Aircraft leasing company FTAI Aviation (NASDAQ:FTAI) reported Q3 CY2024 results exceeding the market’s revenue expectations, with sales up 60% year on year to $465.8 million. Its GAAP profit of $0.76 per share was 2.7% below analysts’ consensus estimates.

Is now the time to buy FTAI Aviation? Find out by accessing our full research report, it’s free.

FTAI Aviation (FTAI) Q3 CY2024 Highlights:

- Revenue: $465.8 million vs analyst estimates of $420.4 million (10.8% beat)

- EBITDA: $232 million vs analyst estimates of $214.6 million (8.1% beat)

- EPS: $0.76 vs analyst expectations of $0.78 (2.7% miss)

- Gross Margin (GAAP): 52.9%, up from 48.3% in the same quarter last year

- EBITDA Margin: 49.8%, down from 53% in the same quarter last year

- Market Capitalization: $14.66 billion

Company Overview

With a focus on the CFM56 engine that powers Boeing and Airbus’s planes, FTAI Aviation (NASDAQ:FTAI) provides aircraft and engine leasing as well as the maintenance and repair of these products.

Vehicle Parts Distributors

Supply chain and inventory management are themes that grew in focus after COVID wreaked havoc on the global movement of raw materials and components. Transportation parts distributors that boast reliable selection in sometimes specialized areas combined and quickly deliver products to customers can benefit from this theme. Additionally, distributors who earn meaningful revenue streams from aftermarket products can enjoy more steady top-line trends and higher margins. But like the broader industrials sector, transportation parts distributors are also at the whim of economic cycles that impact capital spending, transportation volumes, and demand for discretionary parts and components.

