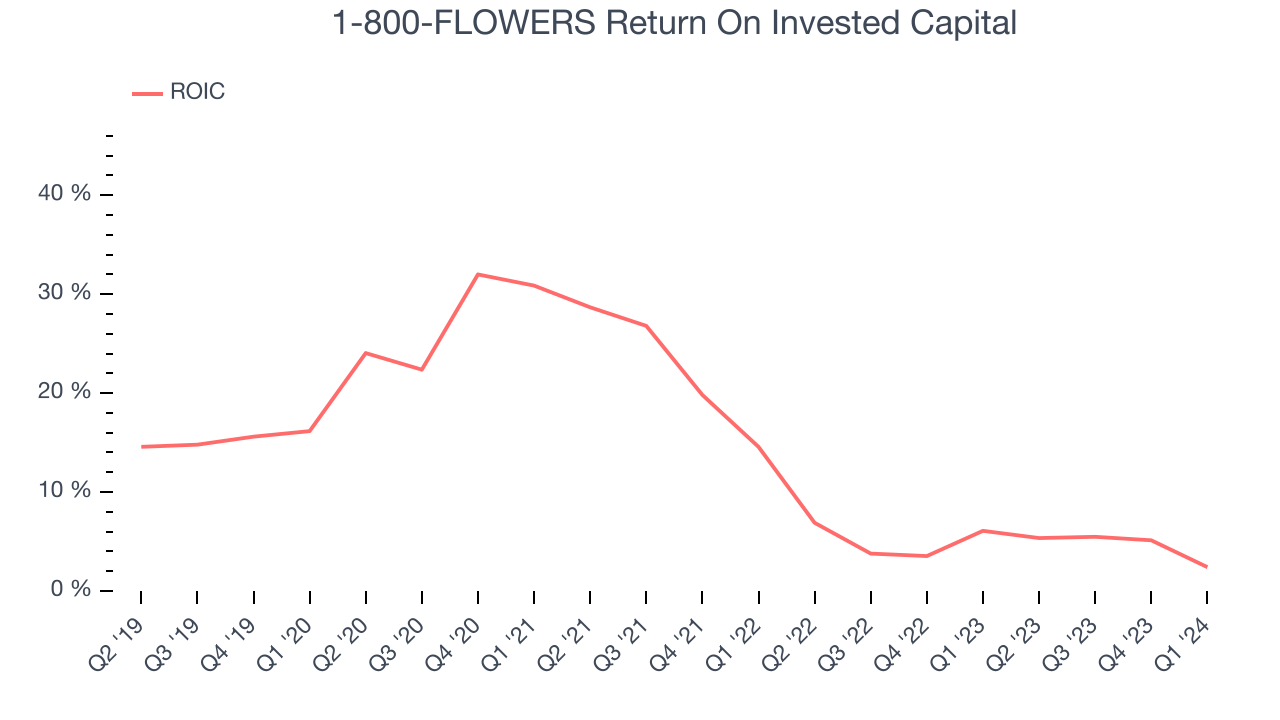

Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing revenue. But was it capital-efficient? A company’s ROIC explains this by showing how much operating profit a company makes compared to how much money the business raised (debt and equity).

1-800-FLOWERS's five-year average return on invested capital was 14%, somewhat low compared to the best consumer discretionary companies that pump out 25%+. Its returns suggest it historically did a subpar job investing in profitable business initiatives.

The trend in its ROIC, however, is often what surprises the market and drives the stock price. Unfortunately, 1-800-FLOWERS's ROIC significantly decreased over the last few years. Paired with its already low returns, these declines suggest the company's profitable business opportunities are few and far between.

Balance Sheet Risk

As long-term investors, the risk we care most about is the permanent loss of capital. This can happen when a company goes bankrupt or raises money from a disadvantaged position and is separate from short-term stock price volatility, which we are much less bothered by.

1-800-FLOWERS's $312.6 million of debt exceeds the $184 million of cash on its balance sheet. Furthermore, its 84x net-debt-to-EBITDA ratio (based on its EBITDA of $1.53 million over the last 12 months) shows the company is overleveraged.

At this level of debt, incremental borrowing becomes increasingly expensive and credit agencies could downgrade the company’s rating if profitability falls. 1-800-FLOWERS could also be backed into a corner if the market turns unexpectedly – a situation we seek to avoid as investors in high-quality companies.

We hope 1-800-FLOWERS can improve its balance sheet and remain cautious until it increases its profitability or reduces its debt.

Key Takeaways from 1-800-FLOWERS's Q1 Results

We struggled to find many strong positives in these results. Its revenue, operating margin, and EPS fell short of Wall Street's estimates. Management cited a weak demand environment for consumer discretionary products, echoing what other companies in the sector have shared this quarter. Looking ahead, the company expects sales to continue declining, but its full-year EBITDA guidance of $97.5 million at the midpoint beat analysts' expectations. Overall, the results could have been better. The company is down 3.4% on the results and currently trades at $8.73 per share.

Is Now The Time?

1-800-FLOWERS may have had a tough quarter, but investors should also consider its valuation and business qualities when assessing the investment opportunity.

We cheer for all companies serving consumers, but in the case of 1-800-FLOWERS, we'll be cheering from the sidelines. Its revenue growth has been a little slower over the last five years, and analysts expect growth to deteriorate from here. And while its projected EPS for the next year implies the company's fundamentals will improve, the downside is its declining EPS over the last five years makes it hard to trust. On top of that, its operating margins reveal poor profitability compared to other consumer discretionary companies.

1-800-FLOWERS's price-to-earnings ratio based on the next 12 months is 25.1x. While we've no doubt one can find things to like about 1-800-FLOWERS, we think there are better opportunities elsewhere in the market. We don't see many reasons to get involved at the moment.

Wall Street analysts covering the company had a one-year price target of $12.38 per share right before these results (compared to the current share price of $8.73).

To get the best start with StockStory, check out our most recent stock picks, and then sign up for our earnings alerts by adding companies to your watchlist here. We typically have the quarterly earnings results analyzed within seconds of the data being released, and especially for companies reporting pre-market, this often gives investors the chance to react to the results before the market has fully absorbed the information.