Railway infrastructure company L.B. Foster (NASDAQGS:FSTR) reported Q2 CY2024 results beating Wall Street analysts' expectations, with revenue down 4.9% year on year to $140.8 million. The company expects the full year's revenue to be around $537.5 million, in line with analysts' estimates. It made a GAAP profit of $0.26 per share, down from its profit of $0.32 per share in the same quarter last year.

Is now the time to buy L.B. Foster? Find out by accessing our full research report, it's free.

L.B. Foster (FSTR) Q2 CY2024 Highlights:

- Revenue: $140.8 million vs analyst estimates of $137.4 million (2.5% beat)

- EPS: $0.26 vs analyst expectations of $0.42 (38.1% miss)

- The company dropped its revenue guidance for the full year from $542.5 million to $537.5 million at the midpoint, a 0.9% decrease

- EBITDA guidance for the full year is $35.5 million at the midpoint, below analyst estimates of $36.36 million

- Gross Margin (GAAP): 21.7%, in line with the same quarter last year

- Adjusted EBITDA Margin: 5.7%, in line with the same quarter last year

- Market Capitalization: $225.7 million

John Kasel, President and Chief Executive Officer, commented "After a strong start to the year in the first quarter, second quarter results were somewhat softer as compared to last year. Sales were down 4.9%, with organic sales down 3.4% and 1.5% lower sales from portfolio actions completed last year. The organic decline was realized primarily in the Rail segment, with softness in the domestic rail market adversely impacting both volumes and pricing. On a positive note, within our growth portfolio, the technology and services components of the Rail portfolio delivered solid gains year over year, including a recovery in our UK business. Infrastructure organic sales were essentially flat year over year, with continuing adverse weather conditions in the south and mid-west hampering project deliveries. Gross margins overall were 21.7%, down 10 bps versus last year, with lower margins in the Rail segment largely offset by improved margins in Infrastructure due primarily to our strategic portfolio actions. Net income was $2.8 million, down $0.7 million from last year, and Adjusted EBITDA was $8.1 million, down $2.5 million from last year, with the decline due primarily to the lower sales and margins in the Rail segment, along with $0.5 million in professional service costs incurred associated with the announced restructuring. We remain focused on executing our strategic playbook to drive growth and shareholder returns while managing the near-term headwinds we're currently experiencing."

Founded with a $2,500 loan, L.B. Foster (NASDAQ:FSTR) is a provider of products and services for the transportation and energy infrastructure sectors, including rail products, construction materials, and coating solutions.

General Industrial Machinery

Automation that increases efficiency and connected equipment that collects analyzable data have been trending, creating new demand for general industrial machinery companies. Those who innovate and create digitized solutions can spur sales and speed up replacement cycles, but all general industrial machinery companies are still at the whim of economic cycles. Consumer spending and interest rates, for example, can greatly impact the industrial production that drives demand for these companies’ offerings.

