Breakfast restaurant chain First Watch Restaurant Group (NASDAQ:FWRG) missed analysts' expectations in Q1 CY2024, with revenue up 14.7% year on year to $242.4 million. It made a GAAP profit of $0.12 per share, down from its profit of $0.15 per share in the same quarter last year.

First Watch (FWRG) Q1 CY2024 Highlights:

- Revenue: $242.4 million vs analyst estimates of $245 million (1.1% miss)

- Adjusted EBITDA: $28.6 million vs analyst estimates of $24.5 million (16.7% beat)

- EPS: $0.12 vs analyst estimates of $0.10 (26.3% beat)

- Full year guidance for same store sales and revenue growth lowered; adjusted EBITDA guidance maintained

- Gross Margin (GAAP): 22.5%, down from 23% in the same quarter last year

- Same-Store Sales were up 0.5% year on year

- Store Locations: 531 at quarter end, increasing by 47 over the last 12 months

- Market Capitalization: $1.52 billion

Based on a nautical reference to the first work shift aboard a ship, First Watch (NASDAQ:FWRG) is a chain of breakfast and brunch restaurants whose menu is heavily-focused on eggs and griddle items such as pancakes.

The first location was opened in 1983 in Pacific Grove, California. It gained a reputation for its tasty, made-to-order breakfast and brunch offerings. Freshness was also a differentiator. Unlike many traditional breakfast joints that relied on pre-made or frozen ingredients, First Watch emphasized fresh ingredients. The company grew in the ensuing decades through organic expansion as well as acquisitions of chains such as The Good Egg, which were converted into First Watch locations.

Today, diners at First Watch can select from a variety of omelettes, pancakes, salads, and even cocktails. Emphasizing its commitment to freshness, First Watch has a seasonable menu that may feature pumpkin pancakes or even butternut squash soup in the Fall.

The core First Watch customer is someone who appreciates breakfast and brunch fare but wants a bit more of an elevated experience compared to your traditional diner. This core customer also values fresh ingredients and appreciates healthier options such as salads and light sandwiches. Inside First Watch restaurants, the ambience exudes classiness. Rooms have plenty of natural light and feature greenery as well as tasteful artwork. Seating ranges from comfy booths to larger tables that can accommodate families or groups.

Sit-Down Dining

Sit-down restaurants offer a complete dining experience with table service. These establishments span various cuisines and are renowned for their warm hospitality and welcoming ambiance, making them perfect for family gatherings, special occasions, or simply unwinding. Their extensive menus range from appetizers to indulgent desserts and wines and cocktails. This space is extremely fragmented and competition includes everything from publicly-traded companies owning multiple chains to single-location mom-and-pop restaurants.

Competitors offering breakfast fare include IHOP owner Dine Brands (NYSE:DIN), Denny’s (NASDAQ:DENN), The Cheesecake Factory (NASDAQ:CAKE), and private company Waffle House.Sales Growth

First Watch is a mid-sized restaurant chain, which sometimes brings disadvantages compared to larger competitors benefiting from better brand awareness and economies of scale. On the other hand, First Watch can still achieve high growth rates because its revenue base is not yet monstrous.

