Cable news and media network Fox (NASDAQ:FOXA) reported results in line with analysts' expectations in Q1 CY2024, with revenue down 15.6% year on year to $3.45 billion. It made a non-GAAP profit of $1.09 per share, improving from its profit of $0.95 per share in the same quarter last year.

FOX (FOXA) Q1 CY2024 Highlights:

- Revenue: $3.45 billion vs analyst estimates of $3.44 billion (small beat)

- EPS (non-GAAP): $1.09 vs analyst estimates of $0.96 (13.5% beat)

- Gross Margin (GAAP): 40.5%, up from 33.2% in the same quarter last year

- Free Cash Flow of $1.39 billion is up from -$615 million in the previous quarter

- Market Capitalization: $14.77 billion

Founded in 1915, Fox (NASDAQ:FOXA) is a diversified media company, operating prominent cable news, television broadcasting, and digital media platforms.

FOX was initially established to meet early 20th-century demands for entertainment and news. Over the decades, the company has significantly evolved, branching into various media segments and adopting digital platforms.

FOX provides a broad spectrum of media services including news coverage, sports broadcasting, and other entertainment. FOX caters to a large audience, seeking engagement with diverse viewers, from news aficionados to entertainment consumers.

The company's revenue is primarily derived from advertising, subscription fees, and content licensing. Furthermore, it must produce quality content to maintain its channel space.

A notable aspect of FOX's value proposition is its focus on delivering content that resonates with specific viewer segments, particularly those seeking a certain perspective on news and entertainment. This targeted content strategy has enabled FOX to carve out a niche in the competitive media landscape.

Broadcasting

Broadcasting companies have been facing secular headwinds in the form of consumers abandoning traditional television and radio in favor of streaming services. As a result, many broadcasting companies have evolved by forming distribution agreements with major streaming platforms so they can get in on part of the action, but will these subscription revenues be as high quality and high margin as their legacy revenues? Only time will tell which of these broadcasters will survive the sea changes of technological advancement and fragmenting consumer attention.

Competitors in the media and entertainment industry include Comcast Corporation (NASDAQ:CMCSA), Walt Disney (NYSE:DIS), and Paramount Global (NASDAQ:PARA).Sales Growth

