Breakfast restaurant chain First Watch Restaurant Group (NASDAQ:FWRG) reported results in line with analysts' expectations in Q2 CY2024, with revenue up 19.5% year on year to $258.6 million. It made a GAAP profit of $0.14 per share, improving from its profit of $0.13 per share in the same quarter last year.

Is now the time to buy First Watch? Find out by accessing our full research report, it's free.

First Watch (FWRG) Q2 CY2024 Highlights:

- Revenue: $258.6 million vs analyst estimates of $257.6 million (small beat)

- EPS: $0.14 vs analyst estimates of $0.12 (13.2% beat)

- Lowered Full-Year Same-Store Sales Guidance from +1% growth to -1% decline

- Gross Margin (GAAP): 23.5%, up from 22.8% in the same quarter last year

- Adjusted EBITDA Margin: 13.7%, up from 11.9% in the same quarter last year

- Locations: 538 at quarter end, up from 492 in the same quarter last year

- Same-Store Sales were flat year on year (7.8% in the same quarter last year)

- Market Capitalization: $862.1 million

“We are pleased with our second quarter results and proud of our teams for delivering exceptional experiences for our customers and employees. Amidst a challenging backdrop, which we view as transitory, we are operating our restaurants at a very high level and with tremendous efficiency, as exemplified by our adjusted EBITDA growth, high customer satisfaction scores, improved employee turnover and accelerated ticket times,” said Chris Tomasso, First Watch CEO and President.

Based on a nautical reference to the first work shift aboard a ship, First Watch (NASDAQ:FWRG) is a chain of breakfast and brunch restaurants whose menu is heavily-focused on eggs and griddle items such as pancakes.

Sit-Down Dining

Sit-down restaurants offer a complete dining experience with table service. These establishments span various cuisines and are renowned for their warm hospitality and welcoming ambiance, making them perfect for family gatherings, special occasions, or simply unwinding. Their extensive menus range from appetizers to indulgent desserts and wines and cocktails. This space is extremely fragmented and competition includes everything from publicly-traded companies owning multiple chains to single-location mom-and-pop restaurants.

Sales Growth

First Watch is a mid-sized restaurant chain, which sometimes brings disadvantages compared to larger competitors benefiting from better brand awareness and economies of scale. On the other hand, First Watch can still achieve high growth rates because its revenue base is not yet monstrous.

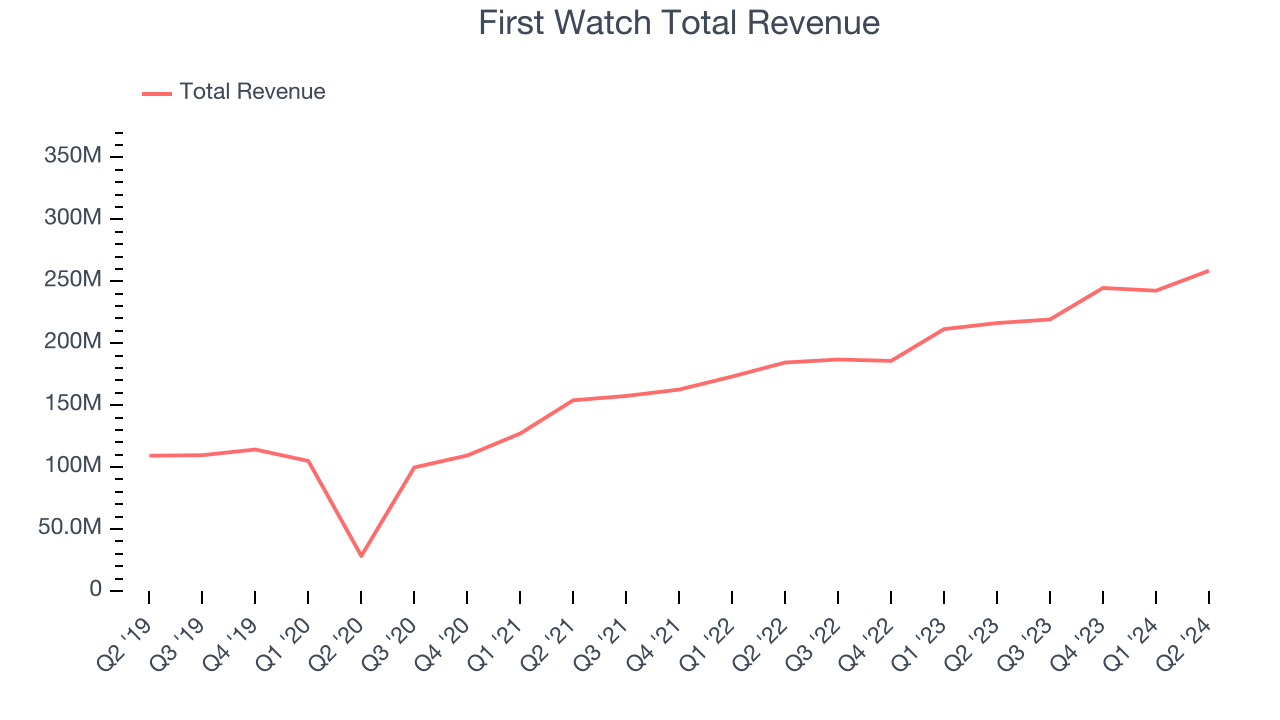

As you can see below, the company's annualized revenue growth rate of 18.7% over the last five years was excellent as it added more dining locations and increased sales at existing, established restaurants.

