Pet food company Freshpet (NASDAQ:FRPT) announced better-than-expected results in Q1 CY2024, with revenue up 33.6% year on year to $223.8 million. On the other hand, the company's full-year revenue guidance of $950 million at the midpoint came in slightly below analysts' estimates. It made a GAAP profit of $0.37 per share, improving from its loss of $0.52 per share in the same quarter last year.

Freshpet (FRPT) Q1 CY2024 Highlights:

- Revenue: $223.8 million vs analyst estimates of $216.1 million (3.6% beat)

- EPS: $0.37 vs analyst estimates of -$0.19 ($0.56 beat)

- The company reconfirmed its revenue guidance for the full year of $950 million at the midpoint

- Gross Margin (GAAP): 39.4%, up from 30.3% in the same quarter last year

- Free Cash Flow was -$41.07 million compared to -$40.48 million in the previous quarter

- Sales Volumes were up 30.6% year on year

- Market Capitalization: $5.29 billion

Contrasting itself with the typical processed pet foods found throughout the industry, Freshpet (NASDAQ:FRPT) is a pet food company whose product portfolio includes natural meals and treats for dogs and cats.

The company was founded in 2006 with the vision of better food for pets, who were becoming more and more important parts of a family. Since its founding, Freshpet has expanded its portfolio organically rather than through the mergers and acquisitions that are common in the packaged foods industry.

At the core of Freshpet's offering is a commitment to fresh, all-natural pet food. The food is typically sold refrigerated, emphasizing its freshness and real ingredients. Notable brands under the Freshpet umbrella include Freshpet Select, Vital, and Nature's Fresh. These brands offer various recipes, including grain-free options, high-protein meals, and foods tailored for specific life stages or health needs.

Freshpet's core customer is the health-conscious pet owner who views their pet as a family member and wants to provide the best nutrition possible. This target audience is willing to pay a premium for high-quality, natural ingredients, and values transparency in sourcing and production. Freshpet products can be found in the refrigerated sections of grocery stores, pet stores, and mass market retailers. While fresh food is a differentiator, it makes Freshpet’s products a bit more challenging to ship than traditional, shelf-stable pet food.

Perishable Food

The perishable food industry is diverse, encompassing large-scale producers and distributors to specialty and artisanal brands. These companies sell produce, dairy products, meats, and baked goods and have become integral to serving modern American consumers who prioritize freshness, quality, and nutritional value. Investing in perishable food stocks presents both opportunities and challenges. While the perishable nature of products can introduce risks related to supply chain management and shelf life, it also creates a constant demand driven by the necessity for fresh food. Companies that can efficiently manage inventory, distribution, and quality control are well-positioned to thrive in this competitive market. Navigating the perishable food industry requires adherence to strict food safety standards, regulations, and labeling requirements.

Competitors in the better-for-you pet food space include Blue Buffalo (owned by General Mills, NYSE:GIS) and Hill's Pet Nutrition (owned by Colgate-Palmolive, NYSE:CL). Private competitors include The Farmer's Dog and Ollie.Sales Growth

Freshpet is a small consumer staples company, which sometimes brings disadvantages compared to larger competitors benefitting from better brand awareness and economies of scale. On the other hand, one advantage is that its growth rates can be higher because it's growing off a small base.

