Wrapping up Q4 earnings, we look at the numbers and key takeaways for the sales software stocks, including Freshworks (NASDAQ:FRSH) and its peers.

Companies need to be able to interact with and sell to their customers as efficiently as possible. This reality, coupled with the ongoing migration of enterprises to the cloud drives demand for cloud-based customer relationship management (CRM) software that integrate data analytics with sales and marketing functions.

The 4 sales software stocks we track reported a slower Q4; on average, revenues beat analyst consensus estimates by 3.33%, while on average next quarter revenue guidance was 0.39% under consensus. Technology stocks have been hit hard on fears of higher interest rates as investors search for near-term cash flows, but sales software stocks held their ground better than others, with share prices down 0.72% since the previous earnings results, on average.

Freshworks (NASDAQ:FRSH)

Founded in Chennai, India in 2010 with the idea of creating a “fresh” helpdesk product, Freshworks (NASDAQ: FRSH) offers a broad range of software targeted at small and medium sized businesses.

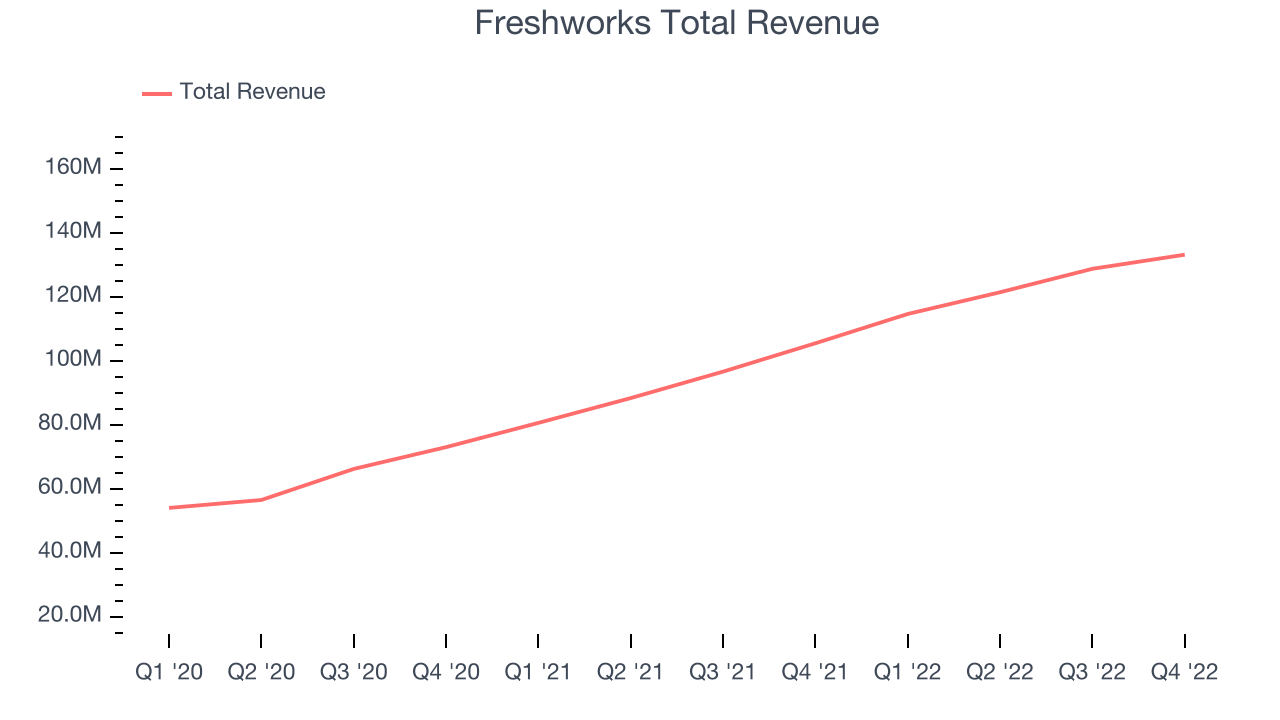

Freshworks reported revenues of $133.2 million, up 26.3% year on year, beating analyst expectations by 2.18%. It was a slower quarter for the company, with revenue guidance for the next quarter and the full year missing analysts' expectations.

“Freshworks capped off a strong finish to the year with revenue growing 30% on a constant currency basis in Q4,” said Girish Mathrubootham, CEO and Founder of Freshworks.

The stock is down 12% since the results and currently trades at $14.42.

Read our full report on Freshworks here, it's free.

