Cross border payment processor Flywire (NASDAQ: FLYW) beat analysts' expectations in Q2 CY2024, with revenue up 22.2% year on year to $103.7 million. The company expects next quarter's revenue to be around $151.5 million, in line with analysts' estimates. It made a GAAP loss of $0.11 per share, improving from its loss of $0.15 per share in the same quarter last year.

Is now the time to buy Flywire? Find out by accessing our full research report, it's free.

Flywire (FLYW) Q2 CY2024 Highlights:

- Revenue: $103.7 million vs analyst estimates of $100.4 million (3.3% beat)

- EPS: -$0.11 vs analyst expectations of -$0.09 (16.4% miss)

- Revenue Guidance for Q3 CY2024 is $151.5 million at the midpoint, roughly in line with what analysts were expecting

- The company dropped its revenue guidance for the full year from $505 million to $494.5 million at the midpoint, a 2.1% decrease

- Gross Margin (GAAP): 61.5%, up from 60.2% in the same quarter last year

- Free Cash Flow was -$21.72 million compared to -$39.61 million in the previous quarter

- Market Capitalization: $2.24 billion

“Our second quarter results demonstrate resilient performance across the business where we signed more than 200 new clients and grew revenue by 22% and revenue less ancillary services by 26% year-over-year, despite revenue headwinds related to the ongoing Canadian government actions involving student study permits,” said Mike Massaro, CEO of Flywire.

Originally created to process international tuition payments for universities, Flywire (NASDAQ:FLYW) is a cross border payments processor and software platform focusing on complex, high-value transactions like education, healthcare and B2B payments.

Payments Software

Consumers want the ability to make payments whenever and wherever they prefer – and to do so without having to worry about fraud or other security threats. However, building payments infrastructure from scratch is extremely resource-intensive for engineering teams. That drives demand for payments platforms that are easy to integrate into consumer applications and websites.

Sales Growth

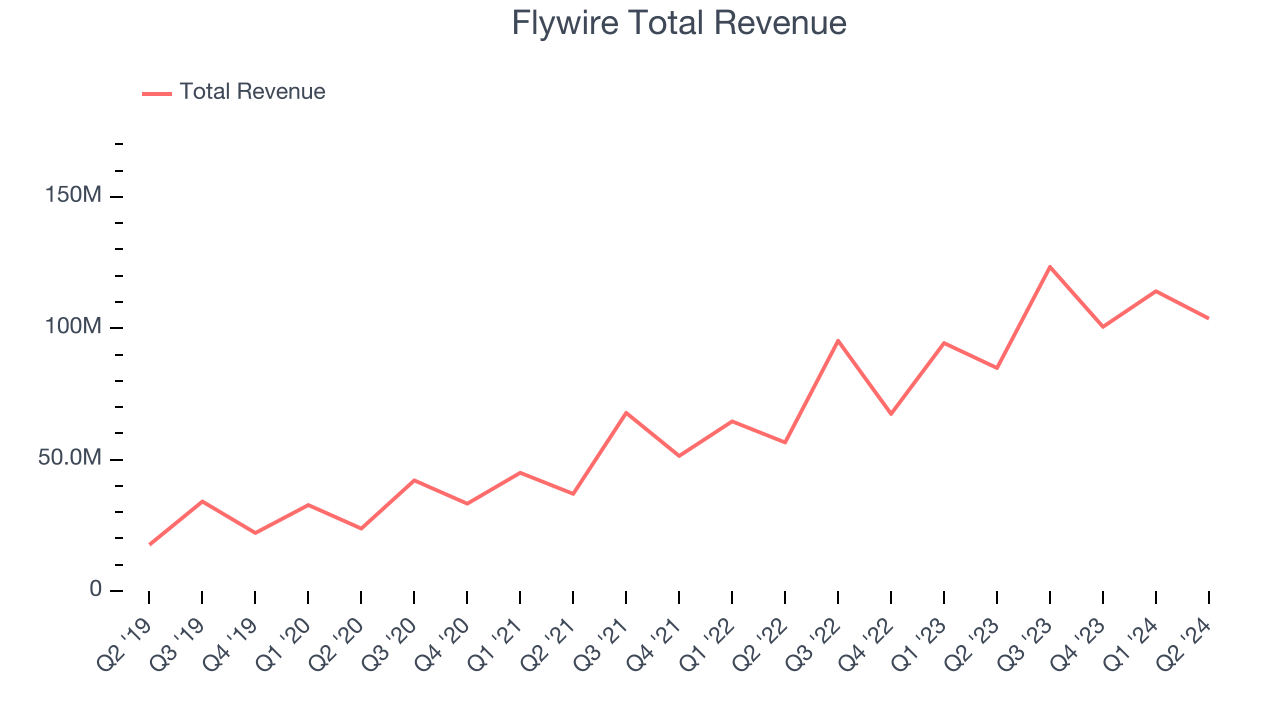

As you can see below, Flywire's revenue growth has been incredible over the last three years, growing from $36.98 million in Q2 2021 to $103.7 million this quarter.