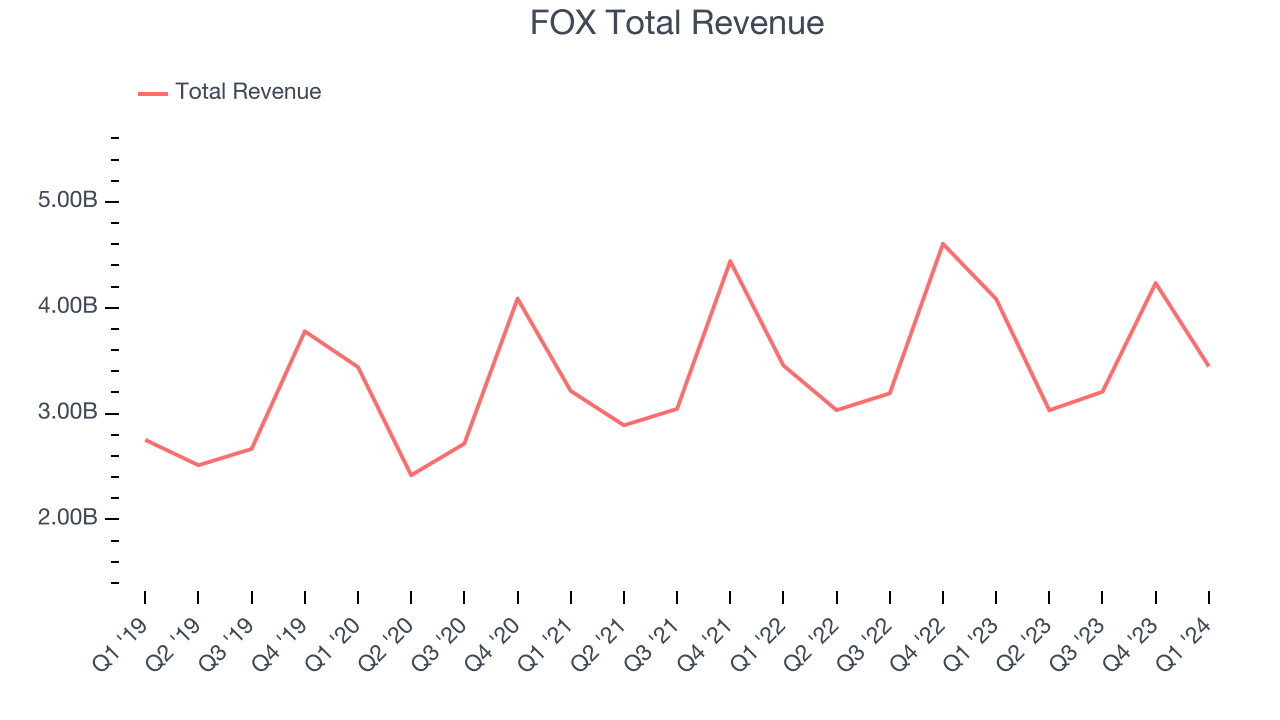

Reviewing a company's long-term performance can reveal insights into its business quality. Any business can have short-term success, but a top-tier one sustains growth for years. FOX's annualized revenue growth rate of 4.3% over the last five years was weak for a consumer discretionary business.  Within consumer discretionary, a long-term historical view may miss a company riding a successful new product or emerging trend. That's why we also follow short-term performance. FOX's recent history shines a dimmer light on the company as its revenue was flat over the last two years.

Within consumer discretionary, a long-term historical view may miss a company riding a successful new product or emerging trend. That's why we also follow short-term performance. FOX's recent history shines a dimmer light on the company as its revenue was flat over the last two years.

We can better understand the company's revenue dynamics by analyzing its most important segments, Advertising and Affiliate, which are 35.8% and 56.2% of revenue. Over the last two years, FOX's Advertising revenue (marketing services) was flat while its Affiliate revenue (licensing and retransmission fees) averaged 3% year-on-year growth.

This quarter, FOX reported a rather uninspiring 15.6% year-on-year revenue decline to $3.45 billion of revenue, in line with Wall Street's estimates. Looking ahead, Wall Street expects sales to grow 7% over the next 12 months, an acceleration from this quarter.

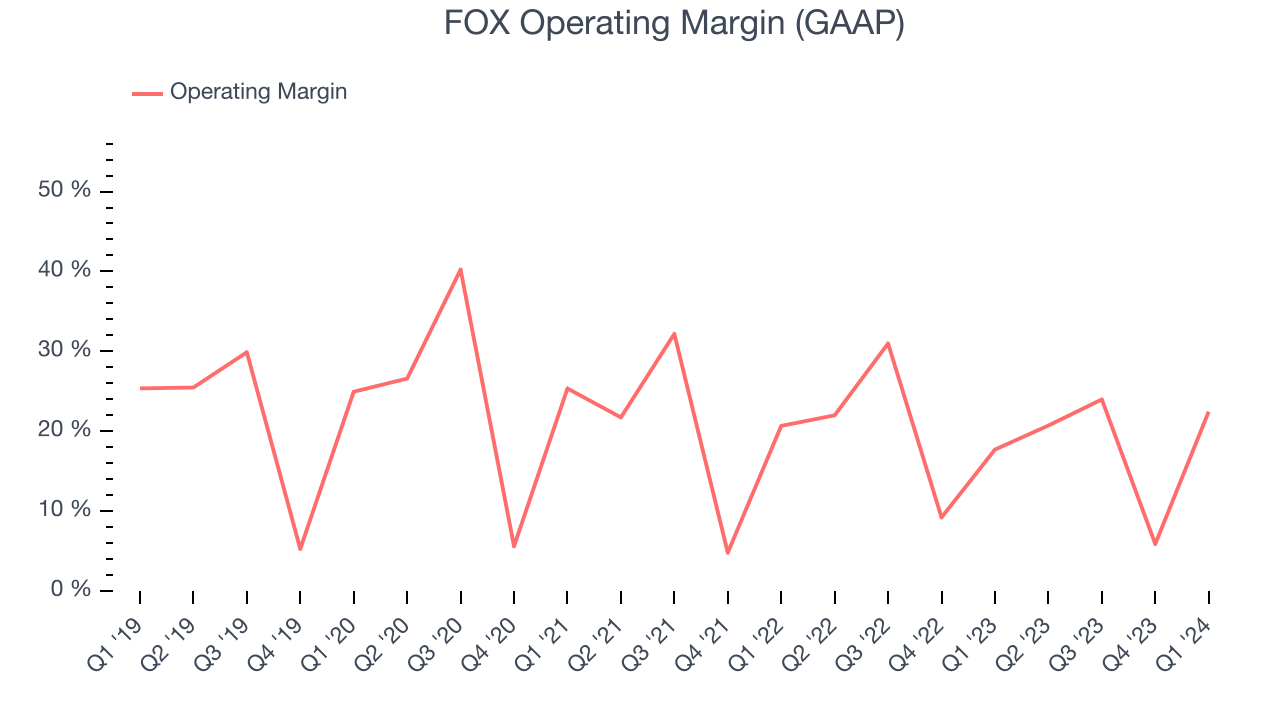

Operating Margin

Operating margin is a key measure of profitability. Think of it as net income–the bottom line–excluding the impact of taxes and interest on debt, which are less connected to business fundamentals.

