Pop culture collectibles manufacturer Funko (NASDAQ:FNKO) reported Q4 FY2023 results exceeding Wall Street analysts' expectations, with revenue down 12.6% year on year to $291.2 million. On the other hand, next quarter's revenue guidance of $220.5 million was less impressive, coming in 8% below analysts' estimates. It made a non-GAAP profit of $0.01 per share, improving from its loss of $0.35 per share in the same quarter last year.

Funko (FNKO) Q4 FY2023 Highlights:

- Revenue: $291.2 million vs analyst estimates of $282 million (3.3% beat)

- EPS (non-GAAP): $0.01 vs analyst estimates of -$0.02 ($0.03 beat)

- Management's adj EBITDA guidance for the upcoming financial year 2024 is $75.0 million at the midpoint, above analyst estimates of $70.5 million (6.4% beat)

- Free Cash Flow of $29.53 million, up from $810,000 in the previous quarter

- Gross Margin (GAAP): 37.6%, up from 28.3% in the same quarter last year

- Market Capitalization: $323.1 million

Boasting partnerships with media franchises like Marvel and One Piece, Funko (NASDAQ:FNKO) is a company specializing in creating and distributing licensed pop culture collectibles.

Funko was born from toy collector Mike Becker's desire to bring back low-tech, whimsically designed toys and collectibles from the past. Over time, Funko evolved from a nostalgia-focused concept to a leading pop culture product company, driven by its mission to connect fans with their favorite pop culture characters and stories.

Funko's core product line comprises collectibles like vinyl figures, bobbleheads, and plush items, underpinned by a wide array of licensing agreements with major entertainment companies. These products cater to the increasing demand for pop culture merchandise, tapping into fans’ desires to own physical representations of their favorite characters.

Revenue for Funko is generated through multiple channels, including specialty retailers, mass-market stores, and direct-to-consumer sales through its website. Its products appeal to a broad spectrum of consumers, from avid collectors and enthusiasts to casual fans.

Leisure Products

Leisure products cover a wide range of goods in the consumer discretionary sector. Maintaining a strong brand is key to success, and those who differentiate themselves will enjoy customer loyalty and pricing power while those who don’t may find themselves in precarious positions due to the non-essential nature of their offerings.

