Business software provider Freshworks (NASDAQ: FRSH) reported results ahead of analysts' expectations in Q1 CY2024, with revenue up 19.9% year on year to $165.1 million. On the other hand, next quarter's revenue guidance of $169 million was less impressive, coming in 1.8% below analysts' estimates. It made a non-GAAP profit of $0.10 per share, improving from its profit of $0.03 per share in the same quarter last year.

Freshworks (FRSH) Q1 CY2024 Highlights:

- Revenue: $165.1 million vs analyst estimates of $163.5 million (small beat)

- EPS (non-GAAP): $0.10 vs analyst estimates of $0.08 (31.6% beat)

- Revenue Guidance for Q2 CY2024 is $169 million at the midpoint, below analyst estimates of $172.1 million

- The company dropped its revenue guidance for the full year from $707.5 million to $700 million at the midpoint, a 1.1% decrease

- Gross Margin (GAAP): 84.3%, up from 81.7% in the same quarter last year

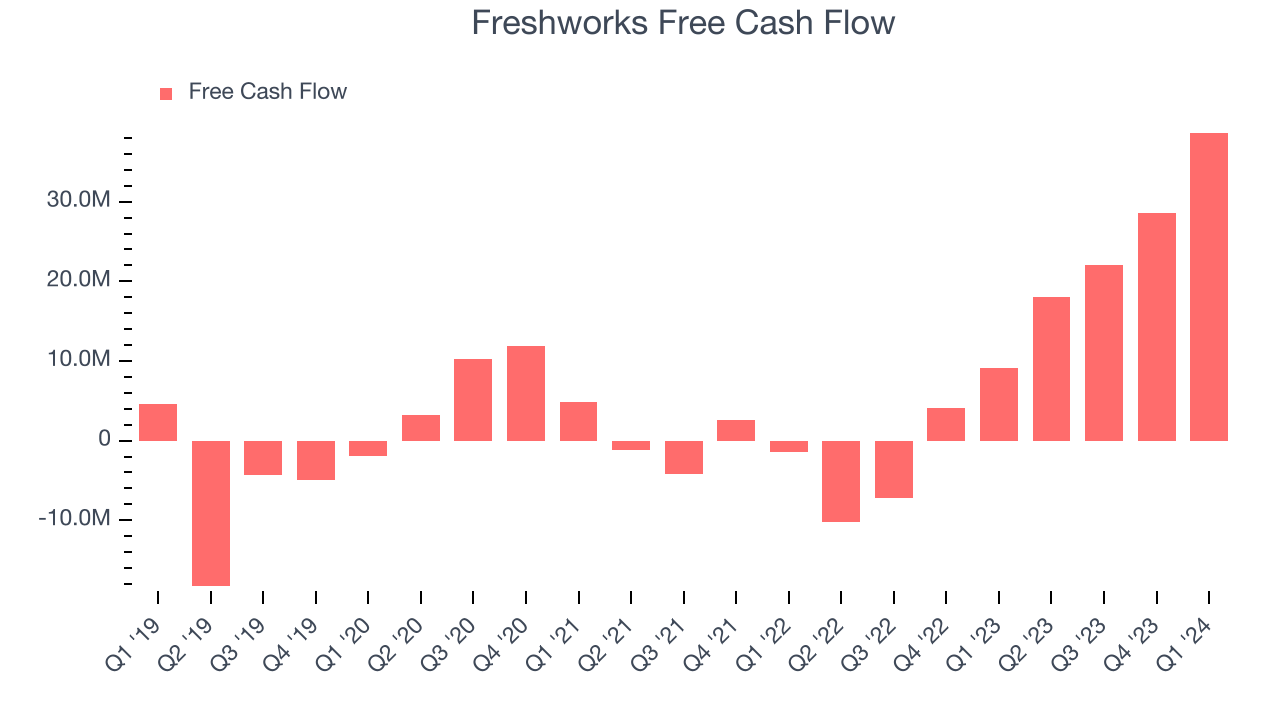

- Free Cash Flow of $38.67 million, up 35.3% from the previous quarter

- Net Revenue Retention Rate: 106%, in line with the previous quarter

- Customers: 20,549 customers paying more than $5,000 annually

- Market Capitalization: $5.33 billion

Founded in Chennai, India in 2010 with the idea of creating a “fresh” helpdesk product, Freshworks (NASDAQ: FRSH) offers a broad range of software targeted at small and medium-sized businesses.