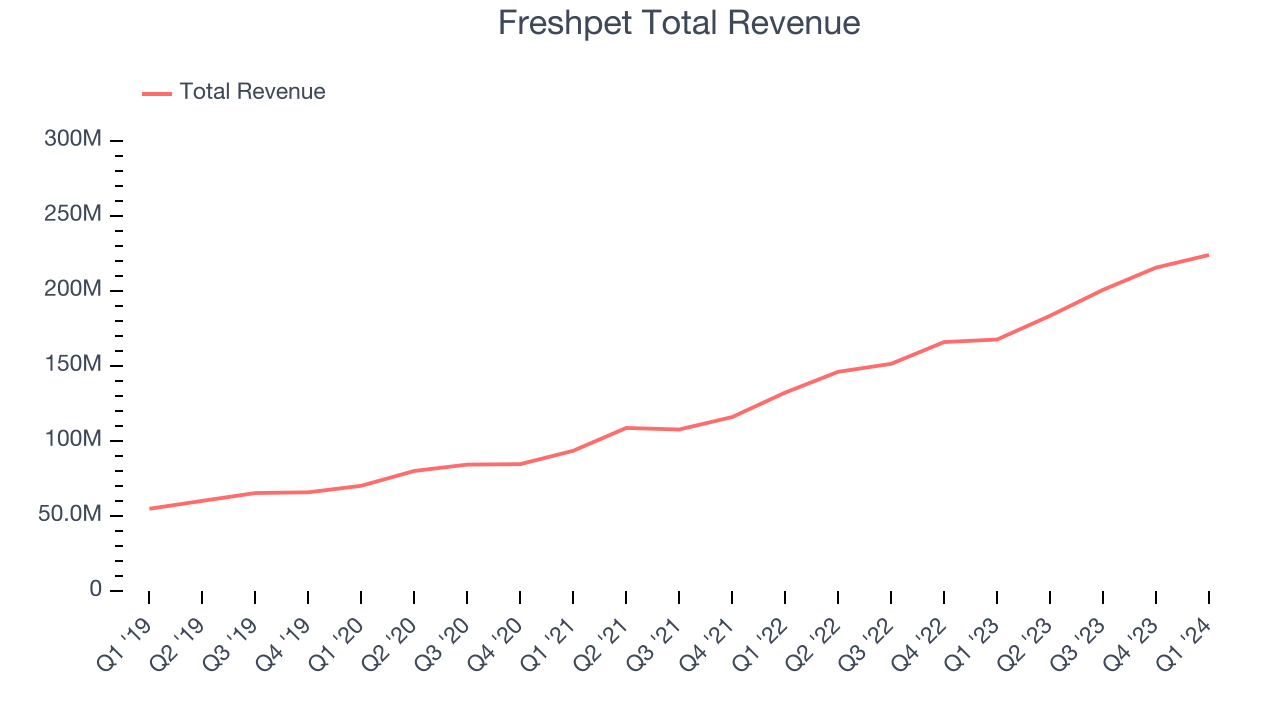

As you can see below, the company's annualized revenue growth rate of 34% over the last three years was incredible for a consumer staples business.

This quarter, Freshpet reported wonderful year-on-year revenue growth of 33.6%, and its $223.8 million in revenue exceeded Wall Street's estimates by 3.6%. Looking ahead, Wall Street expects sales to grow 21.9% over the next 12 months, a deceleration from this quarter.

