Cross border payment processor Flywire (NASDAQ: FLYW) reported Q1 CY2024 results beating Wall Street analysts' expectations, with revenue up 20.9% year on year to $114.1 million. Revenue guidance for the full year also exceeded analysts' estimates but next quarter's guidance of $103.5 million was less impressive, coming in 3.5% below expectations. It made a GAAP loss of $0.05 per share, down from its loss of $0.03 per share in the same quarter last year.

Flywire (FLYW) Q1 CY2024 Highlights:

- Revenue: $114.1 million vs analyst estimates of $107.7 million (6% beat)

- EPS: -$0.05 vs analyst estimates of -$0.03 (-$0.02 miss)

- Revenue Guidance for Q2 CY2024 is $103.5 million at the midpoint, below analyst estimates of $107.2 million

- The company dropped its revenue guidance for the full year from $518 million to $505 million at the midpoint, a 2.5% decrease

- Gross Margin (GAAP): 63.5%, in line with the same quarter last year

- Free Cash Flow was -$39.61 million, down from $58.83 million in the previous quarter

- Market Capitalization: $2.48 billion

Originally created to process international tuition payments for universities, Flywire (NASDAQ:FLYW) is a cross border payments processor and software platform focusing on complex, high-value transactions like education, healthcare and B2B payments.

Over the past two decades, digitization of payments has seemingly permeated most aspects of the global economy - which is relatively true when thinking about digital commerce or banking. But certain sectors, with very high value transactions, can’t adopt a “one size fits all” approach, often due to currency impacts. As a result, many organizations with the greatest need to facilitate online digital payments either have to resort to building their own processing solution from the ground up or stick to cashing checks, and the customer service headaches that come with them.

Flywire was created to facilitate cross border tuition payments for the global education market, international students studying in the US, or attending elite boarding schools. It has since found similar use cases internationally in healthcare, travel, and B2B payments, but education still remains its core market, accounting for the majority of its revenues.

Flywire has spent over 10 years developing a proprietary global payment network that operates in almost every country in the world, supporting more than 130 currencies and connecting all of the key global banks, as majority of Flywire’s high value transactions payments are not card-related and rely on bank transfers. The benefit of owning the network is that Flywire has full visibility over its fund flows and can better manage currency exchange risks on transactions for both itself and its customers, as managing FX rates on large dollar payments is particularly important.

Payments Software

Consumers want the ability to make payments whenever and wherever they prefer – and to do so without having to worry about fraud or other security threats. However, building payments infrastructure from scratch is extremely resource-intensive for engineering teams. That drives demand for payments platforms that are easy to integrate into consumer applications and websites.

Flywire’s competitors in the education space are largely in house legacy systems and legacy cross border payment systems like Western Union’s GlobalPay (NYSE: WU) along with many next generation B2B payment providers like Bill.com (NYSE: BILL) or Coupa Software (NASDAQ: COUP).