Small and medium sized businesses (SMB) are facing the same digital transformation pressures as larger enterprises. However, they don’t have the human and capital resources to build out integrated front office and back office products for customer service, IT service management (ITSM) and sales & marketing automation (CRM) tools, and are hesitant to have multiple vendors like Zendesk, ServiceNow, and Salesforce, which can be too complex for a small business to manage.

Freshworks has assembled a one-stop-shop for SMB customers looking for customer service, IT service management (ITSM) and sales & marketing automation (CRM) tools. Its approach is to provide enterprise grade products at a discount to larger competitors.

Sales Software

Companies need to be able to interact with and sell to their customers as efficiently as possible. This reality coupled with the ongoing migration of enterprises to the cloud drives demand for cloud-based customer relationship management (CRM) software that integrates data analytics with sales and marketing functions.

Freshworks operates in a highly competitive space, with rivals like Microsoft (NASDAQ:MSFT), Salesforce.com (NASDAQ: CRM), ServiceNow (NYSE: NOW), Hubspot (NYSE: HUBS), PagerDuty (NYSE:PD), and Zendesk (NASDAQ: ZEN).

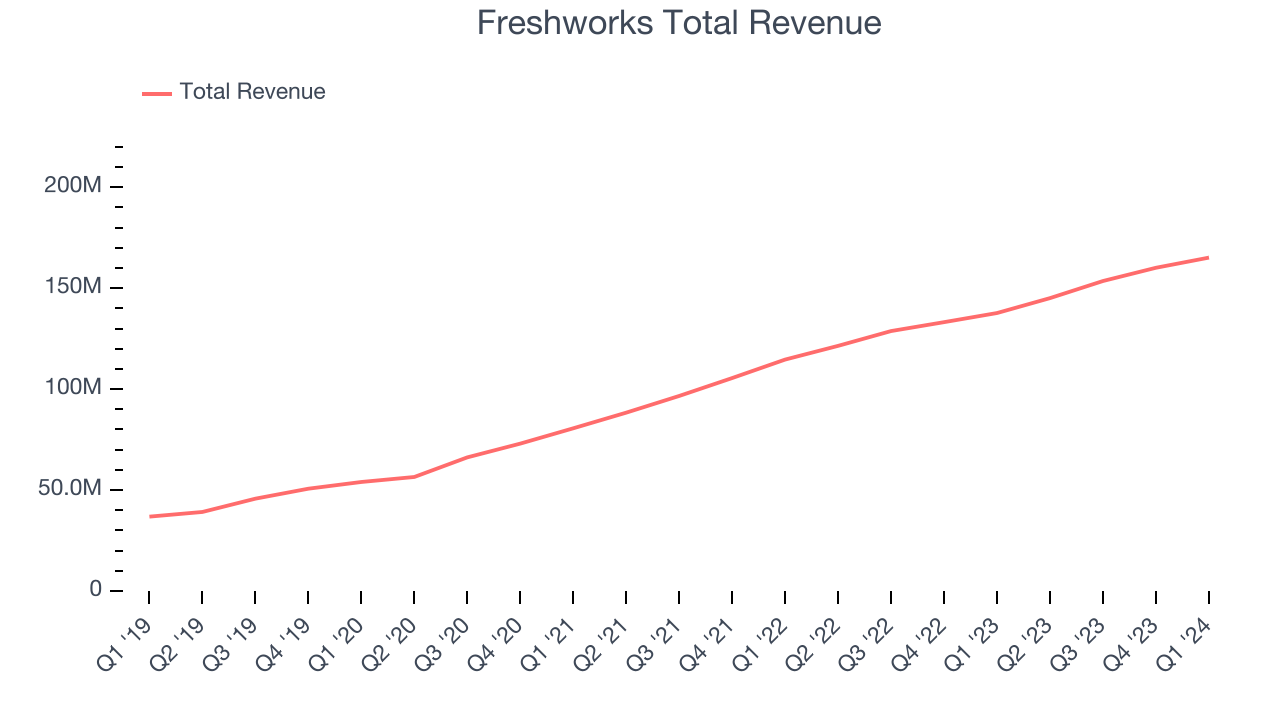

Sales Growth

As you can see below, Freshworks's revenue growth has been very strong over the last three years, growing from $80.59 million in Q1 2021 to $165.1 million this quarter.