Best Q4: Salesforce (NYSE:CRM)

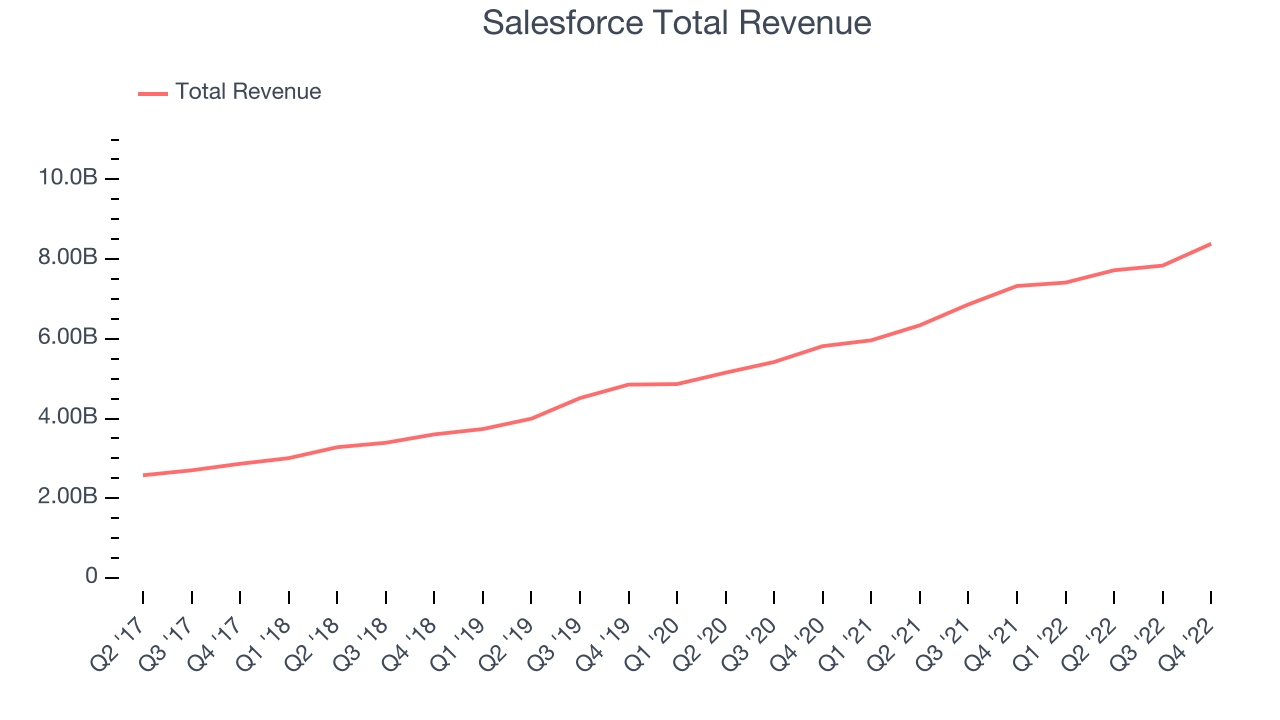

Launched in 1999 from a rented one-bedroom apartment in San Francisco by Marc Benioff and his three co-founders, Salesforce (NYSE:CRM) is a software as a service platform that helps companies access, manage and share sales information.

Salesforce reported revenues of $8.38 billion, up 14.4% year on year, beating analyst expectations by 4.9%. It was a mixed quarter for the company, with a decent beat of analyst estimates but underwhelming guidance for the next year.

Salesforce achieved the highest full year guidance raise but had the slowest revenue growth among its peers. The stock is up 17.8% since the results and currently trades at $197.09.

Is now the time to buy Salesforce? Access our full analysis of the earnings results here, it's free.

ZoomInfo (NASDAQ:ZI)

Founded in 2007 as DiscoveryOrg and renamed after a merger in 2019, ZoomInfo (NASDAQ:ZI) is a software as a service product that provides sales departments with access to a database of prospective clients.

ZoomInfo reported revenues of $301.7 million, up 35.7% year on year, in line with analyst expectations. It was a weak quarter for the company, with revenue guidance for the next quarter and the full year missing analysts' expectations.

ZoomInfo delivered the fastest revenue growth but had the weakest performance against analyst estimates in the group. The company added 78 enterprise customers paying more than $100,000 annually to a total of 1,926. The stock is down 23.6% since the results and currently trades at $21.97.

Read our full analysis of ZoomInfo's results here.

HubSpot (NYSE:HUBS)

Started in 2006 by two MIT grad students, HubSpot (NYSE:HUBS) is a software as a service platform that helps small and medium-size businesses sell, market themselves, and get found on the internet.

HubSpot reported revenues of $469.7 million, up 27.2% year on year, beating analyst expectations by 5.3%. It was a strong quarter for the company, with a solid beat of analyst estimates.

HubSpot pulled off the strongest analyst estimates beat among the peers. The company added 8,481 customers to a total of 167,386. The stock is up 14.9% since the results and currently trades at $417.06.

Read our full, actionable report on HubSpot here, it's free.

The author has no position in any of the stocks mentioned