Gross Margin & Pricing Power

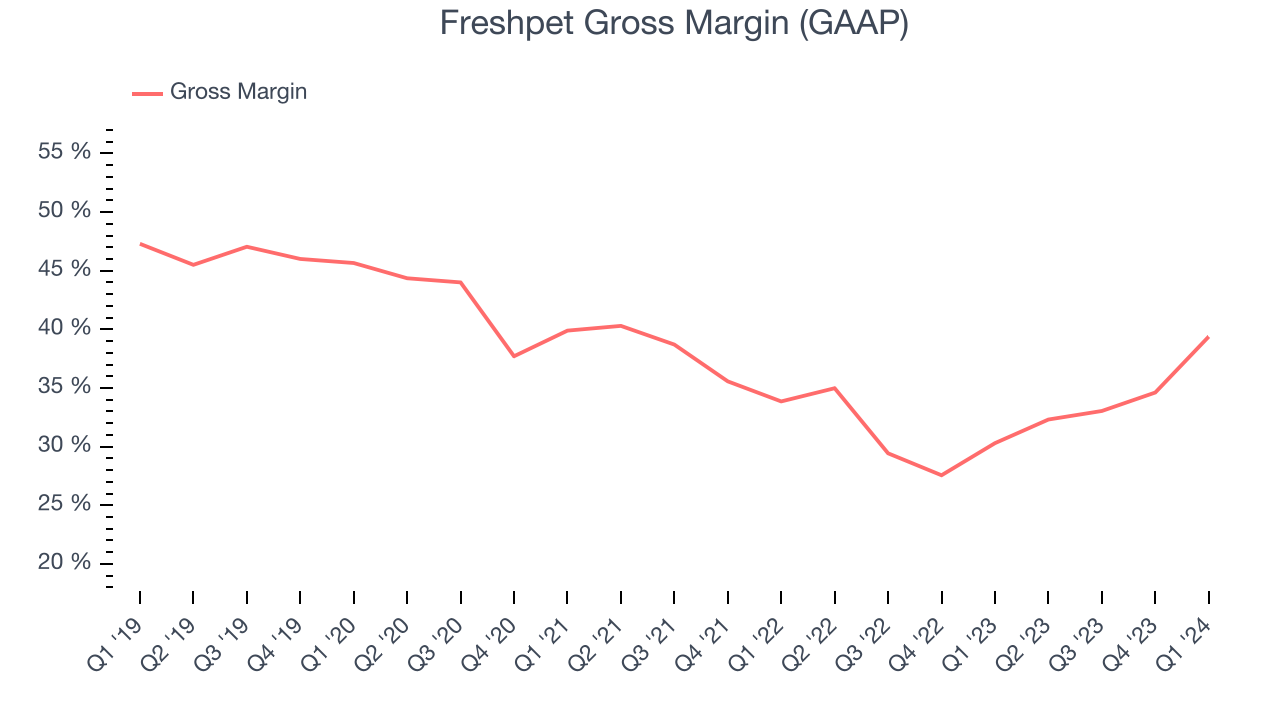

This quarter, Freshpet's gross profit margin was 39.4%, up 9.1 percentage points year on year. That means for every $1 in revenue, $0.61 went towards paying for raw materials, production of goods, and distribution expenses.

Freshpet's unit economics are higher than the typical consumer staples company, giving it the flexibility to invest in areas such as marketing and talent to reach more consumers. As you can see above, it's averaged a decent 33% gross margin over the last eight quarters. Its margin has also been trending up over the last 12 months, averaging 15% year-on-year increases each quarter. If this trend continues, it could suggest a less competitive environment where the company has better pricing power and more favorable input costs (such as raw materials).

Operating Margin

Operating margin is a key profitability metric for companies because it accounts for all expenses enabling a business to operate smoothly, including marketing and advertising, IT systems, wages, and other administrative costs.

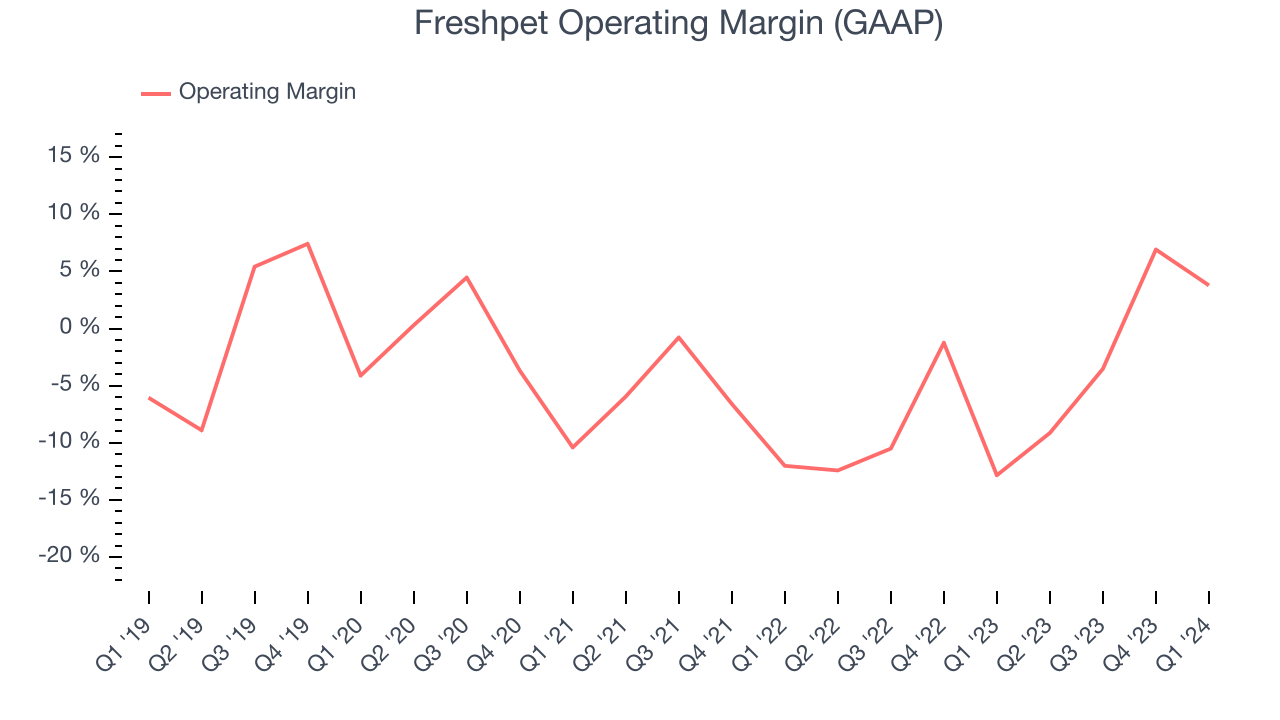

This quarter, Freshpet generated an operating profit margin of 3.8%, up 16.6 percentage points year on year. This increase was encouraging, and we can infer Freshpet was more efficient with its expenses because its operating margin expanded more than its gross margin.