Sales Growth

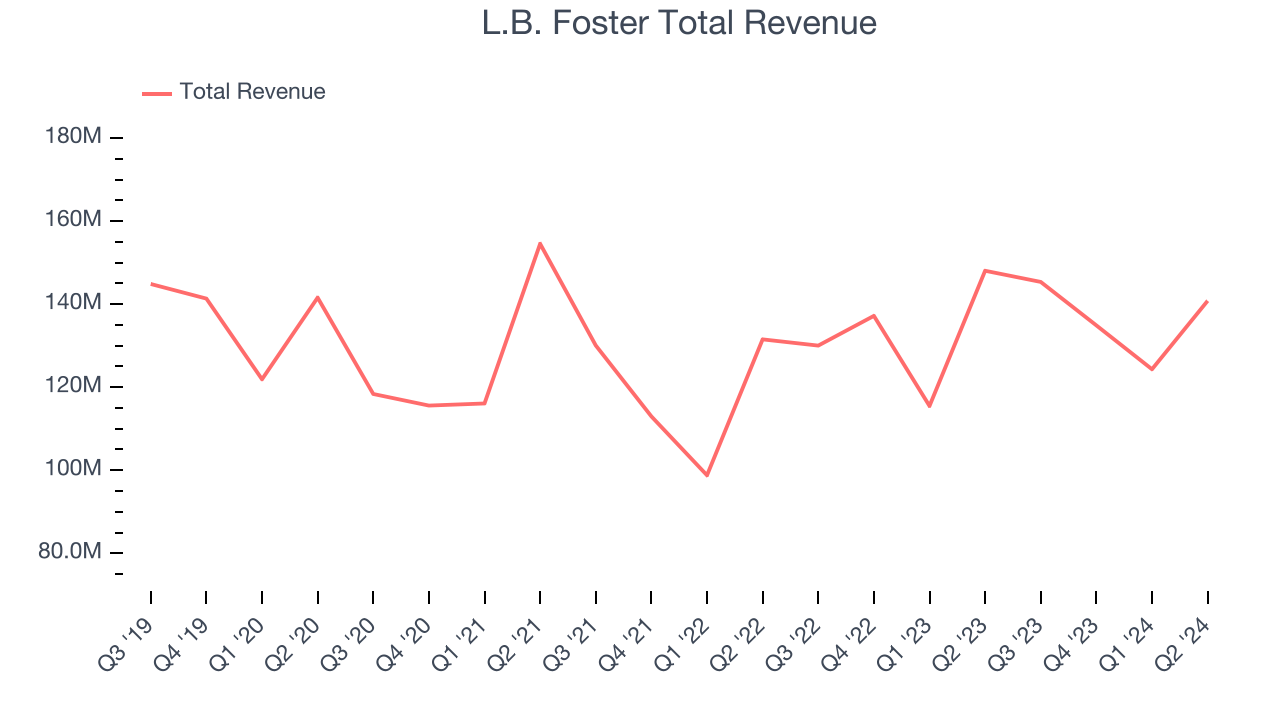

A company’s long-term performance can indicate its business quality. Any business can put up a good quarter or two, but many enduring ones tend to grow for years. L.B. Foster's demand was weak over the last four years as its sales were flat, a poor baseline for our analysis.

Long-term growth is the most important, but within industrials, a stretched historical view may miss new industry trends or demand cycles. L.B. Foster's annualized revenue growth of 7.3% over the last two years is above its four-year trend, but we were still disappointed by the results.

This quarter, L.B. Foster's revenue fell 4.9% year on year to $140.8 million but beat Wall Street's estimates by 2.5%. We also like to judge companies based on their projected revenue growth, but not enough Wall Street analysts cover the company for it to have reliable consensus estimates.

Today’s young investors won’t have read the timeless lessons in Gorilla Game: Picking Winners In High Technology because it was written more than 20 years ago when Microsoft and Apple were first establishing their supremacy. But if we apply the same principles, then enterprise software stocks leveraging their own generative AI capabilities may well be the Gorillas of the future. So, in that spirit, we are excited to present our Special Free Report on a profitable, fast-growing enterprise software stock that is already riding the automation wave and looking to catch the generative AI next.

Operating Margin

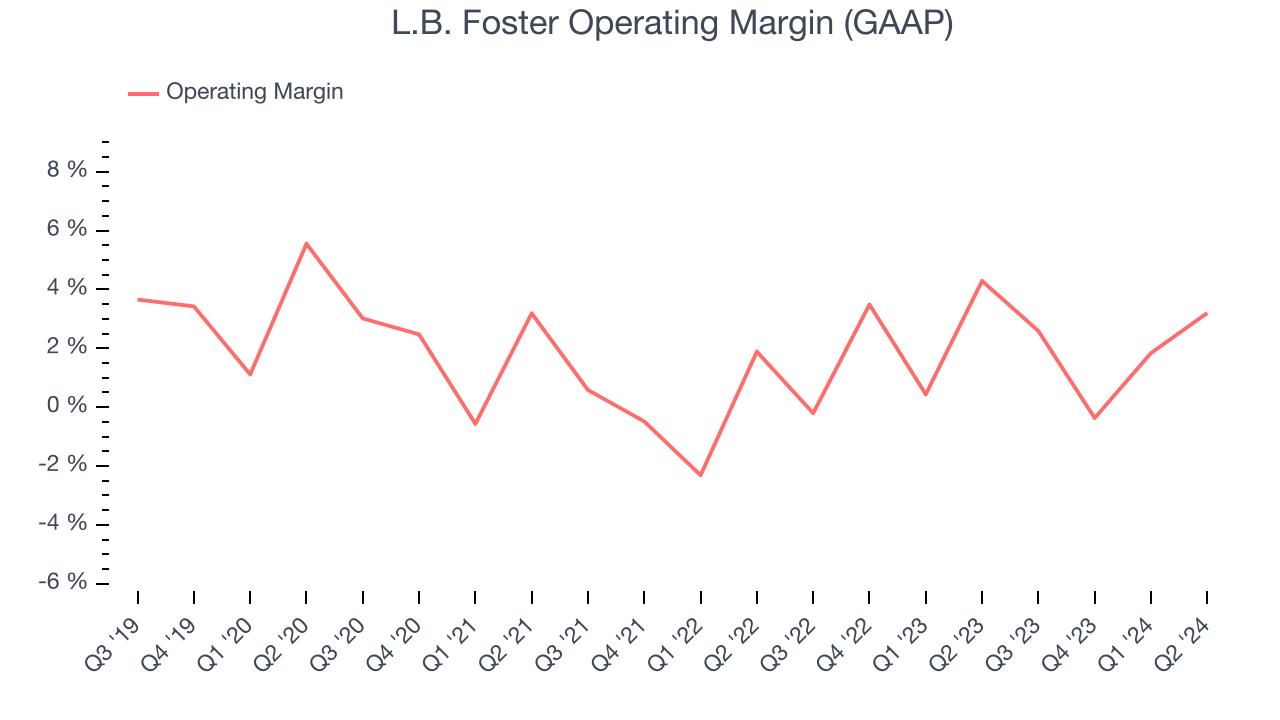

L.B. Foster was profitable over the last five years but held back by its large expense base. It demonstrated lousy profitability for an industrials business, producing an average operating margin of 2%. This result isn't too surprising given its low gross margin as a starting point.