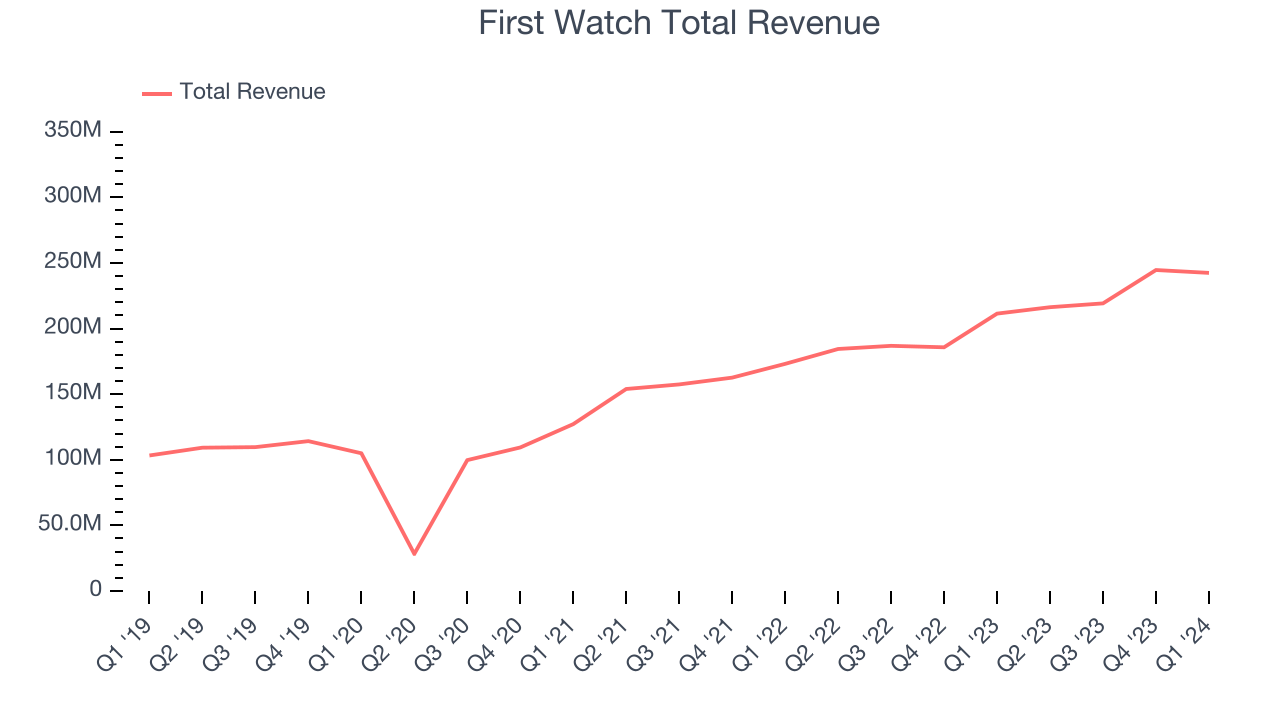

As you can see below, the company's annualized revenue growth rate of 20.5% over the last four years (we compare to 2019 to normalize for COVID-19 impacts) was exceptional as it added more dining locations and increased sales at existing, established restaurants.

This quarter, First Watch's revenue grew 14.7% year on year to $242.4 million, falling short of Wall Street's estimates. Looking ahead, Wall Street expects sales to grow 18.8% over the next 12 months, an acceleration from this quarter.