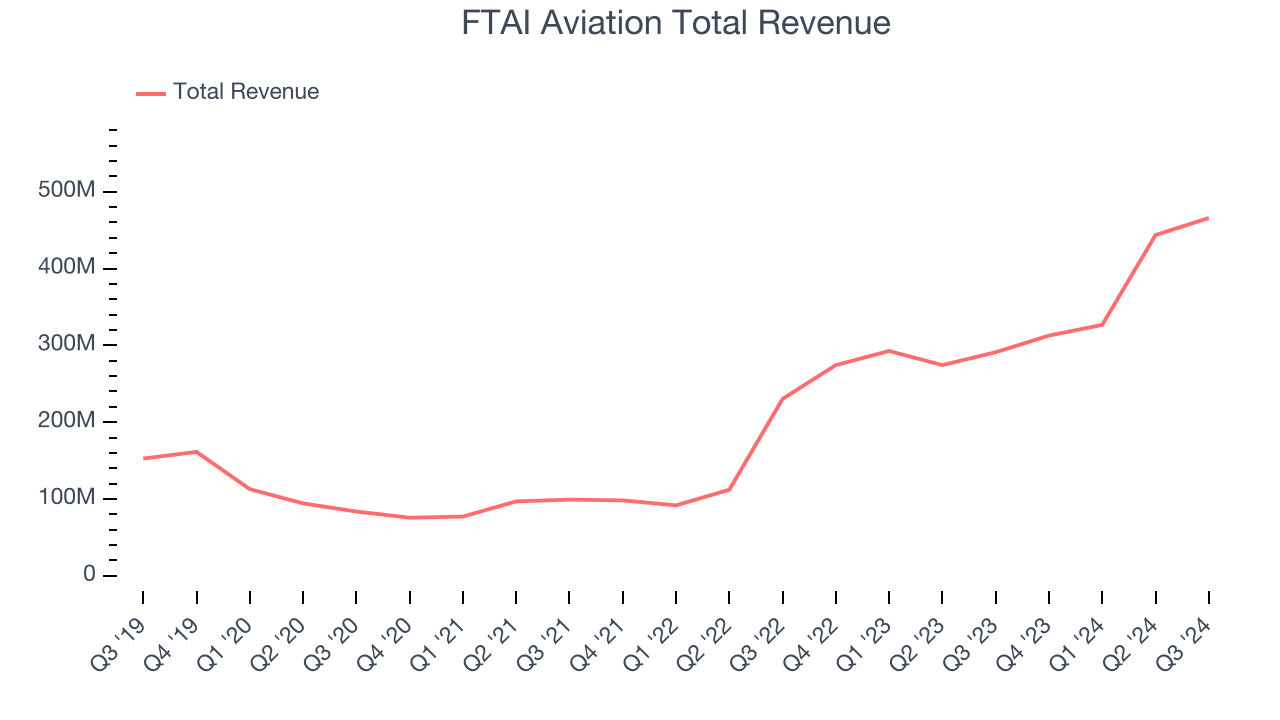

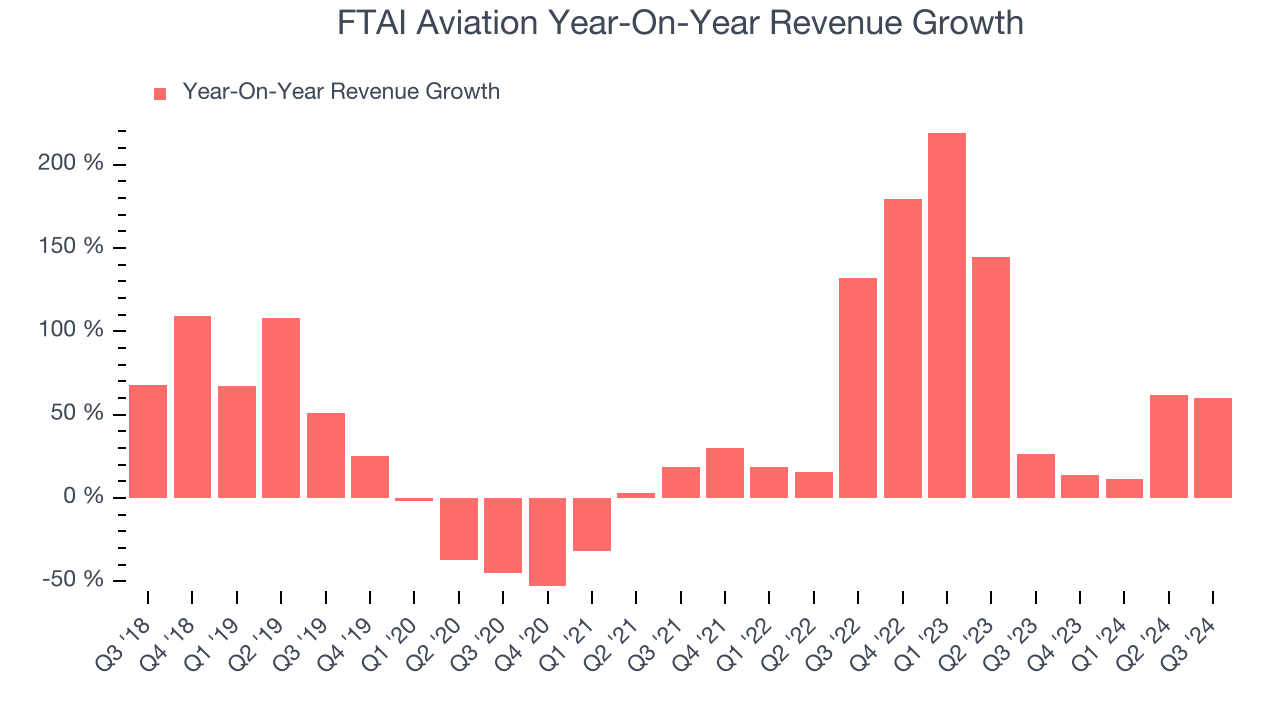

Sales Growth

Reviewing a company’s long-term performance can reveal insights into its business quality. Any business can have short-term success, but a top-tier one sustains growth for years. Over the last five years, FTAI Aviation grew its sales at an incredible 23.2% compounded annual growth rate. This is encouraging because it shows FTAI Aviation’s offerings resonate with customers, a helpful starting point.