Looking at the trend in its profitability, L.B. Foster's annual operating margin decreased by 1.7 percentage points over the last five years. The company's performance was poor no matter how you look at it. It shows operating expenses were rising and it couldn't pass those costs onto its customers.

In Q2, L.B. Foster generated an operating profit margin of 3.2%, down 1.1 percentage points year on year. Since L.B. Foster's operating margin decreased more than its gross margin, we can assume the company was recently less efficient because expenses such as sales, marketing, R&D, and administrative overhead increased.

EPS

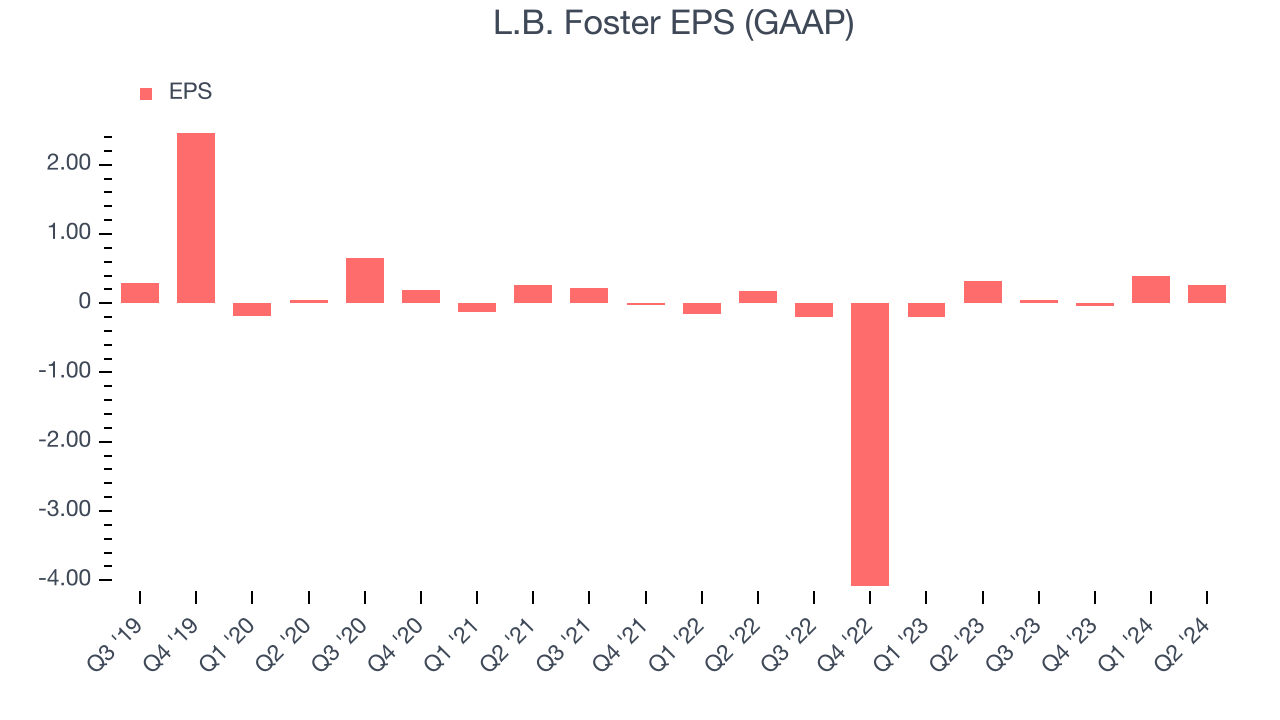

Analyzing long-term revenue trends tells us about a company's historical growth, but the long-term change in its earnings per share (EPS) points to the profitability of that growth–for example, a company could inflate its sales through excessive spending on advertising and promotions.

Sadly for L.B. Foster, its EPS declined by 29% annually over the last four years while its revenue was flat. This tells us the company struggled because its fixed cost base made it difficult to adjust to choppy demand.

Like with revenue, we also analyze EPS over a shorter period to see if we are missing a change in the business. For L.B. Foster, its two-year annual EPS growth of 76.1% was higher than its four-year trend. This acceleration made it one of the faster-growing industrials companies in recent history.

In Q2, L.B. Foster reported EPS at $0.26, down from $0.32 in the same quarter last year. This print missed analysts' estimates. We also like to analyze expected EPS growth based on Wall Street analysts' consensus projections, but there is insufficient data.

Key Takeaways from L.B. Foster's Q2 Results

We enjoyed seeing L.B. Foster exceed analysts' revenue expectations this quarter. On the other hand, its EPS missed and its EBITDA guidance for the full year fell short of Wall Street's estimates. Overall, this quarter could have been better. Despite this, the stock traded up 2.6% to $21.27 immediately after reporting.

So should you invest in L.B. Foster right now? When making that decision, it's important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it's free.