Same-Store Sales

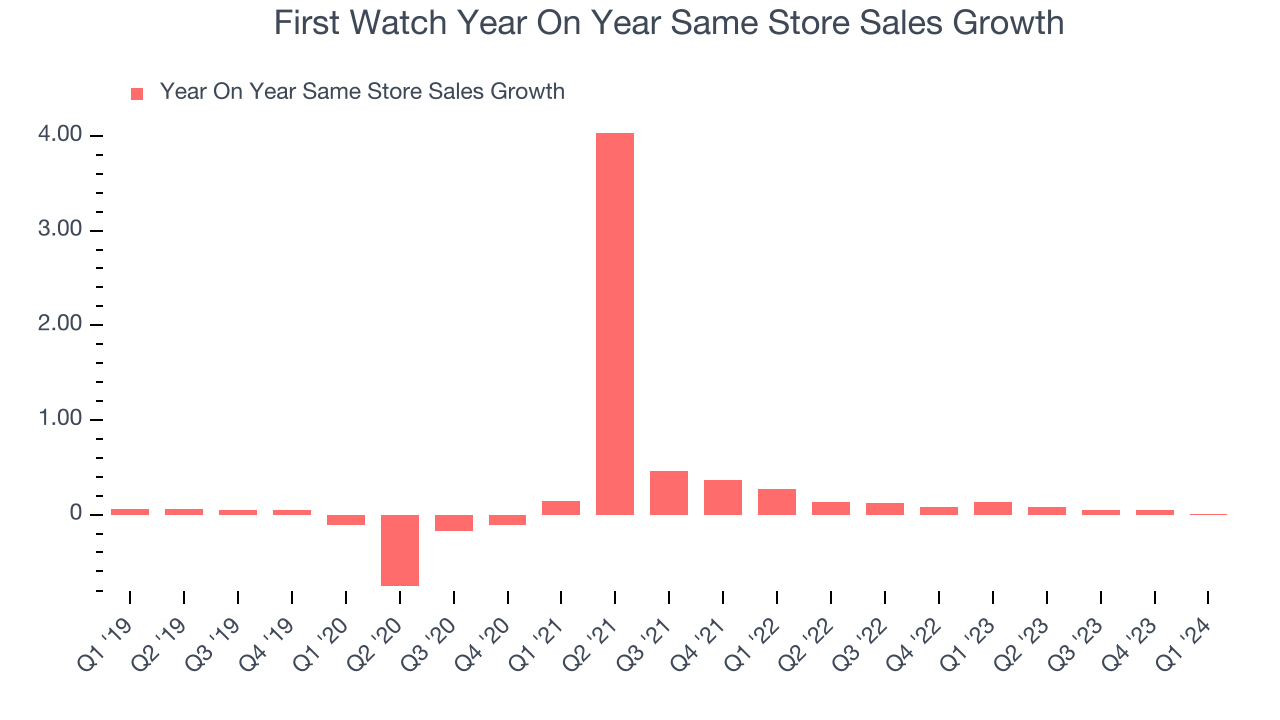

First Watch's demand within its existing restaurants has generally risen over the last two years but lagged behind the broader sector. On average, the company's same-store sales have grown by 8% year on year. With positive same-store sales growth amid an increasing number of restaurants, First Watch is reaching more diners and growing sales.

In the latest quarter, First Watch's year on year same-store sales were flat. By the company's standards, this growth was a meaningful deceleration from the 12.9% year-on-year increase it posted 12 months ago. We'll be watching First Watch closely to see if it can reaccelerate growth.

Number of Stores

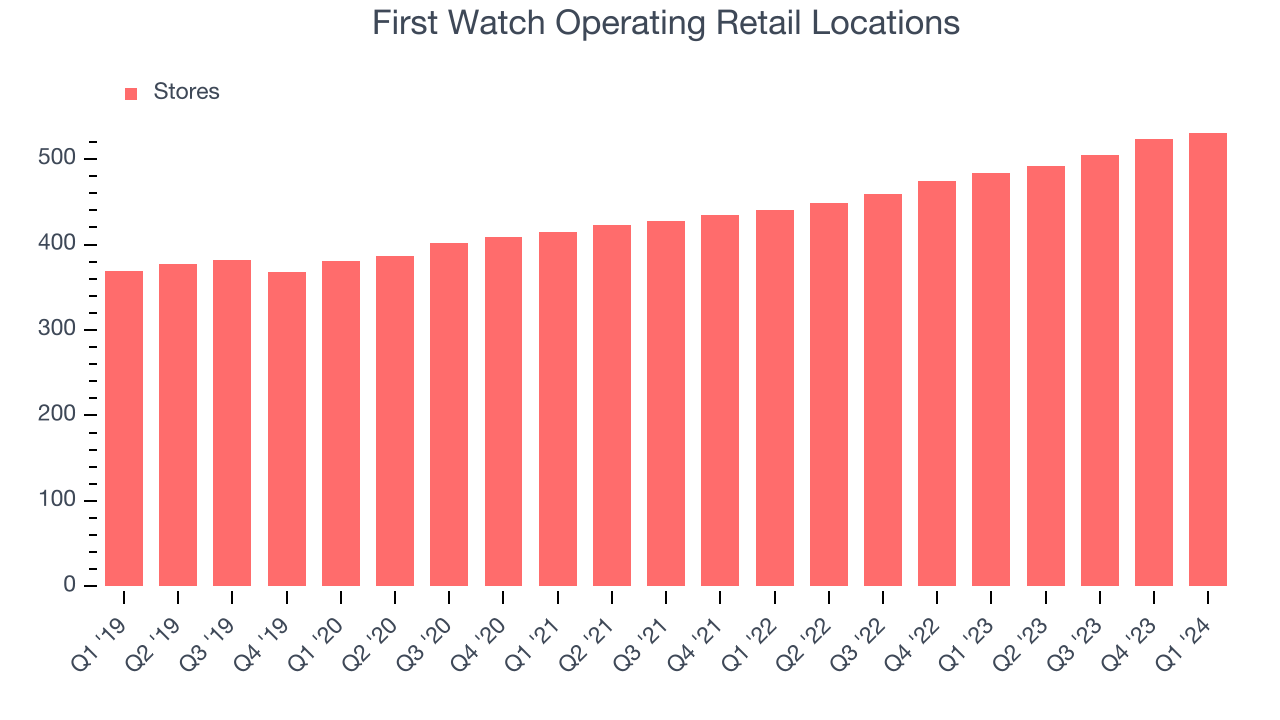

A restaurant chain's total number of dining locations is a crucial factor influencing how much it can sell and how quickly company-level sales can grow.