Sales Growth

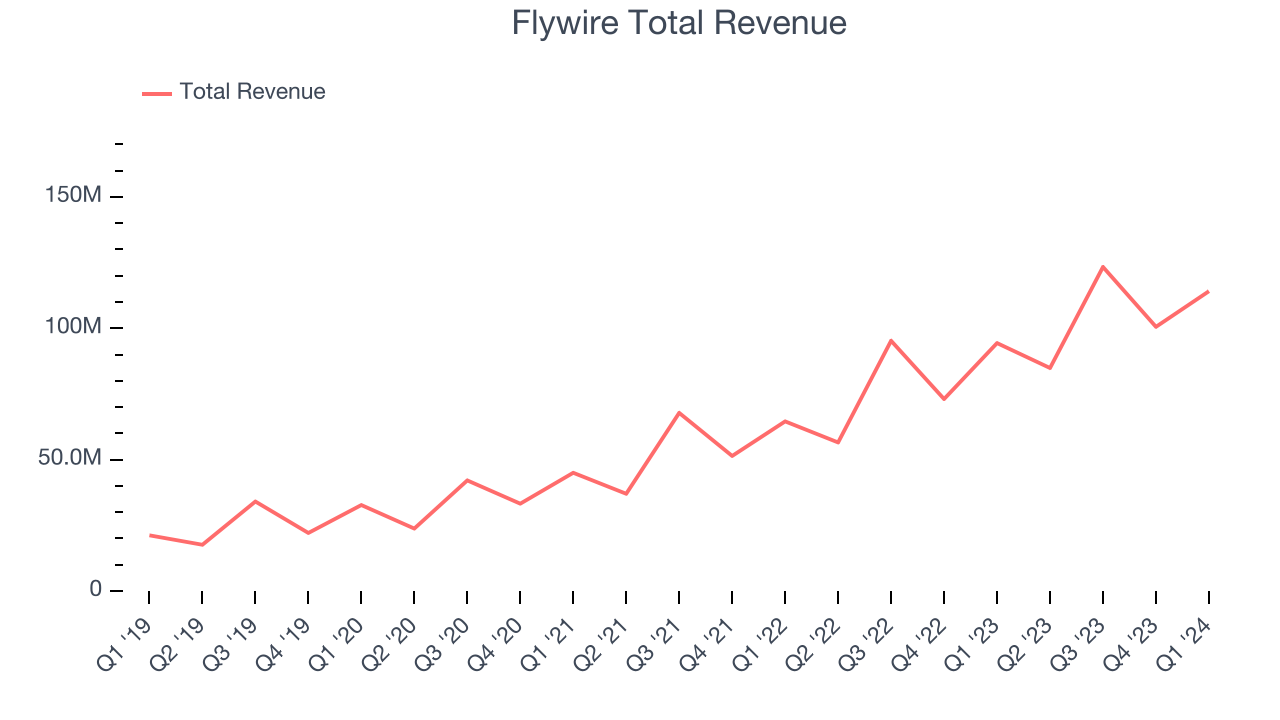

As you can see below, Flywire's revenue growth has been impressive over the last three years, growing from $44.99 million in Q1 2021 to $114.1 million this quarter.

This quarter, Flywire's quarterly revenue was once again up a very solid 20.9% year on year. On top of that, its revenue increased $13.56 million quarter on quarter, a strong improvement from the $22.78 million decrease in Q4 CY2023. This is a sign of acceleration of growth and very nice to see indeed.

Next quarter's guidance suggests that Flywire is expecting revenue to grow 22% year on year to $103.5 million, slowing down from the 50.1% year-on-year increase it recorded in the same quarter last year. Looking ahead, analysts covering the company were expecting sales to grow 24% over the next 12 months before the earnings results announcement.

Profitability

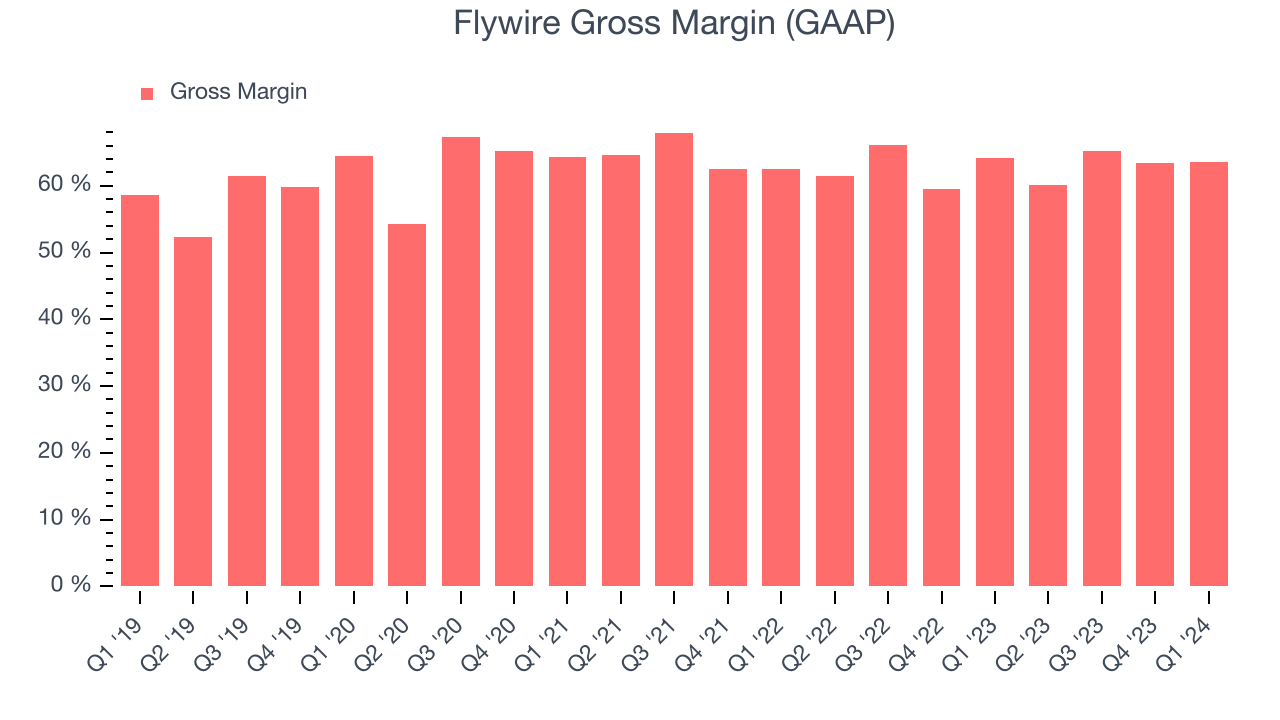

What makes the software as a service business so attractive is that once the software is developed, it typically shouldn't cost much to provide it as an ongoing service to customers. Flywire's gross profit margin, an important metric measuring how much money there's left after paying for servers, licenses, technical support, and other necessary running expenses, was 63.5% in Q1.