This quarter, Flywire's quarterly revenue was once again up a very solid 22.2% year on year. However, the company's revenue actually decreased by $10.43 million in Q2 compared to the $13.56 million increase in Q1 CY2024. Regardless, we aren't too concerned because Flywire's sales seem to follow a seasonal pattern and management is guiding for revenue to rebound in the coming quarter.

Next quarter's guidance suggests that Flywire is expecting revenue to grow 22.8% year on year to $151.5 million, slowing down from the 29.5% year-on-year increase it recorded in the same quarter last year. Looking ahead, analysts covering the company were expecting sales to grow 23.7% over the next 12 months before the earnings results announcement.

Unless you’ve been living under a rock, it should be obvious by now that generative AI is going to have a huge impact on how large corporations do business. While Nvidia and AMD are trading close to all-time highs, we prefer a lesser-known (but still profitable) semiconductor stock benefitting from the rise of AI. Click here to access our free report on our favorite semiconductor growth story.

Cash Is King

Although earnings are undoubtedly valuable for assessing company performance, we believe cash is king because you can't use accounting profits to pay the bills.

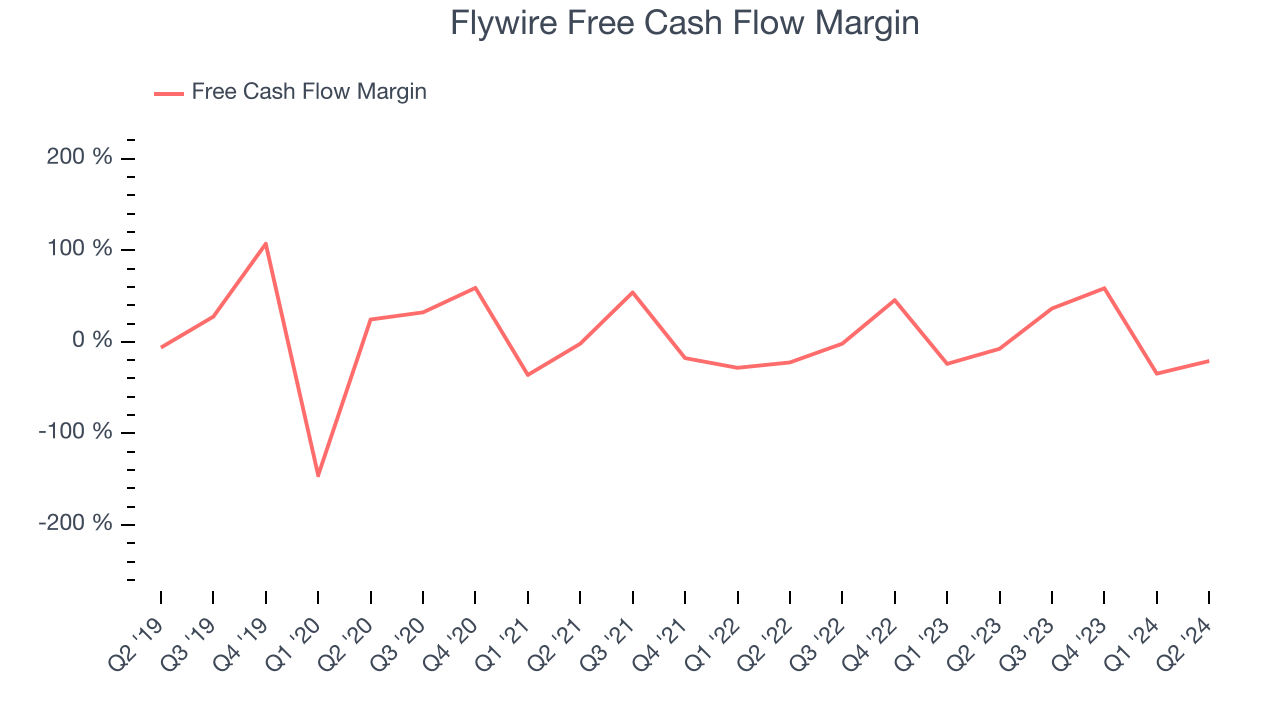

Flywire has shown mediocre cash profitability over the last year, giving the company limited opportunities to return capital to shareholders. Its free cash flow margin averaged 9.6%, subpar for a software business.

Flywire burned through $21.72 million of cash in Q2, equivalent to a negative 20.9% margin. The company's cash burn increased meaningfully year on year and is a deviation from its longer-term margin, but we wouldn't put too much weight on the short term because investment needs can be seasonal, causing temporary swings.

Key Takeaways from Flywire's Q2 Results

It was good to see Flywire beat analysts' revenue expectations this quarter. On the other hand, its gross margin declined and the company revised its full year guidance. Zooming out, we think this was still a mixed quarter. The market was likely expecting more, and the stock traded down 5.3% to $16.85 immediately following the results.

So should you invest in Flywire right now? When making that decision, it's important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it's free.