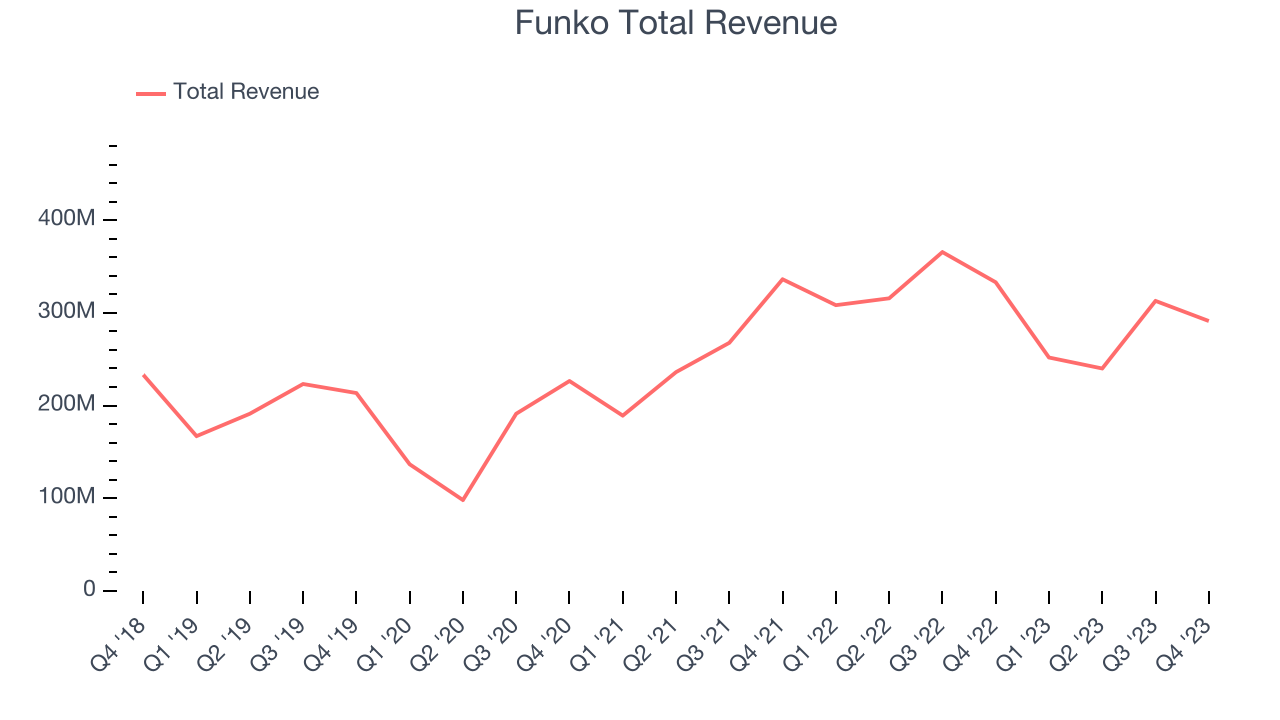

Sales Growth

A company's long-term performance can indicate its business quality. Any business can enjoy short-lived success, but best-in-class ones sustain growth over many years. Funko's annualized revenue growth rate of 9.8% over the last five years was weak for a consumer discretionary business.  Within consumer discretionary, product cycles are short and revenue can be hit-driven due to rapidly changing trends. That's why we also follow short-term performance. Funko's recent history shows the business has slowed as its annualized revenue growth of 3.2% over the last two years is below its five-year trend.

Within consumer discretionary, product cycles are short and revenue can be hit-driven due to rapidly changing trends. That's why we also follow short-term performance. Funko's recent history shows the business has slowed as its annualized revenue growth of 3.2% over the last two years is below its five-year trend.

This quarter, Funko's revenue fell 12.6% year on year to $291.2 million but beat Wall Street's estimates by 3.3%. The company is guiding for a 12.5% year-on-year revenue decline next quarter to $220.5 million, an improvement from the 18.3% year-on-year decrease it recorded in the same quarter last year. Looking ahead, Wall Street expects revenue to decline 1.2% over the next 12 months.

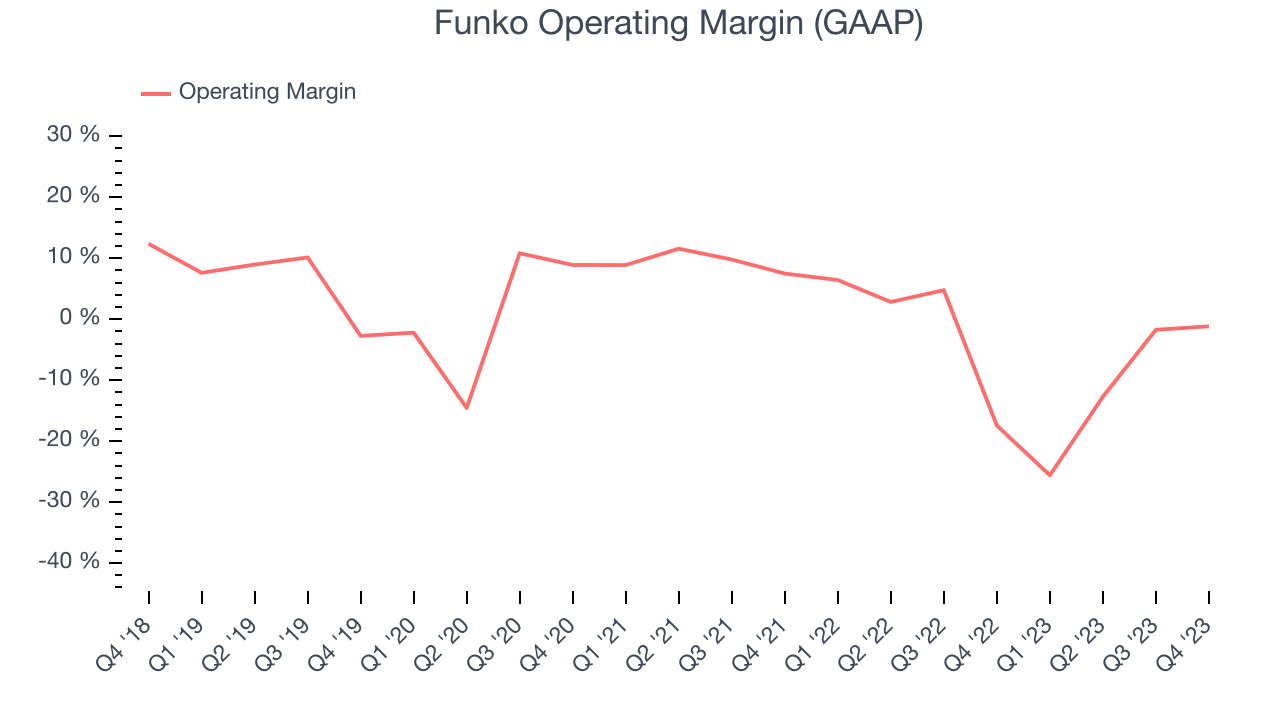

Operating Margin

Operating margin is a key measure of profitability. Think of it as net income–the bottom line–excluding the impact of taxes and interest on debt, which are less connected to business fundamentals.

Given the consumer discretionary industry's volatile demand characteristics, unprofitable companies should be scrutinized. Over the last two years, Funko's high expenses have contributed to an average operating margin of negative 4.8%.