This quarter, Freshworks's quarterly revenue was once again up 19.9% year on year. However, its growth did slow down compared to last quarter as the company's revenue increased by just $5.03 million in Q1 compared to $6.56 million in Q4 CY2023. While we'd like to see revenue increase by a greater amount each quarter, a one-off fluctuation is usually not concerning.

Next quarter's guidance suggests that Freshworks is expecting revenue to grow 16.5% year on year to $169 million, slowing down from the 19.5% year-on-year increase it recorded in the same quarter last year. Looking ahead, analysts covering the company were expecting sales to grow 18.7% over the next 12 months before the earnings results announcement.

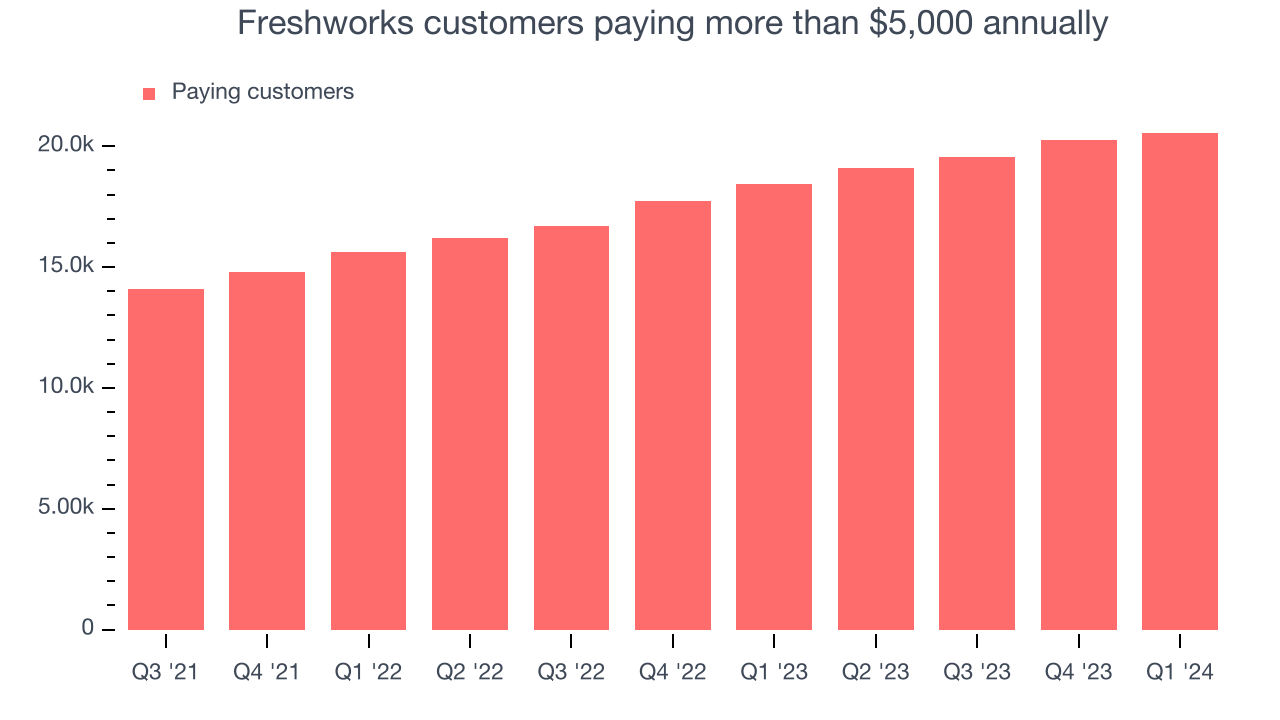

Large Customers Growth

This quarter, Freshworks reported 20,549 enterprise customers paying more than $5,000 annually, an increase of 288 from the previous quarter. That's a bit fewer contract wins than last quarter and quite a bit below what we've typically observed over the past four quarters, suggesting that its sales momentum with large customers is slowing.