Although Freshpet was profitable this quarter from an operational perspective, it's generally struggled when zooming out. Its high expenses have contributed to an average operating margin of negative 4% over the last two years. This performance isn't ideal as unprofitable publicly traded companies are a minority in the consumer staples sector given its stability. However, Freshpet's margin has improved by 9.1 percentage points on average over the last year, an encouraging sign for shareholders. The tide could be turning.

Although Freshpet was profitable this quarter from an operational perspective, it's generally struggled when zooming out. Its high expenses have contributed to an average operating margin of negative 4% over the last two years. This performance isn't ideal as unprofitable publicly traded companies are a minority in the consumer staples sector given its stability. However, Freshpet's margin has improved by 9.1 percentage points on average over the last year, an encouraging sign for shareholders. The tide could be turning.EPS

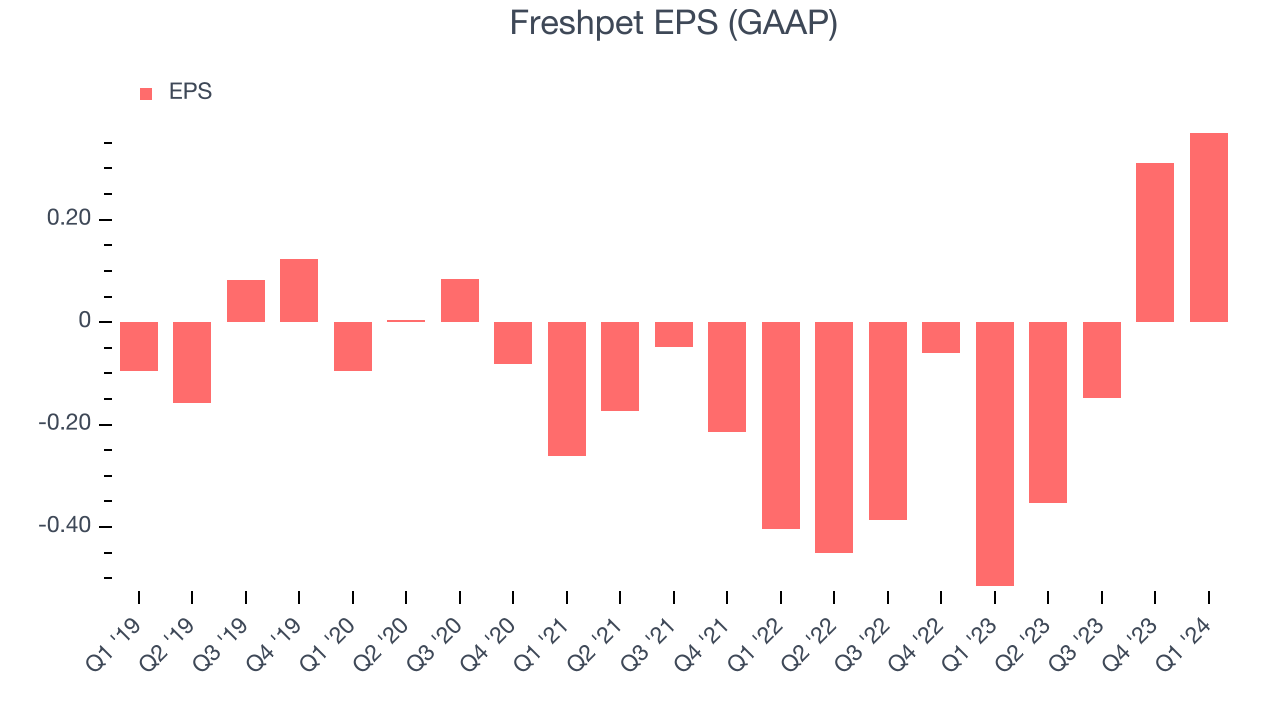

Earnings growth is a critical metric to track, but for long-term shareholders, earnings per share (EPS) is more telling because it accounts for dilution and share repurchases.

In Q1, Freshpet reported EPS at $0.37, up from negative $0.52 in the same quarter a year ago. This print easily cleared Wall Street's estimates, and shareholders should be content with the results.

Between FY2021 and FY2024, Freshpet cut its earnings losses. Its EPS has improved by 39.3% on average each year.