FOX has been a well-managed company over the last eight quarters. It's demonstrated it can be one of the more profitable businesses in the consumer discretionary sector, boasting an average operating margin of 18.1%.

In Q1, FOX generated an operating profit margin of 22.5%, up 4.8 percentage points year on year.

Over the next 12 months, Wall Street expects FOX to maintain its LTM operating margin of 17.4%.EPS

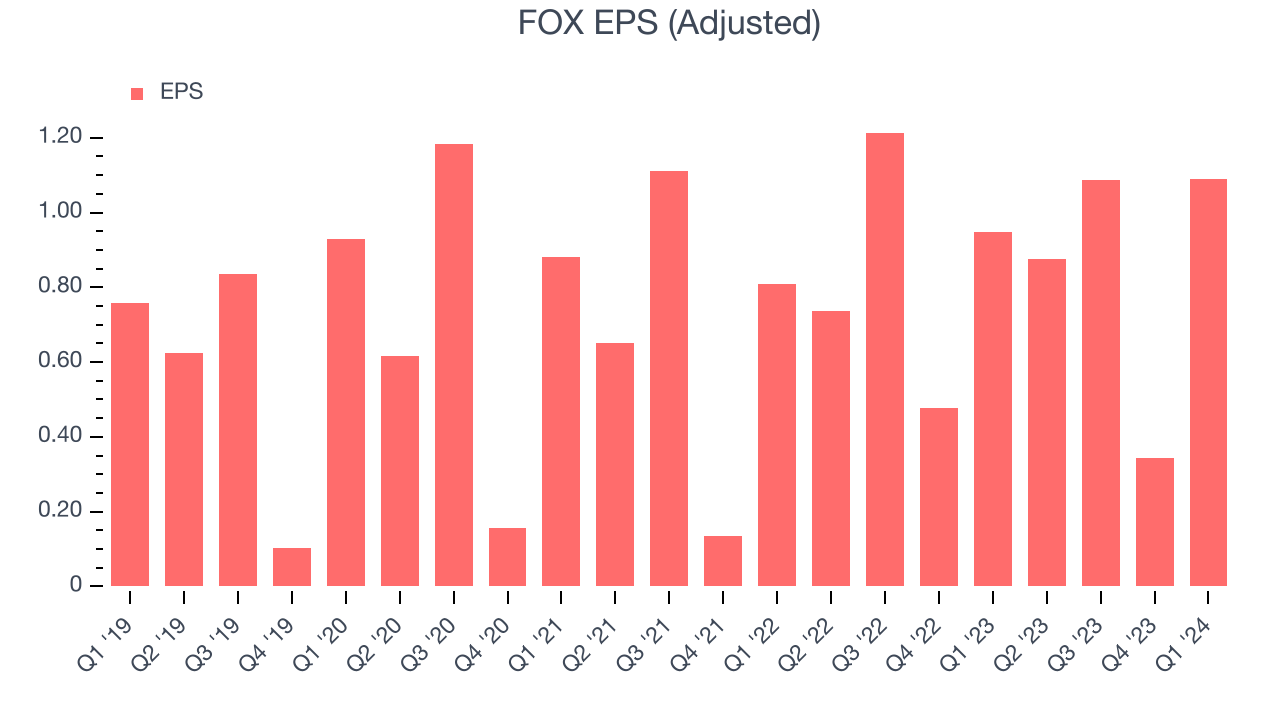

We track long-term historical earnings per share (EPS) growth for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company's growth was profitable.

Over the last five years, FOX's EPS grew 26.8%, translating into a weak 4.9% compounded annual growth rate. This performance is in line with its 4.3% annualized revenue growth over the same period.

In Q1, FOX reported EPS at $1.09, up from $0.95 in the same quarter last year. This print beat analysts' estimates by 13.5%. Over the next 12 months, Wall Street expects FOX to grow its earnings. Analysts are projecting its LTM EPS of $3.39 to climb by 11.1% to $3.77.