Long-term growth is the most important, but within industrials, a half-decade historical view may miss new industry trends or demand cycles. FTAI Aviation’s annualized revenue growth of 70.6% over the last two years is above its five-year trend, suggesting its demand was strong and recently accelerated.

This quarter, FTAI Aviation reported magnificent year-on-year revenue growth of 60%, and its $465.8 million of revenue beat Wall Street’s estimates by 10.8%.

Looking ahead, sell-side analysts expect revenue to grow 21.8% over the next 12 months, a deceleration versus the last two years. This projection is still healthy and indicates the market sees success for its products and services.

When a company has more cash than it knows what to do with, buying back its own shares can make a lot of sense–as long as the price is right. Luckily, we’ve found one, a low-priced stock that is gushing free cash flow AND buying back shares. Click here to claim your Special Free Report on a fallen angel growth story that is already recovering from a setback.

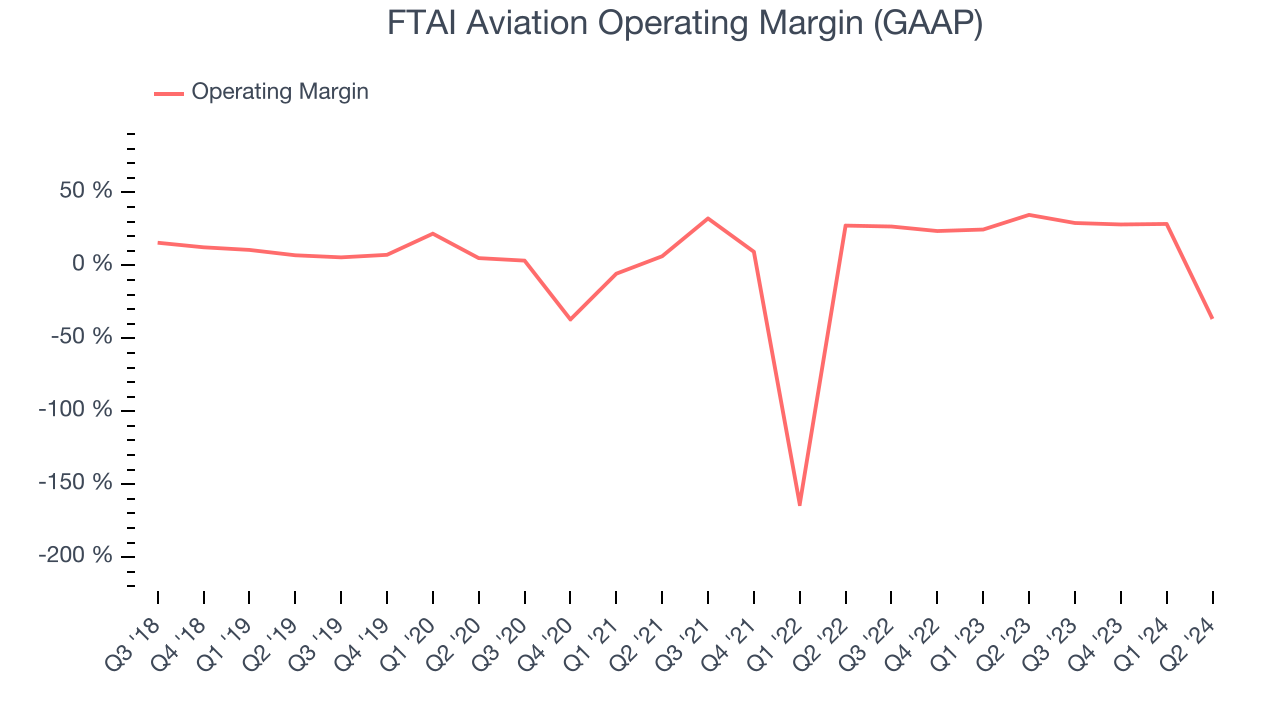

Operating Margin

Operating margin is an important measure of profitability as it shows the portion of revenue left after accounting for all core expenses–everything from the cost of goods sold to advertising and wages. It’s also useful for comparing profitability across companies with different levels of debt and tax rates because it excludes interest and taxes.