In Q4, Funko generated an operating profit margin of negative 1.2%, up 16.3 percentage points year on year.

Over the next 12 months, Wall Street expects Funko to break even on its operating profits. Analysts are expecting the company’s LTM operating margin of negative 9.5% to rise by 8.7 percentage points.EPS

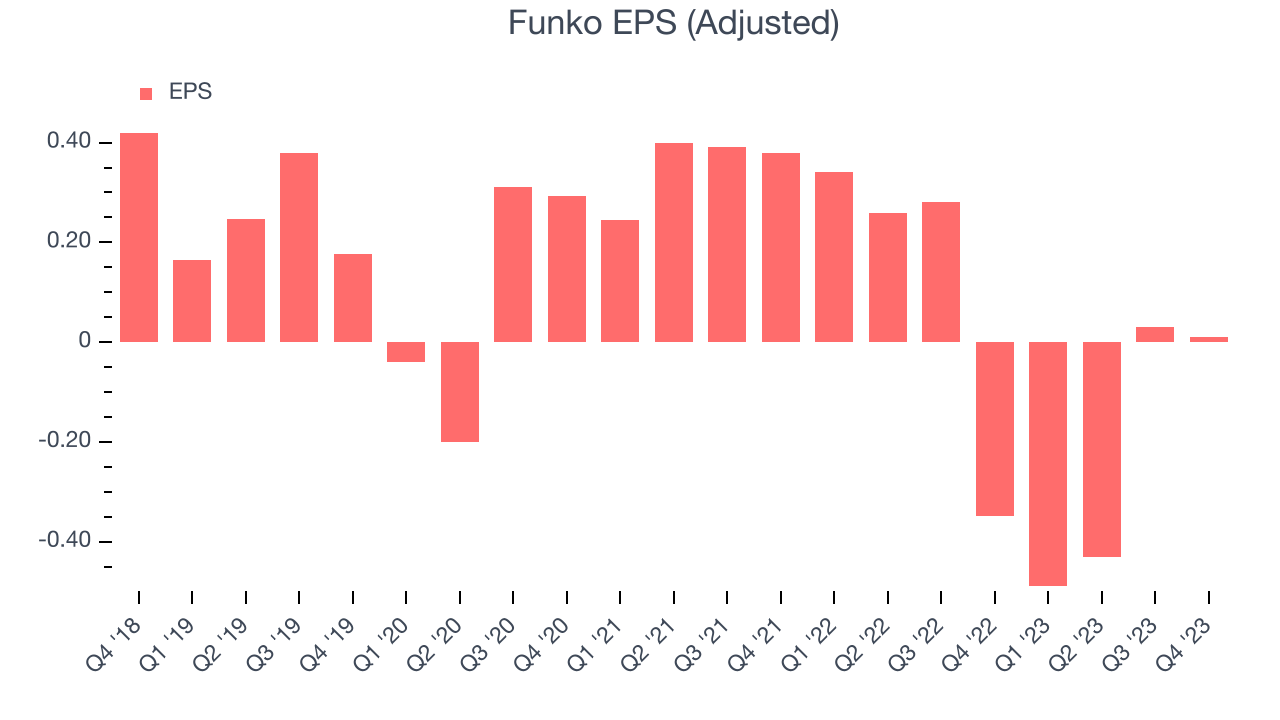

We track long-term historical earnings per share (EPS) growth for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company's growth was profitable.

Over the last five years, Funko's EPS dropped 213%, translating into 25.6% annualized declines. We tend to steer our readers away from companies with falling EPS, where diminishing earnings could imply changing secular trends or consumer preferences. Consumer discretionary companies are particularly exposed to this, leaving a low margin of safety around the company (making the stock susceptible to large downward swings).

In Q4, Funko reported EPS at $0.01, up from negative $0.35 in the same quarter a year ago. This print easily cleared analysts' estimates, and shareholders should be content with the results. Over the next 12 months, Wall Street expects Funko to improve its earnings losses. Analysts are projecting its LTM EPS of negative $0.88 to advance to negative $0.26.