When a chain like First Watch is opening new restaurants, it usually means it's investing for growth because there's healthy demand for its meals and there are markets where the concept has few or no locations. First Watch's restaurant count increased by 47, or 9.7%, over the last 12 months to 531 locations in the most recently reported quarter.

Taking a step back, First Watch has rapidly opened new restaurants over the last eight quarters, averaging 9% annual increases in new locations. This growth is much higher than other restaurant businesses and gives First Watch an opportunity to become a large company over time. Analyzing a restaurant's location growth is important because expansion means First Watch has more opportunities to feed customers and generate sales.

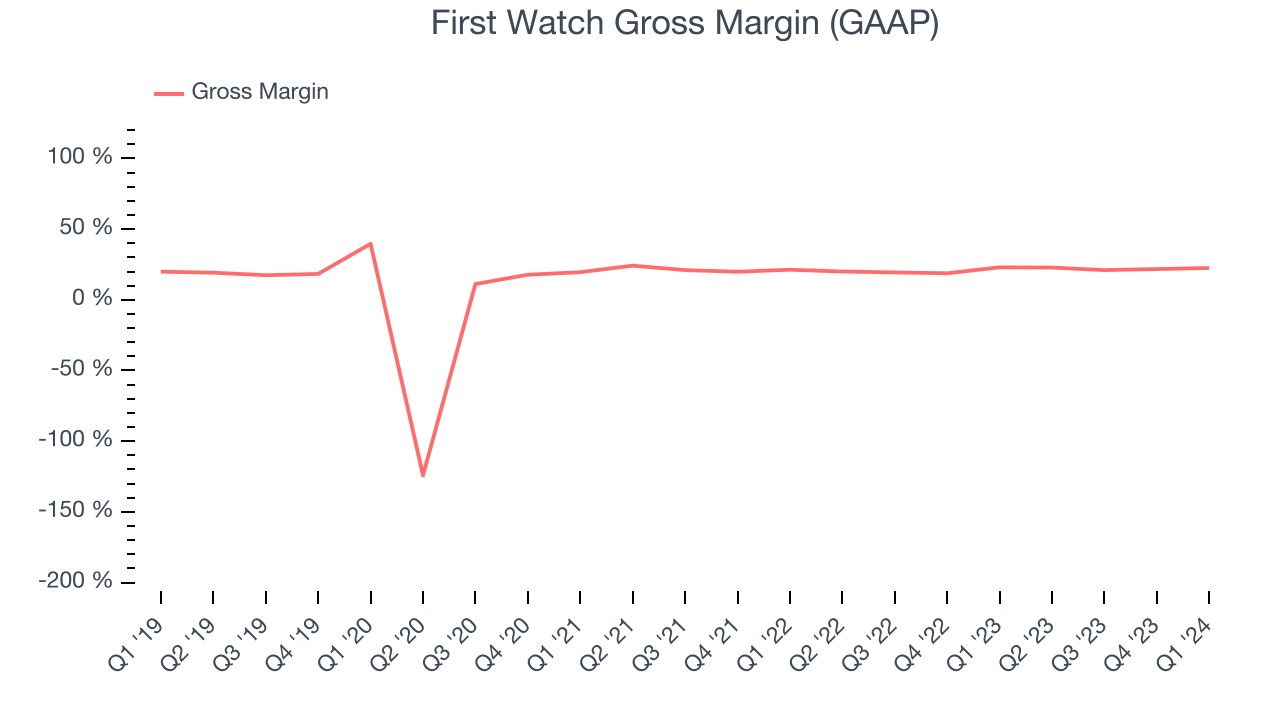

Gross Margin & Pricing Power

First Watch's gross profit margin came in at 22.5% this quarter. in line with the same quarter last year. This means the company makes $0.21 for every $1 in revenue before accounting for its operating expenses.

First Watch has weak unit economics for a restaurant company, making it difficult to reinvest in the business. As you can see above, it's averaged a 21.3% gross margin over the last eight quarters. Its margin, however, has been trending up over the last 12 months, averaging 9% year-on-year increases each quarter. If this trend continues, it could suggest a less competitive environment.