Cash Is King

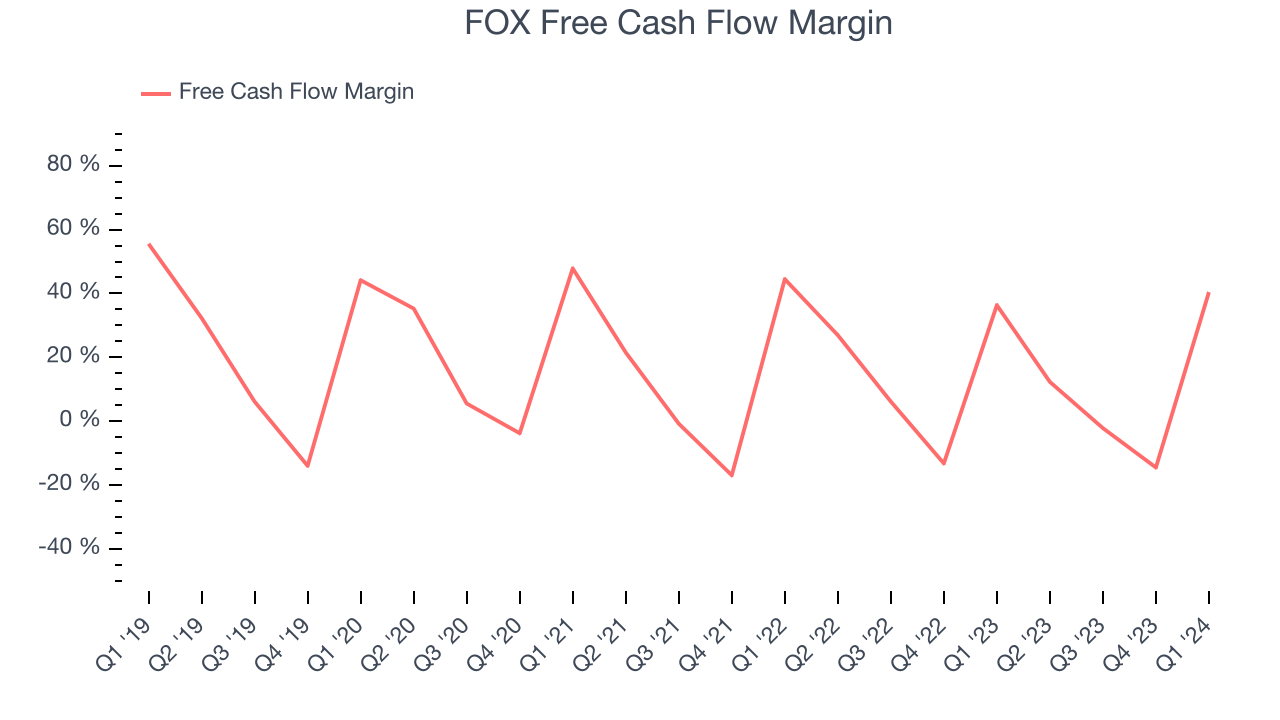

If you've followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can't use accounting profits to pay the bills.

Over the last two years, FOX has shown decent cash profitability, giving it some reinvestment opportunities. The company's free cash flow margin has averaged 10.3%, slightly better than the broader consumer discretionary sector.

FOX's free cash flow came in at $1.39 billion in Q1, equivalent to a 40.4% margin and down 6.1% year on year. Over the next year, analysts predict FOX's cash profitability will improve. Their consensus estimates imply its LTM free cash flow margin of 7.8% will increase to 11.1%.