Product Success

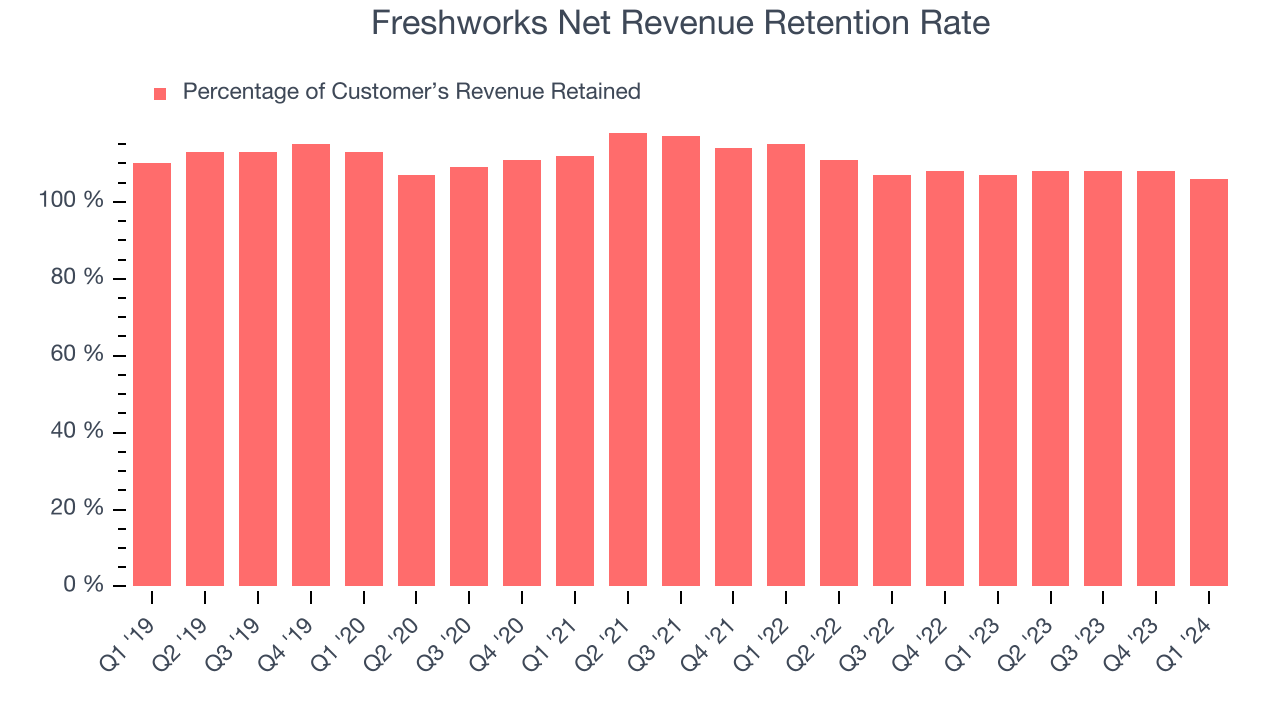

One of the best parts about the software-as-a-service business model (and a reason why SaaS companies trade at such high valuation multiples) is that customers typically spend more on a company's products and services over time.

Freshworks's net revenue retention rate, a key performance metric measuring how much money existing customers from a year ago are spending today, was 106% in Q1. This means that even if Freshworks didn't win any new customers over the last 12 months, it would've grown its revenue by 6%.

Despite its recent drop, Freshworks still has a decent net retention rate, showing us that its customers not only tend to stick around but also get increasing value from its software over time.