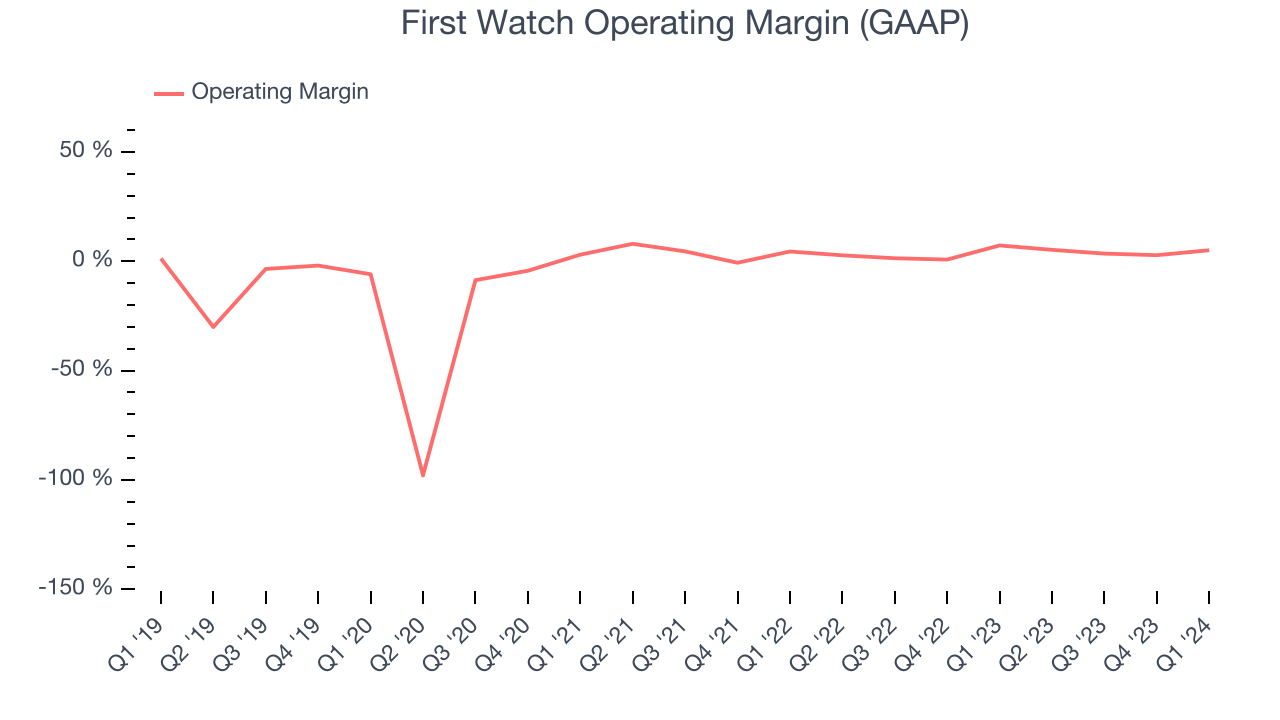

Operating Margin

Operating margin is a key profitability metric for restaurants because it accounts for all expenses keeping the lights on, including wages, rent, advertising, and other administrative costs.

In Q1, First Watch generated an operating profit margin of 5.1%, down 2.2 percentage points year on year. Because First Watch's operating margin decreased more than its gross margin, we can infer the company was less efficient with its expenses or had lower leverage on its fixed costs.

Zooming out, First Watch was profitable over the last two years but held back by its large expense base. Its average operating margin of 3.7% has been paltry for a restaurant business. Its margin has also seen few fluctuations, meaning it will take a big change to improve profitability.

Zooming out, First Watch was profitable over the last two years but held back by its large expense base. Its average operating margin of 3.7% has been paltry for a restaurant business. Its margin has also seen few fluctuations, meaning it will take a big change to improve profitability.EPS