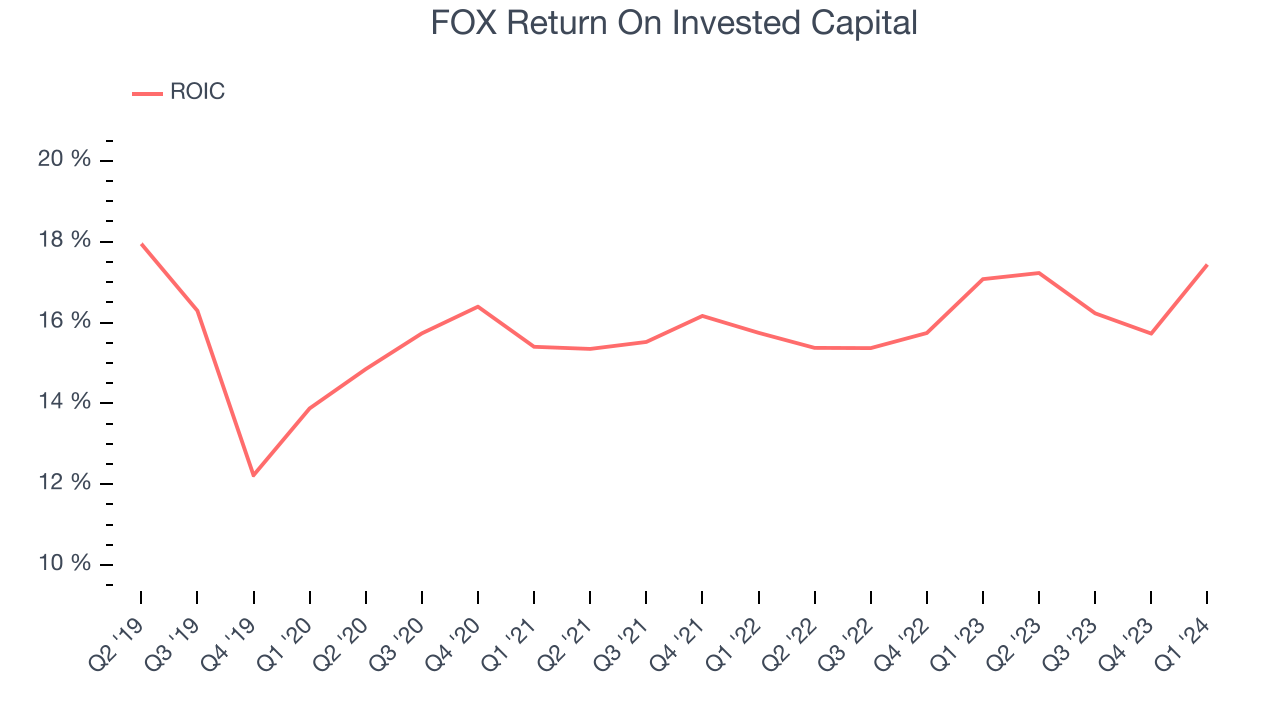

Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing revenue. But was it capital-efficient? A company’s ROIC explains this by showing how much operating profit a company makes compared to how much money the business raised (debt and equity).

FOX's five-year average return on invested capital was 15.9%, slightly better than the broader sector. Just as you’d like your investment dollars to generate returns, FOX's invested capital has produced decent profits.

The trend in its ROIC, however, is often what surprises the market and drives the stock price. Over the last few years, FOX's ROIC averaged 2.6 percentage point increases. This is a good sign, and we hope the company can continue improving.

Balance Sheet Risk

Debt is a tool that can boost company returns but presents risks if used irresponsibly.

FOX reported $3.79 billion of cash and $7.20 billion of debt on its balance sheet in the most recent quarter. As investors in high-quality companies, we primarily focus on two things: 1) that a company's debt level isn't too high and 2) that its interest payments are not excessively burdening the business.

With $2.85 billion of EBITDA over the last 12 months, we view FOX's 1.2x net-debt-to-EBITDA ratio as safe. We also see its $204 million of annual interest expenses as appropriate. The company's profits give it plenty of breathing room, allowing it to continue investing in new initiatives.

Key Takeaways from FOX's Q1 Results

It was good to see FOX beat analysts' operating margin expectations this quarter. We were also excited its EPS outperformed Wall Street's estimates. Overall, this quarter's results seemed fairly positive and shareholders should feel optimistic. The stock is flat after reporting and currently trades at $32.32 per share.

Is Now The Time?

FOX may have had a favorable quarter, but investors should also consider its valuation and business qualities when assessing the investment opportunity.

We cheer for all companies serving consumers, but in the case of FOX, we'll be cheering from the sidelines. Its revenue growth has been uninspiring over the last five years, but at least growth is expected to increase in the short term. And while its strong operating margins show it's a well-run business, unfortunately, its EPS growth over the last five years has been subpar.

FOX's price-to-earnings ratio based on the next 12 months is 8.6x. While there are some things to like about FOX and its valuation is reasonable, we think there are better opportunities elsewhere in the market right now.

Wall Street analysts covering the company had a one-year price target of $38.50 per share right before these results (compared to the current share price of $32.32).

To get the best start with StockStory, check out our most recent stock picks, and then sign up for our earnings alerts by adding companies to your watchlist here. We typically have the quarterly earnings results analyzed within seconds of the data being released, and especially for companies reporting pre-market, this often gives investors the chance to react to the results before the market has fully absorbed the information.