Wall Street expects the company to continue growing earnings over the next 12 months, with analysts projecting an average 118% year-on-year increase in EPS.

Cash Is King

If you've followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can't use accounting profits to pay the bills.

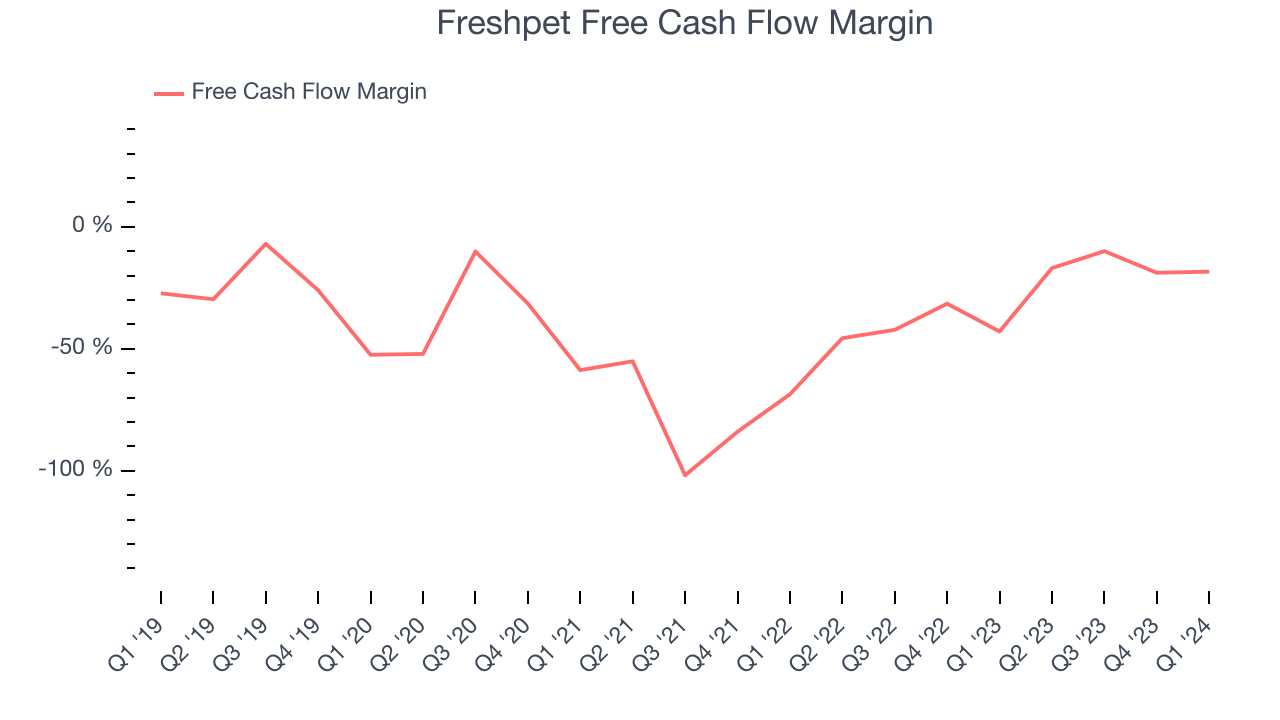

Freshpet burned through $41.07 million of cash in Q1, representing a negative 18.3% free cash flow margin. The company increased its cash burn by 42.8% year on year.

Over the last two years, Freshpet's demanding reinvestments to stay relevant with consumers have drained company resources. Its free cash flow margin has been among the worst in the consumer staples sector, averaging negative 26.6%. However, its margin has averaged year-on-year increases of 24.2 percentage points over the last 12 months, showing the company is taking action to improve its situation.

Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing revenue. But was it capital-efficient? Enter ROIC, a metric showing how much operating profit a company generates relative to how much money the business raised (debt and equity).