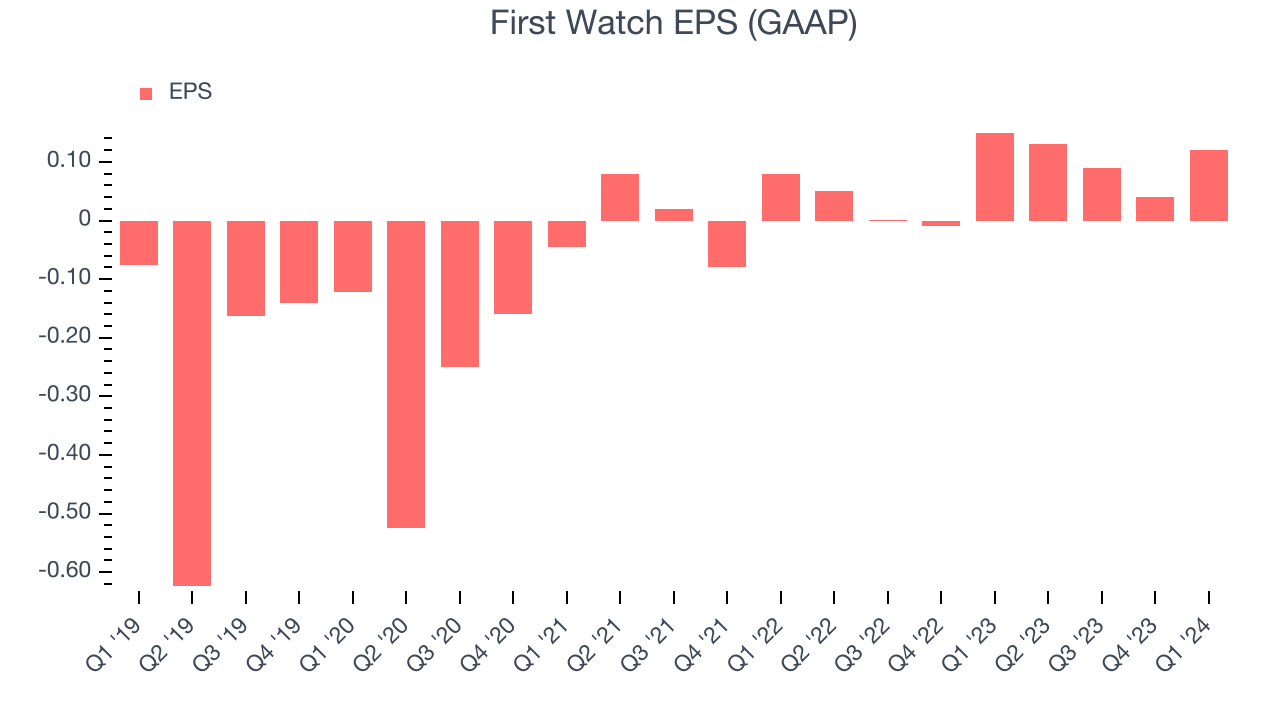

These days, some companies issue new shares like there's no tomorrow. That's why we like to track earnings per share (EPS) because it accounts for shareholder dilution and share buybacks.

In Q1, First Watch reported EPS at $0.12, down from $0.15 in the same quarter a year ago. This print beat Wall Street's estimates by 26.3%.

Between FY2020 and FY2024, First Watch's adjusted diluted EPS grew 136%, translating into a solid 24% compounded annual growth rate. If it can maintain this rate of growth, First Watch will more than double its EPS in the next five years.

Wall Street expects the company to continue growing earnings over the next 12 months, with analysts projecting an average 31.2% year-on-year increase in EPS.