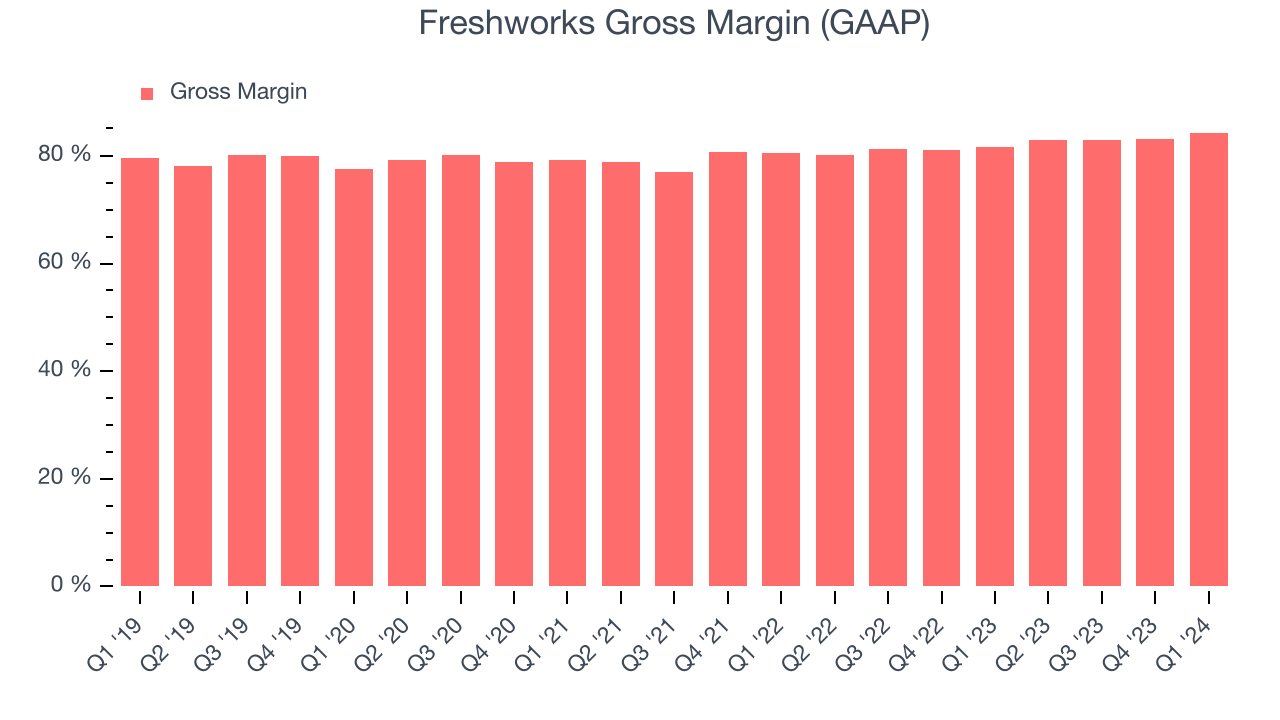

Profitability

What makes the software as a service business so attractive is that once the software is developed, it typically shouldn't cost much to provide it as an ongoing service to customers. Freshworks's gross profit margin, an important metric measuring how much money there's left after paying for servers, licenses, technical support, and other necessary running expenses, was 84.3% in Q1.

That means that for every $1 in revenue the company had $0.84 left to spend on developing new products, sales and marketing, and general administrative overhead. Significantly up from the last quarter, Freshworks's excellent gross margin allows it to fund large investments in product and sales during periods of rapid growth and achieve profitability when reaching maturity.

Cash Is King

If you've followed StockStory for a while, you know that we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can't use accounting profits to pay the bills. Freshworks's free cash flow came in at $38.67 million in Q1, up 325% year on year.

Freshworks has generated $107.4 million in free cash flow over the last 12 months, a solid 17.2% of revenue. This strong FCF margin stems from its asset-lite business model, giving it optionality and plenty of cash to reinvest in its business.

Key Takeaways from Freshworks's Q1 Results

It was good to see Freshworks slightly improve its gross margin this quarter, but its full-year revenue guidance was below expectations. Additionally, it reported smaller net additions due to increased small-to-medium-sized business churn. Overall, the results could have been better. The company is down 17.9% on the results and currently trades at $14.97 per share.

Is Now The Time?

Freshworks may have had a bad quarter, but investors should also consider its valuation and business qualities when assessing the investment opportunity.

There are several reasons why we think Freshworks is a great business. While we'd expect growth rates to moderate from here, its revenue growth has been strong over the last three years. Additionally, its impressive gross margins indicate excellent business economics, and its strong free cash flow generation gives it re-investment options.

The market is certainly expecting long-term growth from Freshworks given its price-to-sales ratio based on the next 12 months is 7.3x. But looking at the tech landscape today, Freshworks's qualities stand out, and we think that the multiple is justified. We still like the stock at this price.

Wall Street analysts covering the company had a one-year price target of $26.07 right before these results (compared to the current share price of $14.97), implying they see short-term upside potential in Freshworks.

To get the best start with StockStory, check out our most recent Stock picks, and then sign up for our earnings alerts by adding companies to your watchlist here. We typically have the quarterly earnings results analyzed within seconds of the data being released. Especially for companies reporting pre-market, this often gives investors the chance to react to the results before everyone else has fully absorbed the information.