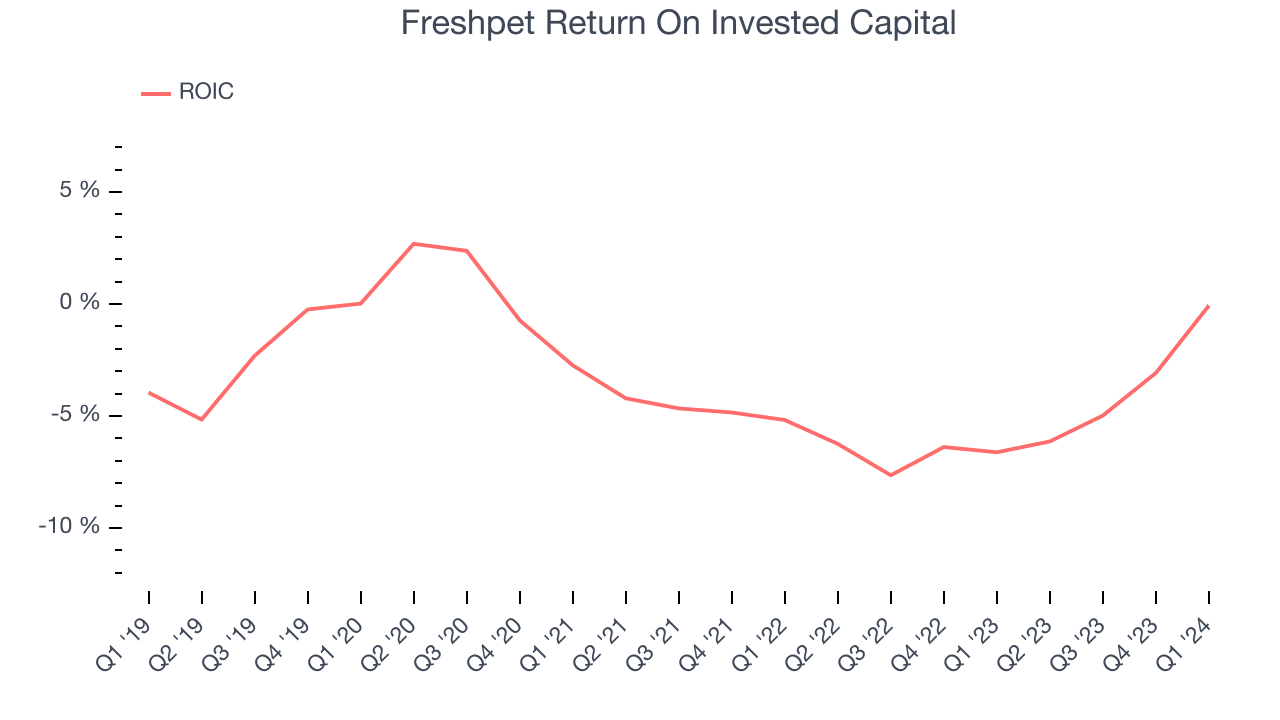

Freshpet's five-year average ROIC was negative 2.9%, meaning management lost money while trying to expand the business. Its returns were among the worst in the consumer staples sector.

The trend in its ROIC, however, is often what surprises the market and drives the stock price. Unfortunately, Freshpet's ROIC averaged 2 percentage point decreases over the last few years. Paired with its already low returns, these declines suggest the company's profitable business opportunities are few and far between.

Balance Sheet Risk

As long-term investors, the risk we care most about is the permanent loss of capital. This can happen when a company goes bankrupt or raises money from a disadvantaged position and is separate from short-term stock price volatility, which we are much less bothered by.

Freshpet is a well-capitalized company with $257.9 million of cash and no debt. This position gives Freshpet the freedom to borrow money, return capital to shareholders, or invest in growth initiatives.

Key Takeaways from Freshpet's Q1 Results

We were impressed that Freshpet beat analysts' revenue, operating margin, and EPS expectations this quarter. That the company reiterated its full year guidance shows that it is squarely on track. Overall, we think this was a really good quarter that should please shareholders. The stock is up 8.6% after reporting and currently trades at $119 per share.

Is Now The Time?

Freshpet may have had a good quarter, but investors should also consider its valuation and business qualities when assessing the investment opportunity.

We have other favorites, but we understand the arguments that Freshpet isn't a bad business. First off, its revenue growth has been exceptional over the last three years. And while its relatively low ROIC suggests it has struggled to grow profits historically, its volume growth has been in a league of its own.

Freshpet's price-to-earnings ratio based on the next 12 months is 95.7x. There are things to like about Freshpet and there's no doubt it's a bit of a market darling, at least for some investors. But it seems there's a lot of optimism already priced in and we wonder if there are better opportunities elsewhere right now.

Wall Street analysts covering the company had a one-year price target of $118.24 per share right before these results (compared to the current share price of $119).

To get the best start with StockStory, check out our most recent stock picks, and then sign up to our earnings alerts by adding companies to your watchlist here. We typically have the quarterly earnings results analyzed within seconds of the data being released, and especially for companies reporting pre-market, this often gives investors the chance to react to the results before the market has fully absorbed the information.