This quarter, First Watch's year-on-year revenue growth clocked in at 19.5%, and its $258.6 million in revenue was in line with Wall Street's estimates. Looking ahead, Wall Street expects sales to grow 16.2% over the next 12 months, a deceleration from this quarter.

Today’s young investors won’t have read the timeless lessons in Gorilla Game: Picking Winners In High Technology because it was written more than 20 years ago when Microsoft and Apple were first establishing their supremacy. But if we apply the same principles, then enterprise software stocks leveraging their own generative AI capabilities may well be the Gorillas of the future. So, in that spirit, we are excited to present our Special Free Report on a profitable, fast-growing enterprise software stock that is already riding the automation wave and looking to catch the generative AI next.

Same-Store Sales

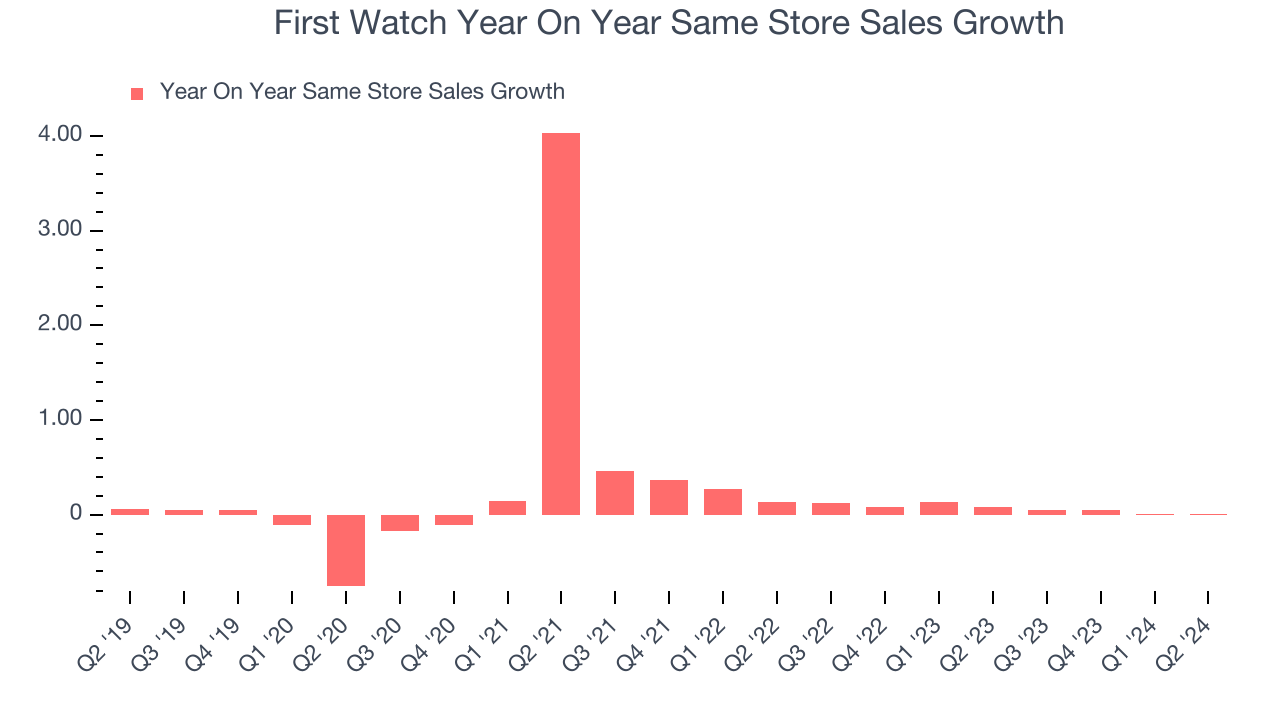

First Watch's demand within its existing restaurants has generally risen over the last two years but lagged behind the broader sector. On average, the company's same-store sales have grown by 6.4% year on year. With positive same-store sales growth amid an increasing number of restaurants, First Watch is reaching more diners and growing sales.

In the latest quarter, First Watch's year on year same-store sales were flat. By the company's standards, this growth was a meaningful deceleration from the 7.8% year-on-year increase it posted 12 months ago. We'll be watching First Watch closely to see if it can reaccelerate growth.

Key Takeaways from First Watch's Q2 Results

It was good to see First Watch beat analysts' revenue and EPS expectations this quarter. On the other hand, it downgraded its full-year same-store sales guidance, citing a challenging consumer environment. Overall, we think this was a mixed quarter. The stock traded down 8.9% to $13 immediately following the results.

So should you invest in First Watch right now? When making that decision, it's important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it's free.