FTAI Aviation has done a decent job managing its cost base over the last five years. The company has produced an average operating margin of 9.5%, higher than the broader industrials sector.

Looking at the trend in its profitability, FTAI Aviation’s annual operating margin decreased by 9.5 percentage points over the last five years. Even though its margin is still high, shareholders will want to see FTAI Aviation become more profitable in the future. Note that some quarters with extremely low margins could be due to one-time charges.

Earnings Per Share

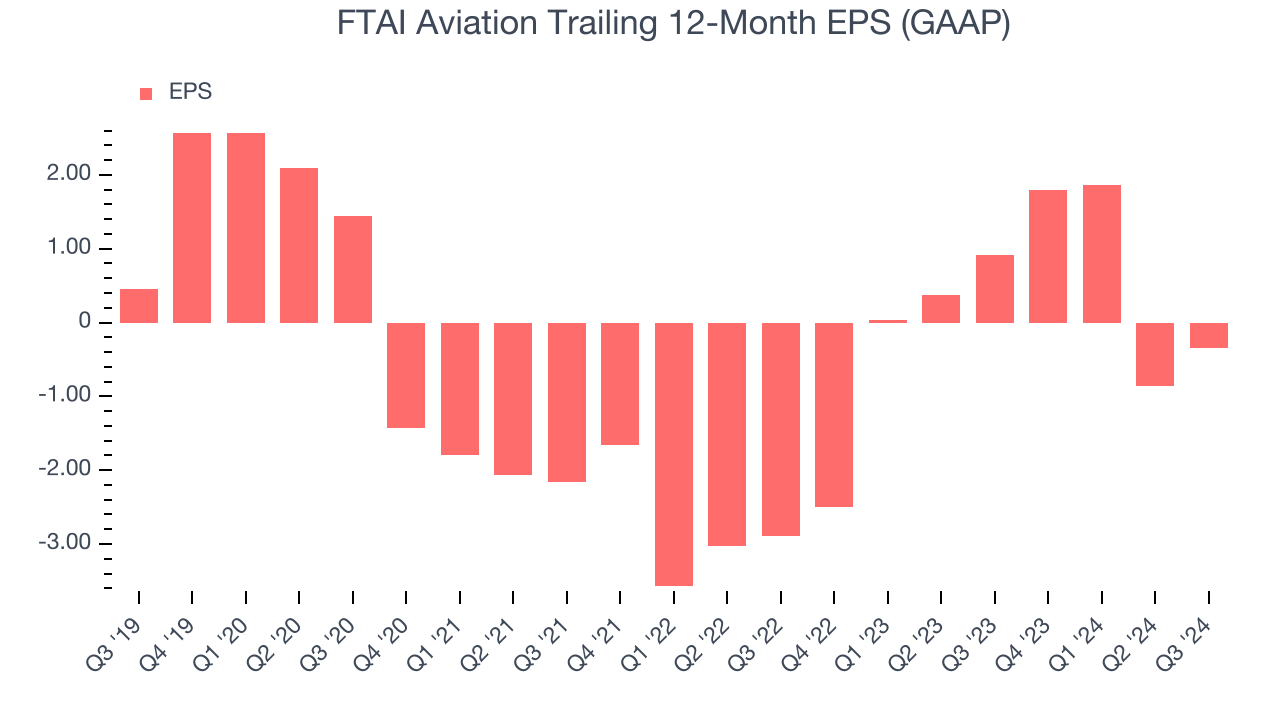

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth was profitable.

Sadly for FTAI Aviation, its EPS declined by 22.6% annually over the last five years while its revenue grew by 23.2%. This tells us the company became less profitable on a per-share basis as it expanded.