That means that for every $1 in revenue the company had $0.63 left to spend on developing new products, sales and marketing, and general administrative overhead. Flywire's gross margin is poor for a SaaS business and we'd like to see it start improving.

Cash Is King

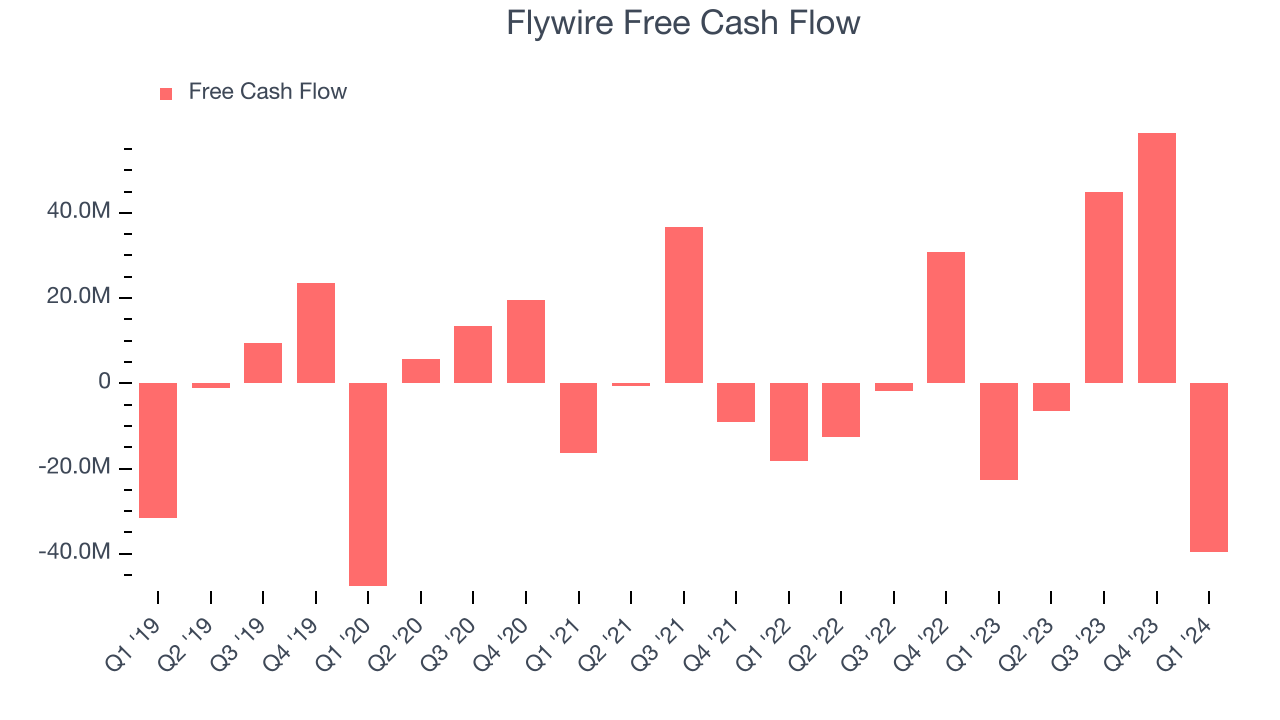

If you've followed StockStory for a while, you know that we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can't use accounting profits to pay the bills. Flywire burned through $39.61 million of cash in Q1 , reducing its cash burn by 74.5% year on year.

Flywire has generated $57.7 million in free cash flow over the last 12 months, a decent 13.6% of revenue. This FCF margin stems from its asset-lite business model and gives it a decent amount of cash to reinvest in its business.

Key Takeaways from Flywire's Q1 Results

We struggled to find many strong positives in these results. While this quarter's revenue topped Wall Street's estimates, its full-year revenue guidance fell short and its free cash flow was down from the previous quarter. Overall, this was a disappointing quarter for Flywire. The company is down 14.9% on the results and currently trades at $17.5 per share.

Is Now The Time?

When considering an investment in Flywire, investors should take into account its valuation and business qualities as well as what's happened in the latest quarter.

We think Flywire is a solid business. We'd expect growth rates to moderate from here, but its revenue growth has been exceptional over the last three years. And while its customer acquisition is less efficient than many comparable companies, the good news is its strong free cash flow generation gives it re-investment options.

Flywire's price-to-sales ratio based on the next 12 months is 4.8x, suggesting the market is expecting slower growth relative to the hottest software stocks. There are definitely a lot of things to like about Flywire, and looking at the tech landscape right now, it seems to be trading at a reasonable price.

Wall Street analysts covering the company had a one-year price target of $34.56 right before these results (compared to the current share price of $17.50), implying they see short-term upside potential in Flywire.

To get the best start with StockStory, check out our most recent Stock picks, and then sign up for our earnings alerts by adding companies to your watchlist here. We typically have the quarterly earnings results analyzed within seconds of the data being released. Especially for companies reporting pre-market, this often gives investors the chance to react to the results before everyone else has fully absorbed the information.