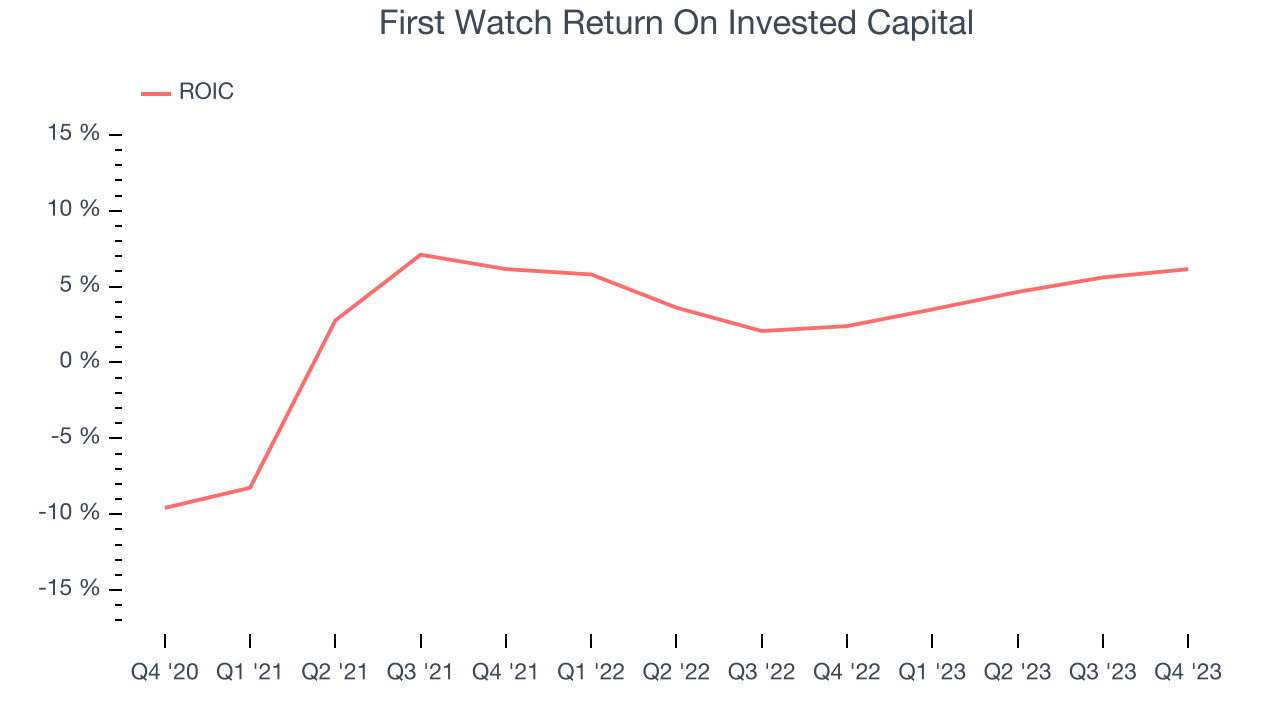

Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing revenue. But was it capital-efficient? Enter ROIC, a metric showing how much operating profit a company generates relative to how much money the business raised (debt and equity).

First Watch's five-year average ROIC was 0.3%, somewhat low compared to the best restaurant companies that consistently pump out 15%+. Its returns suggest it historically did a subpar job investing in profitable business initiatives.

Balance Sheet Risk

As long-term investors, the risk we care most about is the permanent loss of capital. This can happen when a company goes bankrupt or raises money from a disadvantaged position and is separate from short-term stock price volatility, which we are much less bothered by.

First Watch reported $0 of cash and $0 of debt on its balance sheet in the most recent quarter. As investors in high-quality companies, we primarily focus on two things: 1) that a company's debt level isn't too high and 2) that its interest payments are not excessively burdening the business.

With $100.7 million of EBITDA over the last 12 months, we view First Watch's 0.0x net-debt-to-EBITDA ratio as safe. We also see its $8.76 million of annual interest expenses as appropriate. The company's profits give it plenty of breathing room, allowing it to continue investing in new initiatives.

Key Takeaways from First Watch's Q1 Results

We were impressed by how significantly First Watch blew past analysts' gross margin and adjusted EBITDA expectations this quarter. On the other hand, its revenue unfortunately missed analysts' expectations and full year guidance for revenue was lowered slightly. Overall, we think this was still a decent quarter that should satisfy shareholders given the big adjusted EBITDA outperformance, showing that while topline may be a little soft, the growth is much more profitable than expected. The stock is up 3.4% after reporting and currently trades at $25.99 per share.

Is Now The Time?

First Watch may have had a favorable quarter, but investors should also consider its valuation and business qualities when assessing the investment opportunity.

We have other favorites, but we understand the arguments that First Watch isn't a bad business. First off, its revenue growth has been exceptional over the last four years. And while its relatively low ROIC suggests it has struggled to grow profits historically, its new restaurant openings have increased its brand equity.

First Watch's price-to-earnings ratio based on the next 12 months is 51.1x. There are things to like about First Watch and there's no doubt it's a bit of a market darling, at least for some investors. But it seems there's a lot of optimism already priced in and we wonder if there are better opportunities elsewhere right now.

Wall Street analysts covering the company had a one-year price target of $27.89 per share right before these results (compared to the current share price of $25.99).

To get the best start with StockStory, check out our most recent stock picks, and then sign up to our earnings alerts by adding companies to your watchlist here. We typically have the quarterly earnings results analyzed within seconds of the data being released, and especially for companies reporting pre-market, this often gives investors the chance to react to the results before the market has fully absorbed the information.