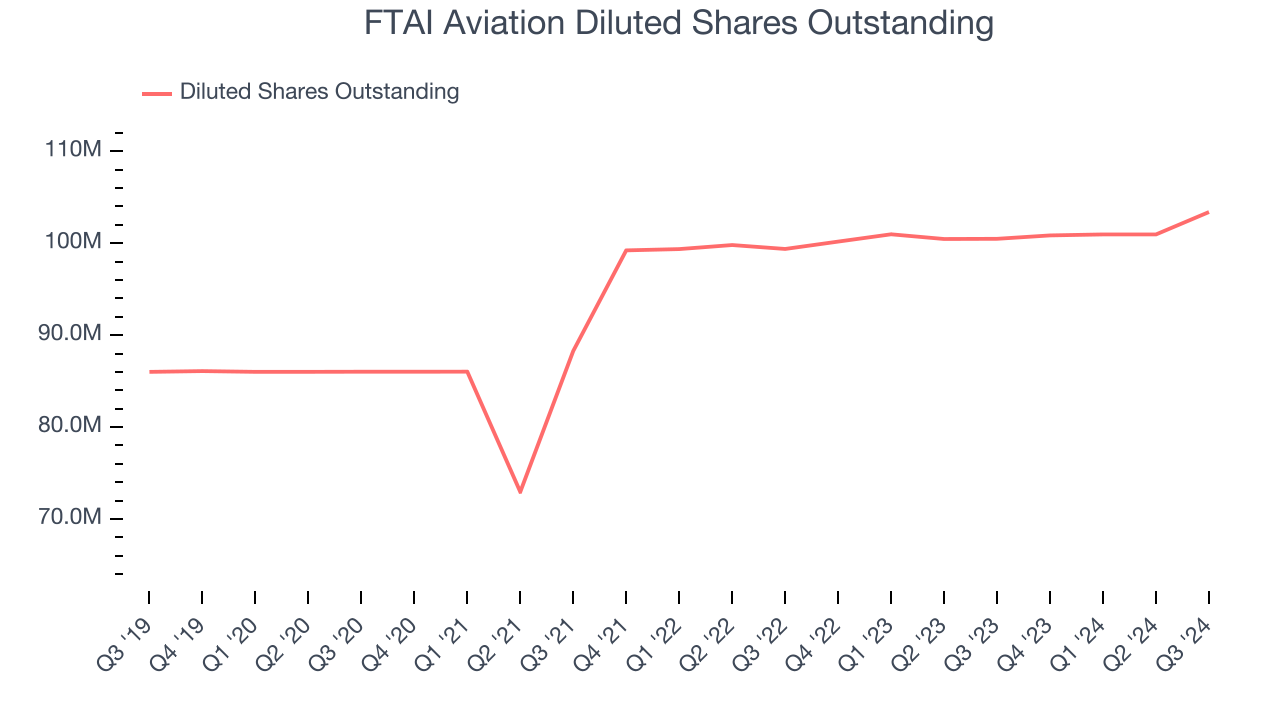

We can take a deeper look into FTAI Aviation’s earnings to better understand the drivers of its performance. As we mentioned earlier, FTAI Aviation’s operating margin declined by 9.5 percentage points over the last five years. Its share count also grew by 20.2%, meaning the company not only became less efficient with its operating expenses but also diluted its shareholders.

Like with revenue, we analyze EPS over a more recent period because it can give insight into an emerging theme or development for the business.

For FTAI Aviation, its two-year annual EPS growth of 65.3% was higher than its five-year trend. This acceleration made it one of the faster-growing industrials companies in recent history.In Q3, FTAI Aviation reported EPS at $0.76, up from $0.25 in the same quarter last year. Despite growing year on year, this print missed analysts’ estimates. Over the next 12 months, Wall Street is optimistic. Analysts forecast FTAI Aviation’s full-year EPS of negative $0.35 will flip to positive $4.05.

Key Takeaways from FTAI Aviation’s Q3 Results

We liked how revenue and EBITDA beat analysts’ expectations this quarter. On the other hand, its EPS missed, but the EBITDA beat makes us a little more comfortable. Overall, we think this was a decent quarter, and the company will provide guidance on the earnings call. The stock remained flat at $145.30 immediately following the results.

FTAI Aviation put up rock-solid earnings, but one quarter doesn’t necessarily make the stock a buy. Let’s see if this is a good investment.When making that decision, it’s important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it’s free.