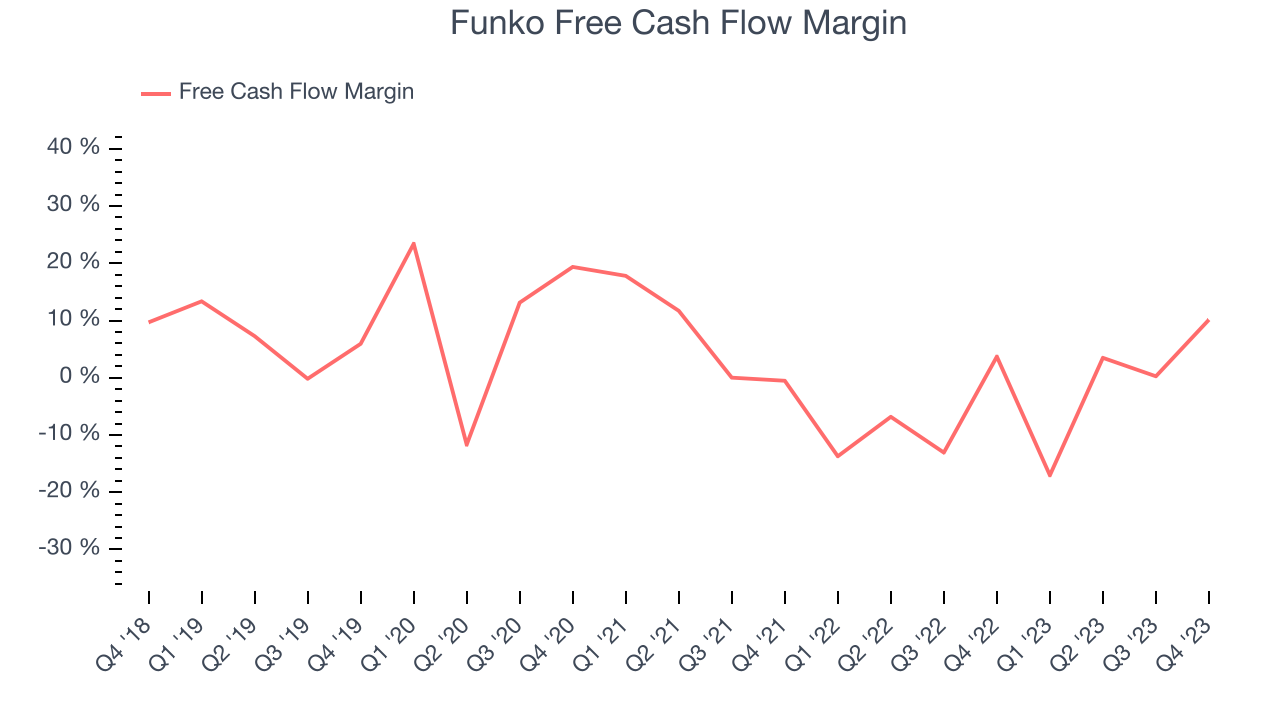

Cash Is King

If you've followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can't use accounting profits to pay the bills.

While Funko posted positive free cash flow this quarter, the broader story hasn't been so clean. Over the last two years, Funko's demanding reinvestments to stay relevant with consumers have drained company resources. Its free cash flow margin has been among the worst in the consumer discretionary sector, averaging negative 4.3%.

Funko's free cash flow came in at $29.53 million in Q4, equivalent to a 10.1% margin and up 140% year on year.

Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing revenue. But was it capital-efficient? Enter ROIC, a metric showing how much operating profit a company generates relative to how much money the business raised (debt and equity).

Funko's five-year average return on invested capital was negative 1.1%, meaning management lost money while trying to expand the business. Its returns were among the worst in the consumer discretionary sector.

The trend in its ROIC, however, is often what surprises the market and drives the stock price. Unfortunately, Funko's ROIC over the last two years averaged 28.3 percentage point decreases each year. In conjunction with its already low returns, these declines suggest the company's profitable business opportunities are few and far between.

Key Takeaways from Funko's Q4 Results

We were impressed by how significantly Funko blew past analysts' EPS expectations this quarter. We were also excited its revenue outperformed Wall Street's estimates. Lastly, while revenue guidance for next quarter fell short of Wall Street's estimates, full year adjusted EBITDA guidance was nicely ahead. Overall, this was a solid quarter for Funko. The stock is up 15.3% after reporting and currently trades at $7.45 per share.

Is Now The Time?

Funko may have had a tough quarter, but investors should also consider its valuation and business qualities when assessing the investment opportunity.

We cheer for all companies serving consumers, but in the case of Funko, we'll be cheering from the sidelines. Its revenue growth has been a little slower over the last five years, and analysts expect growth to deteriorate from here. And while its projected EPS for the next year implies the company's fundamentals will improve, the downside is its declining EPS over the last five years makes it hard to trust. On top of that, its relatively low ROIC suggests it has historically struggled to find compelling business opportunities.

While we've no doubt one can find things to like about Funko, we think there are better opportunities elsewhere in the market. We don't see many reasons to get involved at the moment.

Wall Street analysts covering the company had a one-year price target of $8.25 per share right before these results (compared to the current share price of $7.45).

To get the best start with StockStory, check out our most recent stock picks, and then sign up for our earnings alerts by adding companies to your watchlist here. We typically have the quarterly earnings results analyzed within seconds of the data being released, and especially for companies reporting pre-market, this often gives investors the chance to react to the results before the market has fully absorbed the information.